Did you miss the deadline for the Limited PSLF Waiver? Or were you ineligible for the Waiver because you only have Parent PLUS Loans? If so, there’s good news—as long as you’re still employed in public service, you can benefit from a similar program called the payment count adjustment.

Much like the Limited PSLF Waiver, the payment count adjustment allows borrowers to get credit toward loan forgiveness for past repayment periods and certain forbearances and deferments that would not otherwise count. To qualify for the adjustment and maximize its benefits, you may need to apply to consolidate your federal loans by April 30, 2024. You should also certify your qualifying employment.

Watch our recorded webinar below on how to access PSLF and the payment count adjustment or sign up for a live webinar.

Video: PSLF Webinar Recording 2024_02_09

Skip this video PSLF Webinar Recording 2024_02_09.What is Public Service Loan Forgiveness (PSLF)?

The PSLF Program was created in 2007. It was intended to provide debt relief to federal loan borrowers who work in public service for at least ten years. New PSLF regulations took effect in July 2023. Under these new regulations, you can receive forgiveness of your remaining Direct Loan balance:

- after you’ve made the equivalent of 120 monthly payments under a qualifying repayment plan (usually an IDR plan)

- while working at least 30 hours per week for the government or certain types of non-profit employers

The PSLF Program used to have more complex rules. Those rules, in combination with deficient loan servicing and poor administration, left millions of public service workers unable to access loan forgiveness—often because they had the wrong loan type or made payments under a non-qualifying repayment plan. The payment count adjustment is intended to address these past problems by restoring borrowers’ credit toward PSLF.

What does the Payment Count Adjustment do?

While (1) qualifying employment is required and (2) borrowers must either have Direct Loans or obtain Direct Loans through consolidation by April 30, 2024, the payment count adjustment temporarily eliminates most of the PSLF Program’s other rules. Through the adjustment, some borrowers will receive loan forgiveness while others will get much closer to forgiveness. To summarize:

- Traditionally non-qualifying payments will count. Months in which you failed to make a payment, paid late, paid the wrong amount, paid under the wrong repayment plan, or paid on a loan that was later consolidated will count toward forgiveness.

- Payments on non-qualifying loan types can count. Months in which you made payments on loan types that do not traditionally qualify for PSLF (e.g., FFEL or Perkins Loans) can count toward forgiveness. However, you must apply to consolidate those loans into the Direct Loan Program by April 30, 2024.

- If payments were paused on your Direct Loans due to the COVID-19 emergency, those months will also count toward loan forgiveness.

- Forbearance periods of 12 or more consecutive months, or 36 or more cumulative months, will count toward forgiveness.

- Months spent in certain types of deferment before 2013 (except in-school deferment) will count toward forgiveness. Additionally, periods of Economic Hardship Deferment that occurred in or after 2013 will count.

- Periods of deferment and forbearance for specific military service will count toward forgiveness.

How is the Payment Count Adjustment Different from the Limited PSLF Waiver?

For the most part, the Limited PSLF Waiver, which ended on Oct. 31, 2022, and the payment count adjustment are very similar. However, there are two differences:

- If you are retired or no longer working for a qualifying employer, you cannot receive forgiveness through the adjustment.

- If you previously received Teacher Loan Forgiveness, the adjustment will not give you credit toward PSLF for that period of service.

What Steps Do I Need to Take?

Below are instructions and tips for ensuring that you obtain and maximize potential benefits under the payment count adjustment. If you need to consolidate, you must apply by April 30, 2024. You can also learn more about the adjustment and find answers to frequently asked questions on the U.S. Dept. of Education’s website.

1. Confirm that you have qualifying employment.

How many hours do I need to work? For your employment to count toward PSLF, you must work for one or more qualifying employers:

- for a minimum average of 30 hours per week,

- for a minimum of 30 hours per week throughout a contractual or employment period of at least 8 months in a 12-month period (e.g., school teachers, professors, and instructors), or

- for the equivalent of 30 hours per week as determined by multiplying each credit or contact hour taught per week by at least 3.35 in non-tenure track employment at an institution of higher education.

What is a qualifying employer? A qualifying employer includes the government (federal, state, local, tribal), a nonprofit organization that is tax-exempt under Section 501(c)(3) of the Internal Revenue Code, or a nonprofit organization that provides certain types of public services.

You can verify that your employer qualifies for PSLF by using the U.S. Dept. of Education’s PSLF Employer Search Tool. If the Search Tool doesn’t find your employer, it might be because no one with your employer has applied for PSLF before. It is still possible that your employer qualifies. You can learn more about the requirements for qualifying employment on the U.S. Dept. of Education’s website.

