Author: Financial Management Resources Bureau

The DLS Financial Management Resource Bureau (formerly the Technical Assistance Bureau) has offered financial management advice to municipalities across the state for over 30 years. To share this guidance more broadly, we thought it would be helpful to highlight some of our more useful, timely, or interesting recommendations for the benefit of City & Town readers.

A city or town’s capital assets are a vital part of providing essential services to residents. Capital assets include public buildings and structures, roadways, parks and fields, large equipment like dump trucks, mowers, fire engines, fire breathing apparatus, police cruisers, radio equipment, as well as land acquisitions. Major repairs to a capital asset, or when it needs to be replaced unexpectedly or reaches its expected useful life early, can be a significant shock to the budget. Additionally, deferred maintenance of existing capital assets is a major contributor to capital failures, as these necessary upkeep costs are sometimes avoided in the interest of balancing the budget. One way to better prepare for capital expenditures, both planned and unexpected, is to establish a special purpose capital stabilization fund dedicated to funding regular, required capital repairs and maintenance.

A community can create a special purpose stabilization fund under M.G.L. 40 § 5B with a two-thirds vote of the legislative body and designate capital expenses as its purpose. Additionally, with further acceptance, communities may dedicate all or a portion of a particular fee, charge, or other receipt to provide a consistent funding source. A capital stabilization fund works best accompanied by a set of formal financial policies governing the use and replenishment of reserves, as well as capital planning by defining a capital project (dollar threshold, years of useful life, type of project) and detailing a funding strategy with regard to cash, debt, and uses of the stabilization fund(s). For example, by authorization, the capital stabilization fund is generally for capital expenses, but by policy, the use can be more narrowly defined as a funding source for cash-funded capital expenditures or for maintenance/repair projects that may not qualify to be funded under the capital plan but will preserve the useful life of capital assets.

When adopting policies for capital planning and special purpose stabilization funds, communities should consider the following:

- Overall financing strategy, including use of the capital stabilization fund (balance of debt versus cash capital spending), the size of the annual capital budget (often in terms of a percentage of revenue), and a statement expressing the preference for borrowing terms, such as 10, 15, or 20 years (limited by useful life).

- Definition of a capital project and what can be funded through the capital improvement plan versus what is to be included in the operating budget.

- Criteria used to evaluate, rank, and prioritize capital projects.

- Special purpose stabilization funding source (dedicated source or annual appropriation) and level (minimum dollar amount or a percentage of the budget).

- A method to replenish the fund, including establishing indicators for when to appropriate into the funds, such as a percentage of new growth or free cash above a policy target.

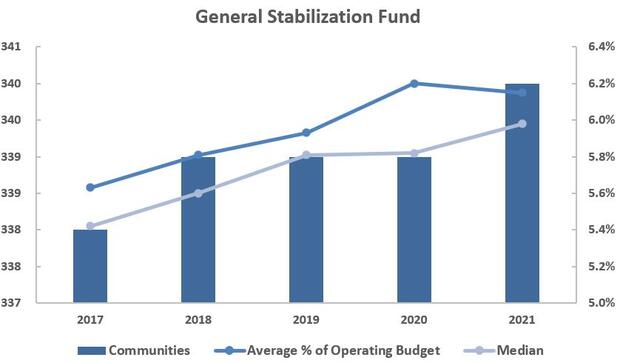

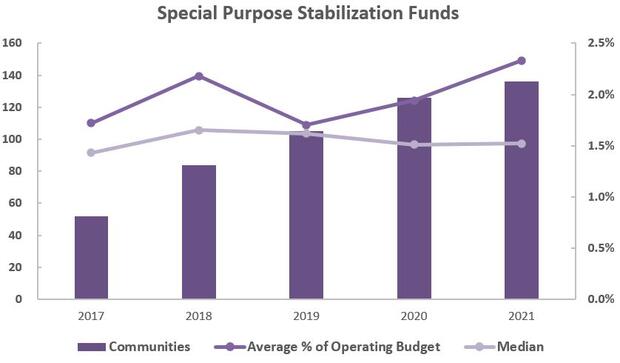

Based on municipal data submitted to DLS on the Schedule A, the below graphics display the number of communities reporting a general stabilization fund and those reporting at least one special purpose stabilization fund. Our review found that 97% of communities have a general stabilization fund. The statewide average balance for FY21 is 6.15% of the general fund operating budget. This represents strong adherence to the best practice of maintaining a balance of between 5-7%. In addition, the number of communities with at least one specific purpose stabilization funds has grown over the last five years from less than 15% to close to 40%. Target levels for these funds, either as a total dollar amount or as a percentage, will vary depending on purpose and need.

More information on capital planning is available at Municipal Finance Training and Resource Center. Find more information on the latest guidance on adopting, funding, using, and maintain stabilization funds.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Tracy Callahan, Sean Cronin, Emily Izzo, Paula King, Jennifer Mcallister and Tony Rassias

| Date published: | April 21, 2022 |

|---|