Author: Financial Management Resources Bureau

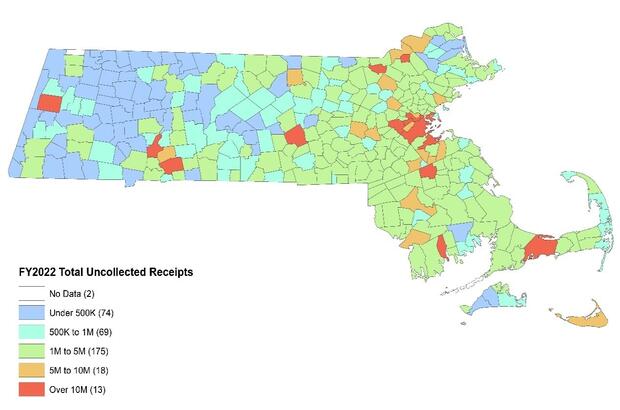

Statistics from the Division of Local Services show cities and towns reporting over $869M in total outstanding receivables at fiscal year-end 2022. This total of outstanding receivables represents the amount of real estate, tax liens, foreclosure receivables, deferred property tax, and personal property that is owed to the municipality but remains unpaid. Looking back over the last five years, the amount of total outstanding receivables peaked in FY2020 at $991M during the pandemic. While the total amount has dropped by more than $100 million in the last two years, it is important that cities and towns remain vigilant and proactive in evaluating the trends, challenges, and collection policies and procedures regarding their uncollected revenues.

Local officials can look at their city or town’s outstanding receivable balances using the Municipal Finance Trend Dashboard. Here are some areas to consider when analyzing your community’s outstanding receivable balance:

Examine Data Details

While it is important to review outstanding receivable balances, these figures are a lump sum of prior fiscal years, plus any accumulated principal and interest. It is important to analyze these numbers in depth, especially in receivable categories like tax liens, in which the 16% per annum interest rate can balloon the balances of older tax titles. Further, comparing historical data to current collection rates can help a community identify positive or negative trends in revenue collection. Learn more about FMRB’s previously published article on understanding tax title balances.

Review Collection Procedures

Financial officials should review their current collection procedures for consistency, timeliness, and efficiency. Some areas to evaluate are bill payment options, timing of demands, and optional collection notices in tax taking process. Consistent collection procedures provide taxpayers with a reliable timeline for bill mailing, due dates, and penalty fees, and encourage taxpayers to pay bills on time.

Adopt/Update Tax Enforcement Policy

A tax enforcement policy can formally define a municipality’s revenue collection processes and set clear expectations for financial officers and taxpayers. Such policy should outline a complete collection process, including timing for each enforcement step from mailing of demands to pursuit of tax title redemption or foreclosure. Financial team members should periodically review this policy and update as needed.

While municipalities have a variety of ways to address outstanding receivables, the needs and circumstances of a community will determine the path to success for an individual city or town. Financial officials should analyze their receivables data and coordinate with each other to formulate an effective approach to address these balances.

The DLS Financial Management Resource Bureau (FMRB) provides tailored consultative services to municipalities across the state. Articles in this series highlight a particular financial management best practice that we frequently recommend.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Tracy Callahan, Sean Cronin, Emily Izzo, Paula King, Jennifer Mcallister and Tony Rassias

| Date published: | September 21, 2023 |

|---|