Summary

Each year, DOER looks at winter weather forecasts, fuel price predictions, and expected energy use for the main heating fuels in Massachusetts - natural gas, electricity, heating oil, and propane. This helps estimate heating costs for Massachusetts homes and helps households and state partners get ready for winter.

The prices and costs in this report are estimates and may change depending on several factors including global markets, your supplier, and the weather. These estimates are meant to show the overall picture of likely costs, not exact bills for any one home. Families should not use them as precise numbers when making their budgets.

Key findings in this report:

- This winter is expected to be slightly milder than last year, with temperatures trending above average but remaining cold overall.

- Natural gas, heating oil and propane prices are expected to be lower than last year, but electricity prices are higher.

- Compared to last winter, electric baseboard heating costs may rise 6%, while heating oil bills may drop 8%, propane by 4% and natural gas by 9%.

- For the first time, Massachusetts will offer a special heat pump rate for residential customers. Households using heat pumps could save around $540 on their heating bills this winter.

- Massachusetts has many programs to help households save money on heating. See the ‘Help with your heating bill’ section for details.

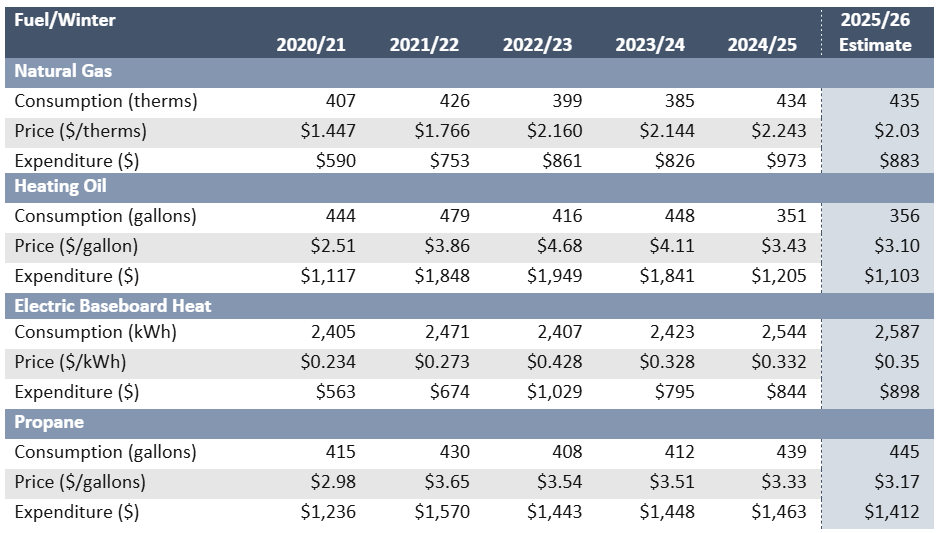

Figure 1 shows estimated energy prices for the upcoming winter compared with the past five winters. Energy prices can change, in part, due to weather, global markets, and demand for fuel. Although heating oil, propane, and natural gas prices are expected to be lower compared to last year, many households will still spend more overall because extended periods of cold weather lead to more heating use. For example, last winter was colder than initially forecasted, which contributed to higher heating bills.

Figure 1: Winter Season Average Residential Heating Fuel Prices

Source: DOER Analysis

Note: The propane and heating oil prices in Figure 1 are averages from many fuel suppliers across Massachusetts. Actual prices will be different depending on the company, so some households may pay more and others may pay less. The prices for electricity and natural gas are averages based on the state’s main utility companies. The electricity rate is for standard electric baseboard heating customers, except the new “Heat Pump Rate” column, which reflects the new rate available for the first time in Winter 25/26. Because each company charges different rates, the average reflects the mix of customers served by these companies.

Introduction

Heating is the largest part of most household energy costs. In Massachusetts, most households heat with natural gas, followed by electricity, heating oil, and propane. To see more detail on how households across the state heat their homes, visit how Mass. Households heat their homes.

