Section 2-106

(a)

In this section:

- (1) ''Deceased descendant'', ''deceased parent'', or ''deceased ancestor'', a descendant, parent, or ancestor who predeceased the decedent.

- (2) ''Surviving descendant'', a descendant who survived the decedent.

(b)

If, under section 2-103(1), a decedent's intestate estate or a part thereof passes ''per capita at each generation'' to the decedent's descendants, the estate or part thereof is divided into as many equal shares as there are (i) surviving descendants in the generation nearest to the decedent that contains 1 or more surviving descendants, and (ii) deceased descendants in the same generation who left surviving descendants, if any. Each surviving descendant in the nearest generation is allocated 1 share. The remaining shares, if any, are combined and then divided in the same manner among the surviving descendants of the deceased descendants as if the surviving descendants in the nearest generation and their surviving descendants had predeceased the decedent.

(c)

If, under section 2-103(3), a decedent's intestate estate or a part thereof passes ''per capita at each generation'' to the descendants of the decedent's deceased parents or either of them, the estate or part thereof is divided into as many equal shares as there are (i) surviving descendants in the generation nearest the deceased parents or either of them that contains 1 or more surviving descendants, and (ii) deceased descendants in the same generation who left surviving descendants, if any. Each surviving descendant in the nearest generation is allocated 1 share. The remaining shares, if any, are combined and then divided in the same manner among the surviving descendants of the deceased descendants as if the surviving descendants in the nearest generation and their surviving descendants had predeceased the decedent.

Comment

This section adopts the system of representation called per capita at each generation. The per capita at each generation system is more responsive to the underlying premise of the original UPC system, in that it always provides equal shares to those equally related. In addition, a recent survey of client preferences, conducted by Fellows of the American College of Trust and Estate Counsel, suggests that the per capita at each generation system of representation is preferred by most clients. See Young, “Meaning of ‘Issue’ and ‘Descendants’”, 13 ACTEC Probate Notes 225 (1988). The survey results were striking: Of 761 responses, 541 (71.11 percent) chose the per capita at each generation system; 145 (19.1 percent) chose the per-stirpes system, and 70 (9.21 percent) chose the pre-1990 UPC system.

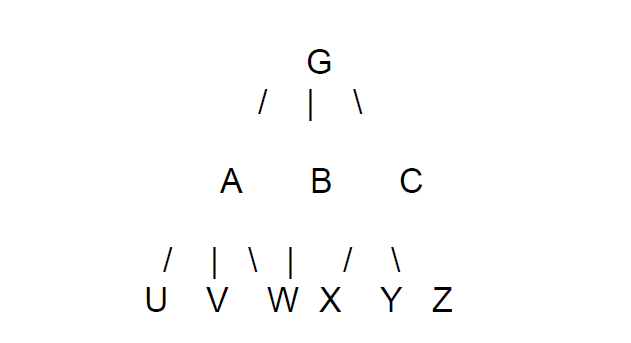

To illustrate the differences among the three systems, consider a family, in which G is the intestate. G has 3 children, A, B, and C. Child A has 3 children, U, V, and W. Child B has 1 child, X. Child C has 2 children, Y and Z. Consider four variations.

Variation 1

All three children survive G.

Solution

All three systems reach the same result: A, B, and C take 1/3 each.

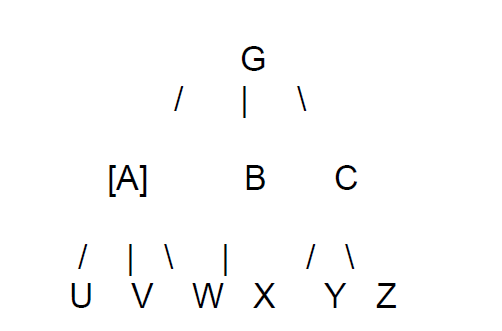

Variation 2

One child, A, predeceases G; the other two survive G.

