Central Processing Unit

The Central Processing Unit (CPU) received 5,191 new referrals for investigation in fiscal year 2022 (FY22) and processed, analyzed, and reviewed 3,636 referrals from the following sources.

Table 2. FY22 CPU Referral Sources

|

Source |

Number of Referrals |

Percentage of Total* |

|

Department of Transitional Assistance |

2,368 |

65% |

|

Hotline |

604 |

17% |

|

MassHealth |

592 |

16% |

|

Data Analytics Unit |

53 |

1% |

|

Department of Early Education and Care |

17 |

0.5% |

|

Other |

2 |

0.05% |

* Percentages do not total 100% because of rounding

The following is a breakdown of the public assistance programs involved in the 3,636 analyzed referrals.

Table 3. FY22 CPU Caseload by Public Assistance Program

|

Type |

Number of Cases |

Percentage of Total* |

|

Supplemental Nutrition Assistance Program |

1,133 |

31% |

|

Emergency Aid to the Elderly, Disabled and Children |

829 |

23% |

|

MassHealth |

816 |

22.4% |

|

Transitional Aid to Families with Dependent Children |

807 |

22.1% |

|

Department of Early Education and Care |

23 |

0.6% |

|

Other |

19 |

0.5% |

|

Merge Case |

8 |

0.2% |

|

Supplemental Security Income |

1 |

0.02% |

* Percentages do not total 100% because of rounding.

CPU team members identified 1,142 referrals as potential intentional program violation (IPV) cases, where BSI determined that a fraud claim had merit but returned the case to the Department of Transitional Assistance (DTA) for further action based on the evidence. Typical agency actions include civil recovery, disqualification, and recalculation of benefits. Additionally, CPU closed 1,438 referrals administratively with no fraud determined after completing preliminary investigations. CPU designated 1,056 referrals for case assignment. CPU team members continued to carry a small caseload in FY22, completing 21 investigations within the unit.

In FY22, CPU assisted with projects for DTA involving Transitional Aid to Families with Dependent Children (TAFDC) and Emergency Aid to the Elderly, Disabled and Children (EAEDC) program benefits, also known as economic assistance (cash benefits). Eligibility for cash benefits is dependent on household size and income; recipients of these benefits are frequently unemployed, underemployed, or unable to work. DTA customarily issues cash benefits twice per month to those who are eligible. Cash benefit recipients are required to report changes in income over $100 and any new income in the household to DTA within ten days.

The first project, referred to as the “PUA Project,” involved collaboration between DTA, the Department of Unemployment Assistance (DUA) which administers and manages unemployment benefits (UI), as well as pandemic unemployment assistance (PUA) exclusively provided during the COVID-19 public health emergency, and the Office of the Inspector General. Reviewing DTA and DUA data matches, DTA identified individuals who failed to report their receipt of UI and/or PUA benefits while receiving EAEDC or TAFDC benefits. DTA program rules require DTA cash benefit recipients to report receipt of UI or PUA benefits to DTA, as receipt of these benefits disqualifies eligibility for EAEDC benefits and may reduce the amount of eligible TAFDC benefits.

During this project, CPU completed the intake and analysis process on 755 EAEDC referrals and 844 TAFDC referrals. In preparation for case assignments, CPU analyzed and reviewed each referral for the BSI team. To complete their analysis, CPU team members were able to gain access to and navigate through DUA’s Web-based case management system, UI Online. In total, CPU designated 931 of these referrals for investigation by the Super Fraud Unit8.

Another project CPU assisted with during FY22 is the Data Analytics Unit’s (DAU’s) PCA High Earner Project. For this project, DAU analyzed PCA income provided by MassHealth for the highest-earning PCAs during 2021 and verified whether their income was accurately reported to other public benefits programs. DAU generated 387 referrals that CPU analyzed in preparation for assignment. CPU team members also continued testing in BSI’s new Case Management System (CMS), as part of Phase II of the procurement process. The team participated in meetings and trainings to test new updates and overall functionality before the new builds were available to the rest of the BSI team.

