New Income-Driven Plan: RAP

A new income-driven repayment plan called the Repayment Assistance Plan (RAP) was created through a reconciliation bill that was signed into law on July 4, 2025. The plan should be available by no later than July 1, 2026 to Direct Loan borrowers.

Parent PLUS Not Eligible for RAP

RAP is not available for Parent PLUS Loan debt. This includes (1) Parent PLUS Loans, (2) Consolidation Loans that paid off Parent PLUS Loans, and (3) Consolidation Loans that paid off Consolidation Loans that paid off Parent PLUS Loans. Learn more about Parent PLUS repayment options in Parent PLUS section of our student loan repayment guide.

RAP Forgiveness Timeline & Subsidies

RAP comes with a 30-year forgiveness timeline (as opposed to 20 or 25 years in other IDR plans) but may offer helpful interest subsidies to some federal loan borrowers. If your RAP payment amount is less than the monthly interest that accrues on your loans, the remaining unpaid interest is not charged. This will prevent your loan balance from increasing while in the plan. Additionally, if your RAP monthly payment does not reduce your principal balance by at least $50, a subsidy will be applied to ensure that the principal balance is reduced by at least $50 each month.

RAP Calculation

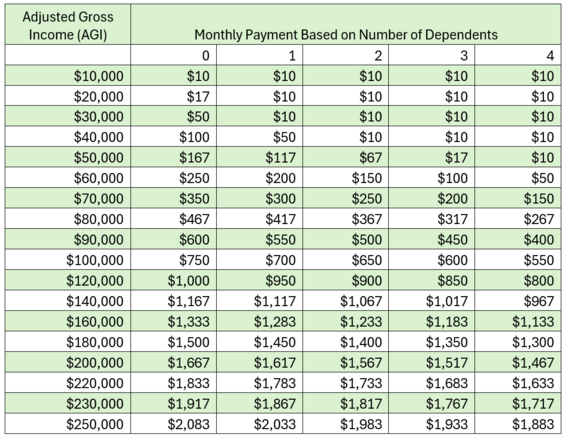

RAP requires you to pay a percentage of your adjusted gross income. If you have dependents, $50 per dependent will be deducted from your monthly payment. The minimum monthly payment under this plan is $10.

You can use the below chart to estimate your RAP payment based on your adjusted gross income and number of dependents.