Overview

The Massachusetts Housing Finance Agency (MassHousing) is an independent, quasi-public agency established by Chapter 708 of the Acts and Resolves of 1966. Its primary function is to provide financing for affordable housing in Massachusetts. According to its website, MassHousing “[confronts] the housing challenges facing the Commonwealth to improve the lives of its people.”

MassHousing does not receive state funding for its operations. According to its website,

[MassHousing] raises capital by selling bonds and lends the proceeds to low- and moderate-income homebuyers and homeowners, and to developers who build or preserve affordable and/or mixed-income rental housing.

MassHousing is governed by a nine-member board of directors, with all members appointed by the Governor.

Section 8 Project-Based Contract Administration

MassHousing serves as the performance-based contract administrator (PBCA) for the Commonwealth on behalf of the US Department of Housing and Urban Development (HUD). In this role, MassHousing oversees key functions related to the administration of Section 8 Housing Assistance Payments (HAP) contracts.1 According to the PBCA agreement between HUD and MassHousing, MassHousing is responsible for the following tasks:

- conducting management and occupancy reviews;

- adjusting contract rents in accordance with HAP contract and HUD requirements;

- processing terminations or expirations of HAP contracts;

- paying monthly vouchers from Section 8 property owners;

- resolving health and safety issues and responding to community and resident concerns;

- submitting Section 8 budgets, requisitions, revisions, and year-end statements to HUD;

- submitting financial statements to HUD; and

- renewing expiring Section 8 HAP contracts.

Management and Occupancy Reviews

As part of the PBCA agreement, MassHousing performs management and occupancy reviews (MORs) of properties receiving project-based Section 8 housing assistance from HUD. These reviews evaluate management practices and include a physical inspection of a property’s overall appearance, security, and compliance with HUD requirements, leasing and occupancy requirements, management and resident relations, and program accessibility.

Section 880.612 of Title 24 of the Code of Federal Regulations states that, after the HAP contract’s effective date, the contract administrator must conduct an inspection of the project and review its operation at least once per year. This is to determine whether the owner complies with the contract and whether the units receiving Section-8 housing assistance are in decent, safe, and sanitary condition. According to Federal Register 87, No. 122, dated June 27, 2022, HUD revised the MOR scheduling to a risk-based system. The performance-based MOR schedule considered both a project’s risk rating, as determined by HUD, and the most recent MOR score to establish whether the project’s next MOR would be scheduled within 12, 24, or 36 months of the previous MOR. MassHousing adopted the HUD risk-based system of MOR scheduling and incorporated the system into its “Management and Occupancy Review (MOR) Guidelines.”

The MOR process begins when the quality assurance manager at MassHousing sends a proposed annual MOR work plan to HUD, which is updated quarterly. A HUD project manager then reviews and approves the work plan2 and sends it back to MassHousing via email. After receiving approval from HUD, a MassHousing asset manager schedules an MOR with at least 14 days’ notice, confirms the review details in writing with the property manager, and provides the property manager with a list of documents that the property management team needs to have available on the day of the review.

Next, the asset manager completes a Form HUD-9834 “Management Review for Multifamily Housing Projects” to evaluate the physical condition of the property and the effectiveness of the property management practices. The asset manager completes Form HUD-9834 Part 1 – Desk Review3 before the on-site review and Form HUD-9834 Part II On-Site Review questionnaire with the property manager on the day of the review. The asset manager then reviews tenant files4 to verify tenant certifications and recertifications (such as household information and income and asset documentation), move-in and move-out dates, and rejection files.

Upon completion of the on-site review, the asset manager holds an exit meeting with the property manager to discuss their initial observations and findings. According to Section 6-9 of Chapter 6, REV-1, of HUD handbook Multifamily Asset Management and Project Servicing (4350.1), written summary reports for on-site reviews must be completed by the asset manager within 30 calendar days of completing the on-site review. The asset manager sends via email the written summary report, which consists of a cover letter, a summary report, a rating, and findings, to the owner and property manager or their designated contact.

The following table details the five possible ratings outlined in Chapter 6, REV-1, of HUD handbook Multifamily Asset Management and Project Servicing (4350.1).

| Rating | Range |

|---|---|

| Superior | 90–100 |

| Above Average | 80–89 |

| Satisfactory | 70–79 |

| Below Average | 60–69 |

| Unsatisfactory | 59 and below |

For reviews rated as “Below Average” or “Unsatisfactory,” the asset manager also provides a copy to the HUD account executive. The property manager may submit an appeal of the rating to MassHousing within 30 days of receiving the report. The HUD account executive communicates the final appeal decision to the property manager within 45 calendar days of either receiving the appeal letter from the owner or property manager or the conclusion of the appeal meeting between the property manager and HUD director, if one is requested. Following the initial appeal decision rendered by MassHousing, if the property manager disagrees with the outcome, they may submit a final appeal to the local HUD project manager, who makes the final decision. According to Section 7 of MassHousing’s “Management and Occupancy Review (MOR) Guidelines,” the portfolio manager at MassHousing reviews the report and accompanying documentation prepared by the asset manager to ensure that all sections of the form have been completed. Additionally, the asset manager and portfolio manager need to confirm that the conclusions drawn and any required corrective actions are well-supported and that the ratings assigned are appropriate.