2. Identify your federal loan types to see if you need to consolidate.

Borrowers can have several different types of federal loans, including Direct Loans, Federal Family Education Loans (FFELs), and Perkins Loans. To qualify for the Payment Count Adjustment for PSLF, federal loan types that are not Direct Loans (e.g., FFELs or Perkins Loans) must be consolidated into the Direct Loan Program by April 30, 2024. Additionally, only Direct Loans are eligible for SAVE, the new, more affordable income-driven repayment plan.

Here’s how to see whether your loans are Direct Loans, FFELs, or Perkins Loans:

- Log in to your Federal Student Aid (FSA) account at studentaid.gov. If you haven’t already set up an FSA ID, please create one.

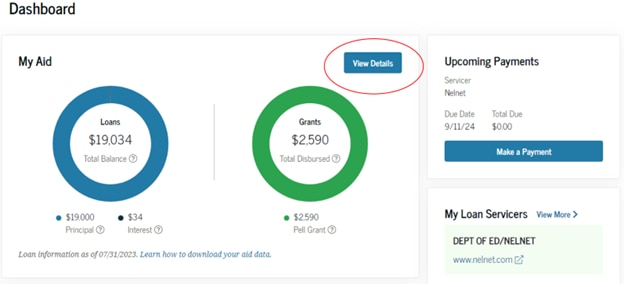

- Once logged in to studentaid.gov, you will see your account dashboard as pictured below, which shows your total federal loan balance.

- Click “View Details.”

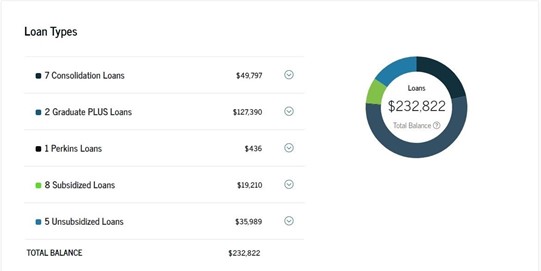

- Then, scroll down to the section entitled “Loan Types.” You will see different categories of loans, as shown below.

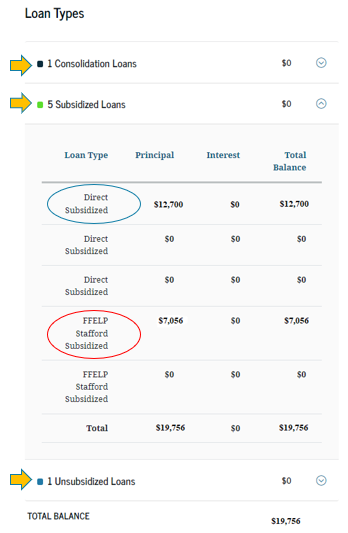

- Click on each loan category to see all your loans within the category. In the below example, there are two loans with outstanding balances. One is a Direct Loan, but the other is a FFEL Program Loan. The FFEL Program loan will need to be consolidated. You will need to carefully review each loan category to see if it contains loan types other than Direct Loans.

Please note that private loans are not eligible for PSLF, the Payment Count Adjustment for PSLF, or the SAVE plan. Private loans will not appear in your studentaid.gov account.

3. Consolidate any non-Direct Loans into the Direct Loan Program.

If you have any federal loans that are not Direct Loans (e.g., FFELs or Perkins Loans), you must apply to consolidate those loans into the Direct Loan Program by April 30, 2024.

How to consolidate. You can apply for a Direct Consolidation Loan from the U.S. Dept. of Education’s consolidation website in one of two ways:

- You can submit an electronic application in 45 minutes or less by logging in with your Federal Student Aid (FSA) ID and password.

- Or you can download the Direct Loan Consolidation Application, fill it out, and send it to your newly chosen servicer (associated instructions can be found on the U.S. Dept. of Education’s consolidation website under Frequently Asked Questions, Can I Submit A Paper Application.

Choosing a servicer. If you apply to consolidate online, check the box indicating you are pursuing PSLF and choose MOHELA from the servicer selection drop down menu. If you are mailing in a paper consolidation application, you can send your completed application to:

MOHELA

c/o Aidvantage

PO Box 300006

Greenville, TX 75403-3006

Please note that although you have chosen MOHELA as your servicer, you will initially receive communications from Aidvantage, which is another federal loan servicer. Aidvantage is processing consolidations for MOHELA.

