Understanding Your Statement

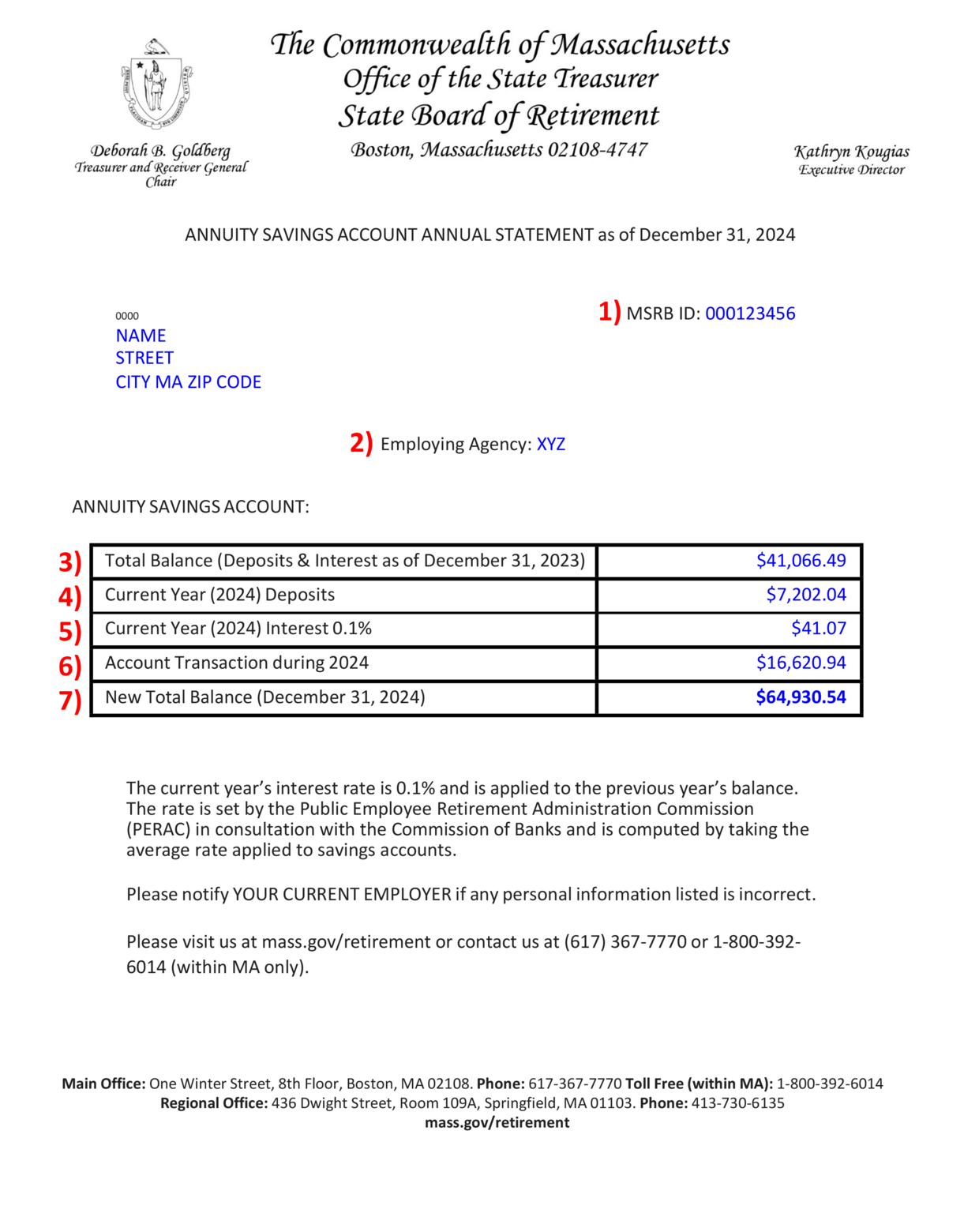

The annual statement reflects the balance of your accumulated retirement contributions plus any interest your account has accrued as of the end of 2024. Your employing agency forwards your contributions to the MSERS and they are maintained in an annuity savings account on your behalf for your retirement. For more information on your retirement benefits please see the MSERS Retirement Benefit Guide.

