Q1: Why am I receiving a health care tax statement (1095-C)?

Full time employees of the Commonwealth of Massachusetts, including institutions of higher education, the Massachusetts Bay Transit Authority (MBTA), or Massachusetts School Building Authority (MSBA) who work an average of 30 or more hours per week must be provided this form. This is a requirement of the Affordable Care Act.

Q2: Why am I receiving Form 1095-C now, after I have already filed my taxes?

The IRS requires that Form 1095-C be postmarked by March 1, 2024.

You do not need to wait until you receive the Form 1095-C to file your taxes, and you should not submit the Form 1095-C with your tax return. The Commonwealth of Massachusetts provides this information to the IRS.

You should retain the Form 1095-C with other important tax records.

Q3: What should I do with the Form 1095-C?

You or your tax preparer will need to refer to this information when filing your federal tax return. Do not include this form with your filing to the IRS.

Q4: What other forms may I receive? And how are they different?

- Form 1095-B details the months of health insurance coverage that you, your spouse and/or any eligible dependents had for each month. Form 1095-B is generally provided by the insurance carrier and gives details about the health insurance coverage you elected, including who in your family was covered.

This form is available upon request from the Group Insurance Commission (GIC) via https://www.mass.gov/forms/contact-the-gic or by mailing a request to: GIC, PO Box 556, Randolph, MA 02368. Note: If you were a full-time employee and changed health plans during the year to or from a non-GIC employer, you may receive multiple Forms 1095-B. - Form 1095-A provides information as to any Marketplace coverage you had (if applicable), and any Premium Tax Credits you received. If applicable, this form would be provided by the Marketplace Exchange.

Q5: Why did I get more than one Form 1095-C?

If you worked at more than one agency, municipality, or company, you may receive a Form 1095-C from each employer – for example, if you changed jobs during the year and were enrolled in coverage with both employers.

Note: If you work more than one job at the Commonwealth of Massachusetts (including working for one or more agencies or institutions of higher education), you will receive one Form 1095-C that will be inclusive of all your jobs within the Commonwealth. The MBTA and MBSA are considered separate employers.

Q6: Who should I contact if I have questions regarding the Form 1095-C that I received?

- If you have questions about your Form 1095-C issued by the Commonwealth of Massachusetts, call your human resources department.

- If you have any questions about a Form 1095-B (offer of health insurance coverage) from the GIC, please see the Form 1095-B Frequently Asked Questions at https://www.mass.gov/service-details/1095-b-and-1099-hc-tax-form. You can also visit the IRS website: https://www.irs.gov/affordable-care-act.

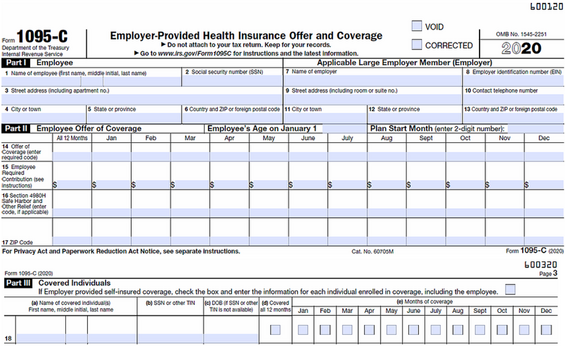

Q7: What information is included on the Form 1095-C?

Part I - Employee and Employer Information reports information about you and your employer, the Commonwealth of Massachusetts.

Part II - Employee Offer and Coverage reports information about the coverage offered to you by your employer, the affordability of the coverage offered, and the reason you were or were not offered coverage by your employer.

Part III - Covered Individuals is blank. This information is reported on the Form 1095-B.

Example form

Part I Employee: Employees assessed ACA full-time including from Commonwealth of MA, University of Mass, MBTA or MSBA are listed under the Applicable Large Employer

Part I Employer: Employer information including Tax ID for Commonwealth, MBTA or MSBA

Part II Employee Offer of Coverage:

Employee‘s Age on Jauary1: Not applicable, Commonwealth does not offer plans with Health Reimbursement Arrangement (HRA)

All 12 Months: If the reporting value for you unchanged throughout the year, then you will have a single value for the year

Line 14: Employer’s Offer of Coverage codes reporting

Line 15: The lowest cost of Commonwealth Heath Plan available to you, not the cost of coverage you chose, if any

Line 16: The determination of a “Safe Harbor” of affordability, based on your rate of pay, not your annual pay

Line 17: Zip Code: Not applicable, Commonwealth does not offer plans with Health Reimbursement Arrangement (HRA)

Part III Covered Individuals: This part will be Blank, this data will be on the 1095-B form, available upon request

Additional Resources

-

Open PDF file, 175.24 KB, Printable - 1095-C Frequently Asked Questions (FAQs) (English, PDF 175.24 KB)