What is Direct Pay?

Direct Pay (also known as Elective Pay) is a program established by the Inflation Reduction Act (IRA) that enables tax-exempt and governmental entities – such as cities and towns -- to receive a payment equal to the full value of tax credits for building qualifying clean energy projects or making qualifying investments.

By filing a return and using Direct Pay, these entities can receive a cash refund from the IRS for certain clean energy projects.

Direct Pay applies to projects put into service January 1, 2023 through December 31, 2032, creating a decade of tax opportunity to save money on necessary infrastructure replacements and upgrades while reducing energy costs and carbon emissions.

Unlike competitive grant programs, the overall potential of these tax credits to states and municipalities is unlimited. In most cases, the Investment Tax Credit results in a refund equal to 30% of the project investment.

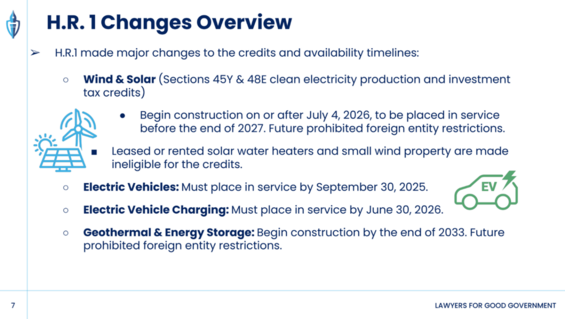

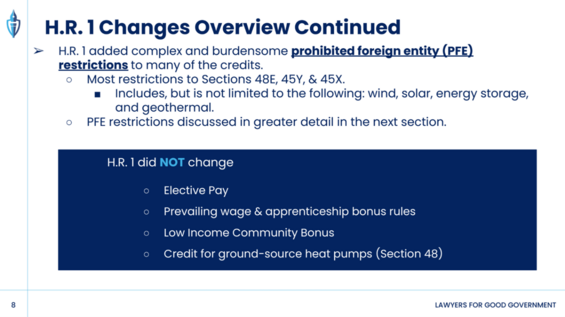

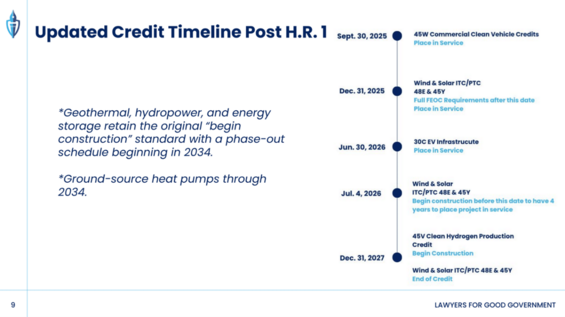

How has the One Big Beautiful Bill Act (“OBBBA”) changed Direct Pay?

The passage of H.R. 1, also known as OBBBA, significantly affects Direct Pay tax credit opportunities and timelines. Direct Pay still exists as a federal program, but OBBBA now imposes a variety of new restrictions, especially for solar and wind projects, and electric vehicle purchases and infrastructure.

OBBBA did NOT change tax credits available for ground-source heat pumps. If your community is considering or undergoing this type of project, please contact FFIO at FedFundsInfra@mass.gov

For details on how OBBBA changed the rules for Direct Pay, please see updated information provided by Lawyers for Good Government, which hosted a webinar ("Moving Forward with Elective Pay after H.R. 1 (OBBBA)") on July 30, 2025.

Video: OCIR - Direct Pay - MA Federal Funds Partnership October 2025

Skip this video OCIR - Direct Pay - MA Federal Funds Partnership October 2025.Process Timeline

For your reference, here is the general process for tax-exempt entities seeking to file for Direct Pay tax credits.

Decide filing date: Cities and towns must first decide whether they will file based on a calendar or fiscal year.

Identify qualifying projects: The IRS requires that eligible entities own the asset for which they are seeking credits. To understand if a project owned by an entity qualifies for a particular year, the entity must determine that the project was placed into service. Property is considered to be placed in service when it is “first placed in a condition or state of readiness and availability for a specifically assigned function.”

Pre-register 120 days before filing date: Entities must pre-register with the IRS to obtain a Unique Registration Number for each applicable credit property. The IRS recommends registering 120 days before the filing deadline.

File! For calendar year filers seeking to claim credits for 2023 projects, file Form 990-T, Form 3800, and the applicable source form for calculating and claiming any applicable credits.