Authors: Tony Rassias (Bureau of Accounts Deputy Director) and Courtney Cardello (Public Finance Section)

Established in 1911, the Massachusetts State House Notes Program is a convenient, no-cost note certification procedure for the issuance of short-term debt, long-term serial, and refunding notes by a governmental entity. Administered by the Public Finance Section of the Bureau of Accounts (BOA), the program provides an alternative to the certification of Notes procedure by commercial banks.

What are State House Notes?

State House Notes are borrowing instruments for local governmental entities for the short-term. They are known by different names and acronyms:

- Revenue Anticipation Note (RAN)

- Renewal of Revenue Anticipation Note (RRAN)

- Bond Anticipation Note (BAN)

- Renewal of Bond Anticipation Note (RBAN)

- State Aid Anticipation Note (SAAN)

- Renewal of State Aid Anticipation Note (RSAAN)

- Federal Aid Anticipation Note (FAAN)

- Renewal of Federal Aid Anticipation Note (RFAAN)

- Refunding Note

- Serial Note

They all, however, must receive certain local approvals and submit required supporting documentation to the Bureau of Accounts for certification. Lenders await this certification before forwarding funds to the borrower.

Approval by BOA’s Public Finance section involves uploading documentation into Gateway and once approved, the original executed note is immediately forwarded to the winning bank by the responsible city, town, district, or county official.

State House Notes by the Numbers from FY2023 to FY2025

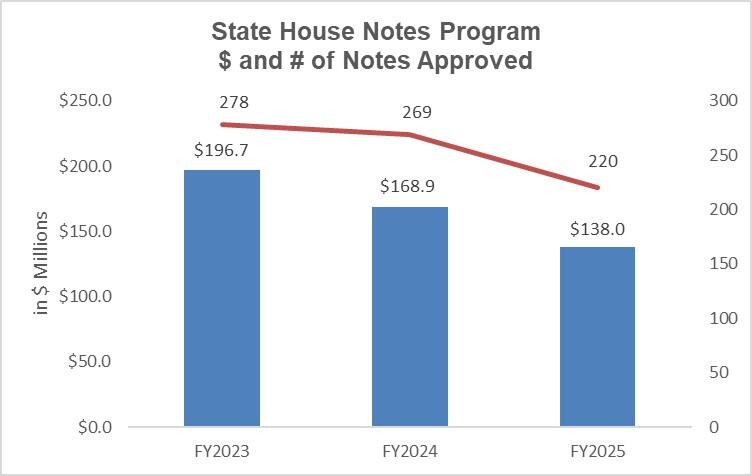

The following graph displays the dollar amount and number of State House Notes approved for issuance from FY2023 to FY2025.

The general decline in the number of State House Notes approved and their dollar value in recent fiscal years may be explained in terms of the complexity of today’s capital market. As a result, a growing trend has moved toward the purchase of notes with full disclosure that includes a full legal opinion, an official statement, a short-term rating by a rating agency (e.g. Moody’s, S&P, Fitch), recent audited financial statements and a municipal financial advisor. With full disclosure, notes have a much wider bidding pool than just local banks.

In addition, the general decline may have been due to intergovernmental funds for capital improvement distributed during the pandemic, supply chain failures, delays in beginning major projects and other factors.

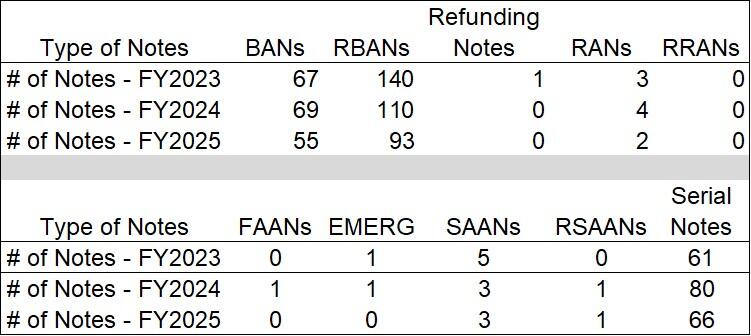

The following table shows the number of State House Notes approved from FY2023 to FY2025 by type.

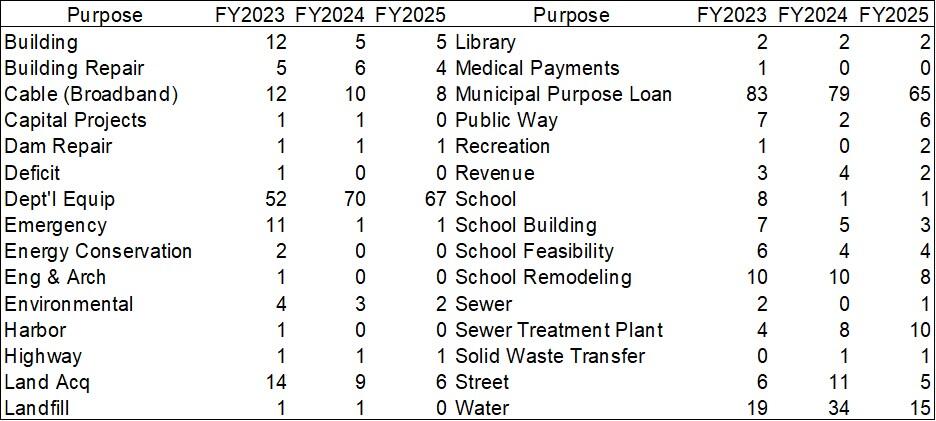

The following table displays the number of State House Notes approved from FY2023 to FY2025 by purpose.

