FORM 1099-R UPDATE

All 2025 Form 1099-Rs have mailed.

Please allow ample time for your Form 1099-R to be delivered to you via the United States Postal Service (USPS). You can view the USPS Service Alerts here: https://about.usps.com/newsroom/service-alerts/

If you don't receive your Form 1099-R by mid-February, you can call our office at 617-367-7770. If you need to request a duplicate 1099-R from the Board, you can do so beginning on February 20, 2026.

Form 1099-Rs for 2025 will be viewable on your PayInfo account in mid-February.

Go to mass.gov/payinfo to log in to your account. Please note, although this is a handy item to have available for reference, it is not considered an official Form 1099-R and cannot be used to file your taxes. Therefore, be sure to hold on to the original hard copy that was mailed to you.

Additionally, due to the technical limitations of PayInfo, PayInfo can only display one Form 1099-R. PayInfo will display Form 1099-Rs for members who received a monthly benefit in 2025. It does not display refund Form 1099-Rs.

Important information for those who turned age 59 ½ in 2025:

One important reminder is for retired members who received a monthly retirement benefit both pre and post-age 59 ½ in 2025. Please be advised that most of you will receive two Form 1099-Rs. (PayInfo can only display ONE Form 1099-R.) The retirement allowance paid up until the month before you turned age 59 ½ will be reported on one Form 1099-R using distribution code 2, and the retirement allowance paid for the remainder of the year will be reported on a second Form 1099-R using distribution code 7. Note that you will also receive two Form 1099-Rs if you received a partial refund in addition to your retirement benefit. Information from both forms should be used for tax reporting purposes.

Please be sure to keep your mailing address up-to-date with MSRB to ensure you receive your 1099-R tax statement and other correspondence in a timely manner. Note, even if you receive your allowance through direct deposit, the Board will periodically mail important correspondence to you. Members who need to update their address may use the Retiree Change of Address Form, which is posted on this website on the All Forms page. Note: MSRB staff cannot accept address changes over the phone.

Tax season is right around the corner. Now might be a good time to check your year-to-date tax withholdings. Want to change your tax withholding election with the Board? Click here to download the official IRS W-4P Tax Form. Please fill it out, sign it, and mail it to our Boston office.

Need help understanding your Form 1099-R?

