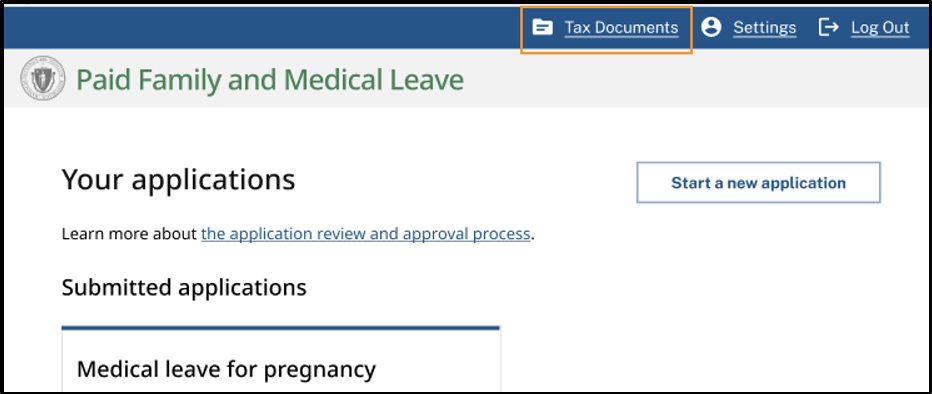

Log in to your account and navigate to tax documents

If you created an online account, you can download your 1099-G tax form by logging in to your PFML account.

Once you are logged in, you must consent, as required by the IRS, to receiving your 1099-G tax form as a PDF download. If you choose not to provide consent, you will not have access to the PDF version of your 1099-G tax form. You will still receive the form via mail. You can add or remove your consent via your PFML account at any time.

To start, click on the Tax Documents tab at the top of the page.