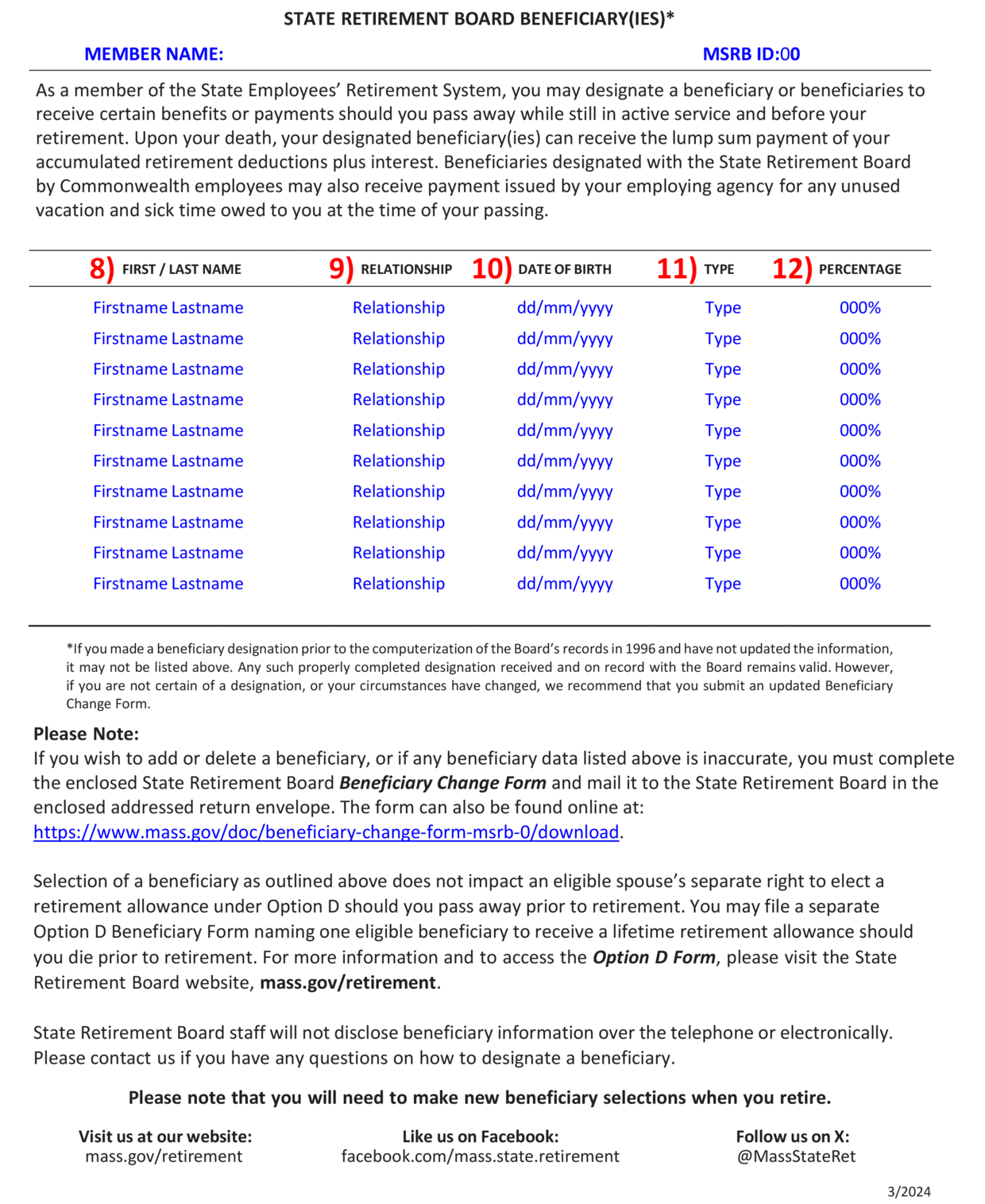

Page 2 of this year's Member Annual Statement will contain a list of your current beneficiaries on record with the State Retirement Board.

1) MSRB ID: your unique six-digit retirement account code with the Massachusetts State Retirement Board (“Board”). For security purposes, it is used instead of your social security number. Note: it is not the same as your Employee ID number.

2) Employing Agency: the agency you worked for as of December 31, 2024.

3) Total Balance: the balance of your account as of the previous year-end, December 31, 2023.

4) Current Year (2024) Deposits: the total amount of all your 2024 paycheck contributions.

