Overview

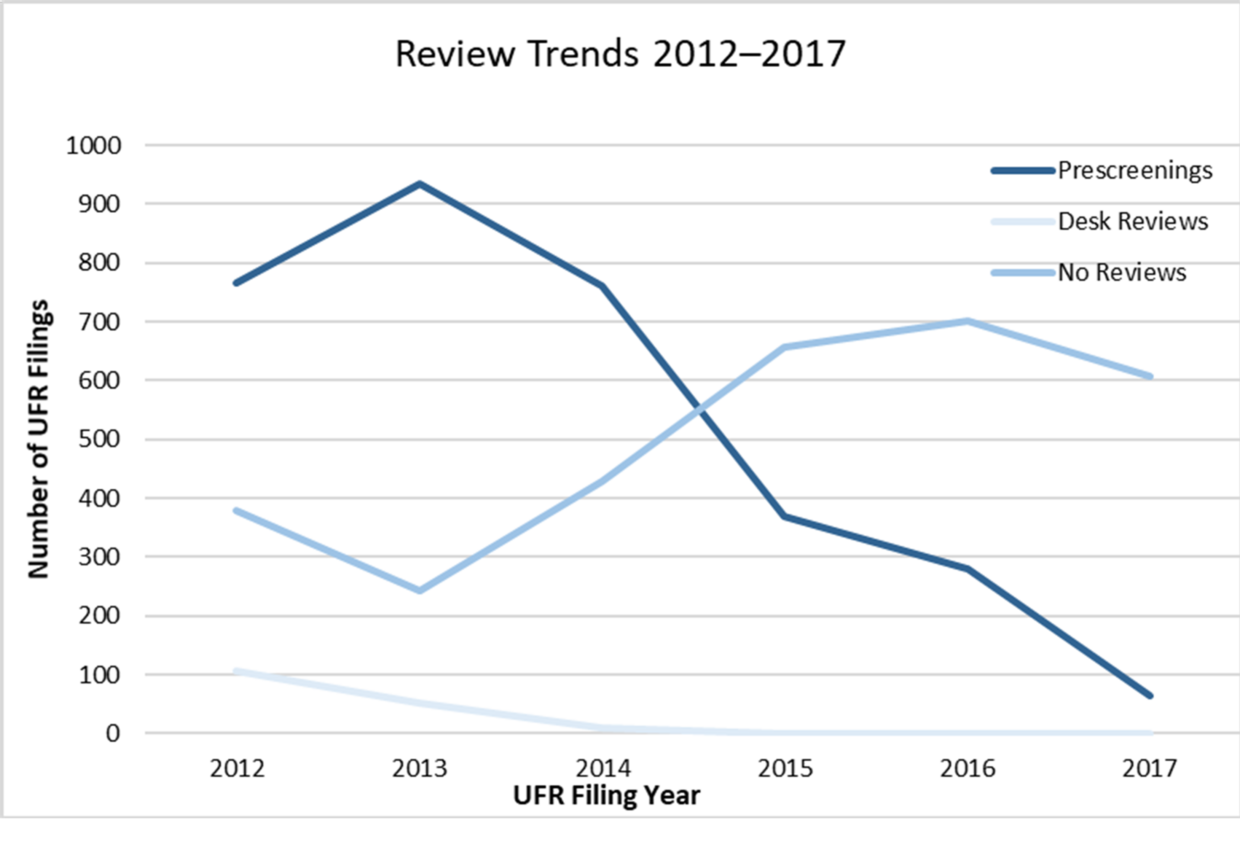

Our analysis of the Operational Services Division’s (OSD’s) reviews of Uniform Financial Statements and Independent Auditor’s Reports (UFRs)5 for fiscal years 2012–2017 indicated that reviews had fallen to historic lows during our audit period. Substantially reduced prescreening6 reviews, combined with a shift away from detailed desk reviews,7 provide less assurance that financial statements are prepared in accordance with OSD’s fiscal policies and that any instances of noncompliance with applicable regulations and policies are effectively detected. Further, insufficient monitoring can result in revenue lost to the Commonwealth.

