Central Processing Unit

The CPU received 8,643 new referrals for investigation in FY23 and processed, analyzed, and reviewed 5,552 referrals from the following sources.

Table 2. FY23 CPU Referral Sources

|

Source |

Number of Referrals |

Percentage of Total* |

|

DTA |

4,030 |

72.59% |

|

Hotline |

1,006 |

18.12% |

|

MassHealth |

491 |

8.84% |

|

DAU |

20 |

0.36% |

|

EEC |

2 |

0.04% |

|

BSI |

1 |

0.02% |

|

Task Force |

1 |

0.02% |

|

Other |

1 |

0.02% |

* Percentages do not total 100% because of rounding.

The following is a breakdown of the public assistance programs involved in the 5,552 analyzed referrals.

Table 3. FY23 CPU Caseload by Public Assistance Program

|

Type |

Number of Cases |

Percentage of Total* |

|

Supplemental Nutrition Assistance Program |

3,723 |

67.06% |

|

MassHealth |

763 |

13.74% |

|

Transitional Aid to Families with Dependent Children |

749 |

13.49% |

|

Emergency Aid to the Elderly, Disabled and Children |

219 |

3.94% |

|

Merge Case10 |

62 |

1.12% |

|

Other |

29 |

0.52% |

|

EEC |

6 |

0.11% |

|

Supplemental Security Income |

1 |

0.02% |

CPU team members identified 2,184 referrals as potential IPV cases, where BSI determined that a fraud claim had merit but returned the case to the DTA for further action based on the evidence. Typical agency actions include civil recovery, disqualification, and recalculation of benefits. Additionally, CPU closed or merged 1,811 referrals administratively with no fraud determined after completing preliminary investigations. CPU designated 1,557 referrals for active investigation. CPU team members also continued to carry a small caseload in FY23, completing 34 investigations within the unit.

During FY23, the CPU team completed a project with DTA‘s Data Matching Unit (DMU). For this project, CPU completed the intake process of 4,796 referrals involving individuals identified by DTA as having unreported or underreported household wages while in receipt of DTA assistance. In addition, CPU analyzed, reviewed, and prepared these referrals for the BSI team.

Another project CPU assisted with during FY23 was BSI’s DAU’s Personal Care Attendant (PCA) High Earner Project. For this project, DAU analyzed PCA income provided by MassHealth for the highest-earning PCAs during 2022 and determined whether their income was accurately reported to other public benefit programs. DAU generated 401 referrals that CPU analyzed in preparation for assignment to examiners, out of which 288 new cases were prepared for assignment. During analysis, CPU consolidated a number of these referrals with an already existing referral as a new allegation. These cases were accelerated during the intake process to prepare the team for investigation.

The CPU team members are in direct contact with the public and stakeholders. CPU handles referral intake calls and manages the online referral process. These types of referrals are categorized as hotline referrals. CPU completed the intake process on 1,078 hotline referrals. Additionally, the CPU team assists members of the public and guides them to the appropriate agency to handle their requests. CPU also communicates and collaborates as a team to assist examiners during their investigations. As a team, CPU uses many technical resources to stay current with guidelines and to verify allegations it receives. In turn, CPU continued to update examiners with all policy/income guideline changes from our stakeholders throughout FY23.

