Author: Tony Rassias, Bureau of Accounts Deputy Director

The following piece details July 1, 2024 free cash certifications completed thus far compared to their previous certification. At the time of this writing, 345 cities and towns, not including Boston, have free cash certified as of July 1, 2024. This article will focus on July 1, 2023 and July 1, 2024 certifications for these 345.

July 1, 2024 Certifications

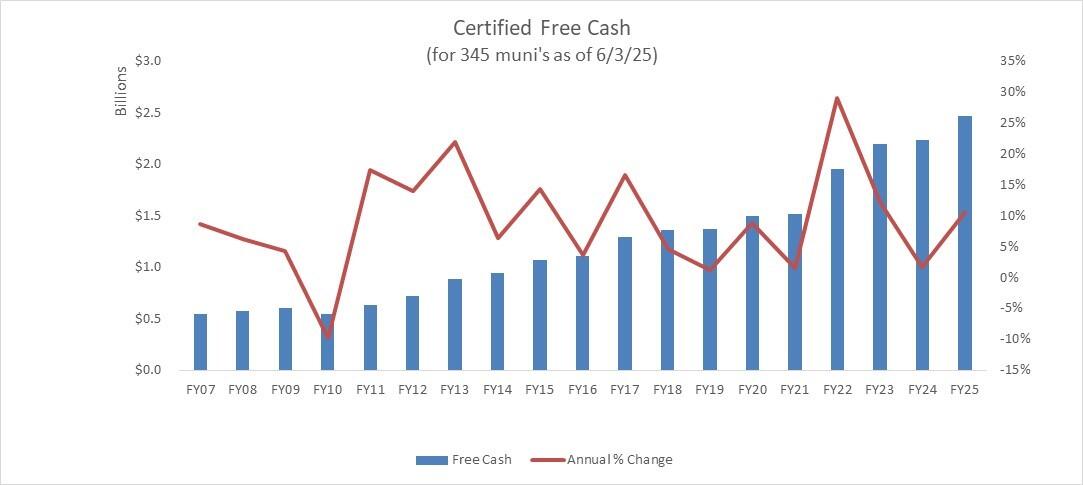

Free cash certifications thus far have totaled $2.47 billion, increasing $236.8 million or 10.6% over their previous certification. This total includes $973.2 million from FY2024 local estimated receipts above budget, $652.4 million from budgeted but unspent FY2024 appropriations and $859.7 million from unobligated July 1, 2023 certified free cash.

The greatest amount certified during this period was in Cambridge with $233.2 million and the least in Heath with -$827. The greatest increase from its previous certification was in Cambridge at $40.9 million (+21.3%) and the greatest decrease in Lawrence at $27.5 million (-63.6%). The median for all increases is $700,757 and median for all decreases is $493,391.

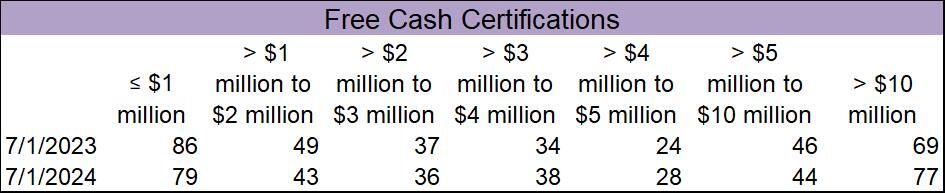

The following table categorizes the last two free cash certifications as of July 1.

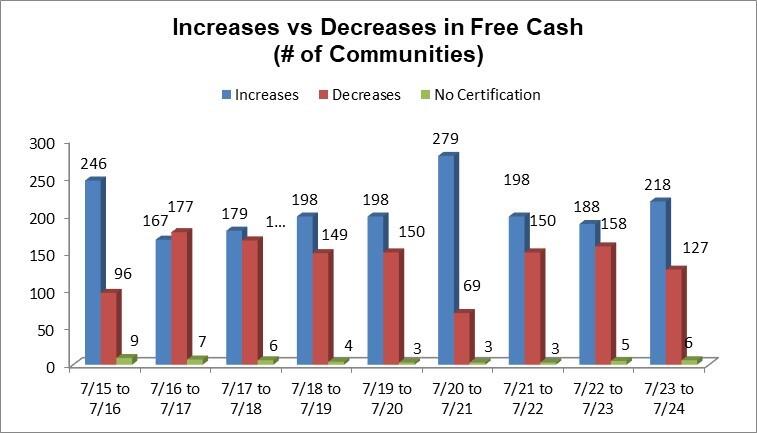

Despite the rise seen thus far in the statewide total, not every community experiences an increase from the previous period, as shown in the graph below.

