- Division of Marine Fisheries

The Division of Marine Fisheries (DMF) works with sister agencies within the Executive Office of Energy and Environmental Affairs (EEA) to ensure that existing Massachusetts marine stakeholders, including commercial fishers, can remain profitable, resilient, and safe during the development of offshore wind in the region. DMF engages with fishing industry members to better understand the issues, concerns, and complications arising from offshore wind development in state and adjacent federal waters. DMF also works directly with offshore wind developers to promote accountability and understanding of the potential impacts on Massachusetts' marine stakeholders. Additionally, DMF provides the public with easily accessible information on offshore wind development, as well as efforts to promote coexistence among marine stakeholders. Finally, DMF continues to create and lead groups of fishers, scientists, managers, and developers that seek to identify and solve the day-to-day issues that may emerge from new user-group conflicts.

In the last six months, DMF offshore wind staff have engaged in numerous stakeholder events and offshore wind meetings, attended science and technology conferences, and represented the New England state sector on the Regional Fund Administrator’s Design and Oversight Committee for offshore wind mitigation. However, the primary product of DMF’s offshore wind work has been the announcement, review, and selection of projects for the first solicitation of the Massachusetts Fisheries Innovation Fund.

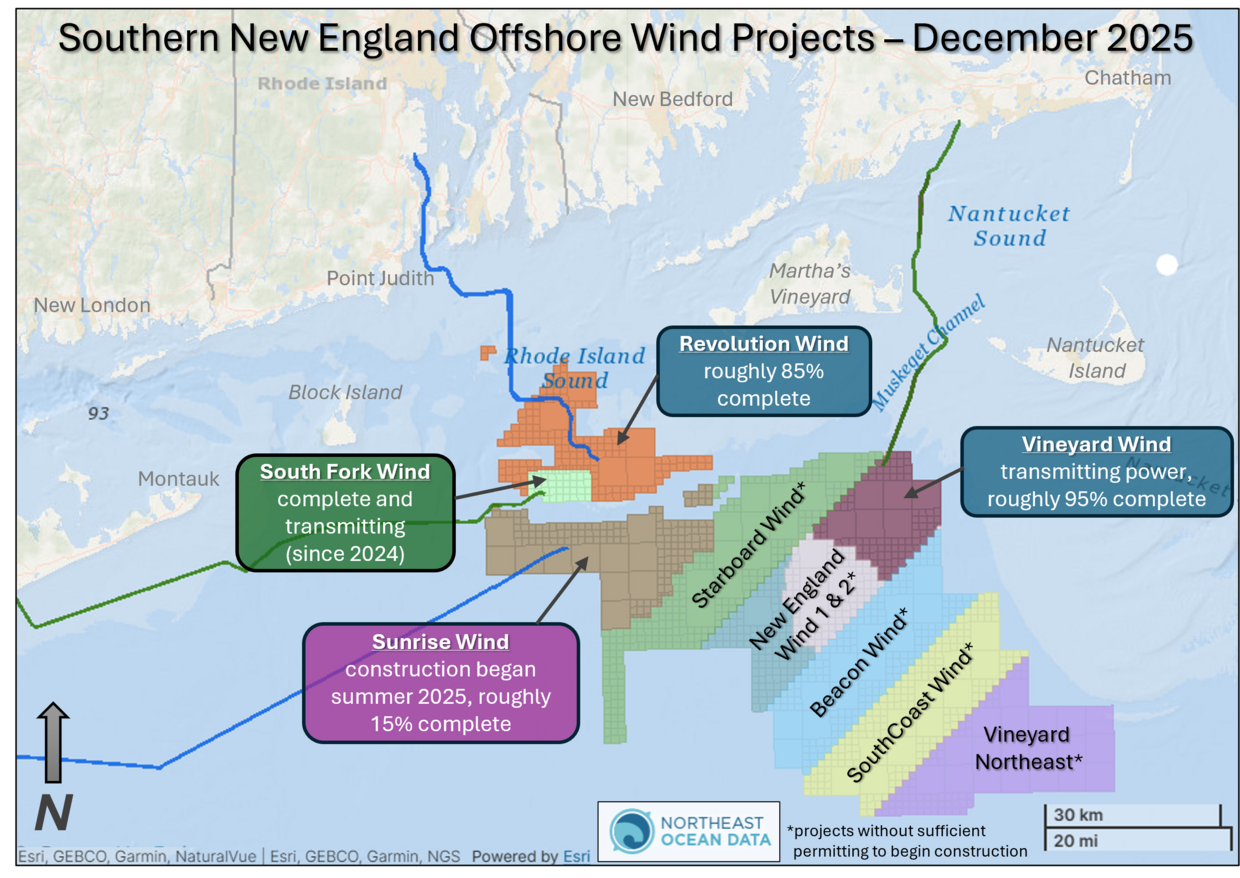

Offshore wind (OSW) projects continue to be planned and developed in New England and beyond despite some regulatory challenges and uncertainty. In Southern New England waters, three offshore wind projects continue construction (Vineyard Wind, Revolution Wind, and Sunrise Rise), and one project is operational (South Fork). One project in the New York Bight (Empire Wind) and another in the Mid-Atlantic region (Coastal Virginia Offshore Wind) were also under construction during the second half of 2025. These projects were either completed, under construction, or had all necessary federal permits prior to the federal administration’s Offshore Wind Memo in January that initiated a review of federal wind leasing and permitting practices. Further, eight OSW lease areas are in early phases in the Gulf of Maine. However, two projects were impacted by federal stop-work orders from the Department of Interior for nearly one month: Empire Wind and Revolution Wind. Both stoppages have been lifted, but financial losses and uncertainty within the OSW sector resulted. An early December decision by a federal judge found that the January Memo was contrary to law, though the decision is expected to be appealed.

