Authors:

Jared Curtis - Bureau of Accounts Springfield Office Supervisor

Matt Andre - Bureau of Accounts Springfield Office Field Representative

Generally speaking, last winter wasn’t so bad weather-wise. However, for whatever it’s worth, the Farmers’ Almanac’s weather forecast for this season predicts, “chill, snow, repeat.” Should that be the case, local officials may be wondering if their city or town’s snow and ice budget are sufficient for the upcoming winter.

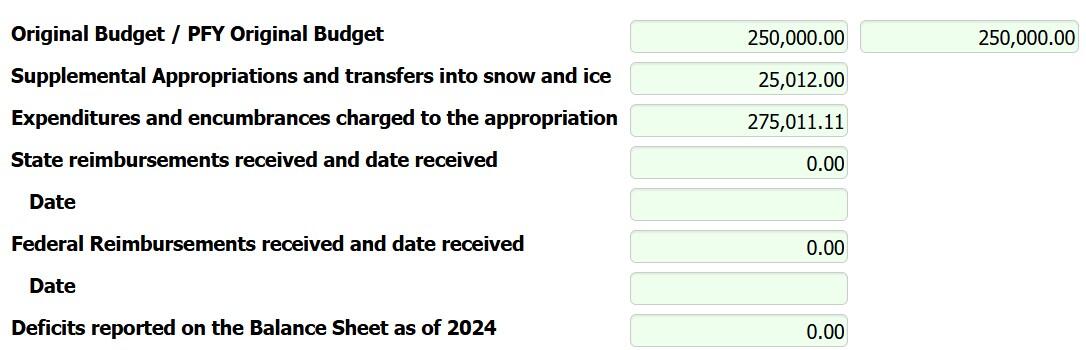

This article reviews figures from Snow and Ice Data Sheets (see example below) submitted by cities and towns to the Bureau of Accounts (BOA) annually by September 30 on an unaudited basis. This submitted information is utilized during the balance sheet and tax rate review processes. This article will review the current law, G.L. c. 44, § 31D, that allows cities and towns to expend funds in excess of appropriation for snow and ice removal provided certain preconditions are met, illustrate an example of the current law, and look at budget and expenditure data obtained from these data sheets.

The Current Law - Chapter 44, § 31D

Under current law, if a city or town appropriation for the snow and ice budget equals or exceeds the prior fiscal year appropriation, the snow and ice account may incur a liability or may be legally overspent after approval by the city or town’s chief administrative officer (CAO). (G.L. c. 4, § 7 defines the CAO as the “mayor of a city and the board of selectmen in a town unless some other local office is designated to be the chief administrative officer under the provisions of a local charter.”) The account deficit as of June 30 may be eliminated by including it in the next annual tax rate without appropriation by the community’s legislative body, unless otherwise provided for.

The Division of Local Services (DLS) has opined that the previous fiscal year’s appropriation is the original budget amount appropriated at a community’s annual town meeting or included in the annual city budget prior to providing any further supplemental appropriations.

If the conditions required to permit deficit spending under G.L. c. 44, § 31D are not met, then the fundamental rule of municipal finance under G.L. c. 44, § 31 applies and liabilities and expenditures in excess of appropriation (deficit spending) are prohibited.

Example

The accounting officer informs the CAO that the snow and ice budget may need an extra $100,000 by fiscal year end. The CAO asks whether this year’s total snow and ice removal appropriation is equal to or more than last year’s original appropriation. It is determined that this fiscal year’s annual budget appropriation was $1,000,000, supplemented with an additional appropriation of $50,000 during the fiscal year. The prior fiscal year’s annual budget appropriation was also $1,000,000, supplemented with an additional appropriation of $200,000 during the fiscal year.

The accounting officer explains DLS’ opinion to the CAO who then grants approval to deficit spend up to an additional $100,000. The actual amount in deficit as of June 30 was $95,000. The deficit spending is authorized under G.L. c. 44, § 31D. The legally authorized $95,000 deficit is reported by the accounting officer to the assessors to be raised on the tax rate recap for the next fiscal year, if not otherwise provided for.

Had the current fiscal year’s appropriation been less than $1,000,000, the $95,000 deficit would not have been authorized under G.L. c. 44, § 31D and would have been an illegal appropriation deficit. In the case of an illegal appropriation deficit, unless corrected prior to year-end through transfer or appropriation of unexpended reserves, the deficit would be reported by the accounting officer to the assessors to be raised on the tax recap for the next fiscal year and it would also be a reduction to the community’s next free cash calculation.

In this example, note that:

- The accounting officer requested permission from the CAO to deficit spend.

- After determining that the amount of the fiscal year’s appropriation for snow and ice removal is equal to or exceeded the previous fiscal year’s appropriation, the CAO granted approval to deficit spend up to a certain amount.

- The current fiscal year’s original annual budget appropriation for snow and ice removal is compared to last fiscal year’s original annual budget appropriation without including any supplemental appropriations.

