Author: Sean Cronin - Senior Deputy Commissioner of Local Services

Happy 2025 to all of you reading this edition of City & Town! The turn of the calendar to a new year always means it’s getting close to preparing and debating the ensuing fiscal year budget, while at the same time reviewing the current fiscal year budget performance, critical processes for each city and town across the Commonwealth. I’d like to thank all of you in local government for all you do to deliver the core services that residents of the Commonwealth depend on. Local government employees undertake the critical and oftentimes unheralded work that keeps our cities and towns safe and functioning.

Hopefully, you’ve registered for our Economic and Fiscal Outlook workshop at the Massachusetts Municipal Association’s (MMA) Connect 351 (formerly known as the Annual Meeting). Set for Friday, January 24 at 2pm, this workshop covers important current issues in municipal finance and looks at FY25 and beyond. In addition to presentations by DLS bureau chiefs, we’re thrilled once again to have Administration and Finance Secretary Gorzkowicz and DOR Commissioner Snyder on the panel.

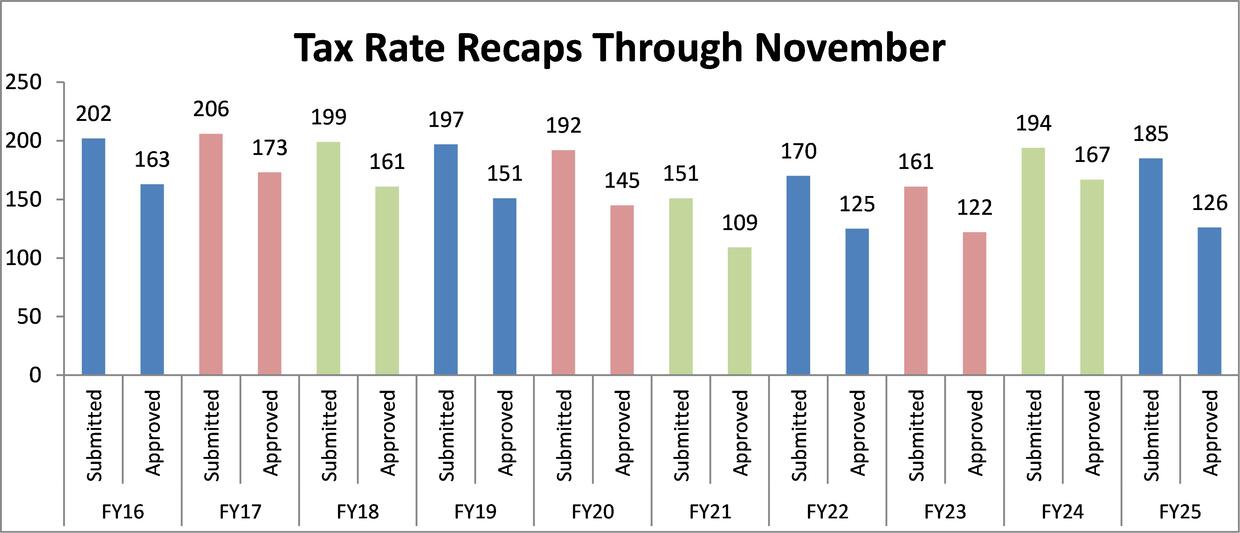

At the conclusion of each tax rate setting season, I like to provide some management metrics. An important workload metric for DLS is the number of property tax recaps submitted/approved by the end of November. Why? Because fewer submitted by the end of November means more need to be approved in just one month (December), which can result in the need to delay review and approval of other important items (e.g., municipal, regional school district and special purpose district balance sheets and Schedule A’s).

As shown in the first graph below, 126 tax rates were set by the end of November, meaning up to 225 tax rates had to be approved in December (216 were approved, with the remaining nine not submitted by the municipality by the end of December). In addition, there were 47 special purpose tax rates that had to be approved in December.

