Author: Deb Wagner, Director of Accounts

On March 10, 2020, then-Governor Charlie Baker declared a state of emergency in Massachusetts for the COVID-19 pandemic. Days later, the national emergency declaration took effect. This pandemic spurred the creation of historic levels of resources for local governments to address aspects of this crisis, such as health and safety, economic relief and mental health resources.

The U.S. Treasury, through the Coronavirus Aid, Relief, and Economic Security (CARES) Act’s Coronavirus Relief Fund (CvRF), provided resources to directly respond to the COVID-19 crisis. Covered costs included core services including direct staffing to address pandemic needs, backfilling positions due to quarantine and isolation, PPE, social distancing measures, and expanded public health costs, as well as community support. The Treasury, under the American Rescue Plan Act (ARPA), created the Coronavirus Local Fiscal Recovery Fund (CLFRF). These funds were allocated to provide emergency relief and respond to the negative economic impacts of the health crisis. The Elementary and Secondary School Emergency Relief (ESSER) Fund provided funding through both the ARPA and CARES Acts to address the issues caused by remote learning during the pandemic and other social and emotional needs of students. Finally, FEMA funds bolstered these efforts, covering some costs not covered by other sources of revenue listed here.

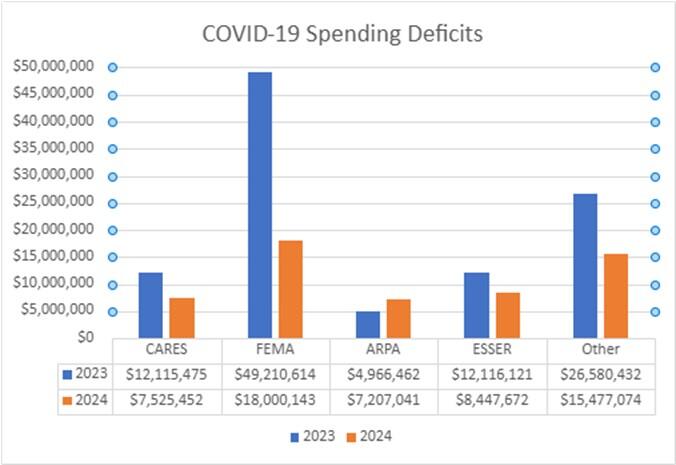

CARES funds were provided by the state government to local governments in Massachusetts during two rounds of drawdown opportunities and a Reconciliation Period, ending October 29, 2021. Use of these monies was audited for compliance with Federal requirements. ARPA proceeds, with the exception of communities that are part of functioning counties in Massachusetts, and ESSER funds were allocated formulaically to local governments. FEMA funds were paid on a reimbursement basis. Over the past two fiscal years, the Division of Local Services (DLS) has been monitoring deficits in special revenue accounts used to track use of these funds. These deficits have been caused by either costs denied for reimbursement or overspending of the mitigation funds received. DLS expects that some deficits may be cured through the receipt of outstanding reimbursements. We noted there was a substantial decrease in the overall amount of outstanding deficits from FY2023 to FY2024, $104,989,104 and $56,657,382, respectively. The chart below shows the deficits for the past two fiscal years’ end, to date:

The “Other” category represents COVID-19 deficits in the special revenue funds simply labeled “COVID-19 Deficits”.

DLS will require these COVID-19 related deficits to be fully funded prior to or on the FY27 tax rate recap. A city or town may appropriate from available funds to cure these deficits or raise them on the tax rate recap form. Further instruction regarding procedures to provide for these deficits will be forthcoming.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | June 5, 2025 |

|---|