CPU plays a central role in assisting, communicating, and collaborating with examiners during the course of their investigations. As a team, CPU continued to keep examiners up-to-date with all Policy/Income guideline changes from our stakeholders throughout FY22. In addition, the unit maintained its technical proficiency utilizing various technologies and applications to stay current with guidelines and to verify allegations received.

MassHealth | DTA | EEC Unit

The Super Fraud Unit (SFU) consists of a special investigator, six fraud examiners, and three senior fraud examiners, all of whom are under the supervision of an assistant director and two supervising fraud examiners.

SFU completed 688 cases in FY22, which contributed to identifying fraud totaling $9,047,145.31 in 544 cases. The breakdown of identified fraud by public benefit program in FY22 is as follows:

- $4,008,664.02 for Supplemental Nutrition Assistance Program (SNAP) investigations (44.31%)

- $2,035,957.94 for MassHealth investigations (22.5%)

- $1,360,629.93 for Transitional Aid to Families with Dependent Children (TAFDC) investigations (15.04%)

- $1,280,784.68 for Department of Early Education and Care (EEC) investigations (14.16%)

- $329,079.74 for Emergency Aid to the Elderly, Disabled and Children (EAEDC) investigations (3.641%)

- $19,459 for Housing Authority investigations (0.22%)

- $12,570 for Social Security investigations (0.14%)

The easing of COVID-19 restrictions and working within a hybrid workplace model presented BSI with opportunities to strategize and develop new methods of conducting civil recoveries and subject interviews. In September 2021, BSI examiners resumed recoveries for the Department of Transitional Assistance (DTA) that were suspended/on pause since March 2020. In addition, BSI staff resumed conducting civil recoveries and interviewed over 50 subjects both virtually and in-office. During FY22, 17 repayment agreements and disqualification consent agreements (DCA) totaled $673,101.76.

The lifting of COVID-19 restrictions allowed examiners to resume fieldwork. Fieldwork is an integral part of an investigation as it often yields compelling and convincing evidence to supplement documentary evidence.

In FY22, SFU investigative efforts resulted in the filing of criminal charges in four separate cases in district courts throughout the Commonwealth. Two cases were filed in Springfield District Court and the other two, filed in Boston Municipal Court and Lawrence District Court respectively, were resolved through civil recovery agreements prior to arraignment. The two civil recovery agreements resulted in a combined repayment of $45,412.39 to MassHealth.

SFU team members host biweekly case progress meetings. These examiner-led meetings keep cases progressing while generating investigative discussions. Mentoring amongst examiners has continued to be a priority for the unit. Examiners who possess strong interviewing, civil recovery recoupment, report writing, or fieldwork experience continually volunteer to mentor others. The internal mentoring program has been mutually advantageous for both senior and less experienced examiners

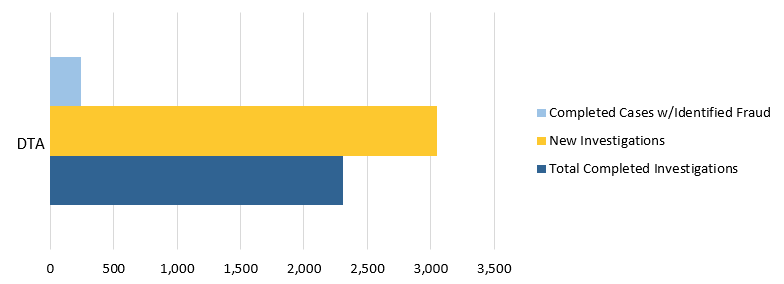

Figure 4. FY22 DTA Caseload

Note: BSI’s DTA caseload for FY22 included SNAP, TAFDC, and EAEDC cases.