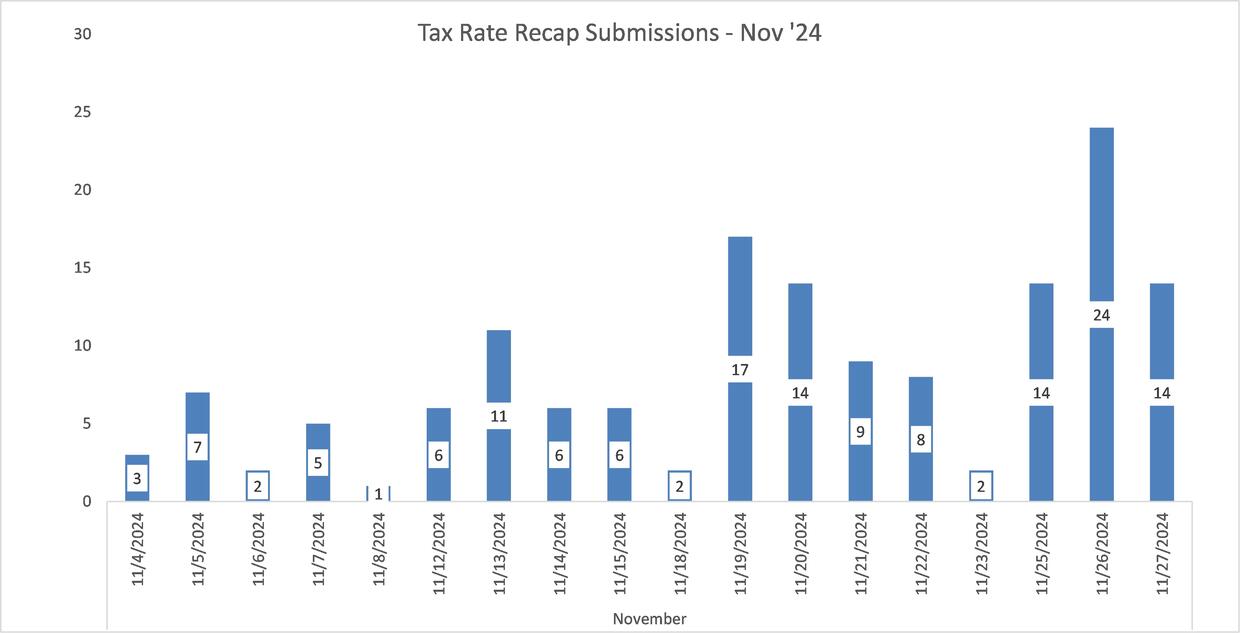

The second graph below shows the November recap submission by date. This is important to highlight because 52 recaps came to DLS the week of Thanksgiving, which was very late this year, effectively pushing the approval of the vast majority of those into December, thereby deflating the number of approved by the end of November.

Thank you to those municipalities that submitted recaps earlier than you did the past few years! From my many years in town hall I understand the normal rhythm during the last quarter of the calendar year and that we can all be creatures of habit (I certainly was!), but I respectfully ask municipal leaders to consider getting your recaps into us earlier. For those who want to learn more about ways to complete the recap sooner and get a tax rate set earlier, visit our Training & Resource Center, specifically the Tax Rate Setting section. In addition, check out the DLS-hosted webinar where Yarmouth finance officials explained how they prepare the recap and are able to get their tax rate approved in the July-August timeframe.

