Author: Tony Rassias, Bureau of Accounts Deputy Director

PERAC, the Public Employee Retirement Administration Commission, is responsible for oversight, guidance, monitoring and regulation of 99 city, town, county, special purpose district and regional school district public pension systems (municipal systems), and 61 state public pension systems inclusive of the Boston Teachers’ system for purposes of this article.

PERAC has recently published its 2023 Annual Report including important indicators on the financial health of each retirement system. Funded Ratios, Investment Return Assumptions, and Funding Schedules as of January 1, 2024, common fiscal metrics of retirement systems, were reported in our March 7th, 2024 City & Town publication and will be updated in a future publication after January 1, 2025 data becomes available.

The purpose of this article is to summarize and compare where possible particular financial indicators taken from PERAC’s 2023 and prior Annual Reports. Except for pension appropriations reported on a fiscal year basis, other reported indicators are based on the system’s last valuation date.

Investment Returns

Strong Composite Investment Return Percentages for retirement systems from 2020 to 2021 weakened considerably in 2022 but returned to positive in 2023.

| Composite Investment Return Percentages | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 |

| 11.64 | -10.84 | 19.51 | 12.80 |

Source: PERAC Annual Reports. Natick was not included in the 2022 Report but subsequently reported -11.9.

From 2020 to 2021, 94 systems showed percentage-point increases and 11 showed decreases with a total median increase of 7.7. From 2021 to 2022, all systems showed double-digit percentage-point decreases that ranged from 22.1 to 41.0 with a total median decrease of 30.9. From 2022 to 2023, 105 systems showed double-digit percentage-point increases that ranged from 15.0 in Norwood to 43.9 in Somerville with a total median increase of 22.4.

Market Value of Investments

The Federal Reserve reported that state and local government retirement systems as of 2023 held total long-term investments of $5.4 trillion. Assets are invested in the economy and are therefore subject to volatility. In Massachusetts, each system reports its allocation of assets to PERAC into as many as seven categories: Global Equity, Core Fixed Income, Value Added Fixed Income, Private Equity, Real Estate, Timberland and Portfolio Completion Strategies. Specific investments within each category are not indicated.

| Composite Market Value (in $ billions) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 |

| 119.2 | 108.4 | 123.6 | 104.1 |

Source: PERAC Annual Reports. Natick was not included in the 2022 Report but subsequently reported $200.5 million

From 2020 to 2021, all systems increased from $2.3 million to $6 billion with a total median increase of $34.9 million. From 2021 to 2022, all systems decreased from $2.1 million to $4.9 billion for with a total median decrease of $28.9 million. From 2022 to 2023, all systems increased from $900,000 in Minuteman Regional to $3.5 billion in Mass Teachers with a total median increase of $21.0 million.

The Cost of Municipal Pension Assessments

Due to increasing pension costs, government leaders nationwide face fiscal challenges providing necessary governmental services while trying to meet pension obligations. Pension costs rely on three major sources of revenue: investment earnings, employer contribution, and employee contribution.

The Massachusetts municipal pension cost, or employer contribution, is an assessment by the retirement system upon participating local governments and must be provided for in the government’s annual operating budget either by appropriation or without appropriation in the next tax levy. (G.L. c. 32, §22) Retirement systems in other States that do not require such provision may leave them short of their required contribution.