UFR Reviews for Fiscal Years 2012–2017

|

OSD Review |

2012 |

2013 |

2014 |

2015 |

2016 |

2017* |

Total |

|---|---|---|---|---|---|---|---|

|

Prescreenings† |

765 |

934 |

762 |

369 |

281 |

65 |

3,176 |

|

Desk Reviews |

106 |

51 |

9 |

0 |

0 |

0 |

166 |

|

No Review |

380 |

242 |

428 |

656 |

701 |

608 |

3,015 |

|

Total |

1,251 |

1,227 |

1,199 |

1,025 |

982 |

673 |

6,357 |

* UFR filings for fiscal year 2017 were due on November 15, 2017, but because of delays in obtaining funding data, OSD extended the due date to December 15, 2017.

† Prescreenings include reviews of initial and subsequent filings by the same vendor.

The graph below shows our analysis of OSD review trends for submitted UFRs for fiscal years 2012–2017.

In addition to assessing whether contracted human-service providers comply with UFR reporting standards and filing requirements, OSD desk reviews are also used to determine possible revenue recoupments for the Commonwealth, as described in the following sections.

Recoupment of Excess Surplus State Contract Revenue

Section 1.03(7) of Title 808 of the Code of Massachusetts Regulations (CMR)8 states,

If, through cost savings initiatives implemented consistent with programmatic and contractual obligations, a non-profit Contractor accrues an annual net surplus from the revenues and expenses associated with services provided to Departments which are subject to 808 CMR 1.00, the Contractor may retain, for future use, a portion of that surplus not to exceed 5% of said revenues. The cumulative amount of a Contractor’s surplus may not exceed 20% of the prior year’s revenues from Departments. . . . [OSD] shall be responsible for determining the amount of surplus that may be retained by each Contractor in any given year and may determine whether any excess surplus shall be used to reduce future prices or be recouped.

The table below details the potential excess state contract revenue that could have been recouped by the Commonwealth or used to reduce future contract prices with human-service providers, as detailed in OSD’s UFR database.

Excess State Contract Revenue 2012–2017

|

UFR Fiscal Year |

Amount in Excess of 5% Annual Limit |

Cumulative Amount in Excess of 20% Limit |

|---|---|---|

|

2012 |

$494,419 |

$9,344,385 |

|

2013 |

1,531,259 |

10,555,023 |

|

2014 |

2,482,034 |

20,025,503* |

|

2015 |

6,344,770 |

26,780,203 |

|

2012–2015 Subtotal |

$10,852,482 |

$66,705,114 |

|

2016 |

7,991,656 |

29,284,655 |

|

2017 |

0† |

0† |

|

Total |

$18,844,138 |

$95,989,769 |

* The total in the OSD database was $33,155,362, but our review disclosed a filing error of $13,129,859 by one vendor, which reduced our calculated excess surplus to $20,025,503.

† This amount was the result of the regulatory change discussed on the previous page.

During our audit of OSD’s UFR review records, we determined that the agency did not identify, or take measures to recoup, any potential surplus state contract revenue provided to contracted human-service providers, except for fiscal year 2015 filings, from which OSD recouped $1,053,580 in fiscal year 2018.

Recoupment of Nonreimbursable Costs

According to 808 CMR 1.05,

Funds received from Departments may only be used for Reimbursable Operating Costs as defined in 808 CMR 1.02. In addition, funds may not be used for costs specifically identified in 808 CMR 1.05 as non-reimbursable.

When a contracted human-service provider is determined to have billed nonreimbursable costs to a state contract, the value of those improper billings is subject to recoupment, intercept, offset, or price adjustment, as determined by the Commonwealth.

A historical review of OSD’s database of UFR filings showed vendors reporting a total of $86,813,090 in nonreimbursable costs in excess of offsetting revenue for fiscal years 2012–2017 for all programs. The following table shows net nonreimbursable costs for each year.

