An Introduction to Building a Resilient Financial Management Operation

The DLS Financial Management Resource Bureau has been providing guidance and assistance to municipalities across the Commonwealth for more than 30 years. Over that time, we’ve analyzed hundreds of financial operations function and observed what characteristics make some more successful than others. In this article, we identify the key players involved in managing a town’s finances and highlight the core financial best practices common among fiscally stable communities.

At the foundation of every well-run local government lies strong communication, collaboration, and consensus among its various boards, committees, and professional staff. This also applies to a community’s financial operations; the absence of any of these characteristics can lead to a host of inefficiencies, risks, and other costly financial challenges. Everything from pulling together a multimillion dollar operating budget to the daily bookkeeping is influenced by the organization’s culture and the institutional practices it has in place.

Focusing on government administration in a town, the select board serves as the chief policymaking body who coordinates the general operations of town government. While these broad responsibilities cover many different aspects of managing a community, it is important that the select board codify several key practices.

As the de facto board the directors, the select board needs to identify the community’s mission, along with a set of annual goals and objectives. Not unlike other organizations, the town must have a clear understanding of its values and priorities so it can begin to establish strategic objectives around where it wants to go. Next, the board should focus on developing meaningful financial policies that align with the overall goals of the organization—the absence of which is like baking a cake without a recipe. The policies should be crafted with enough clarity to be readily understood by the public and provide for enough flexibility to operate within that policy. Lastly, the select board needs to participate in the annual budget process and take responsibility for monitoring the municipality’s ongoing financial performance.

The town administrator or manager serves as the community’s chief administrative officer who is generally tasked with coordinating day-to-day operations. This means administering the policies and procedures laid out by the select board and orchestrating the town’s financial management activities, among many other tasks. Although there are often significant differences in the authorities delegated to the town administrator or manager, the position should be established in a town charter or by a special act of the legislature. Often the role is found less formally laid out job description, which doesn’t serve as a baseline for stability and continuity in the role regardless of changes in personnel.

In managing the community’s financial well-being, the town administrator/manager should be tasked with overseeing the activities of the financial management team, including the town accountant, treasurer, collector, and assessor. As the caretaker of the town’s financial records, the town accountant reviews all bills and payroll to ensure they are within budget and are lawful expenditures. The accountant also issues monthly reports to each department on budget-to-actual revenues and spending and retain custody of all municipal contracts and prepare financial reports for the community.

The collector, as the name implies, collects taxes and other receipts such as fees, licenses and permits as authorized for the community. This involves preparing and mailing tax bills, the accounting of receivables, and enforcing liens on delinquent property taxes. The treasurer functions as the town’s cash manager who is responsible for the deposit, investment, and disbursement of all town funds and issuing debt on behalf of the community. The treasurer pays the town’s bills and often administers payroll and employee benefits. Delinquent property is turned over to the treasurer annually when the collector does a tax taking, and the treasurer manages property which is in tax title or foreclosure.

The assessors are responsible for maintaining a database of all properties in the municipality, including their classification and value. The annual Tax Rate Recapitulation Sheet and annual allowable levy growth report are prepared and submitted by the assessors. The assessors ensure fair and equitable taxes and grant tax abatements and exemptions. The assessors are also responsible for administering motor vehicle, boat, and farm excises.

Collectively, the town administrator/manager, accountant, treasurer, collector, assessor, and IT director form the backbone of a community’s financial management team. As such, they should hold regularly scheduled monthly meetings to open the lines of communication between and among finance officers. These meetings allow for discussion of overall operations and provide a forum to raise and resolve interdepartmental issues. Building an awareness of how each office is dependent on the performance of others helps to ensure that important checks and balances remain intact.

Financial team meetings also create opportunities to develop new ideas and to analyze the impact of upcoming fiscal events. Working together, financial team members can identify critical junctures and offer early strategies to deal with anticipated areas of concern. In every instance, finance officers can make sure that they agree about goals, deadlines, and everyone’s role in the process. The financial management team is not intended to function in a policy-making role. However, it can be advisory to boards and committees in a way that provides information for use in policy development and implementation.

Team management and cooperation among municipal officials are essential to creating a well-defined, coordinated budget process in which the financial goals of the municipality are achieved. It is critical for all municipal officials involved in the budget process to work together to disseminate important information in a timely fashion so that thoughtful decisions can be made to prioritize among competing spending needs. Municipal officials must work together to prioritize budget items effectively and objectively.

The budget process is the foundation on which all other elements of municipal finance are built. The municipal budget is how municipal officials and the legislative body decide how and where available municipal funds shall be spent. Included in the budget are estimated revenues and expenditures relevant to the daily workings of municipal government as well as capital expenditures. Major expenses include employees' salaries, debt service, ordinary community maintenance, pensions, and health insurance.

The development of a community's budget is a continuous process. Each cycle of the budget process overlaps with the next cycle, from monitoring the current budget to planning for next year's budget. As a result of changing financial needs in the community, it is critical to adjust the budget annually to ensure that municipal needs are met.

The budget is a major policy making tool for the community. As a policy instrument it should clearly define the service priorities and goals of the municipality. A good budget should indicate how the money spent on appropriations in the current year will enable the municipality to achieve its short and long range financial and policy goals. In addition, the budget is an important expenditure control document to ensure that funds are spent in accordance with town meeting specifications. It is also an important communication and public information document.

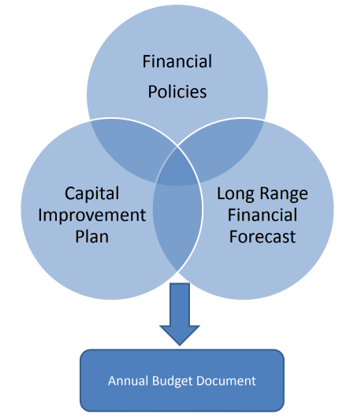

Annual operating and capital budgets should be developed within the framework of a sound long-range financial plan that addresses reserve, debt, and capital policies and needs. Current year spending decisions can have future year implications and the affordability of recurring expenses over the long term makes budgeting difficult even during good economic times. In those years, a community may have to constrain spending growth in department budgets, while during economic downturns it may have to find the resources to balance the budget or make service level decisions that may affect the whole community.