Choosing a repayment plan. If you apply to consolidate online, you will be asked to choose a repayment plan as part of your consolidation application.

- To continue earning credit toward PSLF once the payment count adjustment is completed, PSLF borrowers must either enroll in an Income-Driven Repayment (IDR) plan or the 10-year standard plan. However, if you enroll in the 10-year standard plan, you may pay off your loan before you reach forgiveness, so most borrowers need to enroll in an IDR plan.

- The new IDR plan, called SAVE, will usually offer the lowest monthly payments.

- Parent PLUS loans aren’t eligible for the new more affordable SAVE Plan or any other IDR plan. However, if they are consolidated, Parent PLUS Loans can become eligible for the Income-Contingent Repayment (ICR) plan.

- Additionally, if you have at least one Parent PLUS Loan and one other federal loan (of any type, including another Parent PLUS Loan), you can use a “double consolidation loophole” to get access to the new more affordable SAVE plan. You must complete all the necessary consolidations by July 1, 2025, to access SAVE. Applying for all the consolidations before April 30, 2024 may help maximize the payment count adjustment.

If you use the paper consolidation application, you will need to download and submit an Income-Driven Repayment Plan Request form. After downloading, printing, and completing the form, mail it to MOHELA. You will also need to include the income documentation described on page 5 of the form.

For more information on choosing a repayment plan, please read Section 8 below.

Questions about consolidation. Call the Federal Aid Information Center at 1-800-433-3243 if you have questions about how to consolidate.

4. If you have Direct Loans, find out if consolidating could help some loans get forgiven sooner.

Even if you have Direct Loans, consolidating may help accelerate forgiveness if some of your loans have been in repayment longer than others.

Through the payment count adjustment, Consolidation Loans will be credited with the largest number of qualifying months among the loans that were consolidated. So, if some of your loans have been in repayment longer than others (e.g., you worked full-time for a qualifying employer between undergraduate and graduate studies), forgiveness will come faster on your more recent loans if you consolidate them with your older loans. The entire new Direct Consolidation Loan will receive the credits associated with the underlying loan that had the largest number of qualifying months.

- For example, if you will have 50 qualifying months on one federal loan and 100 qualifying months on another, and you consolidate the two loans, the new Direct Consolidation Loan will receive 100 qualifying months toward loan forgiveness through the adjustment.

However, there are several things to know about consolidating.

- First, if you made more than 120 qualifying payments on an existing Direct Loan, consolidating that loan will disqualify you for any potential refund of the payments you made on that loan beyond the 120 required for forgiveness.

- Second, the new PSLF regulations allow Direct Loan borrowers to buy back past qualifying employment periods in which they didn’t get credit toward PSLF due to being in forbearance or deferment. Through the new buyback process, borrowers can obtain credit toward PSLF by paying what they would have been required to pay under an Income-Driven Repayment (IDR) plan. However, if you consolidate, you won’t be able to buy back your PSLF credit for periods that predate your consolidation.

- Keep in mind that some of these forbearance and deferment periods may automatically receive PSLF credit through the payment count adjustment (for free), so you may not actually need to use the buyback process.

- For example, the payment count adjustment will count forbearance periods that equal or exceed 12 consecutive or 36 cumulative months.

- Additionally, administrative forbearances will automatically count toward forgiveness under the new PSLF regulations, though past periods will not appear as qualifying payments until later in 2024.

- Keep in mind that some of these forbearance and deferment periods may automatically receive PSLF credit through the payment count adjustment (for free), so you may not actually need to use the buyback process.

- Third, if you consolidate your Parent PLUS Loans with your own student loans, unless you are able to take advantage of the “double consolidation loophole” the entire resulting Direct Consolidation Loan will be restricted to the Income-Contingent Repayment (ICR) plan. ICR typically requires much higher monthly payments and offers less favorable terms than the new SAVE Plan.

5. Ensure your employment certifications are up to date.

If you do not have approved employment certifications on file for all your qualifying employment periods since the Oct. 1, 2007 start date of the PSLF Program, you must file a PSLF Form to certify your employment for each uncertified period. You should file a PSLF Form for any period you are unsure about. We recommend filing soon, so that your employment is on record before the payment count adjustment occurs (though you can certify it later if need be).

How to Fill Out and Submit the PSLF Form. You can fill out the PSLF Form in one of two ways:

Digital Signatures with the PSLF Help Tool

You can use the PSLF Help Tool to:

- complete your PSLF Form,

- electronically send your form to your employer for their digital signature (certifying your employment), and

- electronically submit your form to the PSLF servicer, MOHELA.