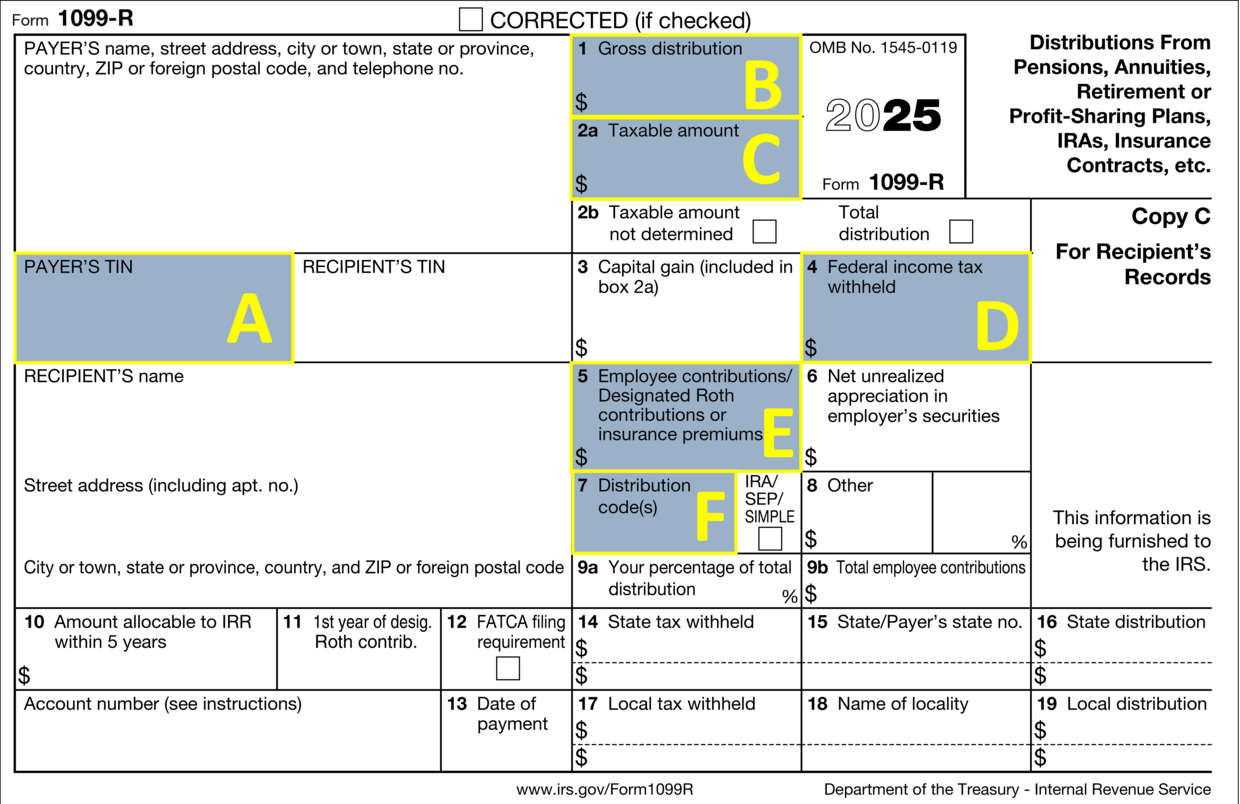

Please refer to the descriptions and corresponding sections highlighted in blue below. If you have any further questions about your taxes, please seek advice from your professional tax advisor or the Internal Revenue Service. Employees of the State Retirement Board are not authorized to advise you on any tax issues.

Please refer to the descriptions below for the corresponding sections highlighted above.

- Box A: Payer's Federal Identifications Number: This is the Massachusetts State Retirement Board's federal Employer Identification Number (EIN).

- Box B: 1. Gross Distribution: This shows the total distribution amount that you received from the Massachusetts State Retirement Board for the calendar year 2025.

- Box C: 2a. Taxable Amount: This shows the distribution amount that is taxable. Money that was deducted from your check for employee contributions to the pension plan are pre-tax and therefore taxable when paid. Some money may have been deducted after tax (for example, if you had bought back time). These amounts are recovered and will not be taxable. They will be deducted over an extended period from when you start receiving your pension and are equal to the difference between your gross and taxable distribution.

- Box D: 4. Federal Income Tax Withheld: This is the total amount of federal income tax withheld from your benefit payment for the calendar year 2025.

- Box E: 5 Employee Contributions or Insurance Premiums: 2025 paid health & dental insurance premiums.

- Box F: 7. Distribution Code: This IRS code identifies the type of distribution you received from the Massachusetts State Retirement Board. The codes are also described on the back of your 1099-R Form.

- Code 1: Premature distribution subject to excise tax penalty (generally a lump-sum distribution).

- Code 2: Applies to certain distributions, including regular retirement benefits, that are eligible for the exception to the premature distribution tax. Code 2 is indicated for benefit recipients under the age of 59 1/2 for a reported year.

- Code 4: Identifies payments received for a survivor, beneficiary, or estate of a deceased member of a MSERS retiree.

- Code 7: Identifies payments for regular pension distributions for benefit recipients over the age of 59 1/2 for the reported calendar year.

- Code G: Identifies as a total distribution that was directly rolled over to a financial institution.

Please note: MSRB Staff is not authorized to give you tax advice of any kind. Please direct all questions about your individual tax liability to your tax accountant professional, the Internal Revenue Service, or the State Department of Revenue.

Contact

Phone

Drop-off hours at both offices are Monday through Friday from 10:00 AM - 3:00 PM, except on state holidays.

Bypass the call center if you know your party's extension.

For those calling from Massachusetts only.