Nonreimbursable Costs Exceeding Eligible Revenue Offsets 2012–2017

|

Fiscal Year |

Nonreimbursable Costs in Excess of Revenue Offsets |

Number of Vendors |

|---|---|---|

|

2012 |

$25,333,373 |

140 |

|

2013 |

10,065,370 |

143 |

|

2014 |

13,329,694 |

131 |

|

2015 |

11,837,713 |

136 |

|

2016 |

14,369,547 |

147 |

|

2017 |

11,877,393 |

128 |

|

Total |

$86,813,090 |

|

During our review of the records related to the reviews performed by OSD during our audit period, we found that OSD did not document its efforts to analyze and determine which nonreimbursable costs that were reported by contracted human-service providers were subject to recoupment.

Authoritative Guidance

Section 22N of Chapter 7 of the Massachusetts General Laws states,

The [Bureau of Purchased Services] shall establish guidelines and standards, consistent with generally accepted governmental auditing standards, for independent financial and performance audits of providers of social service programs and governmental units purchasing programs. The bureau shall coordinate or conduct audits of providers as needed to monitor compliance with applicable fiscal policies. The bureau shall develop and administer a uniform system of financial accounting, allocation, reporting and auditing of providers which conforms to generally accepted governmental auditing standards. The bureau may conduct quality assurance reviews of provider financial statements and their auditors’ reports and work papers.

Because OSD does not conduct audits of the Commonwealth’s contracted human-service providers, it needs to establish an effective desk review process to monitor the audit work performed by the private certified public accountant firms that do conduct them, and it should ensure that providers comply with OSD’s regulations and UFR filing requirements.

Reasons for Noncompliance

OSD had not established formal policies and procedures for desk reviews that established such things as frequency of reviews, criteria for review selection, and what is to be reviewed.

OSD management indicated that previous administrations decided not to recapture cumulative surpluses in excess of 20% of prior-year revenue, and current management continued this practice. Current management indicated that it had made some attempt to recapture annual surpluses above the 5% limit and had recaptured $1,053,580 from fiscal year 2015; however, the previous administration did not maintain records of surplus recovery efforts in relation to the annual 5% limit in previous years.

Recommendations

- OSD should take the measures necessary to perform sufficient reviews of UFR filings to ensure compliance with its fiscal policies.

- OSD should implement policies and procedures for conducting UFR desk reviews, which should include such things as frequency of reviews, criteria for review selection, and what is to be reviewed.

Auditee’s Response

We would like to address several issues with the report, including that the draft report made no reference to Chapter 257 of the Acts of 2008 (Chapter 257), which required the establishment of rates of payment for social service programs, also known as Purchase of Service (POS). This important change in the purchase of health and social services by the Commonwealth resulted in a shift away from the recoupment of non-reimbursable costs to pre-established rates for most of these services. . . .

Section 22N of chapter 7 of the Massachusetts General Laws states that OSD’s Bureau of Purchased Services shall coordinate or conduct audits of providers as needed to monitor compliance with applicable fiscal policies. As we discussed during our meeting, the Legislature has given the bureau broad discretion to identify the means of fulfilling its statutory mission in the most efficient manner. Since the enactment of Chapter 257, OSD has used various approaches to fulfill its mandate and determined that desk audits are no longer the auditing tool that yields the most efficient and cost effective result. OSD has found that a more targeted approach that utilizes use of pre-screening of filings has resulted in the identification of high risk filings in a more efficient manner. As discussed further below, revenue from the UFR Audit unit activities totaled $1,615,638 in Fiscal Year 2018 whereas the expenditure ceiling was capped at $100,000. This illustrates that the pre-screening approach yielded much better financial results and return on investment than the previously employed desk reviews.