Each year, DOER reviews winter weather forecasts, fuel price predictions, and expected energy use to estimate heating costs across the state. This helps residents prepare for their winter energy bills and helps state partners plan resources for the season.

For this analysis, DOER uses data from national sources such as the U.S. Energy Information Administration (EIA) and the National Weather Service’s Climate Prediction Center. These sources provide the best available outlooks, but actual costs will depend on energy markets, weather, and your household’s energy use.

How to use this report

This report aims to help Massachusetts households understand what to expect for heating costs this winter. It includes estimates for fuel prices, fuel use, and household spending for the heating season (November 2025 through March 2026).

You can use this report to:

- See how fuel prices and weather may affect your heating bills

- Compare costs across different fuels and heating systems

- Learn about programs and resources that can help you save money or get help with heating costs

Because energy markets and weather can change quickly, the estimates in this report are best used as guidance and not as exact predictions.

What's driving prices this winter

Fuel prices are a main factor in how much households spend on heating, but winter weather also makes a big difference. A colder winter means households use more fuel, while a warmer winter keeps bills lower. This year, the National Weather Service expects winter to be about 3% warmer than the long-term average (1981–2010), and 1% warmer than last year. This means most Massachusetts households will likely use the same or slightly less energy for heating compared to last winter.

Global energy markets also affect prices, but local fuel prices that households pay reflect regional and state-specific markets and regulations. The U.S. Energy Information Administration (EIA), in its 2025–26 Winter Fuels Outlook, expects wholesale energy prices to be lower this winter than last year.

For natural gas and electricity, prices that customers pay often change slowly because utilities buy energy ahead of time and their rates are set by state regulators. Even if wholesale prices fall, retail prices may remain high for a while. Gas and electricity bills also include costs for delivery and maintenance that don’t change with fuel prices.

For heating oil and propane, prices change more quickly with the market. When wholesale prices drop, households usually see lower prices within about a month. Many people who use oil or propane also buy some of their fuel before winter, so their costs can vary depending on when they bought fuel.

Overall, even though energy prices on the global market are lower this year, it may take time before most households see those lower prices on their heating bills.

Fuel-by-fuel breakdown

Heating Oil

About 20% of Massachusetts households use heating oil, especially in older homes and rural areas. Heating oil prices are connected to the price of crude oil, which is the raw oil used to make products like gasoline and heating oil. One of the main benchmarks for crude oil prices is Brent crude. When Brent prices go up or down, heating oil prices usually move in the same direction. This winter, Brent crude oil is projected to average $64 per barrel ($1.52 per gallon). This is 27 cents per gallon, or 15%, lower than last winter. Based on this, DOER estimates that retail heating oil in Massachusetts will average $3.10 per gallon this winter, down from $3.43 per gallon last winter. On average, households using heating oil can expect winter bills to be about 8% lower or $102 less than last year.

Still, heating oil prices can change quickly. This report gives a seasonal average, but actual prices often rise and fall during the winter because of cold weather or global events. Since heating oil prices closely follow crude oil markets, households may end up paying more or less than the average depending on when they buy fuel.

For the most up-to-date prices, visit DOER’s Massachusetts Home Heating Fuel Prices website, which posts weekly survey data from the State Heating Oil and Propane Program (SHOPP).

Propane

About 4% of Massachusetts households heat with propane. For the 2025-26 winter season, DOER projects that retail propane prices will average $3.17/gallon, compared to $3.33 /gallon in the 2024/25 winter season, thanks to stronger inventories and higher U.S. production. On average, households using propane can expect winter bills to be about 4% lower or $51 less than last year.

Propane prices are linked to both crude oil and natural gas prices, since propane is a byproduct of both. In New England, propane must be brought in by rail or truck, so supply bottlenecks during very cold weather can cause sudden price spikes.

Massachusetts residents can track current propane prices on DOER’s Home Heating Fuels Prices website, which posts weekly survey data from the SHOPP.

Natural Gas

About half of Massachusetts households heat with natural gas, making it the most common heating fuel in the state. Retail gas rates are approved by the Department of Public Utilities (DPU) for the heating season beginning November 1. These rates include both supply and delivery charges, which include the costs of buying gas, meeting demand, building and maintaining infrastructure, and other approved expenses.