Fraud Investigations Unit, formerly MassHealth | DTA | EEC Unit

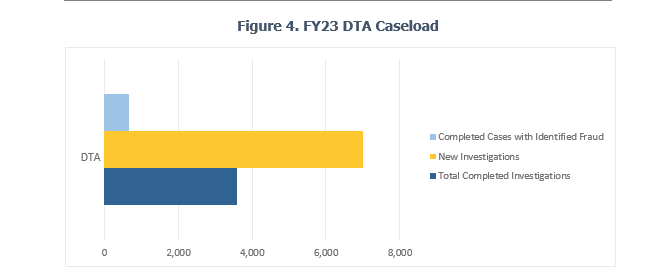

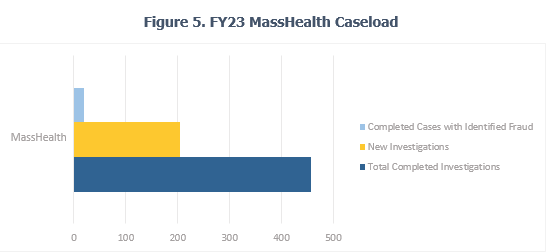

FIU completed 981 cases in FY23, which contributed to identifying fraud totaling $9,551,227.91 in 756 cases. The breakdown of identified fraud by public benefit program in FY23 is as follows:

- $3,398,554.28 for Supplemental Nutrition Assistance Program (SNAP) investigations (35.58%)

- $1,592,061.91 for MassHealth investigations (16.67%)

- $4,080,089.37 for Transitional Aid to Families with Dependent Children (TAFDC) investigations (42.72%)

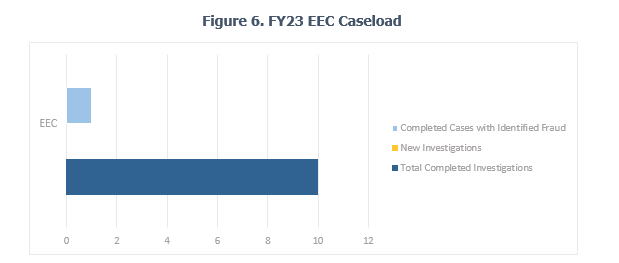

- $340,492.76 for EEC investigations (3.56%)

- $66,551.09 for Emergency Aid to the Elderly, Disabled and Children (EAEDC) investigations (0.70%)

- $50,482.83 for Other (0.53%)

- $22,995.67 for Social Security investigations (0.24%)

Due to the ongoing backlog in the court system caused by the COVID-19 pandemic, BSI has favored civil recoveries over filing complaints in court. Civil recoveries have been the more favorable option as they often end with a signed agreement for repayment, and on occasion, repayment takes place through a reduction of ongoing benefits. During FY23, FIU completed 12 civil recoveries, totaling $371,570.25 in fraudulent overpayments. The process of a BSI civil recovery involves coming to a repayment agreement to recoup overpaid benefits attributed to fraud. BSI sends all signed repayment agreements to the respective agency for collection.

In May 2023, BSI was notified that a directive from the Centers for Medicare and Medicaid Services prohibited MassHealth from collecting overpayments from its members. To comply with this new federal directive, BSI halted all civil recoveries in the MassHealth program and returned all completed investigations back to the agency. BSI has a continued pause on civil recoveries for completed MassHealth investigations.

Collaboration continued with MassHealth and AGO on the PCA Task Force investigating PCA fraud–related cases. During FY23, BSI participated in a joint investigation with the task force that determined the subject used her married name to apply as a consumer for services through the PCA program and her maiden name to apply as the PCA for herself. The subject submitted timesheets and was paid for the PCA services she fraudulently indicated that she provided to herself. The calculated amount of overpayment totaled $36,897.30 for approximately two years of fraud. The case was recommended for criminal prosecution and presented to the Grand Jury in Worcester Superior Court. Two indictments were issued: larceny over $1,200—Section 30 of Chapter 266 of the Massachusetts General Laws—and Medical Assistance Fraud—Section 40 of Chapter 118E of the General Laws. The subject was sentenced to one year committed in a house of corrections on both counts to run concurrent with 200 days credited as time served.

During FY23, members of the PCA Task Force from MassHealth, AGO, and BSI conducted their second personal care management (PCM) | fiscal intermediary (FI)11 stakeholder meeting. This meeting highlighted recent investigations and educated BSI’s partners on the information needed for our investigations to be successful. Stakeholder meetings have been beneficial to improving our communication with PCMs and FIs.

Note: BSI’s DTA caseload for FY23 included SNAP, TAFDC, and EAEDC cases.

