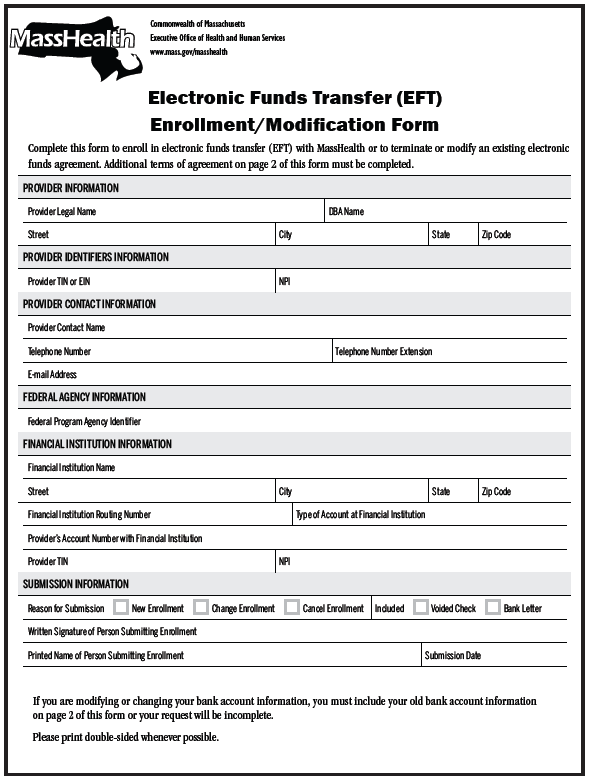

Electronic Funds Transfer (EFT)

The Office of the Comptroller and the Office of the State Treasurer have mandated that all providers enrolled in MassHealth, including individual practitioners who will receive payments directly, participate in EFT. EFT payments are automatically deposited into a designated bank account. They are less expensive to process, highly dependable in getting deposited into a provider’s account, and processed in a secure manner. EFT is helpful in streamlining operations by reducing paperwork, and it functions as a convenient and effective electronic method of reimbursement.

Please note that all payments are issued by the Office of the Comptroller. Account reconciliation is the provider’s responsibility. Although MassHealth does not reconcile provider accounts, there is information on the billing tips page (that providers can use to help reconcile the accounts with the RA.

Learn more about the EFT form.

VendorWeb

VendorWeb is the online application through which statewide contractors may view their payment transactions with the Commonwealth of Massachusetts. VendorWeb provides information on scheduled payments and payment history.

To use VendorWeb, you must know your Vendor Code and the last 4 digits of your Taxpayer Identification Number (TIN). If you are unable to locate your Vendor Code, contact the applicable Customer  Service for your provider type. VendorWeb shows Prompt Payment Discounts as well as any intercepted payments.

Service for your provider type. VendorWeb shows Prompt Payment Discounts as well as any intercepted payments.

VendorWeb is managed by the Office of the Comptroller. The website contains a general How to use VendorWeb job aid as well as a job aid specifically for MassHealth providers.

To access VendorWeb and more information regarding the available job aids, please go to massfinance.state.ma.us/VendorWeb/vendor.asp

Overpayments

Voids and Adjustments

If a provider receives an overpayment for one of the reasons below, the provider must return the full amount paid by MassHealth for a particular claim or remittance advice. To do this, the provider must request that the payment be voided. Do not send a company check or return the original check received from the Department of the State Treasurer. Instead, deposit the check and follow the void procedures outlined below.

Please Note: If a provider was notified by letter that MassHealth is performing a retrospective utilization review, a peer review, or any other review of your services, please do not return overpayments for the period under review, as they cannot be accepted.

Reasons to Request a Void (non-dental and non-pharmacy)

- Payment was made to the wrong provider number

- Payment was made for the wrong member

- Payment was made for overstated services

- Payment was made for services for which full reimbursement has been received from other payers

Providers can only void previously paid non-dental and non-pharmacy claims in the following ways:

- Through the Provider Online Service Center using the HIPAA-compliant 837 format

- By submitting a paper Void Request Form

Learn more information about how to void a claim

Adjustments

If a provider is paid incorrectly, either underpaid (requesting more money) or overpaid (returning a partial payment), the provider should adjust (replace) the claim.

Learn more about how to adjust a claim.

Providers can only adjust previously paid non-dental and non-pharmacy claims through the Provider Online Service Center using the HIPAA-compliant 837 format.

Please Note: An adjustment should only be processed within one year from the date of service. Please do not revert to this process if the claim is beyond 12 months.

Provider Overpayment Disclosure Form

MassHealth has developed a Provider Overpayment Disclosure form for use when disclosure via the Provider Online Service Center (POSC) or direct data entry (DDE) is not appropriate, and the provider is unable to use or follow the standard administrative and billing methods of resolution. This form captures key information that will allow MassHealth to identify the affected claims, such as the Internal Control Number (ICN), the provider’s name and number, and the date of service.

For more information regarding the Provider Overpayment Disclosure form, please see All Provider Bulletin 256.

| Date published: | July 29, 2022 |

|---|