Calculating Benefit Amounts

You will receive a letter with your maximum weekly benefit amount.

The Department calculates your weekly benefit amount using the information you and your employer provide in your application, including any reductions or adjustments.

If you take leave on a reduced or intermittent schedule, we will prorate your benefits based on how many hours of leave you take.

Additional Resources

Payments by Direct Deposit, Check, or Prepaid Debit Card

You enter your payment preference and your payment information as part of your application. You can choose to receive approved paid family or medical leave benefits by direct deposit, by check, or on a U.S. Bank ReliaCard®, which is a prepaid Visa® debit card.

Direct Deposit

If you choose to receive your payment by direct deposit, the payment will be listed in your account statement with this information:

- Organization ID: P046002284

- Organization Name: EOL-DFML

- Entry Description: PFML FAM or PFML MED

Check

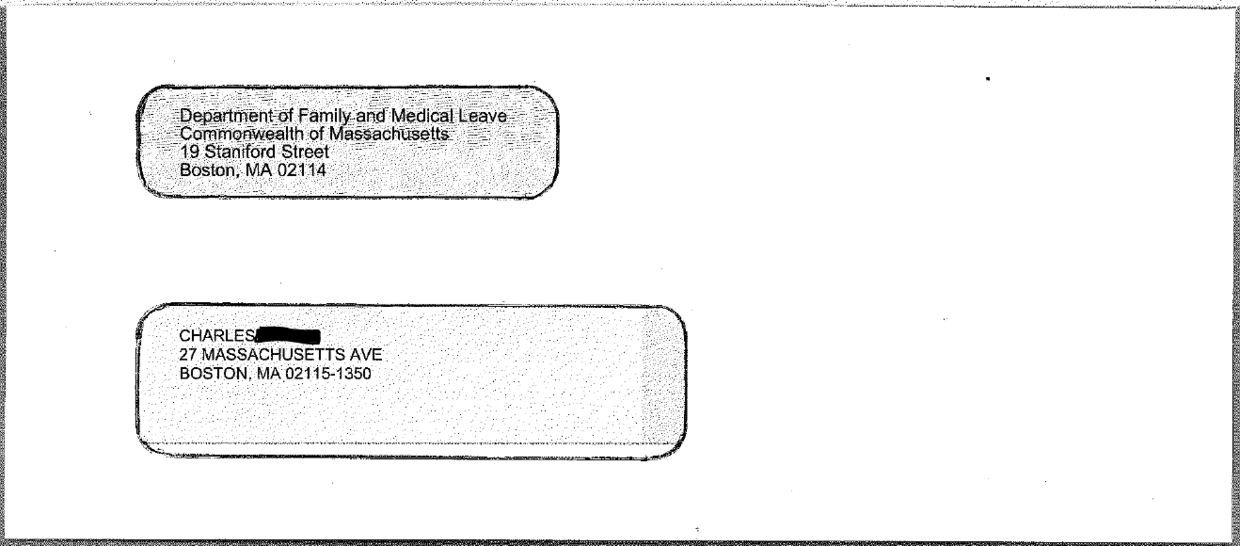

If you choose to receive your payment by check, the envelope will look like this:

The memo line of the check will show:

- PFML Medical Payment Absence Case Number [Period start date-Period end date]

- PFML Family Payment Absence Case Number [Period start date-Period end date]

How to add or change banking information for direct deposit

Call our Contact Center (833) 344-7365 and we will send you a form to update your payment preferences.

U.S. Bank ReliaCard®

If you choose to receive your payment on a U.S. Bank ReliaCard®, which is a prepaid Visa® debit card, your card will be mailed to the address you have on file. You may receive your prepaid card before you receive your first PFML benefits payment. You will need to review the pre-acquisition disclosures before making your payment choice.

With the ReliaCard, you can make purchases everywhere Visa® debit cards are accepted, including in stores, online, and by phone and get cash back with your purchase at many grocery and convenience stores. You can also get cash from any ATM or over the counter at any Visa member bank or credit union. To find the nearest in-network ATM, visit US Bank, MoneyPass, or Allpoint Network.