To use the PSLF Help Tool, you will need to log in with your FSA ID and password. After entering your employment details, you will have an opportunity to apply your digital signature. You will also need to provide an email address for your employer so that your employer can receive and digitally sign your PSLF Form. Be sure to ask your employer what email address to use.

You should also tell your employer to expect an email from DocuSign (dse_NA4@docusign.net) on behalf of the U.S. Dept. of Education’s Office of Federal Student Aid. Once it is digitally signed by your employer, your form will be electronically submitted to the PSLF servicer, MOHELA.

Manual PSLF Form

Alternatively, you can use the PSLF Help Tool to generate a PSLF Form that you can then download as a PDF. While in the PSLF Help Tool, choose “Manual Signature” and on the next page select the “View in My Activity” button. From the “My Activity” page, download your form, print it, sign it, and have your employer sign your form.

If you prefer not to use the PSLF Help Tool, you can simply download a blank PDF of the PSLF Form. Fill out page one, sign it, and ask your employer to complete page two. Once the form is completed and signed by your employer, send it to MOHELA, the servicer for the PSLF Program at the address listed below. If MOHELA is already your servicer, you can upload it on its website.

U.S. Department of Education

MOHELA

633 Spirit Drive

Chesterfield, MO 63005-1243

Fax: 866-222-7060

If you complete a downloaded PDF of the PSLF Form, any digital signatures from you and your employer must be hand-drawn (from a signature pad, mouse, finger, or by taking a picture of a signature drawn on a piece of paper that you then scan and embed on the signature line of the PSLF Form). Typed signatures, even if made to mimic a hand-drawn signature, or security certificate-based signatures are not accepted.

6. If you were steered into forbearance, complain to the U.S. Dept. of Education.

The payment count is intended to address the harm that federal loan servicers caused by inappropriately steering borrowers into long-term forbearances. However, the payment count adjustment will only provide PSLF credit for forbearance periods of 12 or more consecutive months or 36 or more cumulative months. Borrowers who believe they were steered or forced into shorter-term forbearances can seek account reviews and credit toward PSLF by filing a complaint with the Federal Student Aid Ombudsman at StudentAid.gov/feedback.

7. After the payment count adjustment, consider a buyback

The new PSLF regulations allow Direct Loan borrowers to buy back past qualifying employment periods in which they didn’t get credit toward PSLF due to being in forbearance or deferment. If a period of deferment or forbearance is not covered for free by the payment count adjustment or the new PSLF regulations, then you may want to consider a buyback. Through the new buyback process, borrowers can obtain credit toward PSLF by making up the payments they would have been required to pay under an income-driven repayment plan.

If you have consolidated your loans, you can only buy back time after the consolidation. If your loan is paid-in-full, forgiven, or discharged, you can’t buy back time on that loan.

You can learn more about the buyback process on the U.S. Dept. of Education’s website. However, since you may automatically get free credit for some forbearance and deferment periods under the payment count adjustment and the new PSLF regulations, you may want to wait to pursue a buyback until both have been implemented in 2024.

- As a reminder, the payment count adjustment will count the following forbearance and deferment periods toward forgiveness:

- forbearances that were 12 or more consecutive months or 36 or more cumulative months

- any months spent in economic hardship or military deferments in 2013 or later

- any months spent in any deferment (with the exception of in-school deferment) prior to 2013

- Additionally, the new PSLF regulations will count the following forbearances and deferments toward forgiveness:

- Cancer treatment deferments

- Economic hardship deferments

- Military service deferments

- Post-active-duty student deferments

- AmeriCorps forbearances

- National Guard Duty forbearances

- U.S. Dept. of Defense Student Loan Repayment Program forbearance

- Certain administrative forbearances related to local or national emergencies or military mobilizations

- Administrative forbearances of up to 60 days to collect and process documentation supporting a request for deferment, forbearance, repayment plan change, or consolidation

8. Prepare to pay under the new PSLF rules (or maybe TEPSLF rules) in July 2024.

Through the payment count adjustment, some public service workers will reach 120 qualifying payments and receive loan forgiveness. Others will receive an increase in their qualifying payment count but will need to continue working toward forgiveness after the payment count adjustment is completed in mid-2024.

These borrowers need to begin paying under the PSLF rules—including paying under an Income-Driven Repayment (IDR) plan (or in rare cases, the standard 10-year plan) by July 2024.

