Author: Financial Management Resource Bureau

The DLS Financial Management Resource Bureau (formerly the Technical Assistance Bureau) has offered financial management advice to municipalities across the state for over 30 years. To share this guidance more broadly, we thought it would be helpful to highlight some of our more useful, timely, or interesting recommendations for the benefit of City & Town readers.

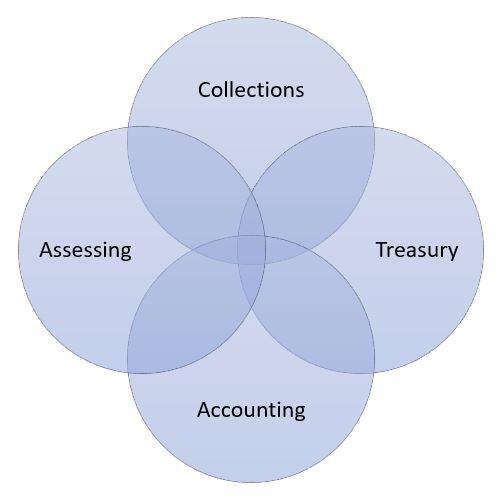

A municipality’s financial operations are dependent on the coordination and collaboration of the financial management team formed by accounting, assessing, collection, and treasury offices. Under city or town leadership, these finance offices must maintain open lines of communication along with the understanding of their role and its relation to the others. A prime example of the interdepartmental coordination needed in a strong financial management is the property tax billing process, from generating the commitment, collecting and managing the payments, to reconciling the accounts.

The assessing office is responsible for preparing a commitment, which is a detailed list of parcels subject to the property tax, and a corresponding warrant that serves as the authorization for the collector to levy and collect the taxes. They also approve adjustments to the bills included in the commitment in the form of abatement requests and statutory exemptions. In this way, the assessing office is the ‘starting point’ for this portion of a municipality’s revenues, and as such, the information created establishes the basis for several reconciliation obligations with the other three offices. The assessors must independently provide all documents - warrants, commitments, and adjustments to the collection and accounting offices to maintain important checks and balances for recordkeeping.

The collector, after receiving the commitment and warrant and verifying they are equal to the bill file, issues the bill and establishes a control book for each type of receivable. The control book maintains records for commitments and all subsequent activity including, collections, abatements and exemptions, refunds, and transfers. On a regular basis (at least weekly depending on volume), collection activity is summarized and the revenue, i.e., cash, checks, online payments, and credit cards, is reconciled and turned over to the treasurer and the activity summary is provided directly to the accounting office. Separately providing the turnover information to treasury and accounting maintains the necessary independent verification points for reconciliations.

The collector applies any adjustments due to abatements and exemptions to the receivable files. On at least a monthly basis, the collector verifies that the control book activity totals equal the outstanding receivables and forwards the period end records to the accounting office. The treasurer verifies the revenue from the collector, then verifies the collection summary activity is entered in the treasurer’s revenue system and transmits the data to the accounting office for recording. The treasurer also records this information in the cashbook (the treasurer’s source book of original entry required to record of the community’s financial activity), which is internally reconciled to the bank accounts. At month end, the treasurer must provide the cash summary information to the accountant or auditor.

Before posting each periodic revenue file to the general ledger, accounting must verify that information provided by the collector matches the records turned over from the treasurer. Then, at the end of each month, the accountant or auditor must reconcile the cash balance with the treasurer, receivable adjustments with the assessor, and total receivable detail with the collector.

From this example, the interdependability of the financial management team is clear. Each of these financial offices has its own role and internal procedures, while all sharing responsibility for the fiscal operations. DLS routinely recommends this team, along with other officials as appropriate meet regularly to build and foster the relationship needed to be successful. The meetings should be used to establish agreement about goals, deadlines, and common objectives, and identify critical junctures and strategies to deal with anticipated areas of concern. Regular discussion topics should include the status of assigned responsibilities and due dates related to cyclical procedures, effectiveness of internal controls, status of monthly reconciliations, budget preparation, monthly revenue and expenditure reports, and required submissions to the DLS.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Sean Cronin, Emily Izzo, Lisa Krzywicki and Tony Rassias

| Date published: | April 20, 2023 |

|---|