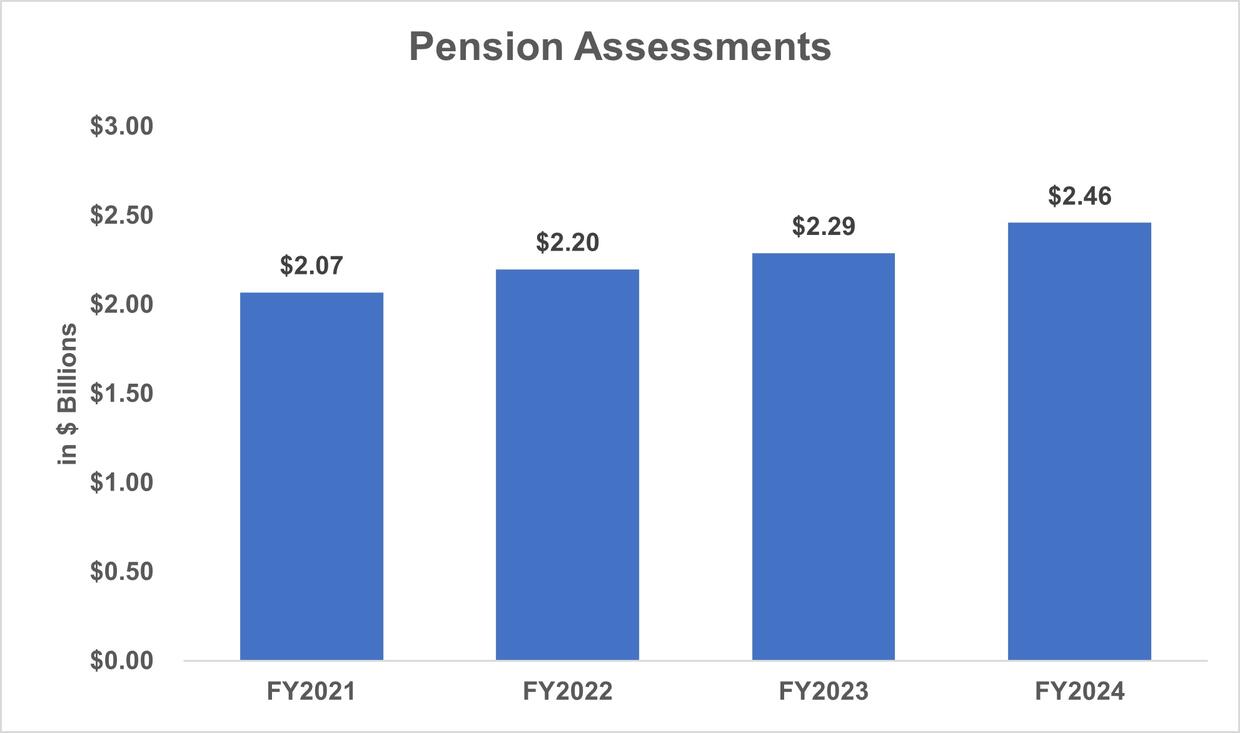

For all 99 Massachusetts municipal systems, the following graph shows recent growth in total reported municipal pension assessments.

Source: PERAC Annual Reports

From FY2021 to FY2022, the $131.8 million net increase included 91 systems that increased from $27,000 to $29.7 million, four had no change and four that decreased from $800,000 to $7.1 million. From FY2022 to FY2023, the $92.3 million net increase included 92 systems that increased from $32,000 to $38.5 million, three had no change and four that decreased from $6.4 million to $29.1 million. From FY2023 to FY2024, the $167.4 million net increase included 93 systems that increased from $36,000 in Minuteman Regional to $35.7 million in Boston, five had no change and one that decreased by $1.3 million in Watertown.

The Unfunded Liability

The system’s unfunded liability is another common fiscal metric. Should revenue sources fall short in a system with this liability, other revenues must be increased for the system to be adequately funded or the system’s unfunded liability will grow. A system where the unfunded liability is $0 is said to be “fully funded.”

Projecting future pension costs requires an actuarial look at future demographic and economic events such as investment returns, the number of workers, retirees, life expectancy, wage and benefit growth, inflation, and the value of invested assets.

A system’s unfunded liability is updated with each system’s actuarial valuation to provide an up-to-date assessment of the system’s condition. Otherwise, the liability remains the same until a new valuation is completed. An update, however, does not guarantee a liability reduction.

On an actuarial basis, the nationwide unfunded liability is estimated at over $1 trillion. PERAC annually reports the unfunded liability for all systems. Seen below is the unfunded liability for the 99 municipal systems.

| The Unfunded Liability for Massachusetts Municipal Retirement Systems (in $ billions) | |||

|---|---|---|---|

| Funding Gap | $ Inc. (Dec.) | % Inc. (Dec.) | |

| 2020 | 17.963 | ||

| 2021 | 17.796 | -0.167 | -0.93 |

| 2022 | 15.594 | -2.202 | -12.37 |

| 2023 | 15.217 | -0.377 | -2.42 |

| 2020 to 2023 | -2.746 | -15.29 | |

Source: PERAC Annual Reports

From 2020 to 2021, the $166.5 million net decrease included 10 systems that increased from $400,000 to $35.1 million, 64 had no change and 25 decreasing from $700,000 to $37.2 million. From FY2021 to FY2022, the $2.2 billion net decrease included 3 systems that increased from $200,000 to $35.3 million, 30 had no change and 66 that decreased from $100,000 to $436.8 million. From 2022 to 2023, the $376.8 million net decrease included 8 systems that increased from $900,000 in Reading to $54.3 million in Leominster, 64 had no change and 27 decreasing from $600,000 in North Adams to $176.5 million in Andover after issuing Pension Obligation Bonds (POBs).

Additional Resources and Suggestions

Through their education sessions and publications, PERAC provides recommendations on assumptions, funding strategies, and funding measures retirement systems should employ to better manage their pension obligations.

For further details on funded ratios and unfunded liabilities, view the DLS Municipal Finance Trend Dashboard Unfunded Liabilities Report.

Conclusion

The greatest challenge facing retirement systems going forward continues to be providing benefits to employees while achieving and maintaining full funding. Closely analyzing and monitoring investment positions, listening to professional advice and considering the example of systems well on their way to full funding can help system administrators navigate their system’s pension obligations and help keep their system financially stable.

1 State systems reported in PERAC’s Annual Report include the Mass State Teachers, MWRA, MHFA, Massport and State.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister, Jessica Sizer and Tony Rassias

| Date published: | December 19, 2024 |

|---|