More recently, on December 22, the US Department of Interior announced a pause—effective immediately—on all offshore wind projects under construction, citing risks to national security. The pause, which cited the issue of radar “clutter”, was enacted to allow the Interior Department, as well as the Department of War, “time to work with leaseholders and state partners to assess the possibility of mitigating the national security risk posed by these projects.” Despite the negative federal sentiment towards offshore wind, and increasing market uncertainty, one Southern New England offshore wind project is operational and two other projects are very near completion.

Southern New England Wind Projects

South Fork Wind

Constructed between June 2023 and February 2024, South Fork Wind, owned and operated by Ørsted, represents the first utility-scale offshore wind farm in the United States. The project is relatively small and consists of only twelve 11-megawatt (MW) Siemens Gamesa wind turbine generators (WTGs) and can produce up to 132MW of renewable energy. Power transmission, which began in mid-2024, is delivered through the Offshore Substation and Export Cable to Long Island, New York, and has the capacity to power around 60,000 homes.

Vineyard Wind

After beginning construction out of New Bedford in the summer of 2023, Vineyard Wind faced a significant setback in July 2024 when a blade on their southernmost turbine delaminated, scattering materials like foam and fiberglass into the ocean. This event, tied to blade manufacturing defects at a plant in Quebec, led to a work suspension and required the removal of many blades that had already been installed. While this occurrence delayed the project by at least six months, progress has since been steady, and generated electricity first reached the Massachusetts energy grid in early 2025. As of December 1, nearly all of the project’s sixty-two 13-megawatt (MW) GE Vernova WTGs had been installed, though faulty blades were still being replaced. Additional inter-array cable laying and WTG commissioning remains, but the project’s expected completion is mid-2026. Vineyard Wind will deliver up to 800 MW of renewable energy to the Massachusetts grid, powering up to 400,000 homes.

Revolution Wind

The first monopile foundations for Revolution Wind, Ørsted’s second commercial scale wind project in the northeast after South Fork Wind, were installed in May 2024. Since then, construction based out of New London, Connecticut, was interrupted by the one-month stop-work order from the Department of Interior. Construction resumed when a federal judge issued a preliminary injunction, ruling the stop work order was unlawful, and has been constant since. As of December 1, most of Revolution Wind’s sixty-five 11-MW Siemens Gamesa WTGs have been installed, and cable construction vessels were working on the inter-array cable network. At its current pace, the project should be completed by mid-2026, at which point it will deliver up to 704MW of renewable energy to Connecticut and Rhode Island, powering up to 350,000 homes.

Sunrise Wind

Installation of monopile foundations began on Sunrise Wind, the larger Ørsted project to the south of Revolution Wind, in June 2025. This project, which will deliver up to 924MW to Long Island, New York, will use the same 11-MW Siemens Gamesa WTGs as the other Ørsted projects. As of December 1, roughly half of the foundations for the project’s 84 WTGs have been installed. Additionally, the wind farm’s high voltage direct current (HVDC) substation arrived from Norway in September and was installed on a jacket foundation. The Sunrise Wind Export Cable construction is ongoing while construction of the wind farm pauses in the winter. This export cable, which will run 100 miles from a central Long Island beach to the wind farm, is currently being tunneled through the surf zone (at 11-60 ft deep) and nearshore installation will follow. Sunrise Wind is expected to be completed in 2027 and will power up to 600,000 New York homes with renewable energy.

Other Ongoing Offshore Wind Projects

Empire Wind

In the New York Bight, despite a federal stop-work order in April and May, Equinor finished installing all 54 monopile foundations in October. The Export Cable is actively being trenched, laid, and buried, from Brooklyn, New York towards the wind array. In 2026, this project is expected to install 15-MW Vestas WTGs at all turbine locations and will generate up to 810MW of renewable energy for New York, powering up to 500,000 homes.

Coastal Virginia Offshore Wind

Further south, off the coast of Virginia, Dominion Energy is progressing similarly on the Coastal Virginia Offshore Wind project. In October 2025, monopile foundations were installed. The project will consist of 176 14.7-MW Siemens Gamesa WTGs, will have three offshore substations, and will deliver power to nearby Virginia Beach. Once complete, this project will generate up to 2,600MW (2.6 gigawatts) and power up to 1.4 million homes with renewable energy.

