Author: Tom Guilfoyle - Bureau of Accounts

This article reviews property tax levies and assessed values for all 351 communities from FY2015 to FY2024. For 343 communities with FY2025 tax rates approved by the Division of Local Services’ (DLS) Bureau of Accounts as of December 24, 2024, the article compares FY2024 and FY2025 tax levies and assessed values and then provides some quick FY2025 stats. It then reviews whether communities are close to their FY2025 levy limits and ceilings. Finally, it reports on tax rates and shifts between property classes. For a variety of trainings and informational resources about property taxes and related content, please visit the Property Taxes and Proposition 2½ Training and Resources page. In addition, visit the report center for the raw data associated with this article and other data sets.

Tax Levies

The property tax levy is the annual amount of taxes assessed upon real and personal property in the community. For most communities, the property tax levy is the largest revenue source. Along with other revenue sources such as estimated receipts and available reserves, these revenues balance the spending needs voted in the omnibus budget. Since FY1982, the property tax levy has been subject to the limits of Prop 2½.

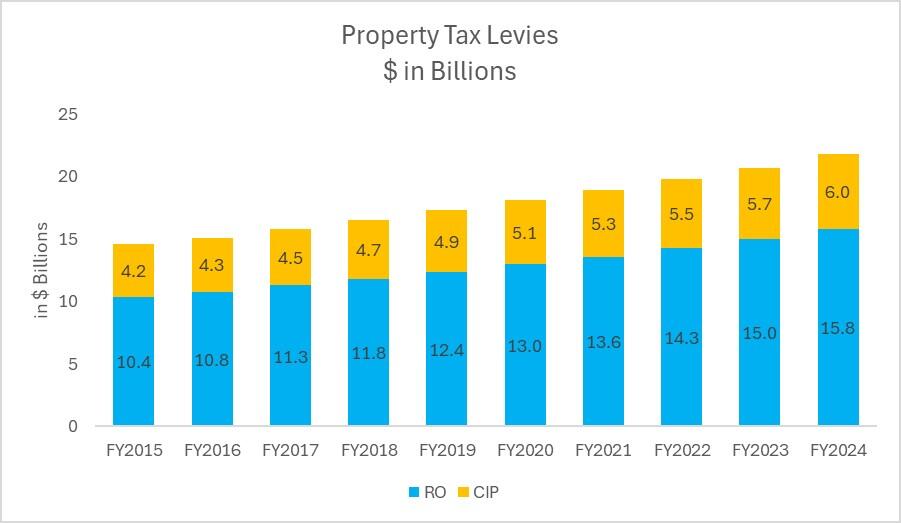

The graph below shows property tax levies for residential and open space (RO) classes as well as commercial, industrial and personal property (CIP) classes for FY2015 to FY2024. Tax levies grew by 49.5% ($7.2 billion) from $14.6 billion to $21.8 billion over this time.

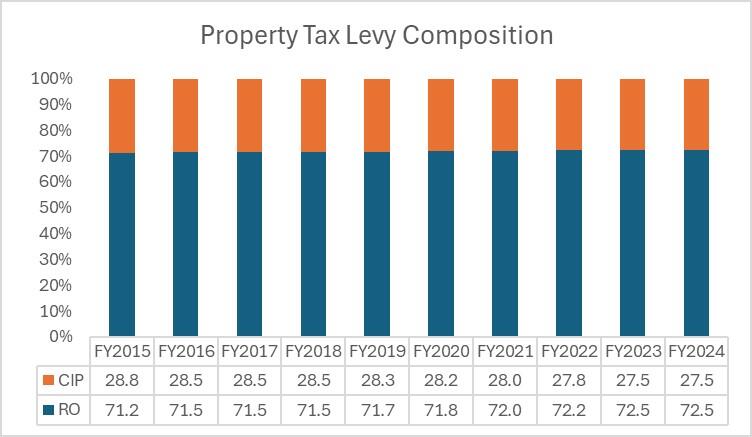

Overall percentages of the tax levy by the respective class groupings from FY2015 to FY2024 are seen in the following chart.