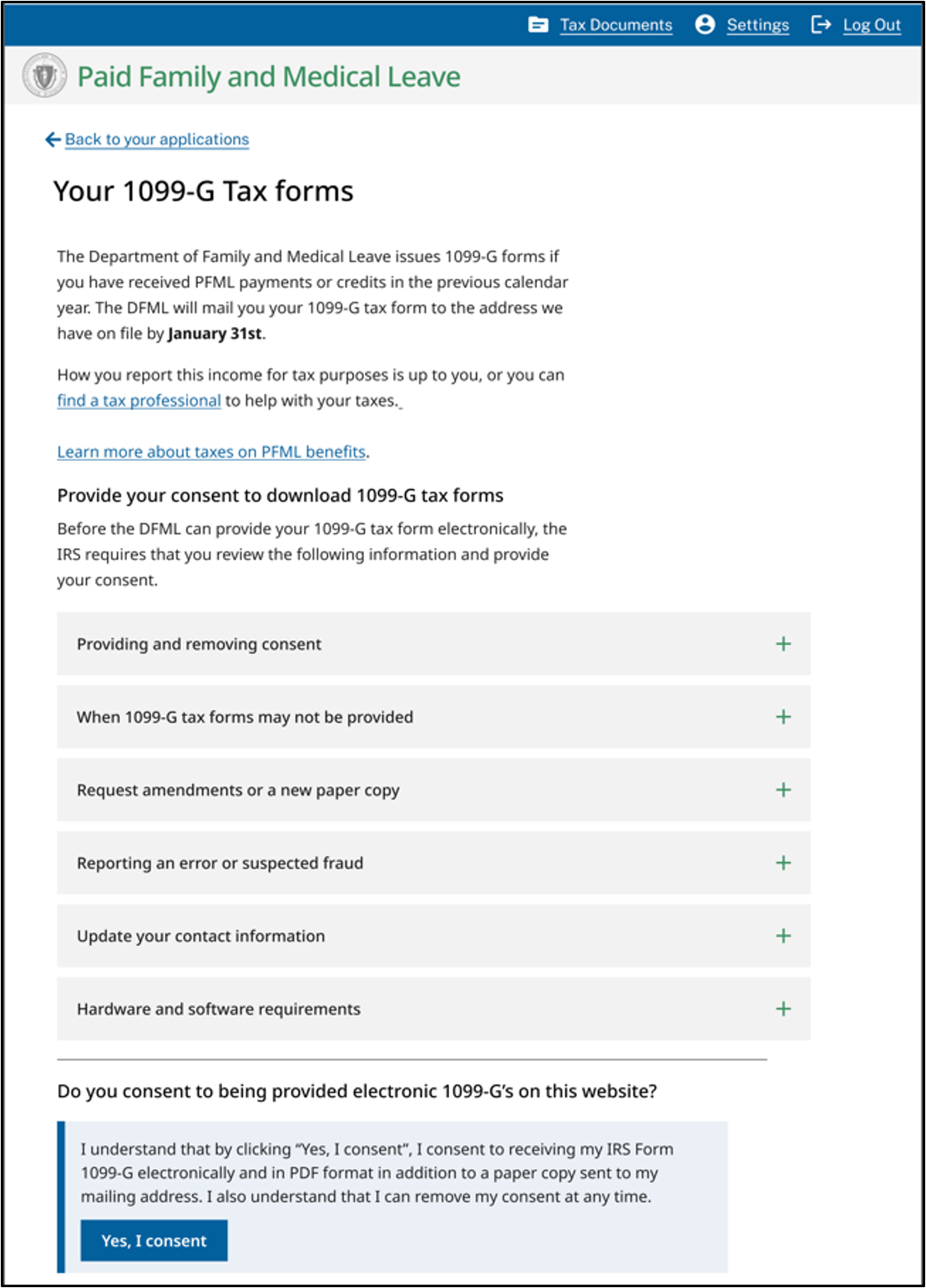

Your 1099-G tax forms page

Once on the Your 1099-G Tax forms page, there are several sections that give you more information on consent, requesting amendments or a new copy, reporting fraud, or updating your contact information.

When you are ready, click the Yes, I consent button at the bottom of the page to proceed.

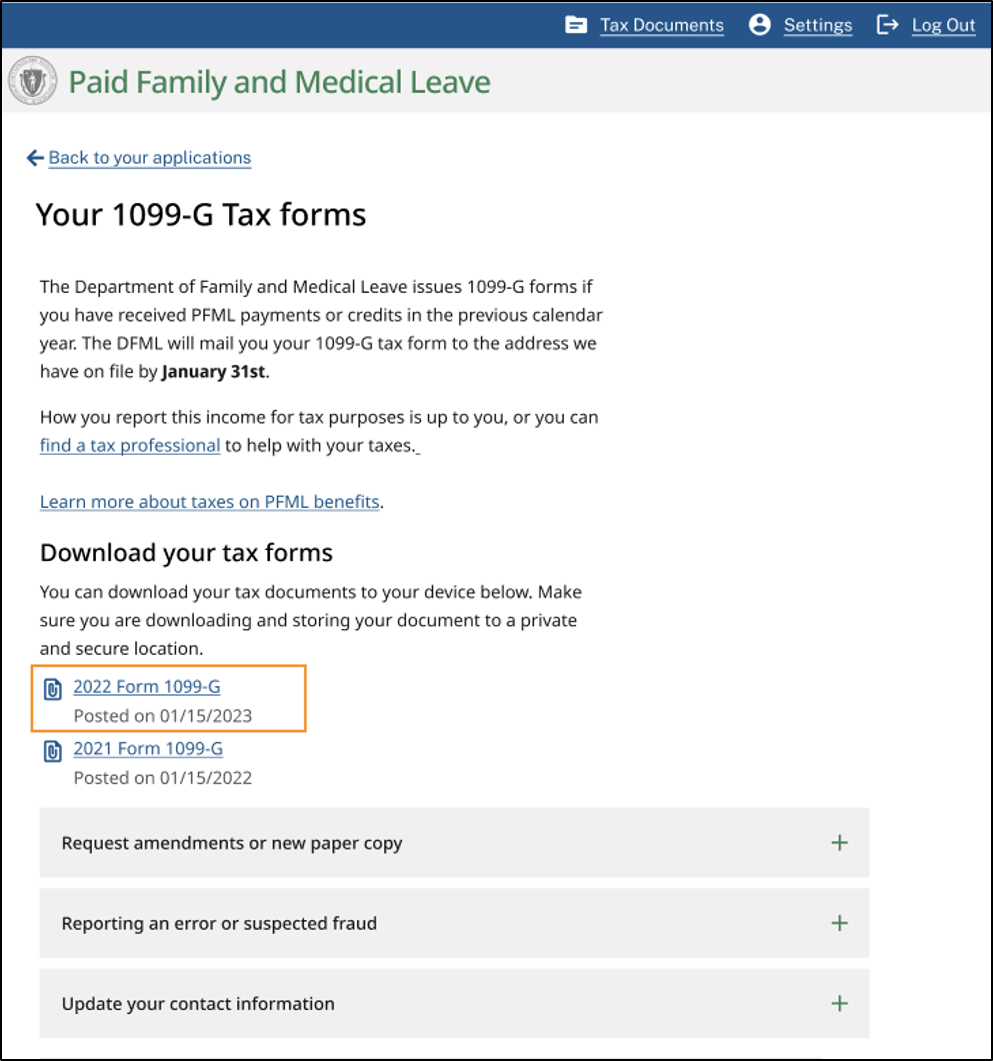

Download your tax forms

Once your consent is received and MFA is set up, you will be able download your 1099-G tax form from Your 1099-G Tax forms page.

You may provide consent to download your digital 1099-G tax form at any time, once the tax forms are ready to view. 1099-G tax forms will be available online through your PFML account for 3 years.

| Date published: | February 1, 2023 |

|---|