Solution

Again, all three systems reach the same result: B and C take 1/3 each; U, V, and W take 1/9 each.

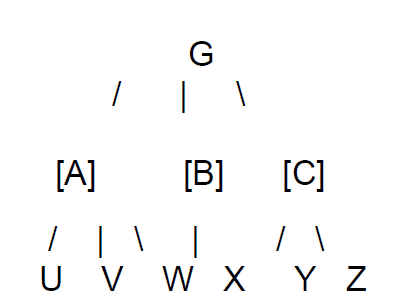

Variation 3

All three children predecease G.

Solution

The pre-1990 UPC and the 1990 UPC systems reach the same result: U, V, W, X, Y, and Z take 1/6 each.

The per-stirpes system gives a different result: U, V, and W take 1/9 each; X takes 1/3; and Y and Z take 1/6 each.

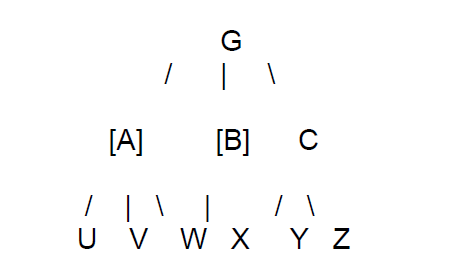

Variation 4

Two of the three children, A and B, predecease G; C survives G.

Solution

In this instance, the 1990 UPC system (per capita at each generation) departs from the pre-1990 UPC system. Under the 1990 UPC system, C takes 1/3 and the other two 1/3 shares are combined into a single share (amounting to 2/3 of the estate) and distributed as if C, Y and Z had predeceased G; the result is that U, V, W, and X take 1/6 each.

Although the pre-1990 UPC rejected the per-stirpes system, the result reached under the pre-1990 UPC was aligned with the per-stirpes system in this instance: C would have taken 1/3, X would have taken 1/3, and U, V, and W would have taken 1/9 each.

The 1990 UPC system furthers the purpose of the pre-1990 UPC. The pre-1990 UPC system was premised on a desire to provide equality among those equally related. The pre-1990 UPC system failed to achieve that objective in this instance. The 1990 system (per-capita-at-each generation) remedies that defect in the pre-1990 system.

Reference

Waggoner, “A Proposed Alternative to the Uniform Probate Code's System for Intestate Distribution among Descendants”, 66 Nw. U. L. Rev. 626 (1971).

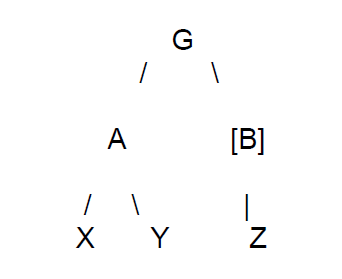

Effect of Disclaimer

By virtue of Section 2-801(g), an heir cannot use a disclaimer to effect a change in the division of an intestate's estate. To illustrate this point, consider the following example:

As it stands, G's intestate estate is divided into two equal parts: A takes half and B's child, Z, takes the other half. Suppose, however, that A files a disclaimer under Section 2-801. A cannot affect the basic division of G's intestate estate by this maneuver. Section 2-801(g) provides that “the disclaimed interest devolves as if the disclaimant had predeceased the decedent, except that if by law or under the testamentary instrument the disclaimant's descendants would take the disclaimant's share by representation if the disclaimant actually predeceased the decedent, and if the disclaimant left descendants who survive the decedent, the disclaimed interest passes by representation to the disclaimant's descendants who survive the decedent”. In this example, the “disclaimed interest” is A's share (1/2) of G's estate; thus the 1/2 interest renounced by A devolves to A's children, X and Y, who take 1/4 each.

If Section 2-801(g) had provided that G's “estate” is to be divided as if A predeceased G, A could have used his disclaimer to increase the share going to his children from 1/2 to 2/3 (1/3 for each child) and to decrease Z's share to 1/3. The careful wording of Section 2-801(d)(1), however, prevents A from manipulating the result by this method.