Authors: Tony Rassias - Bureau of Accounts Deputy Director

The tax rate setting process includes the Boards of Assessors submitting in Gateway the total valuation of each class of real property and of personal property on Form LA-4, “Assessment/Classification Report” and new growth allowed by Prop 2½ on Form LA-13, “Tax Base Levy Growth.” Once submitted, the Bureau of Local Assessment (BLA) reviews these forms to ensure uniformity in assessment classification and consistency with statutory requirements.

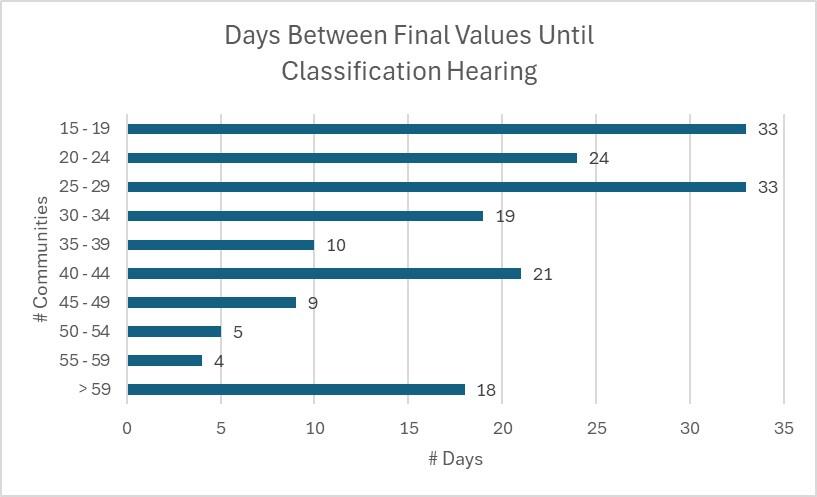

After BLA approval, the Selectboard or City/Town Council conducts a tax classification hearing, a public meeting to help decide that fiscal year’s tax policy. See IGR 25-10 for FY2026 requirements. The following graph shows the number of days between final value approval until the classification hearing date reported to the Division of Local Services (DLS) by communities for FY2025. Note that 176 communities held their classification hearing more than two weeks after final values were approved which for them averaged 29 days.

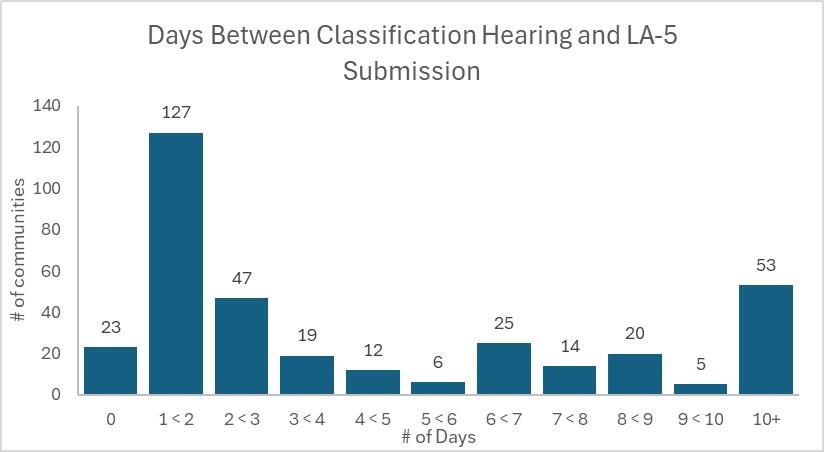

When the classification hearing results become official, Form LA-5, "Classification Tax Allocation," and required supporting documentation is submitted. The following graph shows the number of days between the classification hearing date and LA-5 submission reported to DLS by communities for FY2025.

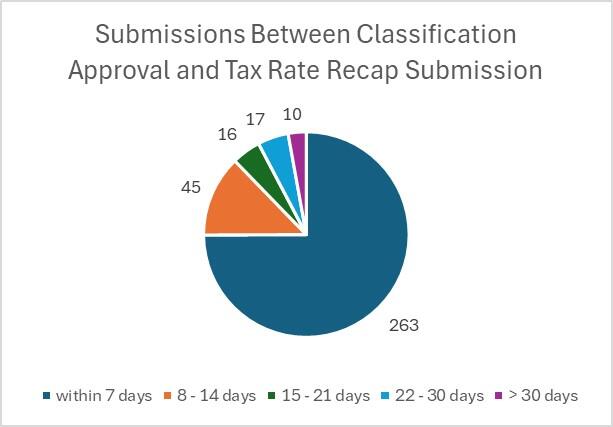

Once the LA-5 has been submitted and a balanced budget is determined in compliance with Prop 2½ tax levy limitations, the Board of Assessors submits the Tax Rate Recap and supporting forms in Gateway. The following graph shows the number of days between classification approval and Tax Rate Recap submission reported by communities to DLS for FY2025. Note that 88 communities submitted their Tax Rate Recap more than seven days after classification was locally adopted.

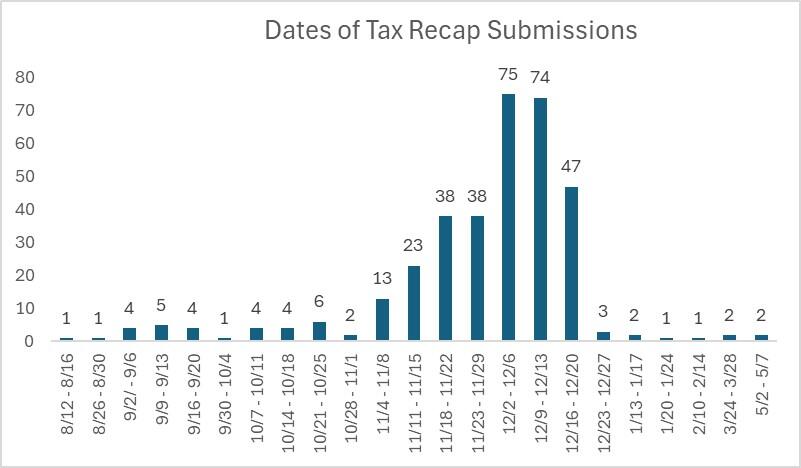

The following graph shows Tax Rate Recap submission dates for FY2025. The Bureau of Accounts will approve the setting of a FY2026 tax rate when all applicable tax rate requirements have been met.

Helpful Resources

In order to establish realistic timetables for meeting all requirements and ensuring the timely setting of the tax rate, please refer to DLS Bulletin 2019-02, Recertification and Tax Rate Target Dates.

Cities and towns using a quarterly tax payment system should refer to IGR No. 25-3, Fiscal Year 2026 Tax Bills Quarterly Tax Payment System (March).

Cities and towns using a semi-annual preliminary tax payment system should refer to IGR No. 25-5, Fiscal Year 2026 Tax Bills Semi-annual Payment System Annual Preliminary Bills (March).

Cities and towns using a semi-annual payment system and opting to issue preliminary tax bills for FY2026 should refer to IGR No. 25-6, Fiscal Year 2026 Tax Bills Semi-annual Payment System Optional Preliminary Bills (April).

Cities and towns using a semi-annual payment system should refer to IGR No. 25-4, Fiscal Year 2026 Tax Bills Semi-annual Payment System (March).

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | September 4, 2025 |

|---|