Author: Data Analytics & Resources Bureau

During the tax rate setting season, it’s essential for local officials and any other interested parties to understand the Tax Rate Status Report. This report serves as a vital tool for determining how close a municipality is to finalizing its property tax rate for the year.

Key Features of the Tax Rate Status Report

1. Municipality and Fiscal Year Selection

The report includes a dropdown menu that allows users to select a specific municipality and fiscal year. This feature ensures that users can access the relevant data for their community and the appropriate time frame.

2. Export to PDF

For those who prefer a hard copy or need to share the report, there is an "Export to PDF" button. This allows users to print a PDF version of the report easily.

3. All Approved Tax Rates

An "All Approved Tax Rates" button navigates users to another report that lists all communities with an approved tax rate. This feature provides a broader context for understanding where your municipality stands in comparison to others.

4. Process Steps and Status Grid

The report includes a grid that outlines the process steps involved in setting the tax rate, along with their current status. There are five key process steps:

LA-3 Sales Report

LA-4 Assessment/Classification Report

LA-13 Tax Base Levy Growth Report

LA-5 Options & Certification Report

Tax Rate Recapitulation Sheet

5. Progress Gauge

A visual gauge indicates the progress of the tax rate setting process. For example:

- 20% completion means the first step is completed.

- 40% completion indicates the second step is completed.

- This continues up to 100% as all steps are finalized.

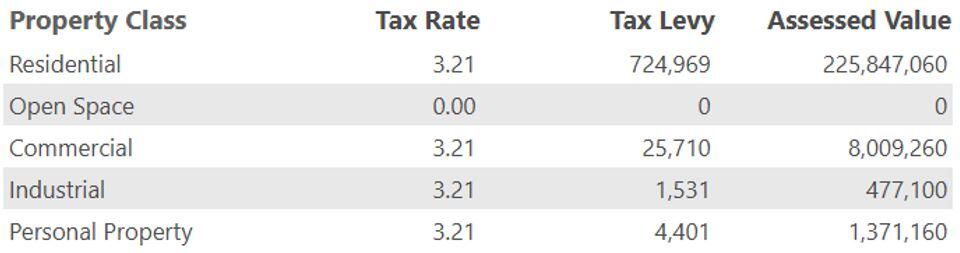

6. Post-Approval Grid

Once the tax rates are set, a grid will display the following information for each property class:

Property Class: This refers to the category of property (e.g., Residential, Commercial).

Tax Rate: The rate applied to the assessed value of the property.

Tax Levy: The total amount of tax to be collected from that property class.

Assessed Value: The total value of the property class.

The Tax Rate Status Report is an invaluable resource for understanding the tax rate setting process in our communities. By familiarizing yourself with its features and data, you can better engage in discussions about local taxation and its implications for our residents. As we navigate this tax rate setting season, utilize this report for transparency and informed decision-making in our municipalities.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | November 21, 2024 |

|---|