Author: Tony Rassias - Deputy Director of Accounts

This article will review municipal enterprise fund data submitted to BOA focusing on current fund types, an explanation of budgeted costs and revenues and fiscal year results of operation. The enterprise fund statute, G.L. c. 44, § 53F½, initially enacted in 1986, gives cities and towns the flexibility to account separately for all financial activities associated with a broad range of municipal services. To learn more details about enterprise funds including reasons why to adopt one, what governmental services are eligible, how their costs and revenues are budgeted, review the Bureau of Accounts’ (BOA) enterprise fund manual.

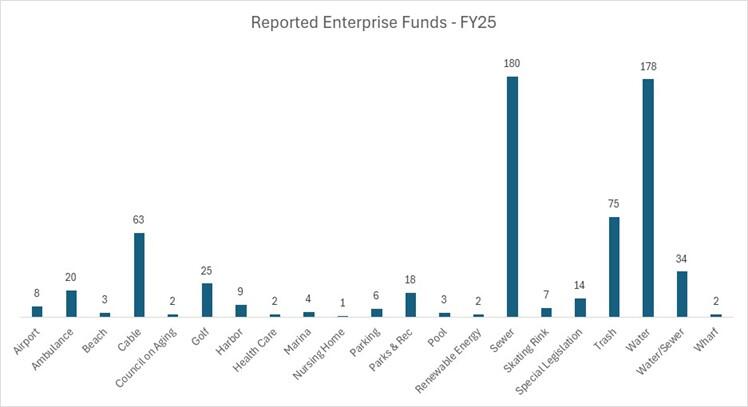

In FY2025, 277 Massachusetts cities and towns reported 656 enterprise funds led by nine in Barnstable, seven in Beverly and six in Ashland, Brockton and Nantucket. The following table details fund types and number of funds within that reported type. It shows that water and sewer are by far the most common type of enterprise fund.

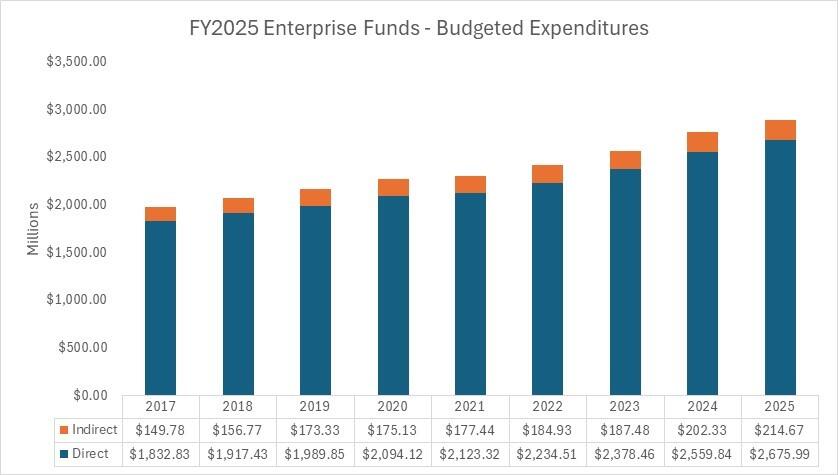

Enterprise Budgeted Costs

Enterprise budgeted costs are reported on tax rate recap form A-2 as:

- Direct costs, appropriated directly into the enterprise budget

- Indirect costs, appropriated within another fund, most often the general fund, for departmental services to the enterprise and then allocated to the enterprise fund

As shown in the graph below, for FY2025 appropriated direct and indirect costs reported as part of the tax rate certification purposes totaled $2.89B, with $2.68B (92.6%) direct and $214.67M (7.4%) indirect. It also shows how these enterprise funds have grown 45.8% since FY2017 ($1.98B vs. $2.89B). Lastly, it shows that indirect costs as a percent of the total have remained relatively consistent.