- Supply charges - The supply portion of a gas bill depends primarily on wholesale natural gas prices. These are influenced by global and regional production, storage levels, imports and exports, economic activity, and weather. In New England, sudden cold snaps can sharply raise demand and push prices higher. In recent years, increased U.S. liquefied natural gas (LNG) exports have also tied U.S. natural gas prices more closely to international markets, making them more volatile.

- Delivery charges – These are set by the DPU, and pay for the costs of running local gas systems. These include pipelines, meters, safety and emergency response, customer service, and state programs like low-income assistance and energy efficiency.

For the 2025–26 winter season, DOER projects retail natural gas prices will average about $2.03 per therm, down from $2.24 last year. A therm is a way to measure the amount of natural gas used for heating. This price estimate is based on rate filings that gas companies submit to the DPU and assume that current supply and delivery rates stay the same at the time of publication. Because each gas company charges different rates, DOER calculates a load-weighted average across all service areas to show a statewide picture. Local distribution companies (LDCs) file these rates with the DPU, and they may adjust them during the season through mechanisms like the Cost of Gas Adjustment Factor (GAF) and the Local Distribution Adjustment Factor (LDAF). Because of this, household monthly and seasonal bills may end up higher or lower than these early season estimates.

For more information on natural gas prices, households can visit the DPU’s website to view filings and approved tariffs. National and regional trends are available through the U.S. Energy Information Administration’s Winter Fuels Outlook and Weekly Natural Gas Update.

Households can also contact their local gas utility for the latest rates, seasonal adjustments, and details on customer assistance programs. For help understanding your bill, visit the DPU’s Understanding Your Heating Bill website.

Electricity

About 20% of Massachusetts households heat with electricity. These include households using electric baseboard heat and more energy-efficient technology like electric heat pumps. Retail electric rates vary by utility and include both supply and delivery charges:

- Supply charges – This is the cost of generating electricity and depends on wholesale market prices. Households can get supply through their utility’s Basic Service, through a municipal aggregation program (Community Choice Electricity), or from a competitive supplier. Studies from the Attorney General’s Office show that competitive supply often costs more than Basic Service.

- Delivery charges – Reviewed and approved by the DPU, these cover the cost of getting electricity to homes, including utility poles, wires, substations, long-distance transmission, and statewide programs like the Mass Save® programs and low-income assistance.

For the 2025–26 winter season, DOER projects the statewide average electric utility rate to be about $0.35 per kilowatt-hour (kWh). This is slightly higher than last year’s $0.33/kWh, though the actual rate depends on the location of a household.

For more information on electric rates and programs, households can check rate schedules on the DPU website, look at DOER’s Electric & Gas Customer Choice Data, or visit www.MassSave.com for details on heat pump incentives and energy efficiency programs.

Heat Pump Rate

Starting this winter, Massachusetts will have its first-ever residential heat pump rate, offered by all three major electric utilities. These seasonal delivery rates, approved by the DPU, lower winter delivery charges for households that heat with air-source or ground-source heat pumps.

As of November 1, 2025, households that received a Mass Save programs rebate since 2019 for a heat pump are being automatically enrolled by their utility, unless they choose to opt out. Other households can contact their utility to confirm their heat pump installation and sign up for the new rate.

While the exact savings depend on the utility, eligible households could save about $540 on their heating bills this winter.

This new rate makes electric heating more affordable, spreads grid costs more fairly, and encourages more households to switch to clean, efficient heating systems. Heat pump rates will have no financial impact on other electric customers; non-heat pump households will not pay more for electricity this winter because of the new rate. While DOER continues to advocate for deeper savings and broader rate reform to better support electrification, this new rate represents an important step toward making clean heating more accessible and cost-effective for Massachusetts residents.

For more information about the new heat pump rates, visit the websites of Eversource, National Grid, or Unitil.

