Author: Andrew Nelson - Bureau of Accounts Supervisor, Tony Rassias - Deputy Director of Accounts

For decades, the Division of Local Services (DLS) has presented a calculation and analysis of the average single-family tax bill in Massachusetts. This article marks the third year of an improved approach that we believe will more accurately examine the subject by including communities that have adopted a residential exemption or senior means-tested exemption. These municipalities represent many of the Commonwealth’s largest population centers such as Boston, Brookline, Cambridge, Somerville and Waltham and their inclusion in the following article results in a comprehensive analysis. Review historical data, related to the average single-family property tax bill. Access our interactive map highlighting data from across the Commonwealth.

The methodology DLS uses presumes Massachusetts is one local governmental entity for which a tax bill would be determined. It does not represent the mean or median of actual single-family property tax bills. We calculate the state average single-family tax bill by multiplying each local average bill by each local parcel count then dividing that product by the total state parcel count.

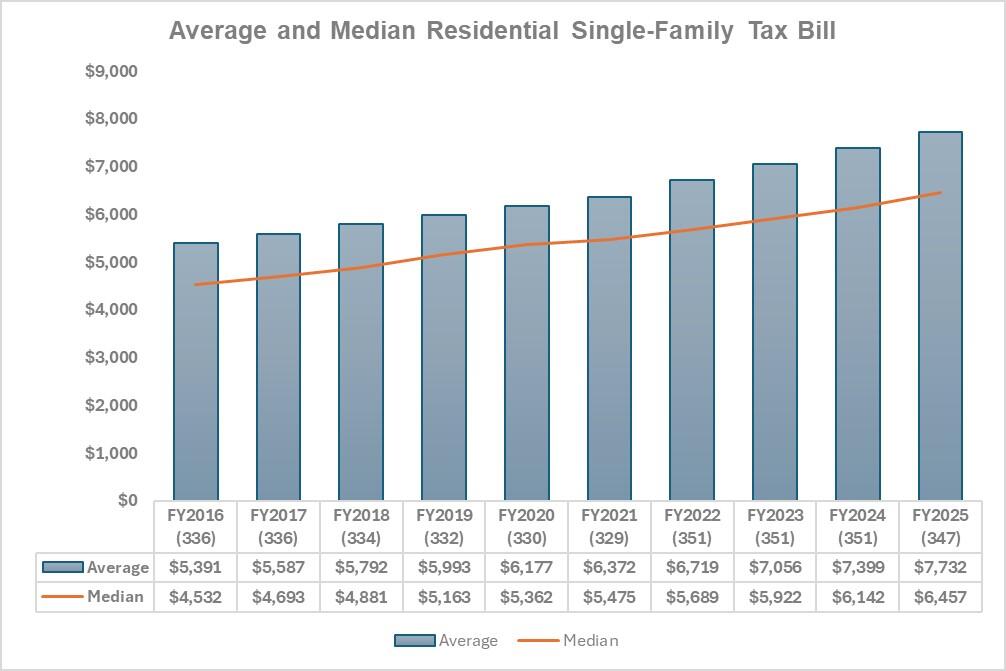

Analysis of data for this article focuses on single-family properties classified as property tax code 101 and does not include condominiums, multi-family homes or apartment buildings. For the 347 FY2025 reporting communities as of February 13, 2025, single-family values statewide represent 63.8% of all residential assessed values and 53.0% of statewide assessed values in all property classes. Based on review of statewide data for FY2025, the average value of a single-family home is $700,615 and the average single-family tax bill is $7,732. For comparison, the FY2024 average single-family tax bill was $7,399.

Single-Family Residential Property Tax Bill – Community Averages

For our analysis, we calculate a community’s average single-family tax bill as follows. Single-family assessed values are divided by number of single-family parcels to determine an average single-family value. The average value is multiplied by the residential tax rate as certified by the Bureau of Accounts for the fiscal year.

The following graph presents the median or midpoint of community averages for the number of communities shown in parenthesis included in the 10-year period from FY2016 to FY2025.