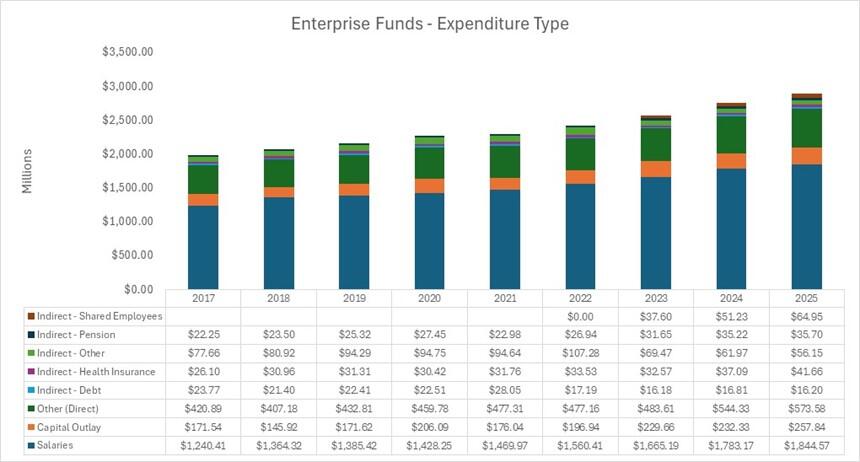

The following graph breaks out the types of direct and indirect costs. It shows that salaries are by far the largest component every year, comprising close to two-thirds of expenses.

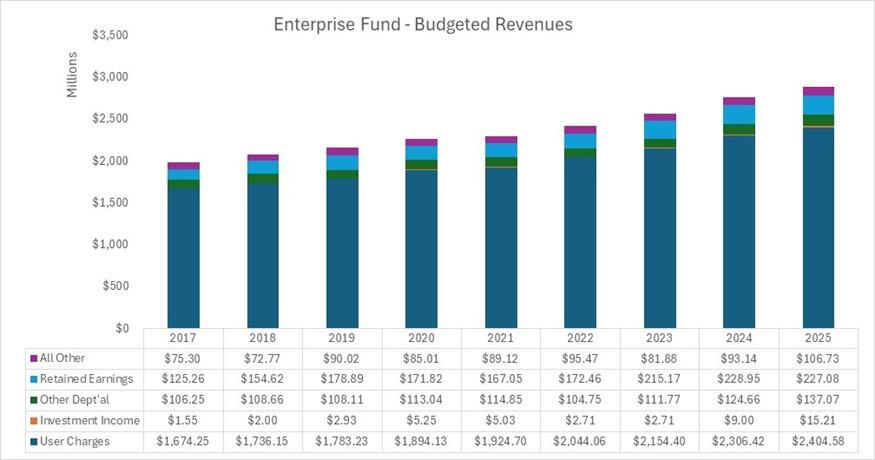

Enterprise Budgeted Revenues

Enterprise budgeted revenues must annually balance with enterprise budgeted costs before a tax rate can be certified by BOA. Costs may be covered by several revenue sources as shown in the graph below. It's important to note that while budgeted revenues must be equal to budgeted costs, enterprise funds do not need to be 100% self-supporting: a municipality can choose to have general fund subsidy. As displayed, the largest source of revenue for enterprise funds is user charges/fees, annually comprising more than 80% of revenue.

The Importance of User Charges and Fees

Since user charges/fees paid by those who use the service (including late charges, fees and interest incurred in the collection process) are the largest source of revenue, it's important that they be estimated prudently. If over-estimated, they could greatly affect retained earnings unless spending is curtailed to offset the shortfall.

Each year as part of the property tax rate setting process, municipalities must provide support of estimated revenues that are above prior year actual receipts by either, or both, (1) a voted rate increase made prior to the submission of the tax rate recap or (2) documentation justifying an increase in usage. The enterprise fund user charge template is used to justify the estimate.

Retained Earnings

Enterprise retained earnings are similar to free cash in the General Fund. They:

- must first be certified by BOA

- may be appropriated by the community’s legislative body until June 30

- return to $0 as of July 1, and

- cannot be appropriated greater than the amount certified

- have restrictions as found in the enterprise fund manual.