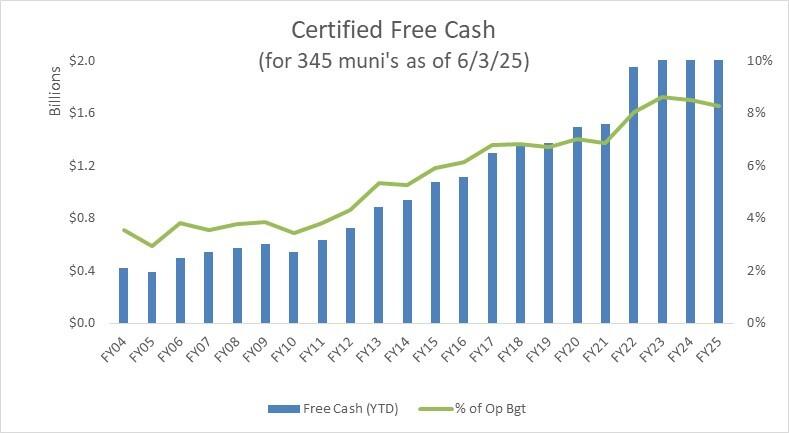

The graph below shows certified free cash for the past two decades, in both total dollars and as a percent of budget, for the same 337 municipalities with free cash certified as of July 1, 2024 (FY25). It shows that when measured as a percentage of the aggregate operating budgets for cities and towns in the data set, free cash has grown from less than 4% to more than 8%.

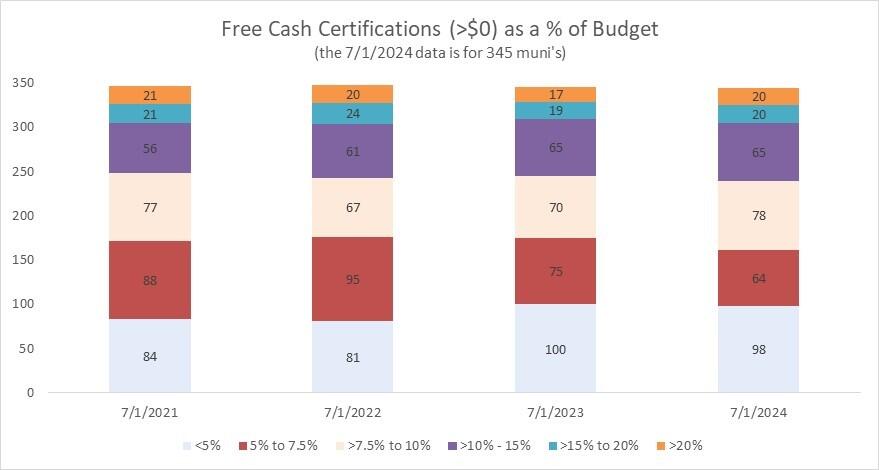

The following table depicts the distribution of free cash measured as a percentage of the operating budget. To view updated data on free cash certifications including percentages of the operating budget.

To learn more about the free cash calculation process, see our webpage on the subject.

Appropriations

The DLS Bureau of Accounts does not receive information as to the purpose of each appropriation. However, BOA can determine whether the appropriation was made in total for a particular purpose, to “reduce the tax rate”, or a combination of both, up until the tax rate is certified. Free cash can only be appropriated if and only after being certified by BOA.