- The accounting officer reported the $95,000 deficit to the assessors to be included in the next fiscal year’s tax rate without appropriation. If the $95,000 deficit had been otherwise provided for, the accounting officer would have reported this to the assessors who would not include the amount in the tax rate but rather upload the accounting officer’s report.

Snow and Ice Removal Budgets

For FY2024, 349 communities reported total original snow and ice removal budgets of $142.2 million, about $3.5 million or 2.5% more than the total FY2023 original budgets.

In 331 communities, the FY2024 original budgets either equaled or exceeded the FY2023 original snow and ice removal budgets and 18 communities budgeted less. The data revealed that in 213 communities, the original budget equaled the previous fiscal year’s budget and in 118 communities the current year budget exceeded the prior year’s budget. Remember that G.L. c. 44,§ 31D allows communities to overspend the snow and ice budget and raise the deficit on the next tax recap without appropriation if certain preconditions noted above are met.

Snow and Ice Removal Budgets Supplemented

During FY2024, 197 communities supplemented their FY2024 original budgets by $38.1 million. Most cities and towns consider supplementing their original snow and ice removal appropriation later in the fiscal year depending upon the severity of the winter. Five communities reduced their original budgets by about $2.2 million netting total supplements to $35.9 million.

Total FY2024 original snow and ice removal budgets plus supplemental appropriations less reductions equaled $163.8 million. They ranged from a low of $15,772 in Aquinnah to a high of $23.7 million in Boston. The median supplemental addition to the original budget for those doing so was $86,500.

Snow and Ice Removal Dollars Spent

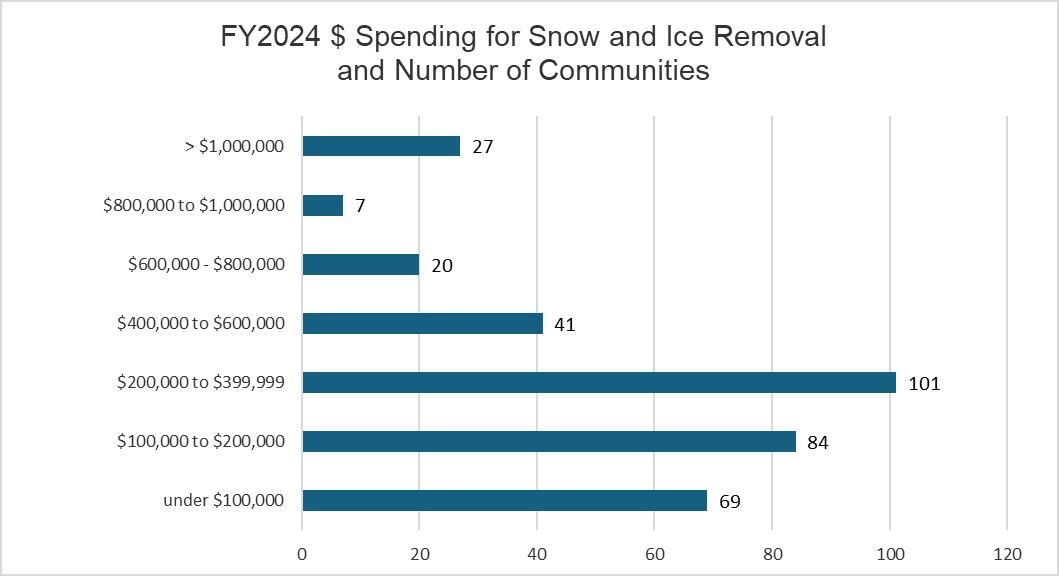

FY2024 snow and ice removal expenditures totaled $147.5 million. The following graph depicts snow and ice expenditures by spending level and the number of communities within each group.

Of the 349 Snow and Ice Data Sheets submitted, 177 communities had original budgets that were sufficient to cover FY2024 total expenditures.

Snow and Ice Removal Dollars in Deficit

Cities and towns that do not sufficiently supplement their original snow and ice appropriation may end the fiscal year with an appropriation deficit which must be eliminated prior to the setting of the next tax rate.

For FY2024, 31 communities reported a snow and ice deficit totaling $3.2 million. As allowed by G.L. c. 44, §31D, 28 communities included an amount to be provided by taxation without appropriation on their FY2025 tax recap while 3 others eliminated their deficit by appropriation or transfer.

The range of the 31 deficit amounts was as follows:

- 1 > $500,000

- 8 between $100,000 and $500,000

- 22 < $100,000

Conclusion

Whether it ends up snowing this winter at a new record level or not, your city or town should develop a snow and ice removal policy that communicates what the employee and resident responsibilities are in the event of a storm. Will next winter be more severe or possibly milder than the last one? We’ll just have to wait and see.

Example of a Snow and Ice Data Sheet

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Christopher Ketchen, Paula King, Jen McAllister, Brianna Ortiz and Tony Rassias

| Date published: | November 20, 2025 |

|---|