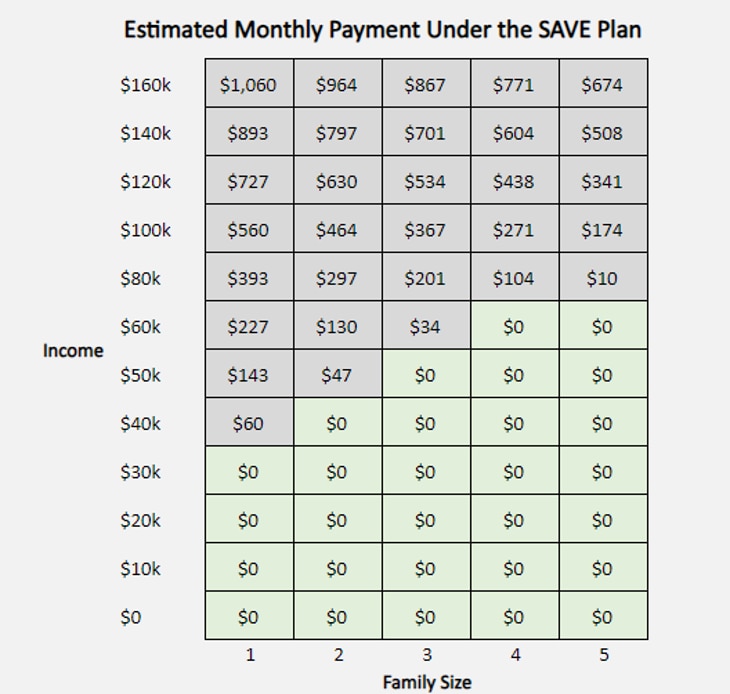

Use the chart below to double check what your monthly payment should be under the new SAVE plan. Your payment depends on your income and family size.

Here are tips to ensure you’re using the chart correctly:

- If your tax filing status was married filing jointly, you need to include your spouse’s income.

- If your tax filing status was married filing jointly, and your spouse also has federal student loans enrolled in SAVE, the sum of your SAVE payment and your spouse’s SAVE payment should equal the amount shown in the chart below for your combined income and family size.

- If your tax filing status was married filing separately, don’t count your spouse in your family size.

- If you were in REPAYE right before the start of the pandemic in March 2020, the income and family size that was used to calculate your payment at that time (e.g., your 2019 or 2020 tax return) will be used to calculate your new SAVE payment.

- If your income has gone down since that time (or your family size has increased), ask for your payment to be recalculated at StudentAid.gov/idr.

- If your income has increased since that time or your family size has decreased, don’t recertify until you’re asked to. You won’t be asked to recertify for at least six months after repayment resumes.

If you live in Massachusetts and believe your SAVE payment is wrong, please file a complaint with our Office.