According to Section 6-15 of Chapter 6, REV-1, of HUD handbook Multifamily Asset Management and Project Servicing (4350.1), the property manager must be notified when there is any noncompliance related to any outstanding management occupancy review findings. Upon receiving this notification, the property manager is required to take remedial actions and provide an explanation for the noncompliance. The asset manager conducts follow-up activities on any noncompliance until all corrective actions have been completed. After the property manager has taken all corrective actions or a decision is made to defer any open findings, the asset manager provides a close-out letter to the property manager. The asset manager then updates the management review fields in the Integrated Real Estate Management System5 with the target completion dates and the MOR closure date, if applicable. If the property manager fails to respond and/or address corrective actions, the asset manager continues to follow up and may refer the issue to the HUD field office for appropriate administrative action. If MassHousing cannot ensure compliance with HUD requirements, the HUD project manager has discretion in resolving deficiencies and may initiate a referral to the Departmental Enforcement Center6 for potential administrative sanctions. This could result in suspension, debarment, limited denial of participation, civil money penalties, and/or other appropriate sanctions.

Asset Management Reviews

According to its website, MassHousing provides financing to developers and property owners of affordable and/or mixed-income rental housing. The MassHousing Rental Management Division conducts asset management reviews (AMRs) of property developments within MassHousing’s multifamily rental portfolio and evaluates the effectiveness of each property management company in managing the asset and maintaining compliance with MassHousing requirements. During the audit period, more than 400 property developments were within MassHousing’s multifamily rental portfolio and were subject to AMRs.

According to MassHousing’s “Asset Management Review Guidelines,” the purpose of an AMR is to monitor property operations. This review includes assessing the overall physical condition of the property and its financial and operational performance. An AMR aims to ensure that property managers comply with established affordability restrictions and applicable federal, state, and MassHousing regulations. MassHousing conducts AMRs on various types of properties in its loan portfolio, including MassHousing’s risk-rated developments, such as multifamily accelerated processing and demonstration disposition developments; Workforce Housing; and Options for Independence developments. Generally, the asset manager performs the initial review one year and one day after the property development’s permanent loan closure. Unless an AMR is deferred, MassHousing asset managers perform AMRs every 12 months, based on risk ratings and program requirements.

The first step of the AMR process involves the asset and portfolio managers reviewing their work plan to determine the AMR schedule for a specific property. The asset manager then sends a review notice for a site visit to the property manager 30 days before the visit. This notice includes a questionnaire and a list of documents that must be prepared for the review. Before the site visit, the asset manager conducts a desk review by completing MassHousing’s internal review forms. This review includes, but is not limited to, documents such as the previous AMR and close-out documentation; the capital needs plan; the most recent real estate assessment center7 inspection, if applicable; financial activity reports; and the property’s affordability profile.

During the site visit, the asset manager reviews the property manager’s policies and procedures while assessing the physical condition of the property. This physical assessment includes inspecting the building’s exterior, grounds, common areas, and a sample of units. Additionally, the asset manager conducts a resident file audit, which involves reviewing a sample of move-in, recertification, move-out, and rejection files, to ensure the property manager’s compliance with federal and state regulations. Before leaving the property, the asset manager performs an exit interview with the property manager to summarize the overall impression of the development, significant findings, and observations made during the site visit. The asset manager informs the property manager that the final report could include additional findings based on the final and overall review.

The AMR report consists of a cover page and a narrative describing the observations, findings, and ratings achieved based on the following AMR scoring criteria: inspection results, capital needs planning, affordability restrictions, fiscal management, and operations requirements. It also clearly identifies corrective actions and their target completion date, which is typically 30 days from the date of the report. The rating categories include superior, satisfactory, and unsatisfactory. The portfolio manager reviews and approves the completed report. If a property receives three or more unsatisfactory ratings among the above AMR scoring criteria, it is classified as an overall failed review of the property. In the case of a failed review, the asset and portfolio managers, in consultation with the senior manager, determine whether the property development should be subject to an action plan or probation. The asset manager then sends the AMR report to the property manager within 30 days of the site visit. The asset manager sends AMRs that have overall failed reviews or unsatisfactory ratings via certified mail.

