Watch a webinar from the Attorney General's Office to learn how to access this opportunity.

If you have federal student loans, you may be able to get debt relief through a “payment count adjustment” that the U.S. Dept. of Education is conducting for the Public Service Loan Forgiveness (PSLF) Program.

To benefit, you may need to take action before April 30, 2024.

Watch a webinar with the Attorney General’s Office to learn more about the steps you may need to take. More information about PSLF and the payment count adjustment is below.

Accessing Debt Relief for Public Service Workers Webinar

Video: PSLF Webinar Recording 2024_02_09

Skip this video PSLF Webinar Recording 2024_02_09.What is Public Service Loan Forgiveness (PSLF)?

The PSLF Program forgives the remaining balance on your Direct Loans after you’ve made 120 monthly payments under a qualifying repayment plan while working at least 30 hours per week for the government or most types of nonprofit employers.

How Can the Payment Count Adjustment Help Me Get Loan Forgiveness Faster?

Through the payment count adjustment, you can receive PSLF credit for past repayment periods that wouldn’t normally count toward forgiveness. For example, you can get PSLF credit for:

- Payments made on ineligible federal loan types.

- Payments made on federal loans that you consolidated.

- Past repayment periods, regardless of whether you made the payment on time, for the full amount due, or under a qualifying repayment plan.

- Forbearance periods of 12 or more consecutive months or 36 or more cumulative months.

Learn more about the payment count adjustment on the U.S. Dept. of Education’s website.

Step 1: Consolidate any non-Direct Loans into the Direct Loan Program.

To benefit from the payment count adjustment, you must consolidate any non-Direct Loans (e.g., FFEL and Perkins Loans) by April 30, 2024.

Consolidate on the U.S. Dept. of Education’s website.

Not sure if you have Direct Loans? Call the U.S. Dept. of Education: 1-800-433-3243 or review our instructions.

Step 2: Even if You Already have Direct Loans, Consider Consolidating to Speed Up Forgiveness.

Even if some or all of your loans are already Direct Loans, consider if consolidating can speed up forgiveness.

The payment count adjustment will credit the new consolidation loan with the largest number of qualifying months among the loans that were consolidated.

For example: If you took out undergrad loans and then worked for a qualifying employer before grad school, forgiveness will come faster on your grad school loans if you consolidate them with your undergrad loans.

Step 3: Enroll in an Income-Driven Repayment (IDR) Plan.

To keep earning credit toward PSLF, most public service workers need to be enrolled in an income-driven repayment (IDR) plan by July 1, 2024. The ICR and PAYE plans are being phased out for many loan types in July, so if you intend to repay in one of those plans, apply now.

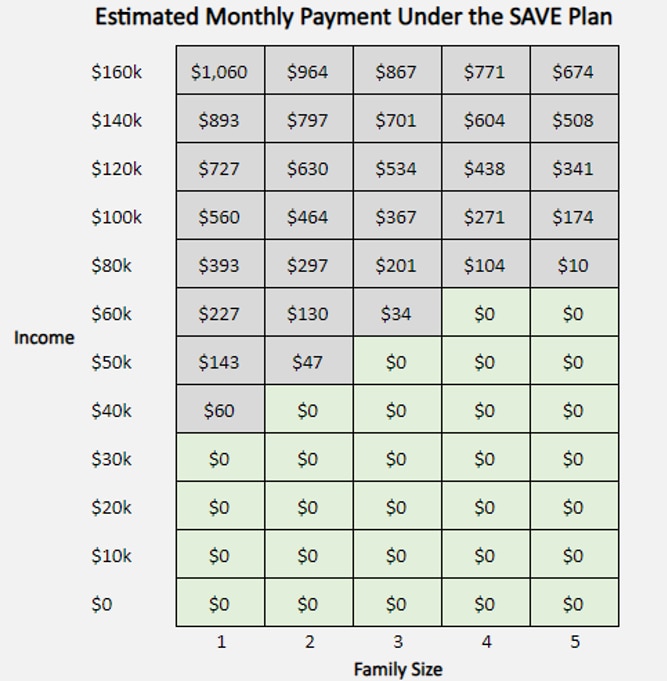

IDR plans base your monthly payment on your income and family size. The U.S. Dept. of Education recently implemented a new, lower-cost IDR plan called SAVE.

The new SAVE plan is the most affordable IDR plan in history! It cuts your monthly payments to $0 if you make less than $32,801 individually. It also caps interest so that your balance won’t grow.

Below is a chart you can use to estimate your SAVE payments. If you are married and file your taxes jointly, remember to include your spouse’s income. More detailed instructions for using this chart to calculate your SAVE payments are on this page.

Enroll in SAVE or another IDR plan on the U.S. Dept. of Education's website.

Step 4: Certify Your Public Service Employment.

The U.S. Dept. of Education can’t give you credit for your public service if it doesn’t know about it! Make sure you have employment certifications on file with MOHELA, the PSLF servicer, for all your qualifying employment periods since Oct. 1, 2007. If any periods are uncertified, work with your employer to fill out a PSLF Form, and submit it to MOHELA.

Learn more about what employment qualifies for PSLF on the U.S. Dept. of Education’s webpage.

Are Parent PLUS Loans Eligible for SAVE or other IDR Plans?

Parent PLUS loans aren’t eligible for the new more affordable SAVE Plan or any other IDR plan. However, if they are consolidated, Parent PLUS Loans can become eligible for the Income-Contingent Repayment (ICR) plan.

Additionally, if you have at least one Parent PLUS Loan and one other federal loan (of any type, including another Parent PLUS Loan), you can use a “double consolidation loophole” to get access to the new more affordable SAVE plan.

You must complete all the necessary consolidations by July 1, 2025 to access SAVE, and applying for them by April 2024 may help maximize credit under the payment count adjustment.

Learn more about the double consolidation loophole on our website.

Still Have Questions?

Learn more about PSLF and the payment count adjustment on our website