Author: Jennifer Williams - Bureau of Local Assessment Field Advisor

Semi-annual billing communities who have not adopted the Chapter 653 local option might expedite their tax rate setting process by shifting their submission date earlier in the calendar year. The following article will provide recommendations local officials might consider to potentially reduce approval times for the tax rate setting process. To learn more about tax billing schedules, please see our Issuing Property Tax Bills training webpage.

Chapter 653 §40 of the Acts of 1989 is a local option adopted by a municipality’s legislative body to assess certain new construction through June 30th of a given fiscal year. While the official assessment date is January 1st, Chapter 653 allows a community to extend the assessing of certain new growth items until June 30th each year. Allowable items include new construction, additions, and alterations to buildings and structures, but do not include lot splits, subdivisions, or condominium conversions. Adopting this local option only provides an additional six months of new growth for the first year of implementation.

A recent Bureau of Local Assessment (BLA) review found that 207 of the Commonwealth’s 351 cities and towns have adopted the local option. Of the 144 remaining communities that have not adopted Chapter 653, 99 communities issue tax bills on a quarterly basis. Communities that issue tax bills on a quarterly basis issue third quarter actual tax bills prior to January 1st each year, while communities that issue semiannual tax bills target to issue tax bills prior to October 1st each year.

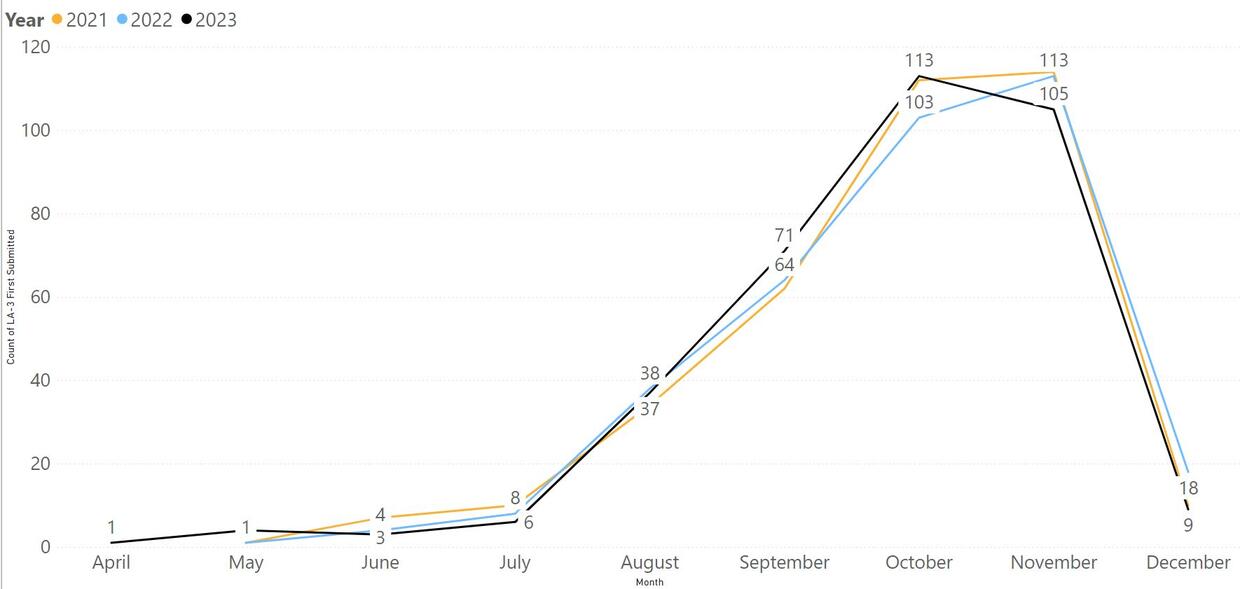

During the FY2024 tax rate setting process, 227 communities submitted their LA3 sales report to the BLA between October and December. That number represents 64.7% of all communities submitting their LA3 sales report during these three months. Within that, 114 (32.4%) of all communities submitted their LA3 sales report in gateway during November and December. Of the 227 cities and towns that submitted from October through December, 23 (10.1%) were municipalities that issue tax bills semiannually. Additionally, 79 (34.8%) were quarterly tax billing communities that did not adopt local option Chapter 653. Overall, the large number of submissions during this period can cause a log jam of the workflow process resulting in longer approval times of Gateway forms and the influx of submissions requiring regulatory review during this time extends approval time for communities who might otherwise benefit from more expedited approval had they submitted earlier in the year.

Our review found that 16 semiannual tax billing communities have adopted Chapter 653. The collection of building permit growth through June 30th along with the target date of issuing tax bills prior to October 1st shortens the timeframe to establish and approve property values and growth and set a timely tax rate. Therefore, communities with this setup may want to consider if maintaining local option Chapter 653 is serving its intended purpose within their respective community. Local officials in semiannual tax billing communities who have not adopted Chapter 653 should strongly consider submitting their property valuation forms earlier in the tax rate setting process, preferably before August. Quarterly tax billing communities that have not adopted local option Chapter 653 can submit their LA3 sales report earlier in the review cycle (preferably in June and July). Since these communities assess growth as of January 1st their building permit inspections should be completed prior to the January 1st assessment date.

With the full understanding that every community has different approaches and challenges, BLA suggest local practitioners and policy makers discuss the benefits (and drawbacks) of expediting their submission processes. There may be instances where external factors such as staffing shortages, availability or schedules of outside revaluation vendors, or other factors affect the timetable for when the assessors are ready to submit these forms for BLA review. However, the benefits of submitting the forms early are a faster, more efficient approval process, additional flexibility with outside consultants’ schedules, and a more enjoyable holiday season.

We hope you find this information useful. If your community has interest in pursuing a new approach to submissions, please feel free to contact your BLA field representative. We are here to help. If there is a topic or area of assessing, you would like to see featured in the future please email us at bladata@dor.state.ma.us.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Sean Cronin, Emily Izzo and Tony Rassias

| Date published: | May 2, 2024 |

|---|