EOHLC commissioned the University of Massachusetts Donahue Institute to estimate the impact of the Affordable Homes Act on the state's economy. The analysis found that the Act, along with previously approved housing initiatives, would leverage or unlock an additional $10 billion in federal, local, and private funding for housing production. Full implementation of the bill could create nearly 30,000 jobs, stimulating $25 billion in economic activity over five years and returning roughly a billion dollars in state and local tax revenues. This analysis shows that the Affordable Homes Act will not only put Massachusetts on the path to housing abundance and affordability; it can also create opportunities for entrepreneurs to start new businesses while strengthening pathways to the middle class for Massachusetts’ young people and new arrivals.

Read an executive summary of the report below, or download the technical memo.

Executive Summary

The Affordable Homes Act is the largest housing bond bill in Massachusetts’ history, with wide-ranging impacts on housing affordability, climate readiness, equity, and economic growth. EOHLC commissioned the University of Massachusetts Donahue Institute (UMDI) to assess the bill’s potential economic outcomes. UMDI’s team of economists and researchers used an industry standard economic modeling tool (IMPLAN) to estimate the direct, indirect, and induced economic activity associated with the act’s spending and policy proposals.

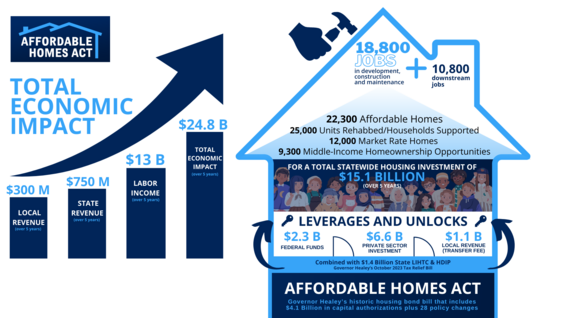

The analysis focused on 16 authorizations within the AHA totaling $3.68 billion, as well as three key policy provisions about surplus land, accessory dwelling units, and local option transfer fees. These program categories represent about 85% of the requested authorizations, but only a fraction of the spending associated with the bill’s implementation; a substantial amount of other state, federal, local, and private investments would be leveraged or unlocked by its provisions. Over the bill’s five-year timeline, this includes $1.2 billion from state Low Income Housing Tax Credits (LIHTC), $207 million of Housing Development Incentive Program (HDIP) subsidies, $2.3 billion of federal LIHTC, $1.1 billion of local transfer fee revenues, and $6.6 billion of private capital or commercial loans. Therefore, the total public and private spending associated with full implementation of the Affordable Homes Act is estimated to be $15.1 billion over five years.

UMDI estimates that these investments in infrastructure and housing construction will create 18,800 new jobs in development, construction, finance, and associated industries; and 10,800 ‘downstream’ jobs serving businesses and workers, for a total of 29,700 jobs. The total labor income from all this employment growth is projected to be $13 billion over the five-year period. All the activities associated with the bill’s implementation will add nearly $3.5 billion per year to the Commonwealth’s economy over the analysis period. In addition, firms throughout the Commonwealth’s supply chain are estimated to gain $1.5 billion of revenues by providing the goods and services needed to complete the new or improved housing. In total, the Affordable Homes Act could create $24.8 billion of total economic impact over a five-year period.

This economic boost could be felt in every corner of the Commonwealth. Based on the geographic distribution of households likely to benefit from the proposed housing investments, UMDI estimated potential job growth and economic impact by county. This portion of the analysis found that Western Massachusetts counties (Berkshire, Franklin, Hampden, and Hampshire) could gain 4,300 jobs (14% of the total) and $1.5 billion of value-added economic activity (11.5% of the total).

All this economic activity will also help boost public revenues. UMDI estimates that the state could recoup just over $750 million in personal income, sales, and corporate tax revenues over five years. Cities and towns could see nearly $300 million in new property tax and meals tax revenue, as well as more vibrant communities through the creation of new homes and businesses.

UMDI’s analysis also highlights a key opportunity for entrepreneurship and upward mobility: ramping up housing production to meet the need will require a substantial expansion in the construction industry, with more firms to build and upgrade homes and more workers to wield a hammer or install a heat pump. State, local, corporate, and educational partnerships related to workforce development initiatives, assistance for new businesses, and other efforts to expand the state’s capacity for housing production can help ensure there are enough firms and workers to achieve our housing goals. By aligning these efforts, Massachusetts will not only put itself on the path to housing abundance and affordability; it can also create opportunities for entrepreneurs to start new businesses while strengthening pathways to the middle class for Massachusetts’ young people and new arrivals.

| Date published: | January 18, 2024 |

|---|---|

| Last updated: | January 18, 2024 |