Comparing heating costs across fuels

Households in Massachusetts use different fuels for heating, and the type of housing often affects which fuel is used. For example, electric baseboard heat is more common in apartments, which are usually smaller than single-family homes that tend to use oil or natural gas. Larger homes need more fuel to stay warm, which leads to higher heating costs. Homes that are well-insulated or weatherized use less fuel to stay at the same temperature. Because of these differences, the average heating costs in this report are not a perfect “apples-to-apples” comparison across fuels.

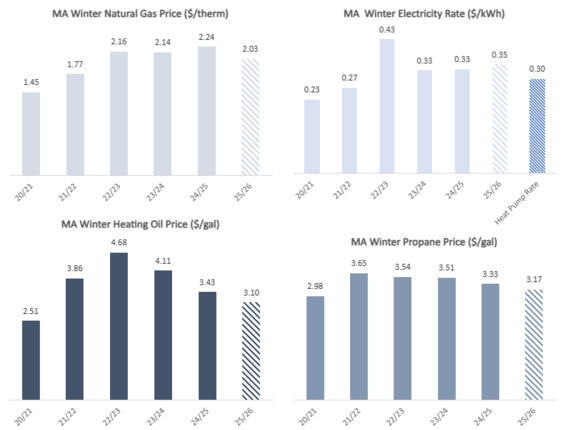

To better compare fuels, Figure 2 shows the estimated cost of producing heat this winter using different technologies and the 2025–26 winter price estimates from this report. The costs are shown in dollars per unit of heat, measured in British thermal units (Btu). This figure only looks at fuel costs—it does not show the full benefits of energy efficiency, reducing carbon emissions, or the added value of air conditioning.

Figure 2: Cost to Produce Heat this Winter (2025/26) for Different Technologies

Source: DOER Analysis

Note: The light-blue bars show the estimated average cost to heat by technology, based on the statewide average fuel or electricity price (for example, the statewide average cost of natural gas is $2.03 per therm). Because fuel and electricity prices are not the same across Massachusetts, the dark-blue lines show the range of costs households are expected to pay this winter.

While Figure 2 uses statewide averages, actual household costs will vary depending on their fuel prices. Because of these differences, households should not assume that switching fuels will automatically lead to savings. To understand likely costs, households should review their own supply rate.

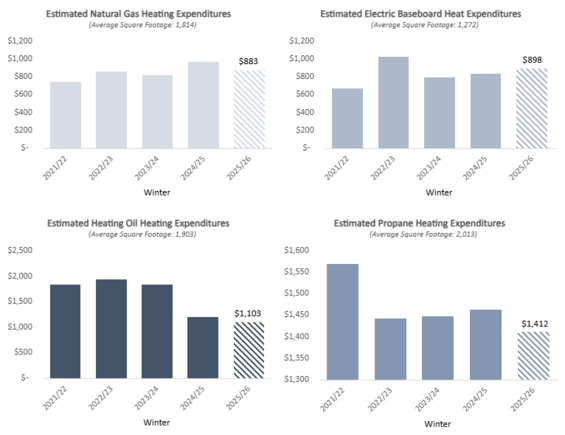

To estimate how much an average Massachusetts household spends on space heating, DOER gathers data from the EIA Energy Outlook, and utility company filings with the Massachusetts DPU. Figure 3 shows the estimated household spending on heating by fuel type for recent winters and the forecast for the 2025–26 season. It is important to note that the electricity data reflects homes using electric baseboard heating, not air-source or ground-source heat pumps. Because heat pumps are much more efficient, they use less electricity to heat the same space and will now have their own separate rate.

Figure 3: Average Winter Household Heating Costs

Source: DOER Analysis

Note: The spending estimates are based on the average size and age of homes that use each type of heating. For example, homes that heat with electricity are usually smaller. The estimates also rely on current fuel prices and expected fuel use.

The numbers above do not reflect differences in home type, size, age, or construction, all of which can affect how much fuel a household uses. Households should not assume that switching fuels will automatically save money. For a more accurate estimate of possible savings, the Mass Save programs offer a Heating Comparison Calculator to compare costs by heating system.

