- Office of Attorney General Maura Healey

Media Contact

Jillian Fennimore

Boston — A national auto lender has agreed to provide $5.4 million in relief to more than 450 Massachusetts consumers over allegations that it charged excessive interest rates on its subprime auto loans, Attorney General Maura Healey announced today.

Under the terms of the assurance of discontinuance, filed Wednesday in Suffolk Superior Court, Santander USA Holdings Inc. has agreed to eliminate interest on certain loans it purchased that allegedly included excessive interest rates due to the inclusion of so-called GAP coverage. Santander has also agreed to forgive outstanding interest on the loans, and reimburse consumers for the interest they have already paid on the debts.

“Consumers need to know that when they take out a loan, they will be treated fairly,” AG Healey said. “It is important that protections under state law are properly applied, especially when it comes to economically disadvantaged consumers in Massachusetts.”

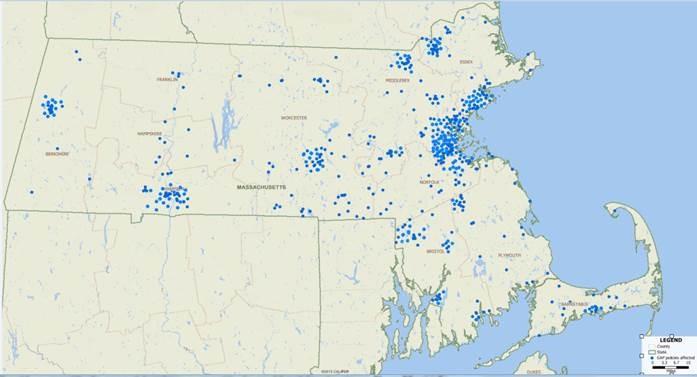

The consumers helped by the settlement are located across the state, with concentrations in Boston, Worcester, Springfield, Pittsfield, and Lowell, among others. On average, the settlement will provide each consumer with approximately $11,000 in relief.

Under the settlement, Santander will also pay $150,000 to the Commonwealth and must perform a supervised audit of its existing loan portfolio to make sure that no additional consumers have been overcharged because of GAP fees. The fees added to the consumers’ loans caused the effective interest rates to exceed the relevant 21 percent state interest cap.

GAP is a product that is intended to limit the shortfall between the payment on an auto insurance claim and the amount the borrower owes on a car loan in the event the financed vehicle is totaled. GAP is sold by car dealers as an add-on product and is often financed in the auto loan.

The Attorney General’s Office continues to review practices in the subprime auto lending arena. The Office will also hold a series of events to educate and assist consumers about auto financing. Consumers who have complaints or disputes relating to auto loans are encouraged to file a complaint with the Attorney General’s Office.

Consumers with questions about settlement eligibility should contact AG Healey’s Insurance and Financial Services hotline at 1-888-830-6277. Eligible consumers will be contacted by Santander about this settlement.

This case was handled by Assistant Attorney General Aaron Lamb, Investigations Supervisor Arwen Thoman, Mathematician Burt Feinberg, Legal Analyst John-Michael Partesotti, and Division Chief Glenn Kaplan of the Attorney General Maura Healey’s Insurance and Financial Services Division.

###