During FY23, FIU continued to receive a high number of case assignments from referrals generated through multiple projects. These projects included the previously reported DTA Pandemic Unemployment Assistance (PUA) project and the PCA High Earner project. While the PUA project wound down, the PCA High Earner project ramped up. The findings from these projects were similar, in that examiners consistently found that, in cases of identified fraud, DTA cash and SNAP benefit recipients failed to report their receipt of unemployment insurance and PUA benefits or PCA income to DTA. Completed PUA cases with identified fraud were returned to DTA as IPVs for their administrative process and overpayment recovery.

During FY23, BSI continued to improve its workflow with an FI, Tempus.[1] The streamlined procedure that BSI and Tempus implemented during the last fiscal year to request documentation and fraud calculations has improved organization and timely results for both agencies.

BSI continued to collaborate with MassHealth and AGO on the PCA Task Force on joint investigations of PCA fraud–related cases. During FY23, the PCA Task Force reviewed PCAs whose wages were well over $100,000 during the 2022 tax year. BSI investigations in these cases reviewed whether the PCAs, who were also in receipt of other public benefits, held other employment that would hinder or interfere with their ability to earn such high PCA wages, and/or whether they accurately reported their earned income to the public benefits programs. These investigations identified PCAs who failed to report their PCA income and were overpaid public benefits as a result.

[1] As an FI, Tempus Unlimited, Inc. performs employer-required tasks and related administrative tasks for individuals, commonly referred to as consumers, in Massachusetts PCA programs. Following the FI merger in January 2022, Tempus now has the sole contract for FI services with the Executive Office of Health & Human Services—Office of Medicaid (MassHealth PCA FI Program).

Lastly, FIU completed four EEC investigations and identified $340,492.76 in fraud. Because individuals suspected of defrauding EEC often also receive other forms of public assistance, BSI routinely checks whether they receive other public assistance benefits and, in particular, their reporting of household income and composition to other agencies. These supplemental investigations have led to the discovery of additional fraud perpetrated in DTA and MassHealth public benefit programs.

As part of BSI’s expanding working relationship with EEC, BSI examiners participate in EEC’s administrative hearings under the Informal Fair Hearings Rules provided by Section 10.11 of Title 606 of the Code of Massachusetts Regulations (CMR). The EEC administrative hearing provides BSI examiners the opportunity to explain their investigations and findings to EEC review officers.

Data Analytics Unit

BSI’s DAU generated 289 referrals for CPU analysis in FY23, 288 of these referrals created new cases and one merged into a case already under investigation. In the majority of these referrals, CPU alleged that PCAs failed to accurately disclose their income to DTA and MassHealth as required while receiving public benefits.

DAU also identified and generated referrals for three MassHealth providers. The analysis focused on improper billing associated with a variety of dental services. Other analyses conducted by DAU in FY23 focused on behavioral health, durable medical equipment, laboratory, and PCA services. DAU also continued to field referrals from BSI’s Public Assistance Fraud Hotline. During FY23, DAU received and analyzed 17 provider referrals made through the hotline, some of which are currently ongoing.

DAU continued the development of its Analytical Support Services. DAU’s Analytical Support Services allow BSI examiners to choose from a suite of services designed to aid in the completion of data analysis tasks associated with their investigations. Some of these services include the creation of visualizations (maps, timelines, charts, graphs, etc.) for presentation in court and other settings; custom findings reports for the analysis of financial, healthcare, and other relevant data; network and social analysis; technical training; and Optical Character Recognition (OCR) services. In FY23, DAU received, processed, and completed eight Analytical Support Services requests. Among the services provided, highlights included processing bank records through OCR and analyzing the output, creating visualizations from various data sources, and creating finding reports for large-scale address analysis, financial records, and electronic benefits transactions (EBT). By collaborating with examiners and completing these requests, DAU was able to streamline investigations by automating otherwise manual processes in addition to summarizing vast amounts of information into a more easily digestible format.