During FY22, SFU worked on multiple projects that generated a high number of referrals for investigation. These projects included the previously discussed DTA Pandemic Unemployment Assistance (PUA) project and the Personal Care Attendant (PCA) High Earner project. The PUA project resulted in the creation of a Report of Investigation template that expedited the investigation-to-conclusion process for examiners. During their investigation of the PUA Project cases, examiners found DTA cash benefit recipients failed to report their receipt of UI and PUA benefits to DTA. The calculated overpayments were generally under $15,000. Completed cases with identified fraud were returned to DTA as IPVs for their administrative process and overpayment recovery.

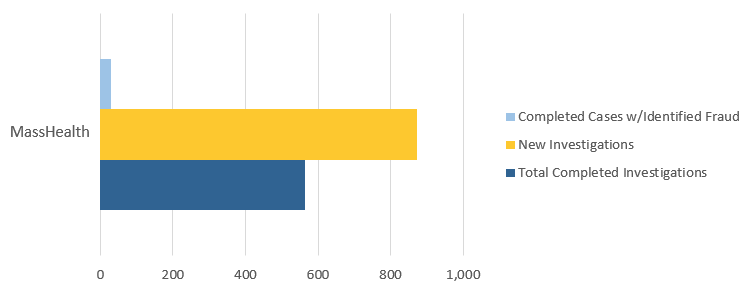

Figure 5. FY22 MassHealth Caseload

During FY22, BSI further improved its workflow with a Fiscal Intermediary (FI),9 Tempus. As an FI, Tempus Unlimited, Inc. performs employer-required tasks and related administrative tasks for individuals, commonly referred to as consumers, in Massachusetts PCA programs. Following the FI merger in January 2022, Tempus now has the sole contract for FI services with the Executive Office of Health & Human Services—Office of Medicaid (MassHealth PCA FI Program). BSI and Tempus have implemented a new procedure to request documentation and fraud calculations. The streamlined process will ensure organization and timely results for both agencies.

BSI continued to collaborate with MassHealth and the Attorney General’s Office on the PCA Task Force on joint investigations of PCA fraud-related cases. During FY22, the PCA Task Force reviewed PCAs whose wages were well over $100,000 during the 2021 tax year. Due to the loosening of certain PCA program rules during COVID-19, the former restraints on overtime and travel no longer apply.

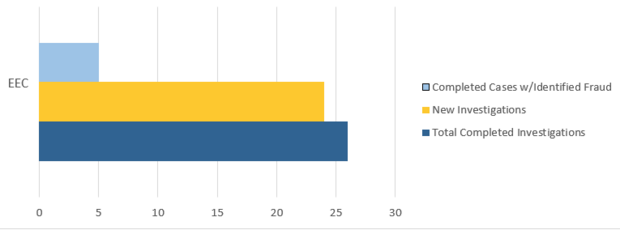

Figure 6. FY22 EEC Caseload

Lastly, SFU completed 18 EEC investigations and identified $1,280,784.68 in fraud from these referrals. Because individuals suspected of defrauding EEC often also receive other forms of public assistance, BSI routinely checks EEC subjects’ other public assistance benefits and, in particular, their reporting of household income and composition to other agencies. These supplemental investigations have led to the discovery of additional fraud in DTA and MassHealth public benefit programs.

As part of BSI’s expanding working relationship with EEC, EEC permits BSI examiners to participate in EEC’s administrative hearings under the Informal Fair Hearings Rules. The EEC administrative hearing provides BSI examiners the opportunity to explain their investigation and its findings to an EEC Review Officer. In FY22, BSI examiners provided testimony about their investigations at two separate EEC administrative hearings.

Data Analytics Unit

During FY22, BSI’s Data Analytics Unit (DAU) generated 387 referrals to CPU. The majority of these referrals alleged that personal care attendants (PCAs) failed to accurately disclose their income to the Department of Transitional Assistance (DTA) and MassHealth agencies as required while receiving public assistance benefits. DAU also continued to field referrals from BSI’s Public Assistance Fraud Hotline, analyzing two provider referrals that alleged provider fraud. These investigations remain ongoing.