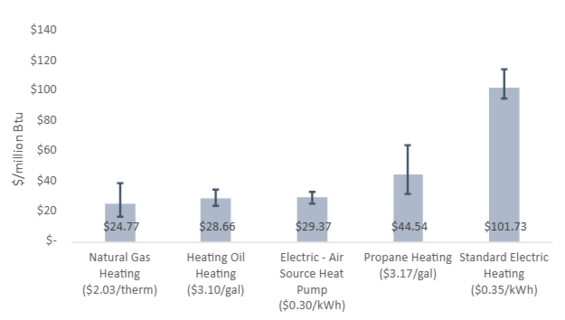

Table 1 below shows DOER’s estimates of space heating costs for the 2025–26 winter season. The table includes estimated retail energy prices in Massachusetts and average fuel use for heating. These numbers only cover space heating; total household costs will be higher once water heating, appliances, lighting, and other energy uses are included.

Table 1: 2025/26 Estimated Heating Costs by Fuel

Table 2 shows both past and estimated future prices, fuel use, and household spending by fuel type in Massachusetts. This helps show how costs have changed over time and what households might expect in the upcoming winter.

Table 2: 2025/26 Estimated Heating Fuel Use and Costs in Massachusetts

For households that want to follow energy markets and prices during the heating season, the U.S. Energy Information Administration (EIA) tracks energy prices and the factors that affect them. To help track all heating fuels, the EIA also publishes its monthly Short-Term Energy Outlook.

Help with your heating bills

Massachusetts offers many programs to help households lower energy costs. These include no-cost home upgrades and extra support for income-eligible households. The best way to reduce heating bills is to use less energy through weatherization and efficiency upgrades.

The statewide Mass Save® program offers:

- Free home energy assessments

- Rebates and incentives for energy-efficient heating equipment, appliances, and insulation and air sealing

- 0% financing for major efficiency upgrades

Households served by municipal light plants (MLPs) may be eligible for similar benefits through their MLP, NextZero or Energy New England. Contact your local municipal utility to learn about programs in your community.

Households can also lower costs through programs like Community Shared Solar (CSS). CSS gives bill credits from large solar projects, usually at a discount compared to Basic Service.

Additionally, the Massachusetts Energy Savings Finder can help you look up local, state, and federal rebates, incentives, and tax credits for both homeowners and renters. This tool can help you find ways to save money on energy upgrades.

If you are having trouble paying your utility bills, contact your utility directly. They may offer discount rates, payment plans, or assistance programs. You can also explore Home Energy Assistance Programs, which provide fuel assistance and efficiency help for income-eligible households. For more details, see the Frequently Asked Questions about Electric, Gas, and Water Utilities.

For more energy-saving tips, visit the U.S. Department of Energy’s Energy Saver website or download the free Energy Savers Guide.

Information on switching to heat pumps

With high heating prices and global markets uncertain, many Massachusetts households are looking at long-term solutions for both stability and savings. Clean heating and cooling technologies—especially heat pumps—are becoming one of the most cost-effective ways to heat and cool a home.

- Air-source heat pumps provide heating at much lower cost than electric resistance, oil, or propane. They work efficiently even in below-zero weather and also cool homes in summer. Learn more in the Massachusetts Clean Energy Center’s Air Source Heat Pump Guide.

- Starting this winter, households with heat pumps can use the new heat pump rate, which lowers delivery charges and helps eligible customers of electric utilities save on their heating bills.

- Mini-split heat pumps are a good choice for homes without ducts, for room additions, or for very efficient new homes that need only small systems.

- Central heat pumps can replace existing central heating and cooling systems.

- Ground-source (geothermal) heat pumps are even more efficient but require more upfront investment.

For more information on these systems, rebates, and incentives, visit the Mass Save programs’ Heat Pump Heating and Cooling website. If your home is served by a municipal utility, check their website or ask directly about available programs.

Contact

Online

Phone

Open M-F 8:45am-5:00pm

Address

| Date published: | November 10, 2025 |

|---|---|

| Last updated: | November 10, 2025 |