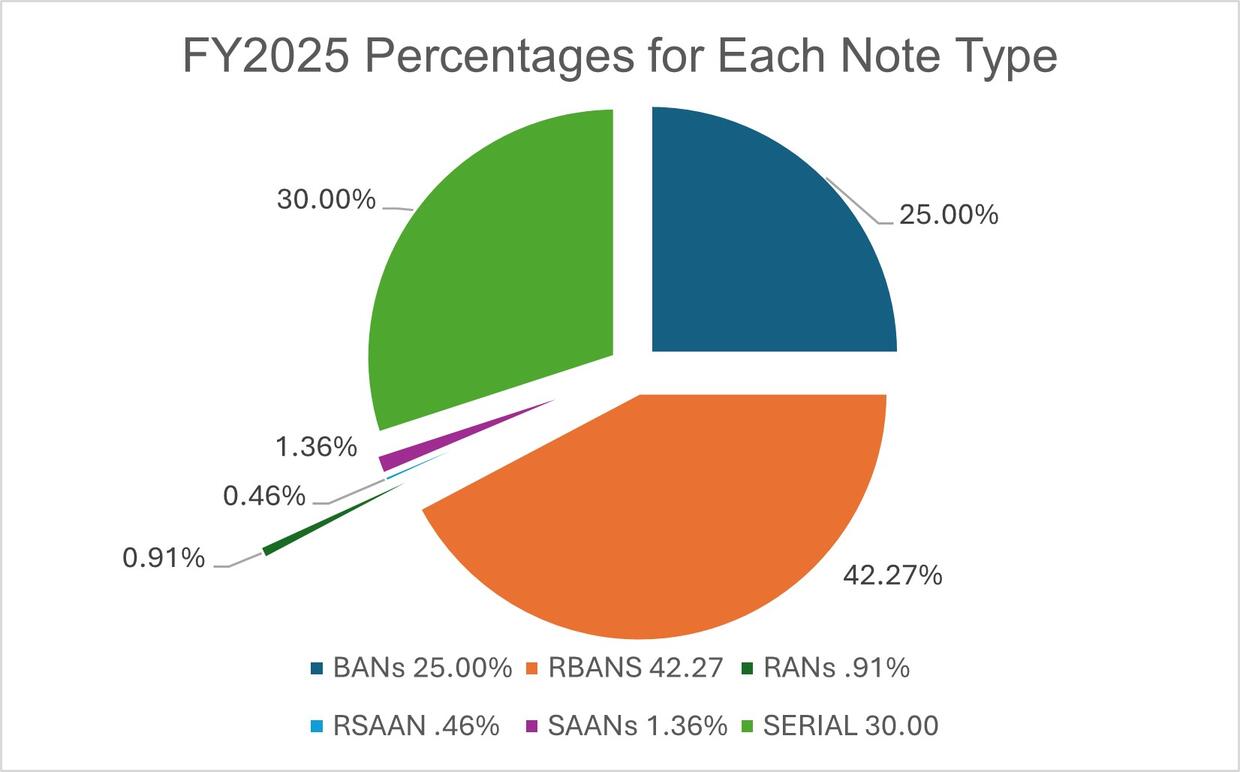

The following chart displays the percentage of FY2025 State House Notes approved for each note type.

Additional FY2025 Statistics

For FY2025 approved Notes, four were for cities, 176 for towns, 23 for special purpose districts, 16 for regional school districts and one for counties. Several of these entities had multiple Notes certified.

Other statistics showed:

- Highest dollar amount ($13.9 million), lowest ($10,000) and median ($355,000)

- Highest interest rate for a Serial Note (6.5%), lowest (4.375%)

- Highest interest rate for a non-Serial Note (8.75%), lowest (3.79%), and median (4.6%)

- Longest number of days to maturity for non-serial (365 days), shortest (63 days), and median (364 days)

- Longest term for Serial Note was seven years, while the shortest term was 174 days.

- The four top purchasers of Notes were Cede & Co, Greenfield Cooperative Bank, bankESB and Unibank for Savings

- Monthly notes processed showed the highest number in October (26), lowest total in February (4)

To familiarize yourself with the State House Notes approval process and to learn more about State House Notes, please visit the Bureau of Accounts’ Public Finance Section’s website.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | August 14, 2025 |

|---|