Gulf of Maine

Four of the eight Gulf of Maine offshore wind lease areas were awarded in late 2024: two to Avangrid, Inc., and two to Invenergy NE Offshore Wind, LLC. These four leases, about 110,000 acres each, are sited as close as 22nm to the Massachusetts coast and, due to their water depth, will feature floating offshore wind turbines. These leases are in very early stages of development, with only Communications Plans being published to date. While construction may be on a decade-long time scale, DMF will continue to be part of discussions about suitable siting, cable routes and landfall sites, as well as the evolution of floating offshore wind technology.

DMF Offshore Wind Activities

Stakeholder Meetings

DMF offshore wind staff continue to facilitate the coexistence of fishing activities and offshore wind development, addressing both anticipated and unexpected impacts. Multiple working groups, committees and commissions create forums for state agencies, developers, fishing industry, and researchers to discuss offshore wind and fisheries-related topics.

Several meetings with groups co-led by DMF and the Office of Coastal Zone Management (CZM) have been held this year: the Massachusetts Fisheries Working Group on Offshore Wind, the Massachusetts Commercial Fisheries Commission, and the Habitat Working Group on Offshore Wind. Staff also support and participate in other state initiatives related to offshore wind, like the Commercial Fisheries Commission’s Offshore Wind Focus Group, the Interagency Offshore Wind Council, and the Marine Fisheries Advisory Commission.

Inter-state Projects

Externally, DMF’s offshore wind staff serve on the Responsible Offshore Science Alliance (ROSA) Advisory Council, assist in the ROSA Funder Coordination Initiative, and participate in the Rhode Island-Massachusetts Boulder Relocation Working Group. This informal multi-state and sector group, led by the University of Rhode Island SeaGrant, combines the expertise of fishermen, researchers, and managers to identify, develop, and seek funding for research projects to address OSW impacts on commercial fishers in southern New England waters.

Site Visit to Revolution Wind

In October, DMF staff were able to charter a for-hire vessel out of Westport and experience a day of rod and reel fishing within a nearby wind farm, Revolution Wind. Recreational Fisheries and Fisheries Biology staff observed what many anglers have relayed: abundant structure-oriented species, late-season “warm water” pelagic species, and generous turbine spacing. While there was an acknowledgement that extra precautions would be necessary while navigating in poor visibility or weather conditions, the trip provided an informative and memorable experience for staff.

Mitigation and Compensation Funds

Fisheries Innovation Fund

As part of a compensatory mitigation agreement between EEA and a developer, Vineyard Wind, in 2020, DMF was selected to administer the $1.75-million Fisheries Innovation Fund (FIF). This fund is designed to “support programs and projects that ensure safe and profitable fishing continues as Vineyard Wind and future offshore wind projects are developed in Northern Atlantic waters”. It is guided by the FIF’s nine-member Advisory Panel, made up of fishing industry representatives from different sectors, and chaired by the Director of DMF. A Request for Proposals document, seeking projects that addressed fishing innovation, community resilience, and/or safety, was approved by the Advisory Panel and released as Solicitation 1 for the FIF in July. The application period closed at the end of August, and DMF received 20 applications seeking $3.37 million. From September through November, two separate review panels were convened to make initial, and then final recommendations for funding.

With approval from EEA and Governor Healey’s Office, DMF announced the six awarded projects at the Fisheries Working Group Meeting in December. These six projects, awarded nearly $1.2 million, will create innovative fishing gear solutions, promote local healthy seafood consumption and address critical safety concerns of fishers operating around offshore wind infrastructure.

Fisheries Direct Compensation

In addition to mitigation funds, DMF also helps promote participation in fisheries direct compensation programs made available by offshore wind developers. These programs aim to financially compensate fishers who can document recent and consistent fishing effort in the wind farm area or the export cable route. While eligibility criteria and application periods differ, these programs (like others from Ørsted or Equinor) have set aside funds for impacted or displaced fishing businesses.

Regional Fund Administrator

Finally, recognizing that the fisheries mitigation programs are inconsistent across programs and states, eleven New England and Mid-Atlantic states began an initiative to develop a regional offshore wind mitigation fund framework. Through this effort, a Regional Fund Administrator—BrownGreer (Virginia) and Carbon Trust (UK)—was selected and a Design Oversight Committee (DOC) was established in late 2024. The DOC, made up of six regional fishing industry representatives, three offshore wind developer representatives, and three east coast state region representatives, advises the Regional Fund Administrator (RFA) on potential changes to claims and eligibility criteria. Over the past year, the RFA has worked to develop initial design elements for the program and conduct periodic in-person engagement from Maine to North Carolina. Topic-specific subcommittees on shoreside, permit transfer, and expedited compensation issues have also been established.

DMF’s offshore wind staff represent the New England state agency sector on the DOC and strive to convey the diversity of New England fisheries and how OSW projects could impact them. While criteria for claims are still being developed, stakeholder engagement remains critical as the RFA and DOC move towards completion of work in late 2026. For more information on the RFA process, visit RFAinfo.org.

By Brad Schondelmeier, Offshore Wind and Fishery Specialist