In addition, DAU again focused on the overall development of its OCR and spatial analysis capabilities and the expansion of their respective use cases. Specifically, DAU made strides related to the automation of processing certain investigatory documents using OCR. Work conducted in FY23 resulted in the successful automated processing of financial records related to eight different bank account types from various financial institutions. These financial records only pertain to BSI’s public benefit fraud investigations. Additionally, DAU made headway related to the automated processing of tax documents. During FY23, DAU developed a Department of Revenue Form 1 summary, which passed multiple quality checks and a proof of concept stage. A related summary of healthcare information, known as Schedule HC, was brought to intermediate development. These advancements are critical to improving the efficiency and effectiveness of our work by automating BSI’s tax transcription process during fraud investigations. DAU also made progress related to the automated processing of PCA timesheets. During FY23, DAU brought the processing of PCA timesheets for one FI, Tempus, to advanced development. Lastly, DAU continued work on a project to map and visualize the travel records of PCAs and other Medicaid providers. DAU made strides in the identification of providers whose claim behavior required closer examination and that effort is ongoing. This work allowed DAU to continue its development of recently acquired spatial analysis tools and enhance its overall spatial analysis capabilities.

DAU’s continued efforts to enhance and further develop the Analytical Support Services program will assist in expediting the investigative process and streamlining certain operational functions within BSI. By utilizing these services, examiners and other units within BSI will improve time by reducing or eliminating manual processes. Additionally, these services provide BSI additional options in how information is processed, summarized, and presented during the investigative process.

DAU continues to support multiple state and federal partners through joint investigative work, in addition to accepting referrals for investigation and creating and sending referrals to the appropriate entities. For example, DAU is collaborating with federal partners, including the federal Office of the Inspector General for Health and Human Services on an ongoing analysis related to services provided within both the Medicaid and Medicare programs.

Other BSI News

During FY23, BSI’s training team, comprised of staff members from all units, continued identifying staff training needs; created informative and engaging trainings, presentations, and job aides; and effectively led training sessions for all BSI staff members. In preparation for onboarding a sizable cohort of newly hired fraud examiners, the training team refreshed BSI’s training content—which consists of multiple presentations, job aids, and learning templates—to reflect up-to-date federal poverty limits and any updated benefit program information. Onboarding materials serve as useful guides and remain available for all BSI staff members to reference.

Following significant training on the process of conducting civil recoveries and interviews, BSI initiated 12 repayment agreements and disqualification consent agreements (DCAs), totaling $371,570.25, during FY23. DCAs are agreements that subjects voluntarily sign to disqualify themselves from receiving further DTA and/or EEC benefits because of their IPVs. When pursuing civil recovery for DTA and EEC cases, DCAs are required as part of the civil recovery agreement.

Also during FY23, BSI internally promoted a supervising fraud examiner to assistant director of CPU following the retirement of the unit’s former assistant director. A fraud examiner subsequently filled the vacated supervising fraud examiner role through an internal promotion. These changes required a considerable transfer of knowledge, both historical and practical.

Finally, FY23 featured the start of the final phase, Phase III, of BSI’s new case management system (CMS) project. The new CMS is a platform where all staff members have access to a full case file without physically requesting information from the assigned examiner. The CMS has enhanced the process by which BSI personnel assign cases, request and save documents, request tasks, track case progress, log financials, and generate reports of investigations. Information requests and information-gathering tasks are assigned and tracked through the CMS and reports are generated within the CMS rather than in separate Word documents.

The functionality to assign and reassign cases in bulk was developed, tested, and added to the CMS as part of Phase III. Email capabilities and compatibility remain under testing. The CMS serves as an organized database for examiners to save case files with greater access to management and significantly decreases BSI’s use of and reliance on paper. The ability to create allegation-based report templates and attach relevant documentary evidence to a report within the CMS has expedited examiners’ administrative processes following their investigations. Phase III of the project continues to allow for feature updates and workflow improvements that further enhance user-friendliness and satisfaction.

| Date published: | December 27, 2023 |

|---|