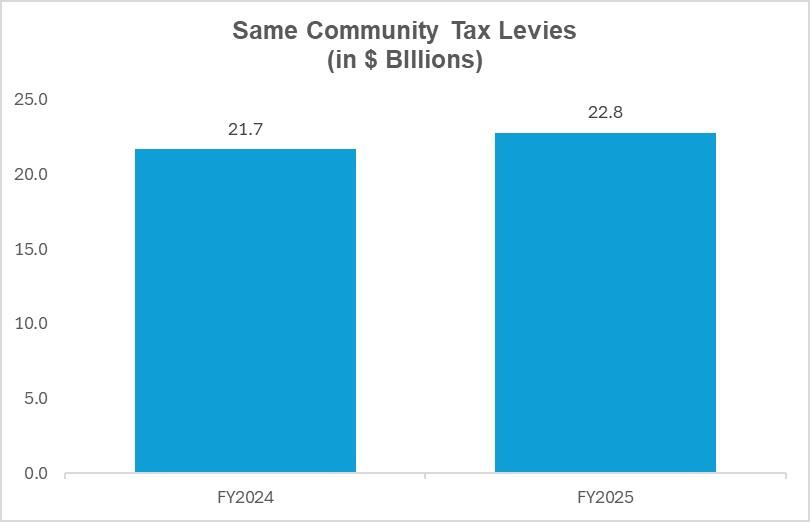

The graph below shows that in total for the 343 communities with certified FY2025 tax rates, tax levies increased from FY2024 to FY2025 by 5.1% ($1.1 billion) from $21.7 billion to $22.8 billion.

Details reveal that the tax levy increased in 334 communities and decreased in nine communities. The median percentage increase was 4.3%. The largest percentage increase was in Savoy (29.3%) and largest decrease was in New Ashford (-21%).

Assessed Values

The tax levy is distributed among taxpayers based on the assessed value (AV) of their properties as determined by the local assessors. Bureau of Local Assessment staff reviews and certifies the assessors’ estimates every five years to ensure that they comply with legal standards. Interim year adjustments to reflect changes in market conditions must also meet legal standards, although they are not certified.

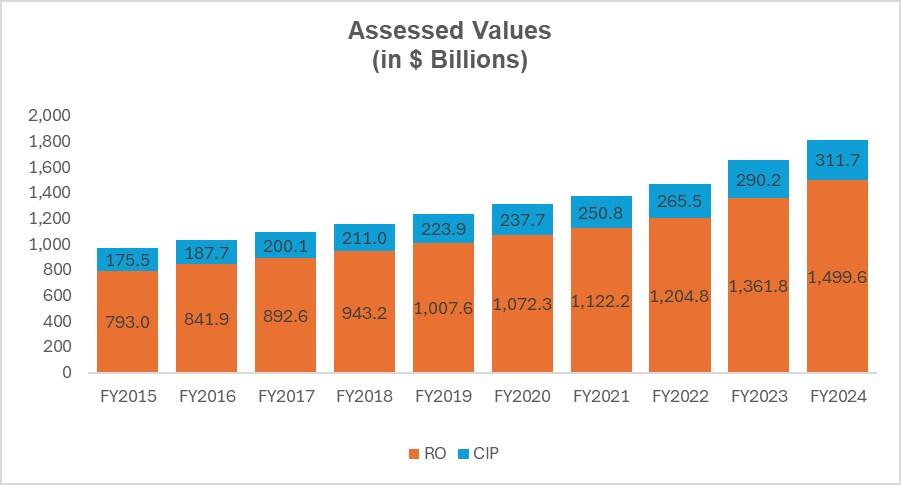

The next graph shows total AV from FY2015 to FY2024. Values rose by 87%, or $842.9 billion, from $968.5 billion to $1.811 trillion. In FY2016, AV first grew to over $1 trillion.

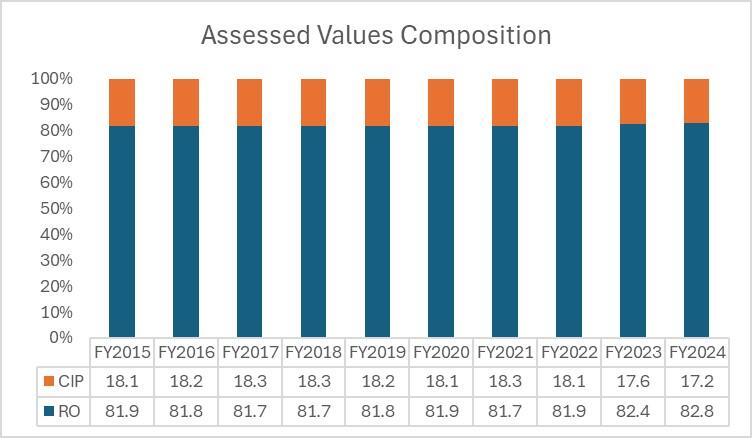

Overall percentages of AV by the respective class groupings from FY2015 to FY2024 are seen in the following chart.

This next graph shows that in total for the 343 communities with tax rates approved for FY2025, AV increased from FY2024 to FY2025 by 5.5% ($98.8 billion) from $1.804.5 trillion to $1.903.3 trillion.

Details reveal that AV increased in 340 communities and decreased in three. The median percentage for increases was 6.2%. The largest percentage increase was in Plainfield (24.1%) while the decrease was in Warwick (2.1%).

The Levy Limit

Prop 2½ places limits on the amount of property taxes a community can levy. One limit is a tax levy ceiling which limits the property tax levy to 2.5% of the full and fair cash value of all taxable real and personal property in the community without specific further community action. Once the 2.5% level has been reached, the levy limit is said to have “hit the ceiling.”

