Author: James J. Paquette, BLA

Municipal finance in Massachusetts has a nomenclature all its own. From cherry sheets to free cash, it’s important to define and explain these unique terms in order to understand their importance to both your community and the broader financial landscape.

The following is the first of a two-part series on equalized valuations (EQV). We’ll begin with some brief historical background, explain the basic components of the EQV process, and display multi-year trends across the Commonwealth. We hope you find this information helpful and interesting.

Equalized valuation (EQV) is the fair cash value of all property in a city or town subject to local taxation (not including exempt properties) as of January first as determined by the Commissioner of Revenue (Commissioner) under G.L. c. 58, §§ 9 -10C. Since 1966, Massachusetts General Law has required that equalized valuations be produced every two years as part of the allocation of aid distributed to cities and towns. Additionally, the change in the total value (from one EQV to the next EQV) is used in the valuation of reimbursable state-owned land.

The need to equalize the values for each community stems from the parameters used in setting the real estate and personal property values in each community. Assessors submit a sales report (the LA- 3) for approval each year to the DLS Bureau of Local Assessment. The report lists real estate that has been sold in the community priorto the required date for setting the values for the forthcoming fiscal year.

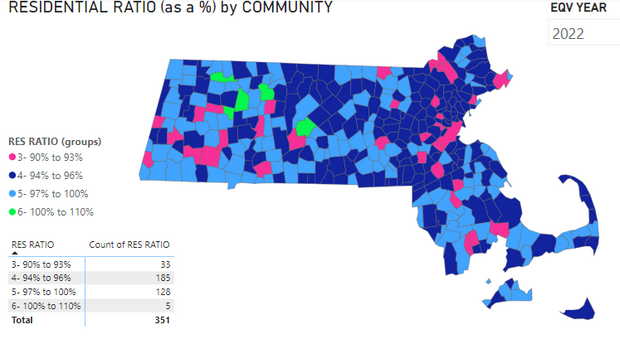

The sales are compared to the new assessments for the upcomingfiscal year. This comparison is called the “Assessment – SalesRatio” and that ratio must determine that the proposed assessmentsare within a 10%, average of actual sales price. (The technicalrequirement is for the median of the sales to be between .90 to1.10). The requirement of the 10% is in place to ensure that the newvalues properly reflect what is happening in the market, but thisprocess results in communities coming in with different ratios – andbecause of those differences, additional steps are necessary toequalize the data.

EQV Process Components

Leveling the playing field is accomplished using the ratio (level ofassessment) for each for each class in each community. This ratioshows at what level that class is being assessed – on average. Theexisting values for each class are divided by the ratio to bring thetotal value to 100%. As a general example, if a community had acurrent residential total value of $10,000,000 and an assessmentlevel (ratio) of .95 then their value at 100% would be $10,526,316(Rounded). [10,000,000 divided by .95]

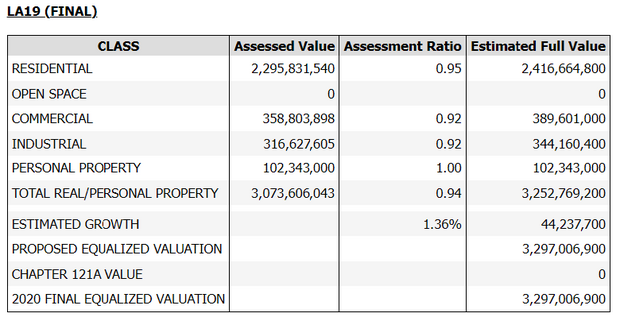

The completed EQV for each community is broken down into itscomponent parts as evidenced below.

Reducing Flood Risk through Local Actions: Upcoming Regional Engagement Sessions

The Executive Office of Economic Development (EOED) is hosting a series of online engagement sessions to inform development of a

Leveling the playing field is accomplished using the ratio (level of assessment) for each for each class in each community. This ratio shows at what level that class is being assessed – on average. The existing values for each class are divided by the ratio to bring the total value to 100%. As a general example, if a community had a current residential total value of $10,000,000 and an assessment level (ratio) of .95 then their value at 100% would be $10,526,316 (Rounded). [10,000,000 divided by .95]

The completed EQV for each community is broken down into its component parts as evidenced below.

Each component of the real and personal property includes the original assessed value, the assessment ratio, and the estimated full value. Estimated growth is then added and produces the proposed Equalized Valuation. The 121A Value (for property subject to the excise imposed under G.L. c. 121A, § 10 is added during the final equalized valuation phase (where applicable).

It should be noted that the process of equalizing values can be complicated by many factors. For example, personal property and certain other specialty properties, such as power plants and land valued under Chapter 61, 61A, and 61B, are considered to be at 100 percent of market value. Those instances and many others are all taken into consideration when producing the final value.

The EQV process is broken into five steps:

- The Proposed EQV is released every two years, on or before June 1st, for each city and town as of January 1st in that year.

- A public hearing for the Revised EQV is held the following June 10th where, based on information received at the hearing or brought to the attention of the Bureau of Local Assessment, the EQV may be revised. Decisions on these requests are sent to the respective communities by July 20th.

- Any community that is unsatisfied by the resulting decision related the Revised EQV can appeal on or before the following August 10th to the Appellate Tax Board (ATB). The ATB must decide the appeal by the Jan 20th of the following year. A failure of the ATB to act upon an appeal within that time is deemed a denial of the appeal. The decision of the ATB is final.

- The Final EQVs are posted on or before January 31st. This entails revising the EQVs modified by the ATB on appeal and adding the 121A values where applicable.

Final Equalized Valuations are available for each community via the Gateway landing page. We’ll continue to explore equalization valuations and related data trends again soon in City & Town. In the interim, if you have any questions regarding your community’s EQV or would like to suggest a topic for future articles, please email us at bladata@dor.state.ma.us.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | October 19, 2023 |

|---|