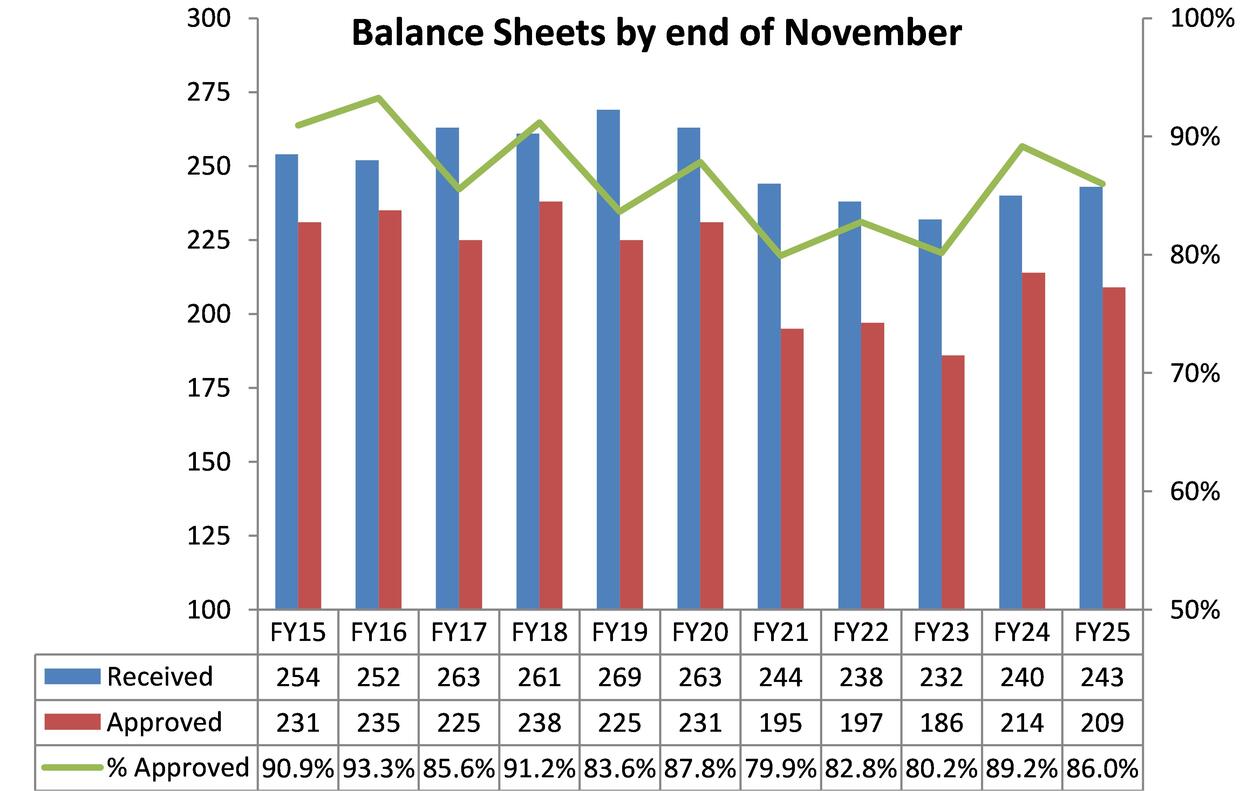

For Free Cash, 243 balance sheets were submitted by the end of November, with 209 approved. As shown in the graph below, 86% of those submitted were approved by the end of November.

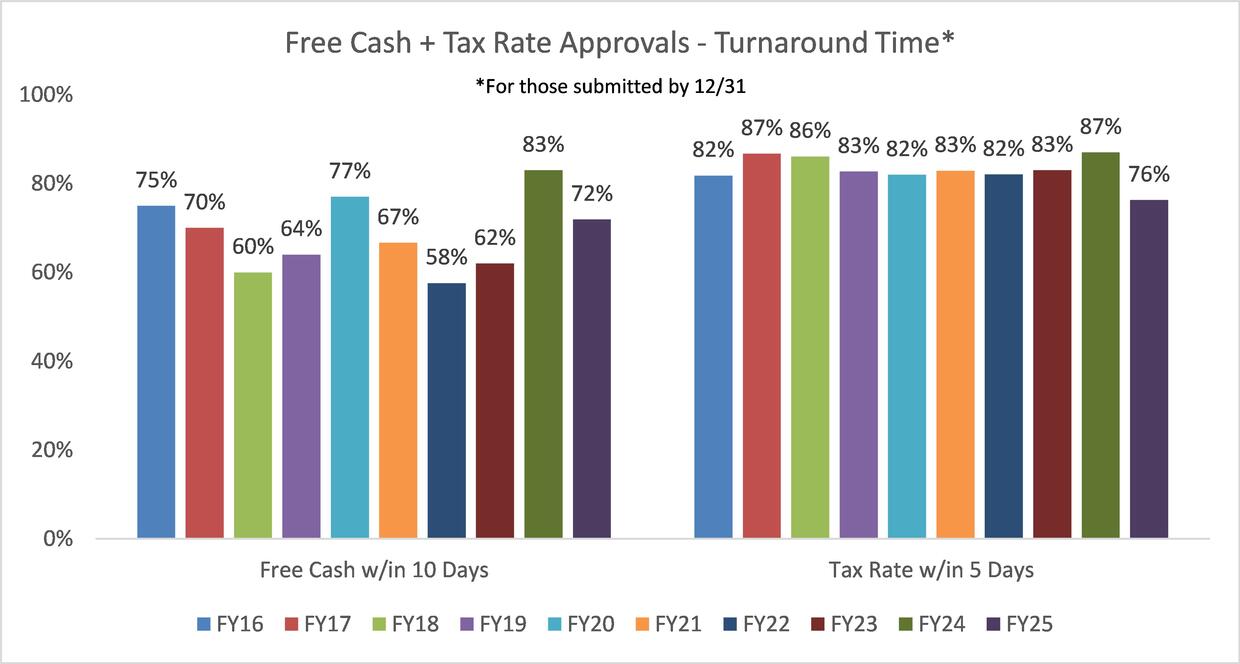

In terms of turnaround time, the graph below depicts 72% of Free Cash submissions being approved within ten working days. For tax rates, 76% were finalized within one work week, an increase from the past few years.