Therefore, OSD respectfully disagrees with the draft audit finding that OSD’s UFR review process may be inadequate. The prescreening or desk review does not specifically involve the analysis of non-reimbursable costs, but, as stated in OSD’s policies and procedures, prescreening consists of reviewing for other compliance. [This includes the Cover page data, independent auditors’ information, financial statements, supplemental schedules for schedules A and B, acknowledgement from the board of directors, audit service check list and information applicable to Federal audits.] OSD informed the [Office of the State Auditor, or OSA] audit team that desk reviews were being replaced by prescreening and that the unit was currently updating policies and procedures to reflect that change. . . .

The funding for OSD’s audit functions has decreased over the past 5 fiscal years from $984,000 to $100,000 per year. The relevant revenue recovered through these audit efforts and audit expenses over the audit period are as follows:

OSD Audit Revenue and Expenditures:

Fiscal Year

Expenditure Cap*

Revenue†

Expenditures‡

2014

$984,000

$465,110

$734,220

2015

$877,082

$249,766

$377,103

2016

$404,584

$319,539

$325,120

2017

$150,000

$669,061

$123,862

2018

$100,000

$1,615,638

$99,589

Total

$2,515,666

$3,319,114

$1,659,894

* Expenditure Caps include totals of Retained Revenue Account (1775-0124) and Field Audit unit Appropriated Account (1775-0106), which was eliminated through a 9C reduction in January 2016 after approximately $1.3 million was spent to fund the unit with little return in 4.5 years. After elimination of funding in Fiscal Year 2016, the Fiscal Year 2017 budget did not include funding for the Unit.

† Revenue from UFR Audit unit activities [was] deposited into Retained Revenue Account number 1775-0124.

‡ These Expenditures represent costs for the Field Audit unit and UFR Audit unit. Audit expenditures in excess of the Expenditure Cap are paid from OSD’s Administrative Fee account. . . .

The numbers presented detailing recoupment of non-reimbursable costs are inconsistent with OSD’s total number of UFRs filed as noted below:

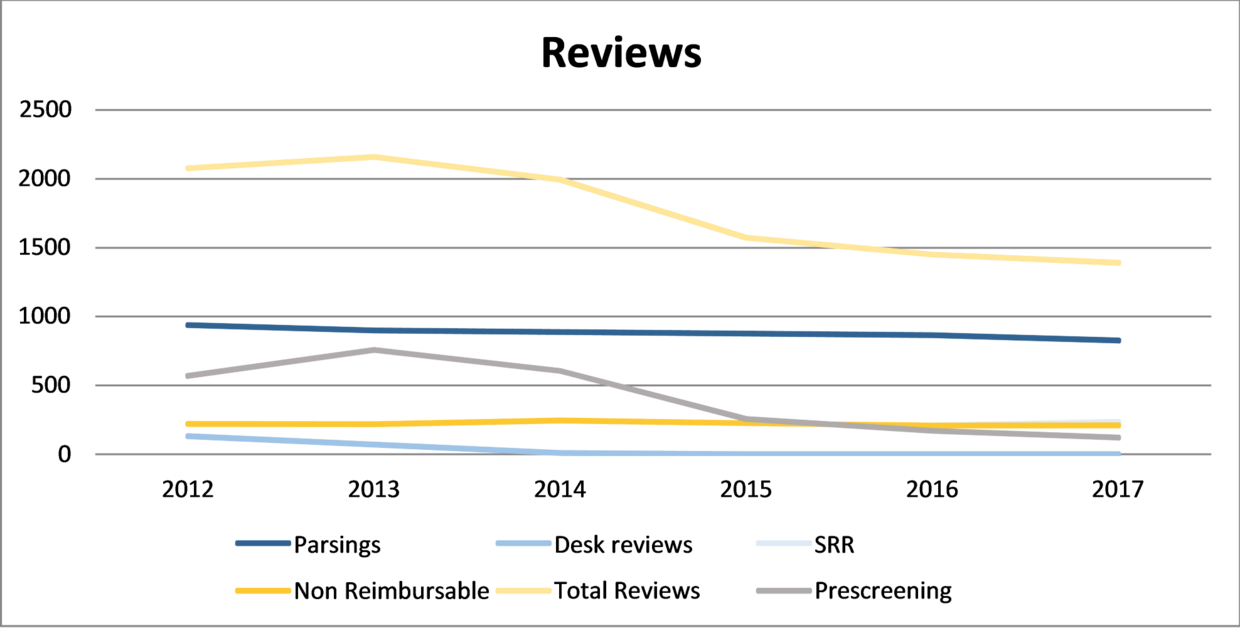

OSD Reviews:

Fiscal Year

2012

2013

2014

2015

2016

2017

Desk reviews

131

70

9

N/A

N/A

N/A

Pre-screenings

570

758

605

256

171

121

Surplus Revenue Retention reviews

220

217

245

222

208

235

Non-Reimbursable reviews

220

217

245

222

208

209

Parsings9

937

898

890

873

864

825

Total Number of reviews

2,078

2,160

1,994

1,573

1,451

1,390

Number of UFRs filed

937

898

890

873

864

825

OSD believes that the number of UFR filings in the [OSA] chart pertaining to “no review” is incorrect. Pursuant to our statute, OSD has determined that the proper approach for monitoring UFRs for fiscal compliance is an approach where all incoming UFRs are parsed in the UFR database and any deficiencies are flagged and communicated to the contractor and their Primary Purchasing Agencies (PPAs). This correspondence is uploaded for the public to view, creating an audit trail. Other types of reviews, including SRR [surplus revenue retention] above the 5% level and non-reimbursable expenses and overbillings, are not tracked through the UFR tracking page or through the desk review and prescreening.

The table of UFR Reviews for Fiscal Years 2012–2017 [in the] draft report does not accurately represent all reviews for the following reasons:

- The [OSA] method used in pulling data for the query:

a. Included items that would not be applicable for prescreening . . .

c. Is pulling duplicate reviews and the UFR was not programmed to track any other type of reviews other than Prescreening and desk reviews; and

- A review can be done without changing the “submitted but not reviewed” box with the UFR. The only accurate way to verify if a contractor’s UFR has been reviewed is to go into a contractor’s eFILE and review the tracking page, the memo field, and correspondence from OSD. OSD no longer does desk reviews, so the chart is correct, which states that, starting in 2015 to present, there were no desk reviews

performed. . . .We believe the methodology used to compile the Amount in Excess [of] 5% Annual Limit and Cumulative Amount in Excess of 20% Limit table [in] the report, detailing the potential excess state contract revenues that could be recouped, ignores the necessity to open up each eFILE in order to conduct an analysis on each contractor to determine SRR liability. As previously explained to the auditors, since 2006, OSD implemented waivers of the accumulated 20% SRR and, effective in Fiscal Year 2016, removed the accumulated SRR altogether after promulgating changes to our regulations, 808 CMR 1.00.

OSD reviews the 5% SRR threshold data annually and has collected overages when applicable. In addition, the POS field audit unit previously reviewed for SRR and Non-Reimbursable Costs as part of their audit program. Primary Purchasing Agencies are an integral part of the checks and balances given their responsibility for managing the contracts and payments and, as such, may have dealt with SRR without the assistance of OSD in certain cases. . . .

OSD reviewed all 165 Approved Special Education programs for the same period noted, Fiscal Years 2012–2017, for non-reimbursable costs and SRR. This is a part of the Special Education annual review and noted in the policies and procedures provided to the [OSA] auditors. The reviews decreased with the decrease in special education programs. Also, the POS field audit unit audited for SRR and Non-reimbursable expenses from January 2012 through Fiscal Year 2014. OSD would also audit additional contractors on a case by case basis if needed.

In response to [OSA’s] reference to $86,813,090 in non-reimbursable costs, in order to validate a contractor’s liability, all UFR documents must be reviewed and often additional information must be sought in order to identify any liability. The statement that there are non-reimbursable expenses totaling $86,813,090 subject to recoupment is not accurate. OSD reviewed with [OSA] a query of 30 contractors run by [OSA] that they presented as a Commonwealth liability. OSD told [OSA] that 28 of the 30 contractors had offsetting revenue that would cover their non-reimbursable expenses resulting in no liability and/or the programs that had non-reimbursable expenses had no POS funding in that particular program. . . .