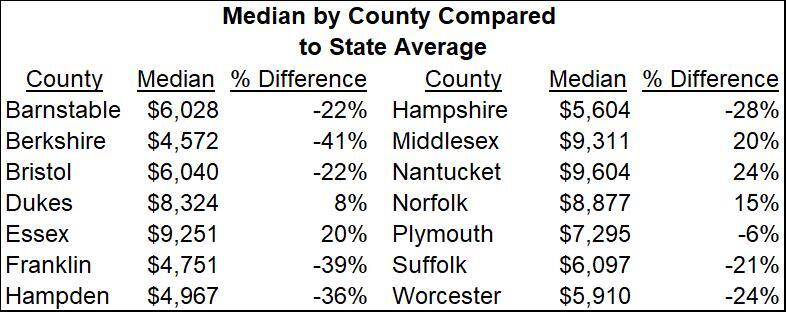

Median of Community Averages by County

The following chart shows the median of the FY2025 average single-family tax bills by county compared to the state median of $7,732.

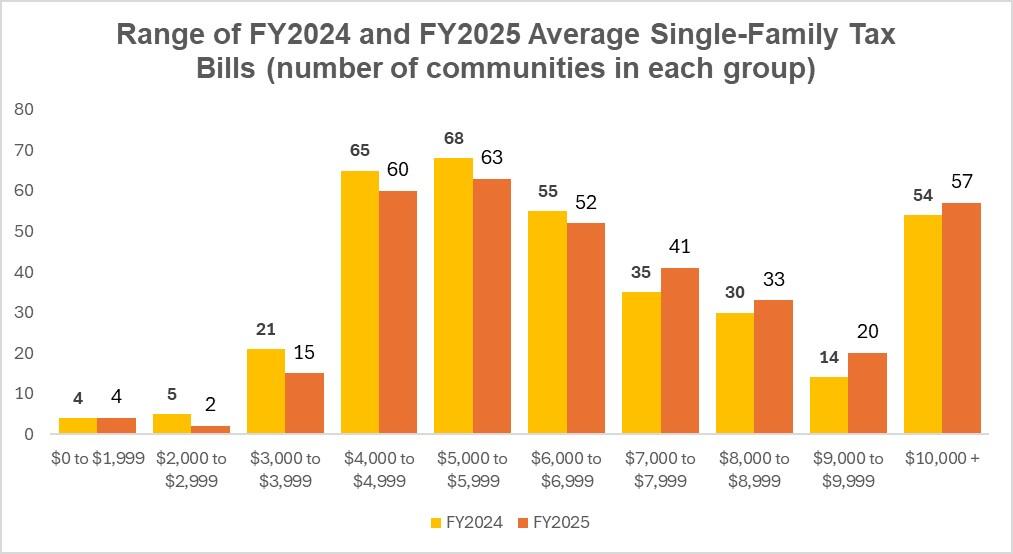

The following graph displays the range of FY2025 average tax bills across the Commonwealth for 347 reporting communities.

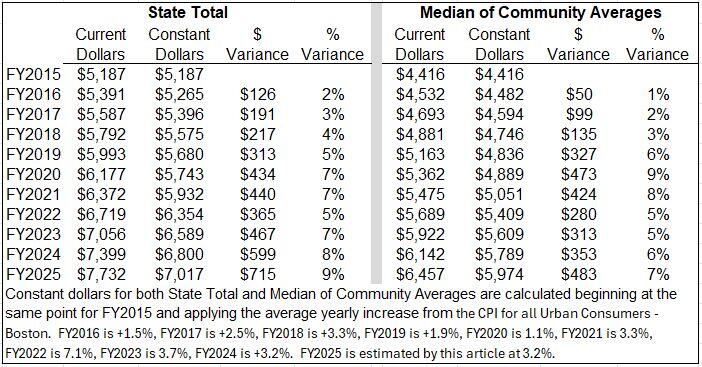

Statewide Trend in Current and Constant Dollars

The following chartdisplays the FY2025 state average single-family tax bill and FY2025 median of the same in current dollars in relation to constant dollars adjusted for inflation. Current dollars for both have outpaced the rate of inflation over the time shown.

(Source: CPI for all Urban Consumers – Boston.)

We continually strive to bring relevant and useful content to City &Town readers. Please email us with questions, comments, and suggestions for future topics at cityandtown@dor.state.ma.us.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | February 20, 2025 |

|---|