Using advanced data analysis, DAU identified and generated referrals for three MassHealth providers. The unit’s analysis focused on improper billing associated with a variety of dental services. Other analyses conducted by DAU in FY22 focused on telemedicine, laboratory, physician, and PCA services. Additionally, prior to FY22, DAU referred two MassHealth dental providers to the Office of the State Auditor’s Medicaid Audit Unit. The Medicaid Audit Unit featured DAU’s findings in two audits issued in FY22. The audits may be found here:

- https://www.mass.gov/audit/audit-of-the-office-of-medicaid-masshealth-review-of-claims-submitted-by-dr-melissa-hamilton

- https://www.mass.gov/audit/audit-of-the-office-of-medicaid-masshealth-review-of-claims-submitted-by-dr-nicholas-franco

In FY22, DAU continued to support multiple state and federal partners through joint investigative work in addition to accepting referrals for investigation and creating and sending referrals to the appropriate entities. DAU collaborated with federal partners, including the Office of the Inspector General’s Office of Investigations and the Executive Office of Health and Human Services, on an ongoing investigation related to services provided within both the Medicaid and Medicare programs.

Lastly, DAU continued the development of its Analytical Support Services, which allows BSI examiners to choose from a suite of services designed to aid in the completion of data analysis tasks associated with their investigations. Services include, but are not limited to, the creation of visualizations (maps, timelines, charts, graphs, etc.) for presentation in court and other settings; the customization of findings reports for the analysis of financial, healthcare, and other relevant data; network and social media analysis; technical training; and Optical Character Recognition (OCR) services. These services will assist in streamlining and automating several aspects of BSI’s operations.

In FY 2022, DAU placed particular focus on the continued development of its OCR and spatial analysis capabilities and the expansion of its respective use cases. Specifically, DAU began work on an OCR project designed to automate the transcription of tax records used in BSI investigations. Additionally, DAU began work on a project designed to map and visualize travel records of PCAs and other Medicaid providers.

Other BSI News

During FY22, BSI’s Training Team continued to identify staff training needs; build informative and engaging trainings, presentations, and job aides; and effectively lead training sessions for all BSI staff. Comprised of staff members from all units, the team led an internal Soft Skill training that included time management, organization, and OneNote tutorials. BSI members participated in group discussions that highlighted diverse perspectives and experiences to enhance their skills. BSI training team members also led a MassHealth (MA21/HIX) refresher presentation for all BSI members. In addition to internal trainings, recently hired examiners completed a training on interviewing.

The Training Team’s continued focus on the process to conduct civil recoveries and interviews helped BSI initiate 19 repayment agreements and disqualification consent agreements (DCAs) totaling $761,162.25. DCAs are agreements that subjects voluntarily sign to disqualify themselves from receiving further DTA and/or EEC benefits because of their IPVs. When pursuing civil recovery for DTA and EEC cases, DCAs are required to complete the civil recovery agreement.

During FY22, BSI successfully on-boarded two new fraud examiners remotely. Using a collaborative team effort, BSI members relied on a detailed onboarding agenda, which consisted of multiple PowerPoints, job aids, and learning templates. These onboarding materials were improved to include updated benefit program information. All onboarding materials serve as useful guides and remain available on the public drive for all BSI staff members to reference.

FY22 also featured the conclusion of Phase II of BSI’s new Case Management System (CMS) project and the start of the final phase, Phase III. The new CMS is a platform where all staff members have access to a full case file without physically requesting information from the assigned examiner. The CMS has enhanced the process by which BSI personnel assign cases, request and save documents, request tasks, track case progress, log financials, and generate reports of investigations. Information requests and information-gathering tasks are assigned and tracked through the CMS and reports are generated within the CMS rather than in separate Word documents. The functionality to assign and reassign cases in bulk is currently in development. The CMS serves as an organized database for examiners to save case files with greater access to management and significantly decreases BSI’s use of and reliance on paper. The ability to create allegation-based report templates and attach relevant documentary evidence directly to a report within the CMS has helped expedite examiners’ administrative processes following their investigations. Phase III of the project has allowed for feature updates and workflow improvements that further enhance user-friendliness and satisfaction.