By exercising our authority to use different approaches to review UFR filings, OSD successfully increased funds recovery. By replacing the time consuming desk review in Fiscal Year 2015 and leveraging UFR prescreening and parsing, OSD is able to review and identify those contractors with high risk of noncompliance with less staff, while ensuring compliance with [generally accepted accounting principles], [the federal Office of Management and Budget], and [generally accepted government auditing standards].

As shown in the chart below, the number of OSD [full-time equivalents] . . . responsible for reviewing UFRs did decline as the Special Field Audit Unit was defunded over time:

OSD UFR FTEs and Funds Recovered for Fiscal Years 2012–2018:

2012

2013

2014

2015

2016

2017

2018

OSD Staff reviewing UFRs

4*

4

4

3

3.5†

1.5

1.5

OSD POS Field Auditors

6

5

5

4

3

0

0

Funds Recovered

$781,211

$826,891

$465,110

$249,766

$319,539

$669,061

$1,615,638

* These 4 FTEs actively reviewed UFRs; there were an additional 6 Field Audit FTEs, who only reviewed UFRs of the contractors they audited.

† These 3.5 FTEs actively reviewed UFRs; there were an additional 3 Field Audit FTEs, who only reviewed UFRs of the contractors they audited.

This OSD UFR FTEs and Funds Recovered for Fiscal Years 2012–2018 table shows that OSD is recovering more funds with less staff. In addition to year over year growth in the years since desk reviews ended, UFR Audit unit’s revenue for Fiscal Year 2018 was $1,615,638. This data helps to illustrate that the current approach of focusing reviews on higher risk areas has yielded better financial results than the desk reviews techniques previously employed.

Auditor’s Reply

Chapter 257 of the Acts of 2008 created a new process for establishing uniform rates for services provided by the Commonwealth’s human-service providers, but did not eliminate OSD’s responsibility of administering a process for identifying and recouping, as appropriate, any nonreimbursable expenses charged to state contracts. The OSD regulations (808 CMR 1.05) that were in effect during our audit period list all costs that are not reimbursable under state human-service contracts. Further, pursuant to 808 CMR 1.04(10), OSD has promulgated an Audit Resolution Policy that establishes what measures need to be taken by both OSD and a contracted human-service provider when nonreimbursable expenses are identified. Regarding nonreimbursable expenses, this policy states,

Under all contracts, reimbursement to Contractors is permitted only for actual reimbursable operating costs incurred (as defined in 808 CMR 1.02) for the contract, based on terms of the contract, Center for Health Information and Analysis requirements, and/or purchasing Department requirements. Non-reimbursable costs (as defined in 808 CMR 1.05) that are defrayed using Commonwealth funds and offsetting revenue (intended for use in defraying reimbursable costs), as designated in the contract or as required by 808 CMR 1.00 or [Office of Management and Budget] Circular A-110 (program income as applicable), are subject to recovery through recoupment, delivery of in-kind services or rate adjustment, in accordance with 808 CMR 1.05. In-kind services furnished by the Contractor in lieu of recoupment or rate adjustment must result in the Contractor incurring additional program costs equal to the value of the non-reimbursable costs. In addition, in-kind service costs must be defrayed with funds other than Commonwealth funds and offsetting revenue, as designated in the contract or as required by 808 CMR 1.00 or [Office of Management and Budget] Circular A-110 (program income as applicable). In-kind services may only be delivered to eligible clients of the Department.