The property manager may file a written appeal within 10 days of receiving the failed AMR report if they disagree with the results. If they decide not to file an appeal, or if the appeal is denied, they must address the recommendations and implement corrective actions within 30 days of the issuance of the AMR report. Finally, the asset manager follows up to ensure that the findings are adequately addressed and closes out the review with a letter to the property manager, owner, or agent. If findings are not adequately addressed, property owners may be subject to termination of their HAP contract and potential debarment from participation in the Section 8 housing program.

Massachusetts 3% Priority Program

The Massachusetts 3% Priority Program is designed to assist the Commonwealth in promoting independent living for people with disabilities and older adults by helping them reside in the least restrictive environments possible. The program offers prioritized access to community-based housing, along with the necessary support services to help individuals thrive within their communities.

Effective September 1, 2020, MassHousing entered into a memorandum of understanding (MOU) related to the 3% Priority Program, with the following housing agencies: the Massachusetts Development Finance Agency, the Massachusetts Housing Partnership Board, and the Department of Housing and Community Development,8 and the following health agencies of the Commonwealth: the Executive Office of Health and Human Services (EOHHS), the Department of Mental Health, the Department of Developmental Services, the Massachusetts Rehabilitation Commission, and the Executive Office of Elder Affairs. The MOU outlined the responsibilities of the parties with respect to the 3% Priority Program units at multi-family developments. The MOU stated that MassHousing agreed to serve as the point of contact between property management companies and EOHHS and would facilitate referrals for vacant units, starting from the effective date of the MOU through March 1, 2023.

According to the 3% Priority Program MOU,

1.2 3% Priority Agreements. . . . The 3% Priority Agreements shall provide a priority for consumers referred by the EOHHS Parties for a least 3% (rounded up if .5 or over) of all subsidized units as shall be specified therein.

2.1 Developments Requiring 3% Priority Units. 3% Priority Agreements shall be required for all rental developments funded or overseen by one or more of the Housing Parties . . . with (a) at least 17 affordable units restricted to households earning up to eighty percent (80%) of the area median income (AMI) and (b) a federal capital subsidy administered by one of the Housing Parties, a state capital subsidy, utilization of state or federal low-income housing tax credits or a project-based rental assistance contract. Units subsidized by the Community-Based Housing (CBH) or Facilities Consolidation Fund (FCF) programs or other similar programs or units already serving clients of the EOHHS Parties will be counted towards the requirement for 3% Priority Units.

According to the “Massachusetts 3% Priority Operations Manual,” if an EOHHS referring agency does not refer a household for a particular unit vacancy, the property manager can fill the vacancy by renting the unit to a different qualified household.

Some MassHousing contracts for multifamily properties include a requirement for multifamily property owners with certain loans to set aside 3% of all low- and moderate-income units for applicants referred by specific agencies within the EOHHS. These agencies include the Executive Office of Elder Affairs, the Massachusetts Rehabilitation Commission, the Department of Developmental Services, and the Department of Mental Health.

According to the “Massachusetts 3% Priority Program Operations Manual,”

The 3% priority program coordinator [which is MassHousing] is responsible for randomly ordering the applicants for the 3% Program units and notifying the EOHHS contacts and property manager of that order. . . . An inventory of 3% program units and respective EOHHS agency occupancy will be maintained in MassAccess [an online search tool for affordable rental homes in Massachusetts], and shared with EOHHS contacts on a quarterly basis.

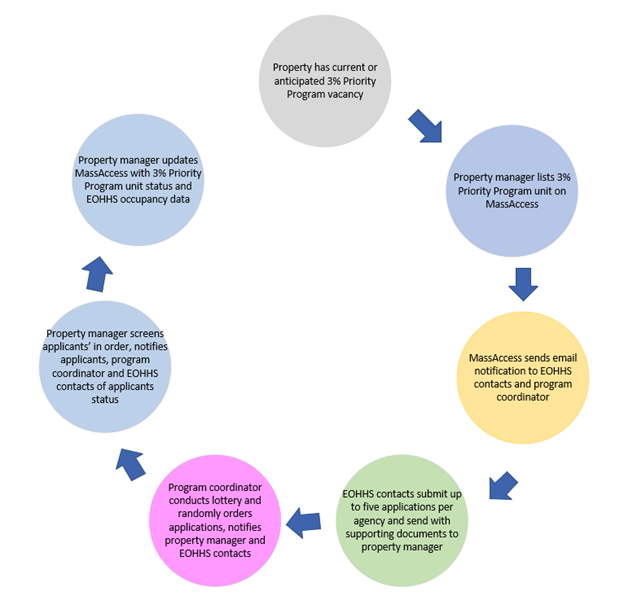

According to the “Massachusetts 3% Priority Program Operations Manual,” below is the process of filling vacancies related to the 3% priority program.

Process for Filling 3% Priority Program Vacancies

| Date published: | October 30, 2025 |

|---|