Author: Financial Management Resource Bureau

Municipalities should understand the importance of getting their tax rates set punctually each fiscal year. This responsible management practice helps to ensure timely cash flow for budgeted expenditures, avert inefficiencies in mandated reporting requirements, and promote residents’ confidence in municipal government by enabling consistent, year-to-year tax billing dates. Indeed, a community can best achieve these goals by ensuring that its tax rate is submitted to the Division of Local Services (DLS) for approval well in advance of tax bill scheduling deadlines.

The property tax levy is the largest revenue source for nearly all municipalities in Massachusetts, constituting 62% of total operating budgets on average, and this is the main reason it is critical to get ahead of the crunch time in the tax rate setting season. Even in the small set of communities (14%) where the tax levy composes less than 50% of the budget, the amounts of local property taxes still run into the tens of millions, and even hundreds of millions, of dollars. Therefore, any time a tax rate is set late and causes a delay in mailing out tax bills, it increases the risk that a community will have a temporary cash flow issue that could potentially necessitate short-term internal or external borrowing.

The Approval Process

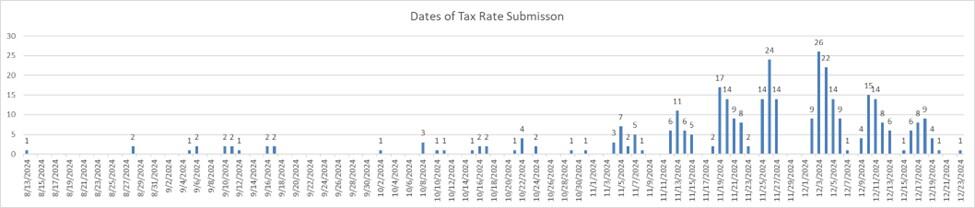

Before any city or town may assess and collect taxes in support of a new fiscal year’s budget, the DLS Bureau of Accounts (BOA) must approve its tax rate(s) (M.G.L. c. 59, § 23). To receive this approval requires the submission of a series of forms through the DLS Gateway known as the Tax Rate Recap, or recap for short. For the current fiscal year, FY2025, BOA approved tax rates by December 24, 2024 for 343 communities (98% of the state’s 351 municipalities). Of these, 262 submitted their recaps within the last five weeks leading up to that date (76%), and BOA approved tax rates for 158 of them during the last three of those weeks. From mid-November onwards, BOA’s average time frame to complete tax rate approvals climbed to 6 days, up from just 1-2 days in October and early November.

By submitting the recap so close to statutory mailing deadlines, a community risks not having enough time to rectify any unanticipated issues if there is a reason that BOA cannot set the tax rate. And this can jeopardize forecasted revenue inflows if it leads to extended tax bill due dates. When a semiannual community mails actual tax bills on or before December 31, the balance of the tax (net of the preliminary tax paid) is due and payable April 1. If, however, the actual tax bills are mailed after December 31, for any reason, the entire balance is payable on May 1 or 30 days after the bills were mailed, whichever is later. When a quarterly community mails the actual tax bills on or before December 31, the balance of the tax is payable in two equal installments, due February 1 and May 1. However, if they are mailed after December 31, the balance is payable, in one installment only, on May 1 or 30 days after mailing, whichever is later.

To optimize an efficient rate-setting process and reduce stress on cash flow, every community should establish a timeline for the series of steps needed to assemble all the data for the recap, working backwards from the date that a billing file needs to be provided to a billing vendor in time to meet statutory mailing dates. The overall process has many steps, and the entire team, including the chief executive officer, should be aware of them and their sequence in the schedule. Included early in the timeline must be a series of reports the assessors submit in Gateway to obtain certification of the community’s property values by DLS’ Bureau of Local Assessment (BLA). This certification must be completed before a local classification hearing can be held. From the first report submitted to BLA through to BOA’s approved recaps, for FY2025, the average lengths of time for quarterly communities to obtain approved tax rates from DLS were 51 days for interim year communities and 66 days for certification communities.

Local leaders should be attentive to factors that could increase the chances of missing process deadlines. Turnover in key positions, such as the assessors or auditor/accountant, can create substantial hurdles in completing valuation reports and recap forms. A good process should allow time for both known downtimes, such as holidays or vacations, and unexpected situations, such as illness of critical staff. In addition, towns should avoid scheduling special town meetings on dates close to the recap submission target dates. It is also crucial to ensure that adequate funding for any necessary valuation-related vendor services will be available prior to July 1, ahead of the vendors’ busiest times.

When BOA is able to certify an early tax rate, the community can assure that tax bills can be mailed out each year on the first calendar date allowable by statute. Not only does this allow taxpayers to plan their finances accordingly, but it also increases perceptions of government competency among residents. By promoting efficient procedures, enabling timely revenue collections, and enhancing public trust, the setting of an early tax rate is not merely an administrative task but a cornerstone of effective municipal governance.

For more information, please review the many training resources available on Tax Rate Setting | Mass.gov.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | April 17, 2025 |

|---|