You may have to pay a fee with certain ReliaCard transactions. See fee schedule for details:

ReliaCard fee schedule disclosure

Support for U.S. Bank ReliaCard®

Please allow up to 10 business days for card delivery. If you have questions about the delivery of your card, or if you need a replacement card, you can log into your account by using the cardholder website at usbankreliacard.com, the U.S. Bank ReliaCard Mobile App, or by calling U.S. Bank Cardholder Services at (855) 779-4900.

Payment Schedules

During the 7-day Waiting Period

When you begin your paid family or medical leave, there is a mandatory waiting period of seven (7) calendar days before benefit payments will start. You will not receive payment for the 7 days of this waiting period.

First payment

If you apply in advance of your leave, you can expect your first payment 2-4 weeks after your leave begins.

If your leave has already started, you can expect your first payment to arrive 2 weeks after it is approved.

Subsequent payments

Subsequent payments are scheduled every Monday. If Monday is a federal or state holiday, payments will move to Tuesday for that week.

Additionally, your payment could be delayed due to changes to your leave, individual bank practices, or processing issues with your bank account information or address.

Here are a few ways to avoid common issues that could delay your payment.

For an intermittent leave schedule

For intermittent leave, you have an unpaid 7-day waiting period that begins the first day you report taking leave.

You need to complete your unpaid 7-day waiting period waiting period and report at least 8 hours of leave before you will receive a payment from the DFML. You may receive more than one payment per week, depending on how your hours are reported.

The most convenient way to report your intermittent leave hours is to log in to your PFML account at paidleave.mass.gov. You can also report intermittent leave hours by calling the Reporting line at (857) 972-9256.

During changes to your leave

If anything changes during your leave that may affect your application status or benefit amount, we will suspend payments while we process the update. Once the change is complete, we will send you any retroactive leave benefits you didn’t receive when we were updating your application.

If we receive additional information about other income or use of leave after we approve your application, we will send you a second notice with your new benefit amount or changes to your leave.

Additional Resources

Payment Status

Once you are approved and payments have started, you can log in to your account and check your payment status each week.

Overpayments

What is an overpayment?

For Department of Family and Medical Leave (DFML), an overpayment is when an employee is paid benefit payments more than what they were entitled to receive or retain. If you receive an overpayment, you will be responsible to pay back the overpayment amount and your future weekly benefits may be reduced to make up for the overpayment.

How do overpayments happen?

Overpayments happen for a number of different reasons. For example:

- The employee received other wages, wage replacement, or benefit payments during their approved leave that would have affected or resulted in a reduction of their PFML benefits

- The employee made changes to or cancelled their original leave application resulting in them receiving a benefit payment to which they were not entitled

- DFML encountered an unintentional error resulting in the employee receiving a payment to which they were not entitled

How do I repay an overpayment?

If you are responsible for paying back an overpayment, you will receive a bill. Please send your payment by following the directions in the bill. You will be provided a web link to pay the bill online: MA Department of Family and Medical Leave. If you choose to mail your payment send only to this address: Department of Paid Family Medical Leave PO BOX 411605 BOSTON MA 02241-1605.

What if I need a repayment plan?

If you receive a bill for an overpayment, you may be able to set up a repayment plan. Call the DFML contact center at (833) 344-7365 to request to enter into a repayment plan. The contact center can give you more information about eligibility and options.

Taxes

When you apply for leave through DFML, you can choose to have state and federal income taxes withheld from your weekly medical or family leave benefit payments. Some medical leave benefits are not subject to taxes under the IRS guidance; no taxes will be withheld from these benefits. Learn more about income taxes on PFML benefits.

If you have questions about your tax withholding, we recommend speaking with a tax professional. DFML cannot offer guidance or advice for individual tax situations.

Child support payments

DFML may receive information from the Child Support Enforcement Division about outstanding court-ordered child support. If you have a child support order from the Massachusetts Department of Revenue Child Support Enforcement Division at the time you apply for PFML benefits or while you are receiving or due PFML benefits, your benefits may be reduced by the amount of the child support order.

Contact

Phone

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Revenue - Hours of operation: Monday-Friday, 9 a.m. - 4 p.m.

| Last updated: | December 29, 2025 |

|---|