| Date: | 10/16/2023 |

|---|---|

| Organization: | Department of Family and Medical Leave |

| Referenced Sources: | Section 3 of M.G.L. c. 175M as amended by Bill H. 4053 |

- This page, Important Legislative Changes to the Massachusetts Paid Family and Medical Leave Program, is offered by

- Department of Family and Medical Leave

Important Changes Important Legislative Changes to the Massachusetts Paid Family and Medical Leave Program

Table of Contents

Overview

Recent legislative changes regarding the Paid Family and Medical Leave (PFML) program will have an impact on both employers and employees. It is important to understand these changes and any responsibilities you may have as an employer or employee. This memo outlines the important information you need to know about these changes.

Legislative Changes

For applications filed on or after November 1, 2023, employees receiving PFML benefits may supplement (or “top off”) their PFML benefits with any available accrued paid leave (sick time, vacation, PTO, personal time, etc.). For employees who choose to supplement their PFML benefits in this way, the combined weekly sum of PFML benefits and employer-provided paid leave benefits cannot exceed the employee’s Individual Average Weekly Wage (IAWW). Employers will be responsible for monitoring and ensuring that the combined weekly sum of employer-provided paid leave benefits and PFML benefits does not exceed an employee’s IAWW. If the application is filed on or after November 1, 2023, applications filed retroactively for a leave that began before November 1, 2023, are eligible for topping off.

Employer Responsibilities

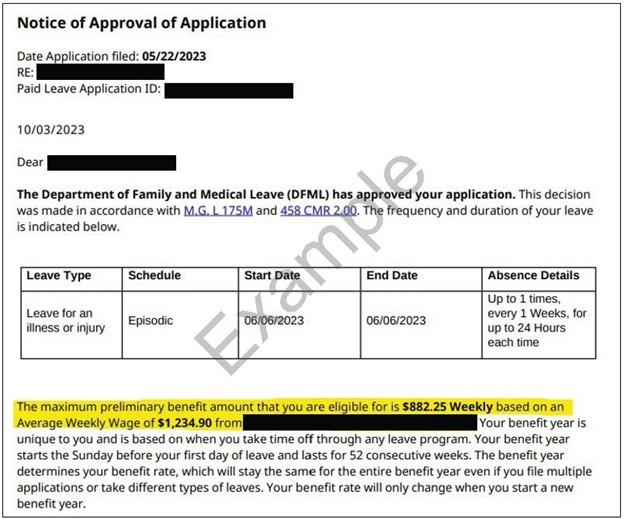

All employers must have registered Department of Family and Medical Leave (DFML) Leave Administrators. An employer’s DFML Leave Administrator can find an employee’s weekly PFML benefit rate and IAWW in the employee’s PFML Approval Notice. The image below shows where a Leave Administrator would find the link to the Approval Notice on the Employer Application Website.

The image below shows where the employee’s weekly benefit amount and IAWW are located on the Approval Notice.

To avoid overpayments once PFML paid benefits begin, employees should not continue to use PTO, like sick time, personal days, vacation time, or other employer provided paid leave programs to cover their full salary after the PFML seven (7) day waiting period.

Employers are responsible for managing any payments made to an employee that exceed the employee’s IAWW. DFML is not involved in the repayment process for top off overages. This process is solely the responsibility of the employer and the employee.