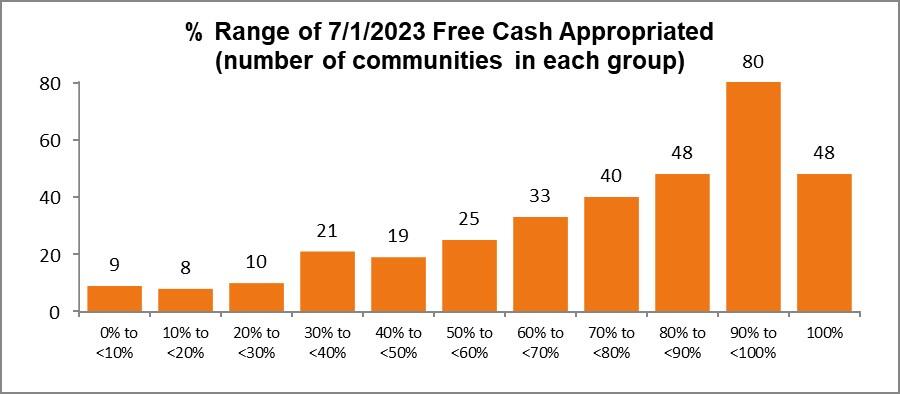

Of the 345 communities being focused upon in this article and up through the approval of their FY2025 tax rate, 342 had free cash certified as of July 1, 2023. Of these 342, two appropriated $0 from their certification, 46 that appropriated their entire certification and 11 that left unappropriated an amount under $1,000. For these same communities and once again up through the approval of their FY2025 tax rate, seven appropriated their entire 7/1/2024 certification which may be appropriated until June 30, 2025. The following table shows the range of 7/1/2023 free cash appropriated and the number of communities in that range.

For the 341 communities that had 7/1/2023 free cash certification to vote from, 288 voted for particular purposes only, while 45 voted a combination of particular purposes and to reduce the FY2024 and/or FY2025 tax rate. There were no communities that voted to reduce the FY2024 tax rate only, five voted to reduce the FY2025 tax rate only and three voted nothing. The total amount appropriated was 1.4 billion or 62% of the total statewide July 1, 2023 certification.

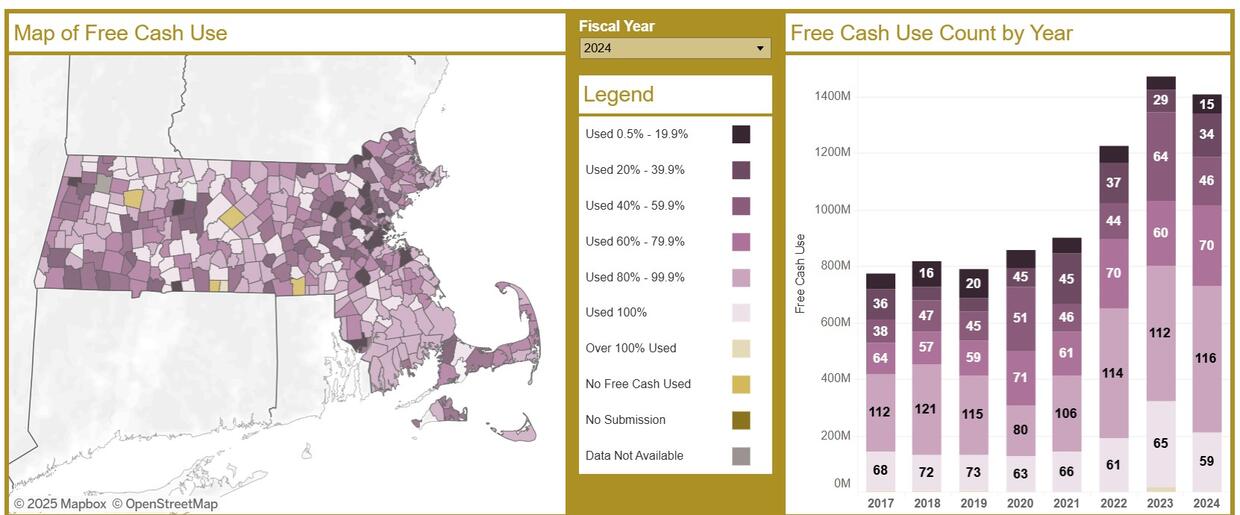

The following visualization found on our website represents the amount of free cash being appropriated against each fiscal year’s budget.

You can use the Municipal Financial Self-Assessment and the Municipal Finance Trend Dashboard tools for community-specific data trended over a multi-year period. Also, please review our City & Town article on Fiscal Stress – A Diminishing Level of Reserves for a refresher on how to improve free cash position and for policies on generating and using free cash. Lastly, for frequently asked questions about free cash, see Counting Free Cash.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | June 5, 2025 |

|---|