5) Current Year (2024) Interest 0.1%: the current year interest rate is 0.1% and is applied to the previous year’s balance. The rate is set by the Public Employee Retirement Administration Commission (PERAC) in consultation with the Commission of Banks and is computed by taking the average rate applied to savings accounts.

6) Account Transaction during 2024: this field only displays when a member had a 2024 transaction such as a “service purchase” and/or “transfer-in.”

7) New Balance (December 31, 2024): your total account balance (after all transactions).

8) FIRST / LAST NAME: The first and last name of your beneficiary(ies).

9) RELATIONSHIP: Your relationship to the beneficiary(ies).

10) DATE OF BIRTH: Your beneficiary(ies) birth date.

11) TYPE: Your beneficiary's designation. They may be listed as PRIMARY or CONTINGENT and/or Option D.

12) PERCENTAGE: The percentage of your annuity balance that your beneficiary(ies) will receive if you pass away prior to retirement. The total percentage for PRIMARY beneficiaries should always equal 100%. The total percentage for CONTINGENT beneficiaries should always equal 100%.

What if any of my personal information listed on my statement is incorrect?

Please notify YOUR EMPLOYING AGENCY'S Human Resources department.

Can I opt-out of the system and stop making contributions?

No, membership and contributions are mandatory for everyone employed with the Commonwealth at least half-time in a creditable position.

Why does my coworker contribute less to the MSERS than I do if we both earn the same salary?

A member’s contribution rate is based on a percentage of your salary and that rate is dependent upon when you became a member of the MSERS or another public employee retirement system so long as that membership was not broken.

If you joined the system: You contribute (percentage of your salary):

Prior to January 1, 1975: 5%

January 1, 1975 to December 31, 1983: 7%

January 1, 1984 to June 30, 1996: 8%

July 1, 1996 or later: 9%

State Police after July 1, 1996: 12%

In addition to the percentages listed above, anyone who entered the system January 1, 1979 or later will pay an extra 2% for any salary they earn above $30,000.00.

Can I withdraw money from my account?

If you separate from state service, you may request to withdraw the contributions you have made into your annuity savings account. Once you take a refund, you are no longer a member of the system. You may request a direct refund or a rollover of your funds to an eligible retirement account.

Can I take a loan from the funds in my account?

No, state law does not allow you to borrow from your annuity savings account under any circumstances.

What happens to this account if I leave my job but don’t retire?

You have a couple of options. You can take a refund of your account or roll it over to an eligible retirement account, or you can leave the funds on account with the Board. If you take a direct refund, we have to deduct 20% for federal taxes and you may be assessed a 10% IRS penalty for early withdrawal depending on your age. You can avoid the taxes and penalties with a rollover. If you leave your funds here, your account will earn interest for up to two years after your last date on the payroll. Accounts stop earning interest after two years. Leaving your funds on account with the Board preserves your current membership rights. In certain instances, if you have vested and separate from service you may defer the start of a retirement allowance until a future date.

Can I get credit for my service if I get a job working in municipal or county government?

If you separate from state service and continue working in the public sector in Massachusetts, i.e. working for city, town, municipal or county government, your contributions and service credit will be transferred to your new retirement system. If you had such service prior to joining the MSERS you should contact the Board to determine if it is service that qualifies to be transferred or may be added by way of a service purchase.

Who receives the funds in my account if I pass away prior to retiring?

If you are an active or inactive member of the MSERS with funds on account, your beneficiaries on file will receive a refund or rollover of your account at the time of your death (M.G.L. c.32, §11(2)). However, if you have a beneficiary who is eligible for a lifetime pension benefit, such as a spouse, that individual may receive a monthly retirement allowance instead [M.G.L. c.32 §12(2)(d)].

What type of account is this?

Your annuity savings fund is considered a 401(a) retirement plan under section 414(d) of the Internal Revenue Code.

Why is the interest rate so low?

The interest rate is set in accordance with the provisions of M.G.L. c. 32, §22(6)(b) and is obtained from the average rates paid on individual savings accounts by a representative sample of no less than 10 financial institutions. The Public Employee Retirement Administration Commission (PERAC) sets the rate in consultation with the Commissioner of Banks. Anyone who voluntarily separates from state service with less than 10 years of creditable service will receive 3% interest on their contributions.