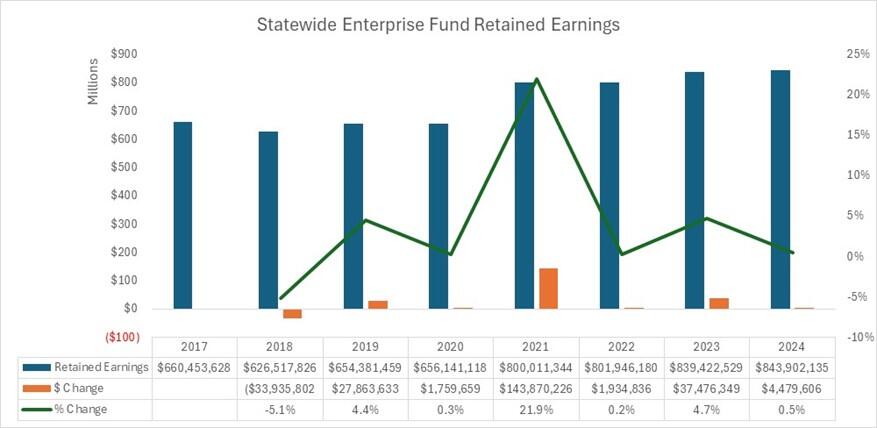

Actual revenues greater than budgeted serve as a positive factor in the calculation of retained earnings. When the opposite occurs, it’s a negative factor unless appropriations are curtailed to offset a revenue shortfall. The following table shows total certified retained earnings in recent years as of July 1.

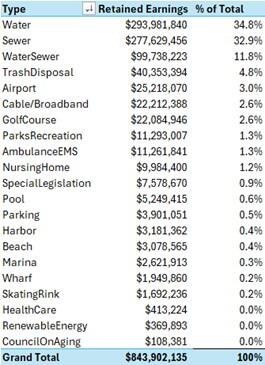

The table below shows the composition of the $843.9M of retained earnings by enterprise fund type.

Budget to Actual Revenues

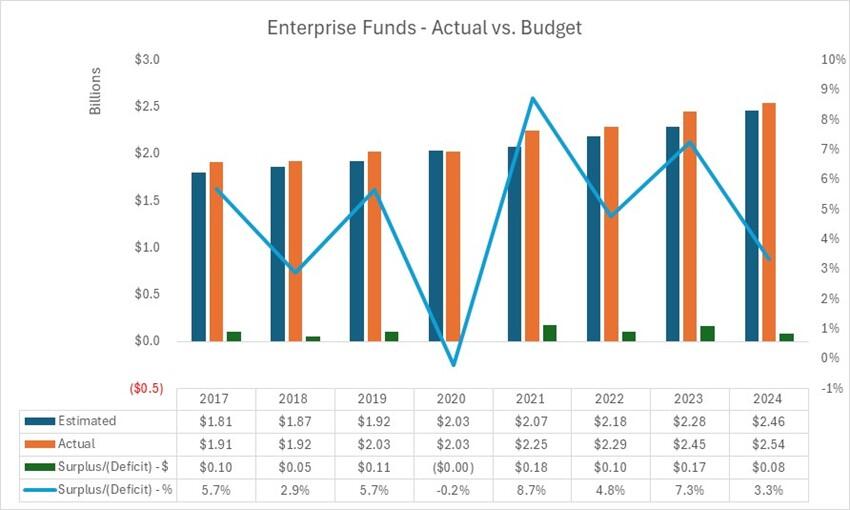

The following graph shows total budgeted estimates to actual revenues submitted to the BOA for tax rate certification purposes since FY2017. (Note: Retained earnings and general fund subsidies are not included in this analysis.)

For more information on enterprise funds and other municipal finance related information, please view the Division of Local Services website.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | July 17, 2025 |

|---|