Steps

Borrowers can have several different types of federal loans, including Direct Loans, Federal Family Education Loans (FFELs), and Perkins Loans. To qualify for the Payment Count Adjustment for PSLF, federal loan types that are not Direct Loans (e.g., FFELs or Perkins Loans) must be consolidated into the Direct Loan Program by Dec. 31, 2023. Additionally, only Direct Loans are eligible for SAVE, the new, more affordable income-driven repayment plan.

Here’s how to see what type(s) of federal loans you have:

- Log in to your Federal Student Aid (FSA) Account at studentaid.gov. If you haven’t already set up an FSA ID, please create one.

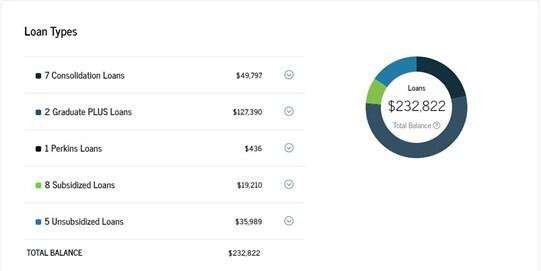

- Once logged in to studentaid.gov, you will see your account dashboard as pictured below, which shows your total federal loan balance.

- Click "View Details".

- Scroll down to the section entitled "Loan Types." In the “Loan Types” section, you will see different categories of loans as shown below.

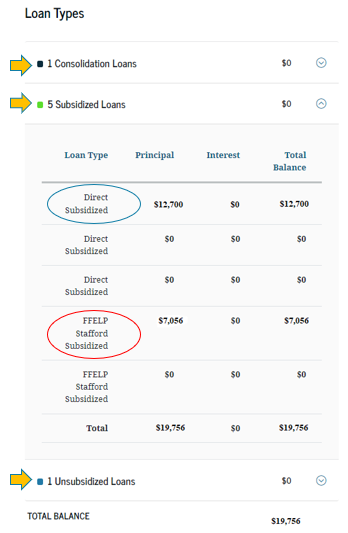

- Click on each loan category to see all your loans within the category. In the below example, there are two loans with outstanding balances. The loan circled in blue is a Direct Loan, which does not need to be consolidated. The loan circled in red is a FFEL Program Loan, which will need to be consolidated into the Direct Loan Program. Carefully review each loan category to see if it contains loan types other than Direct Loans.

Please note that private loans are not eligible for PSLF, the Payment Count Adjustment for PSLF, or the SAVE plan. Private loans will not appear in your studentaid.gov account.