A levy ceiling is one of two types of tax levy restrictions imposed by G.L. c. 59

§ 21C (Proposition 2½). It states that in any year, the real and personal property taxes imposed may not exceed 2.5% of the total full and fair cash value of all taxable property. A levy limit is the other of the two types of tax levy restrictions imposed by G.L. c. 59 § 21C. It states that the real and personal property taxes imposed by a city or town may only grow each year by 2.5% of the prior year's levy limit, plus new growth and any overrides or exclusions. The levy limit can exceed the levy ceiling only if the community passes a debt exclusion, capital expenditure exclusion or special exclusion.

An incremental levy limit or tax levy that is within 90% to 99% of a levy ceiling can be referred to as “approaching the levy ceiling.” Of the 343 communities that have set an FY2025 tax rate as of the date of this writing, none had levy limits that approached their levy ceilings and none had tax levies that approached their levy ceilings. As the incremental lower limit of Prop 2½ continues to increase, the extent to which future changes to the real estate market, either locally or statewide, affect the FY2025 results remains to be seen.

Tax Shift

At the annual classification hearing, mayors, city/town councils and boards of selectmen decide how to further distribute the tax levy. These boards may decide within certain legal limits upon a single tax rate structure which distributes the tax levy in proportion to the share that their property class bears to the total assessed valuation of the community, or a multiple tax rate structure which shifts some of the taxes that would be paid by RO taxpayers under a single tax rate structure onto CIP taxpayers. These boards and councils may also decide to grant a residential exemption, an open space class discount and/or a small commercial exemption.

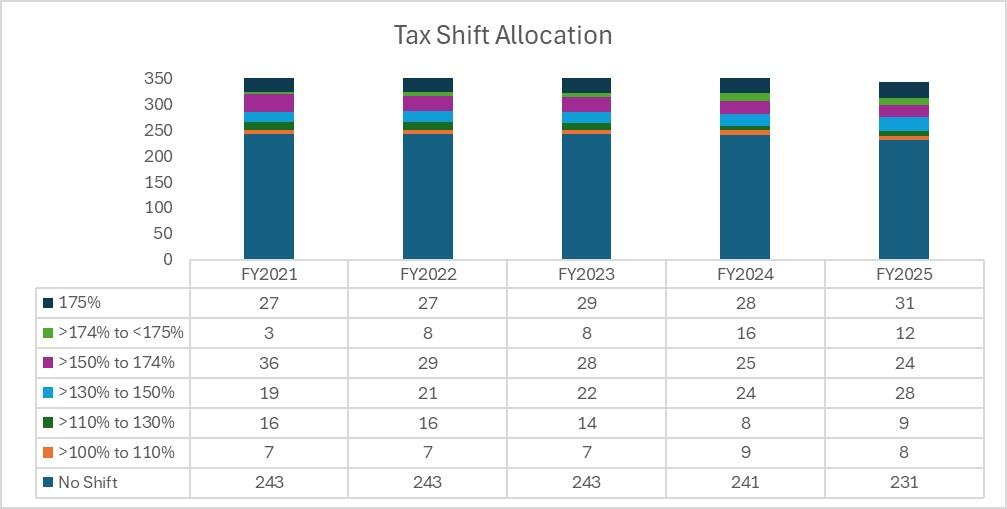

Most communities do not shift the tax burden from the residential and open space classes to the other classes of real and personal property. Generally, the communities that do so have done so for many years. The chart below shows complete data for FY2021 to FY2024 and for 343 FY2025 communities. For the eight tax rates yet to be certified, one (Florida) of eight shifted the burden in FY2024.

Tax Rates

The calculation of the annual tax rate involves the efforts of many local officials as well as the citizenry. Timely tax rate setting is an important key to a successful financial operation and helps avert a cash shortfall, temporary borrowing costs and work-flow disruption in city and town hall financial offices.

Across the Commonwealth, residential tax rates increased in 115 communities and decreased in 225 communities. The highest FY2025 residential tax rate is Longmeadow ($21.12), while the lowest is Edgartown ($2.65). The greatest dollar increase from FY2024 in a residential tax rate is Savoy ($3.38), while the greatest dollar decrease from FY2024 is Plainfield ($2.94). Commercial tax rates increased in 119 communities and decreased in 222 communities. The highest FY2025 commercial tax rate is Holyoke ($38.55) and the lowest is Edgartown ($2.65). The greatest dollar increase from FY2024 in a commercial tax rate is Sandisfield ($4.69), while the greatest dollar decrease is Needham ($3.66).

We hope that you found this article informative. Data compiled for all the charts and graphs in this article can be found on the DLS website. Additional information, trainings and resources on this and a variety of other municipal finance subjects are also available.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | January 16, 2025 |

|---|