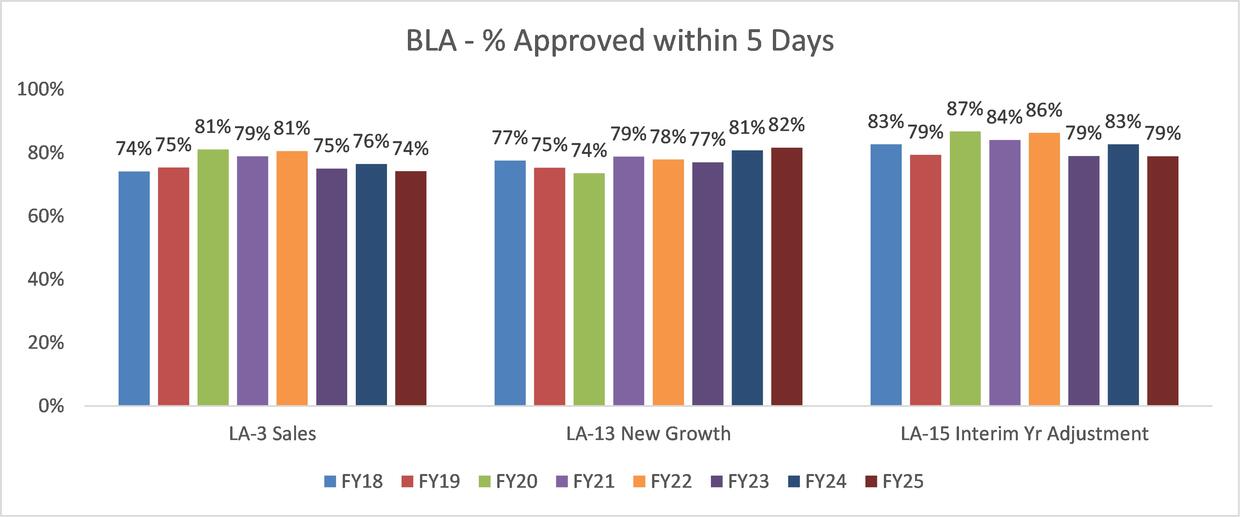

In order to get to tax rate approval, a number of assessment-related items need to be submitted by local boards of assessors and reviewed/approved by the Bureau of Local Assessment (BLA). The graph below looks at the turnaround time for three such items, measured as approved within five working days: LA-3 (sales) 74%, LA-13 (new growth) 82% and LA-15 (interim year adjustment) 79%.

I want to remind local officials that the Community Tax Rate Status visual, which is part of our library of data visualizations and available during the tax rate setting season, is a helpful tool that allows you are able to view the status of each form required to set a tax rate by viewing. Tied to our Gateway system, this tool provides real-time tracking of the status of your community’s forms throughout the entire tax rate setting process and it’s available 24/7.

Calendar Year 2024 (CY24) was another successful one for DLS. In addition to managing the core responsibilities noted above, the team continued to increase and enhance our Training & Resource Center, developed new ways to visualize the data we collect, including the Financial Indicators Dashboard that can be created for municipalities by our Financial Management Resource Bureau (FMRB), offered multiple in-person financial forecasting trainings to groups of municipalities, and advised many municipalities on opportunities to improve their financial management operations by taking advantage of the expertise of our FMRB.

During CY24 we welcomed the following employees to DLS: Chris Ketchen (Chief, Bureau of Local Payments (BLP)), Michael Briggs (BLP) and Scott Ditto (DARB). At the same time, a couple of long-tenured employees who dedicated their career to DLS retired: Tom Dawley (BLA) and Jim Podolak (BOA). They will be missed and I wish them well-deserved, long and healthy retirements!

At DLS, we remain committed to supporting our colleagues in local government. If you have any thoughts or ideas that you would like to share with me directly, please contact me at croninse@dor.state.ma.us. In closing, I wish you the best during the busy coming months and always know that DLS is here to assist.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | January 2, 2025 |

|---|