In most cases, the new IDR plan, called SAVE, will offer lower payments than other IDR plans. Rather than protecting income under 150% of the federal poverty line, it protects income under 225%. This means it will cut monthly payments to $0 if you make less than $32,801 individually (or under $67,501 for a family of four). It also eliminates any remaining interest after a scheduled payment is made. For example: if $50 in interest accumulates each month and you have a $30 payment, the remaining $20 in interest is not charged.

If you intend to repay under either the ICR or PAYE plans, you should apply now, because these plans are being phased out for many loan types in July.

You can apply for SAVE and other IDR plans through your studentaid.gov account.

Parent PLUS loans aren’t eligible for the SAVE Plan or any other IDR plan. However, if they are consolidated, Parent PLUS Loans can become eligible for the Income-Contingent Repayment (ICR) plan.

- Additionally, if you have at least one Parent PLUS Loan and one other federal loan (of any type, including another Parent PLUS Loan), you can use a “double consolidation loophole” to get access to the new more affordable SAVE plan. You must complete all the necessary consolidations by July 1, 2025, to access SAVE. Applying for all the consolidations before April 30, 2024 may help maximize the payment count adjustment.

The following repayment plans do not qualify under the new PSLF rules:

- standard repayment plans for Direct Consolidation Loans

- graduated repayment plans

- extended repayment plans

- alternative repayment plans

The new PSLF rules do count the following forbearances and deferments toward forgiveness:

- Cancer treatment deferments

- Economic hardship deferments

- Military service deferments

- Post-active-duty student deferments

- AmeriCorps forbearances

- National Guard Duty forbearances

- U.S. Dept. of Defense Student Loan Repayment Program forbearance

- Administrative forbearances related to local or national emergencies or military mobilizations

- Administrative forbearances of up to 60 days to collect and process documentation supporting a request for deferment, forbearance, repayment plan change, or consolidation

To learn about all of the new PSLF rules, including rules for lump sum payments, please visit the U.S. Dept. of Education’s PSLF website.

Be prepared— repayment plans that qualify under PSLF rules, including income-driven plans, may result in higher payments. In such cases, borrowers should weigh the cost of making the higher payments for the number of months it will take to receive loan forgiveness against the cost of repaying their loans in full over time with interest (often over a 25- or 30-year period).

Payments may be lower under repayment plans eligible for Temporary Expanded Public Service Loan Forgiveness (TEPSLF) but counting on TEPSLF may be risky. The TEPSLF Program enables borrowers to potentially receive forgiveness based on payments made under repayment plans that don’t typically count toward PSLF, including:

- standard repayment plans for Direct Consolidation Loans

- graduated repayment plans

- extended repayment plans

In some cases, TEPSLF-eligible repayment plans may offer lower payments than plans that qualify under the new PSLF rules. Borrowers who can’t afford payments under the new PSLF rules and those who expect to have nearly 120 qualifying months toward forgiveness by April 30, 2024 may wish to consider making payments under the TEPSLF Program thereafter. However, it may be risky to rely on TEPSLF since it is a temporary program with limited funding. It is possible that TEPSLF will no longer exist by the time borrowers reach 120 qualifying payments. Were this to occur, payments made under TEPSLF-eligible repayment plans would not count toward loan forgiveness under PSLF.

TEPSLF has other rules too. Although TEPSLF will count payments made on Direct Loans under repayment plans that don’t qualify for PSLF, to receive TEPSLF forgiveness, borrowers must pay at least certain amounts in two particular months. Specifically, the payment made 12 months before applying for TEPSLF and the last payment made before applying for TEPSLF must equal or exceed the amount the borrower would have been required to pay under an IDR plan. This is an important hurdle that borrowers should be aware of and plan for if they intend to pursue TEPSLF. You can learn more about TEPSLF’s rules on the U.S. Dept. of Education’s website.

9. Avoid scams.

Student loan “debt relief” companies charge fees for helping student loan borrowers access federal loan debt relief programs. There is nothing these companies can do for you that you can’t do on your own for free!

Some of these companies are trying to take advantage of debt relief opportunities offered by the U.S. Dept. of Education. They may even pretend to work with the U.S. Dept. of Education or a government agency. If anyone contacts you asking for your personal information (like your FSA ID and password), your bank account information, or money to help you access debt relief—they’re trying to scam you. There is nothing third parties can do to speed up PSLF or get you more relief.

Only scammers will ask you to pay for student loan debt relief. You can visit the U.S. Dept. of Education’s website to learn more about the other warning signs of a debt relief scam.