Author: Financial Management Resource Bureau

The Community Preservation Act (CPA) is authorized by MGL c 44B and is a local adoption provision that a city or town may establish a special “Community Preservation Fund” (CP Fund), which may be appropriated and spent for certain open space (including recreation), historic resource, and community housing purposes. Funding credited to the community’s CP Fund comes from a combination of 1) a property tax surcharge not to exceed 3% of the local annual real estate tax, 2) community appropriation of other municipal revenue to the CP Fund (MGL 44B:3(b½)), and 3) annual distributions from the state “Massachusetts Community Preservation Trust Fund” also created under the act.

Monies distributed from the state trust fund come primarily from flat dollar surcharges for recording various documents with the Registry of Deeds or Land Court. In addition, the Legislature may appropriate funding to the state trust fund, specifically $10M in FY2019, $20M in FY2020, and $30M in FY2022. Annually, the Division of Local Services (DLS) reviews participating communities’ CPA data, their real estate tax information, registry CPA fee collections, and the state trust fund activity and then calculates the annual distributions to communities in November.

Over the last few years, there has been mixed activity that has impacted the level of the state trust fund, both up and down. In January 2020, the average rate for a 30-year fixed-rate mortgage was about 3.7%. Then the COVID-19 pandemic hit, and the Fed dropped the federal funds rate to 0%-0.25%, triggering short-term and long-term rates to drop. As a result, this sparked an increase in mortgage refinancing and applications, causing an increase in registry fees and resulting in an increase in the trust fund. In 2022, this activity slowed as the Fed began raising its rates. During 2023, the average mortgage interest rate for a 30-year fixed-rate mortgage was above 6%, topping 7% at one point.

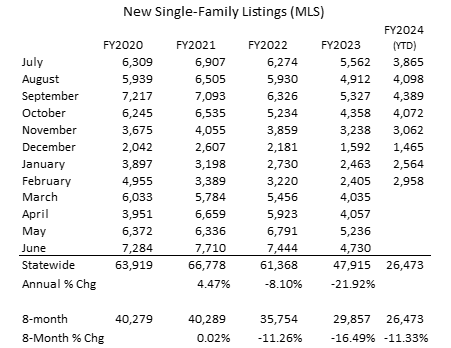

Adding to the higher rates, there is limited inventory and record high housing prices. According to the Massachusetts Association of Realtors (MAR), new single-family listings (a count of properties that are newly listed on the market via the Multiple Listing Service, or MLS) in Massachusetts rose in FY2021 and has declined in both F2022 and FY2023 as seen in the table below. Year-to-date in FY2024, the first half continued to have a decline in new listings. However, there is an increase in January and February relative to the prior year that may be an early indication of possible improvement.

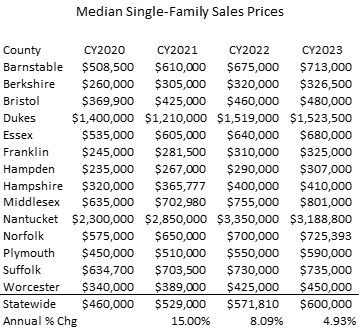

MAR has further reported that the statewide median price (not accounting for seller concessions) of a single-family home in Massachusetts has increased statewide over the last four calendar years. Between 2020 and 2023, the statewide median price grew from $460,000 to $600,000. A breakdown of the median single-family sales by county is detailed in the table below.

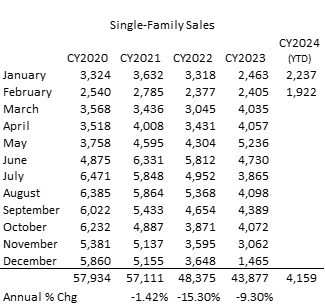

With higher mortgage rates, less inventory, and increasing median sales prices, sales volume has declined. Statewide, MAR reports there were 43,877 single-family home sales in 2023, down from 48,375 in 2022 or -9.3%. While the new listings in January and February of 2024 are up from the prior year, it should be noted that not all listings translate into sales.

As a result of less real estate-related activity, contributions to the state trust fund have declined; therefore, the amount distributed in FY2024 was down. At present, transactions (July-February) decreased almost 15% from FY2023 and the balance of the state trust fund is currently just over $20M. Based on these trends, the amount expected to be distributed in FY2025 could drop even further. The Division of Local Services is monitoring the situation and will communicate information with communities as it becomes available.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Sean Cronin, Emily Izzo and Tony Rassias

| Date published: | April 18, 2024 |

|---|