Author: Financial Management Resource Bureau

Managing all the processes that a municipal government must complete can be a daunting task. Aside from the key tasks of developing the budget and capital plan, setting the tax rate, and mailing tax bills, there are also statutory reporting requirements to DLS for Schedule A and the balance sheet. Additional deadlines for exemptions and abatements also apply.

The key to managing these obligations, ensuring timely collection of revenues, and compliance with state and federal laws is a well-developed municipal calendar. We recommend the calendar identifies the following: all parties involved and their respective roles in the process/task, a clear description of that task, all relevant dates by which staff or officials must act or have a task completed, and a chronological listing by month with the date, staff/official responsible, and clear descriptions of each task.

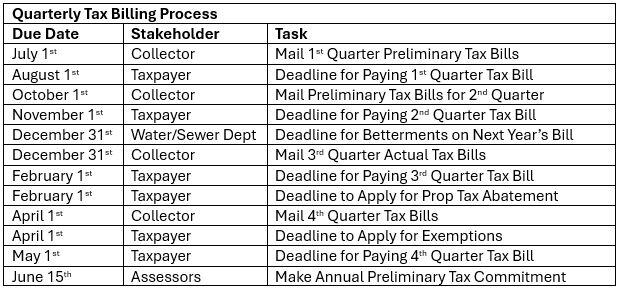

While drafting a municipal calendar, it is essential to have a clear definition of all tasks and processes. For example, the tax billing and collections process is dependent on a clear timeline. First identify everyone who has a role in the process, including the treasurer/collector, the assessor, the water or sewer department if there are applicable betterments, and the taxpayer, given their role is paying the bill.

The next important factor is relevant deadlines both for mailing tax bills by the collector and payment by the taxpayer, followed by whether the community bills semi-annually or quarterly. Refer to the relevant statute in Mass General Law for guidance. If a community bills quarterly, for example, we might expect to see the following important tasks/deadlines on the municipal calendar:

The end result is a complete accounting of all relevant tasks and deadlines for the tax billing process from July to June, providing a complete understanding of what needs to happen, who needs to do it, and when. Staff and officials can then duplicate this effort for other key processes and fill in a schedule of all important tasks based on the date. This will allow the community to build a framework for consistent financial management that identifies key roles and deadlines throughout the year. Once complete, we recommend posting this calendar on the town/city’s website so that all staff and residents have a clear understanding of responsibilities and relative workloads throughout the year. Aside from the tax billing process, other important items to include in the calendar are:

- Cash and receivable reconciliations schedule

- Monthly revenue and expenditure reports (M.G.L c 41 § 58)

- Department turnover schedule

- Town accountant annual report (M.G.L c 41 § 61)

- Tax Recapitulation process

- Year-end DLS submission schedule for free cash certification

- Year-end closing

For more guidance, please refer to our Municipal Calendar publication. This document includes a complete sample calendar that officials can use as a template for developing their own.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | July 17, 2025 |

|---|