We do not dispute that OSD can determine how it wants to monitor contracted human-service providers’ compliance with regulatory requirements and fiscal policies. However, we do not agree that OSD’s decision to use more prescreenings in lieu of desk reviews and on-site audits of certain providers is a more effective way of ensuring compliance with these requirements. Based on OSD’s prescreening checklist and the information we obtained during our audit, the primary purpose of the prescreenings is to determine whether a human-service provider has submitted all required information when filing its annual UFR in the UFR eFile system, not to perform any type of risk analysis. Further, although OSD asserts in its response that the use of prescreenings has yielded better results than its former desk review process, it should be noted that of the $1,615,638 in revenue that OSD’s response says it recovered for fiscal year 2018, $1,053,580 was from a surplus revenue recovery effort it conducted for fiscal year 2015 filings, not from prescreenings it conducted on fiscal year 2018 UFR filings.

In its response, OSD asserts that our analysis does not accurately represent all reviews performed by OSD during our audit period, that we included items not applicable for prescreening, and that we included duplicate reviews. However, we did not include duplicate reviews. Rather, we included reviews of initial and subsequent filings made by providers. We believed that if documents were refiled because OSD or a vendor had deemed it necessary to do so, OSD should receive credit for an additional review because of the additional time necessary for such a review. We defined prescreenings to include items that OSD had historically prescreened, such as alternative filings (instances when full UFRs were not required). We did use a code called “submitted but not reviewed” to develop our data for the “no reviews” category because this was a category established and used by OSD as part of its review process and therefore presumably accurate. During our audit, OSD’s staff never indicated to OSA that the information coded this way might be inaccurate or that we needed to confirm its accuracy using other records such as UFR eFile information. In our opinion, because our review in this area covered a six-year period, OSD had a reasonable amount of time to update at least the majority of the data in this category to ensure its accuracy. Finally, after receiving OSD’s response, OSA selected 25 vendors in OSD’s “submitted but not reviewed” category; examined the UFR eFile information; and determined that in all 25 instances, OSA had properly characterized these UFRs as submitted but not reviewed.

Our method regarding surplus recovery was to identify excess surpluses for each vendor that was recorded in the OSD database, trace a sample to actual UFR filings to verify the reliability of the data in the database, and ask OSD what action it took regarding the excess surpluses. OSD gave us a surplus recovery schedule showing $1,053,580 recovered in fiscal year 2018 (from just 13 providers) that was applicable to fiscal year 2015 filings. If there was additional information in its UFR eFile system, it should have included this information on the schedule or directed us to the applicable vendors in the system. In its response, OSD indicates that it performs annual reviews of surplus revenue retention, but it did not give us any documentation to substantiate this assertion. OSD also could not provide any information regarding surpluses recovered by primary purchasing agencies.

Regarding nonreimbursable costs, when OSD determines that a vendor did receive sufficient non-Commonwealth revenue to offset its nonreimbursable costs, it gives the vendor the option of refiling its UFR to show that non-Commonwealth funds were used to pay nonreimbursable costs. We questioned this practice in a prior audit (No. 2011-5144-7C). In our current audit, during our initial analysis of nonreimbursable costs charged to state contracts, we identified 262 vendors whose UFRs reported total organization net nonreimbursable costs (totaling $298,401,212) and did not report any other non-Commonwealth contract revenue that they could have used to offset these costs. We then selected a sample of 25 of these 262 (not 30 as suggested in OSD’s response) for further analysis and asked OSD for any documentation it might have regarding its reviews of these vendors. We noted that 14 out of 25 had a status of “submitted but not reviewed” in the OSD database and that no separate review of nonreimbursable costs had been performed for any of the 25 entities. As OSD states in its response, “In order to validate a contractor’s liability, all UFR documents must be reviewed and often additional information must be sought in order to identify any liability.” However, in the cases reviewed, there was no documentation that OSD conducted such an analysis, and therefore we cannot comment on its assertion that the majority of the vendors in our sample did have sufficient non-Commonwealth revenue to offset the nonreimbursable costs they charged against their state contracts. We reviewed all UFRs in the database and noted filings with non-Commonwealth revenue that these vendors could use to offset their nonreimbursable expenses. Our review determined that $86,813,090 of the $298,401,212 in nonreimbursable costs reported by vendors might be subject to recovery by OSD and therefore should be investigated by OSD’s staff.

| Date published: | December 19, 2018 |

|---|