Author: Tony Rassias - Deputy Director of Accounts

The Public Employee Retirement Administration Commission (PERAC) is responsible for oversight, guidance, monitoring and regulation of 99 city, town, county, special purpose district and regional school district public pension systems (municipal systems), and six state public pension systems inclusive of the system for Boston teachers. It publishes quarterly a list of retirement boards and their last valuation date (the date when the system’s actuarial valuation was last performed). The most recent list is as of January 1, 2025. The Governmental Accounting Standards Board (GASB) requires a new valuation at least every two years, if not more frequently.

PERAC’s report includes three common fiscal metrics as reported by each system that can help assess whether a retirement system is fiscally healthy: funded ratio, investment return assumption (commonly referred to as assumed rate of return or ARR), and funding schedule (G.L. c. 32, §22F) for amortizing the system’s unfunded actuarial liability (UAL). This article will review the latest list for the 99 municipal systems only and determine how their metrics have changed from one year ago.

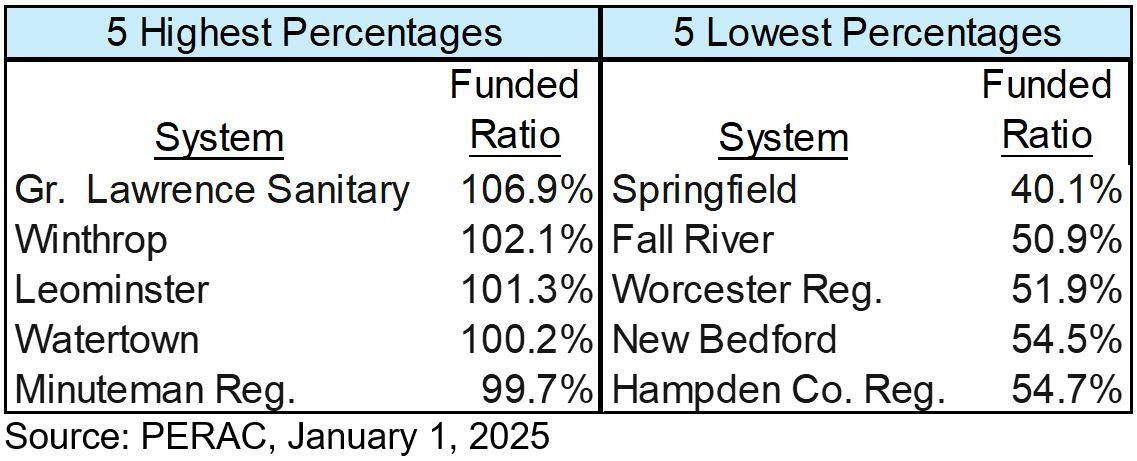

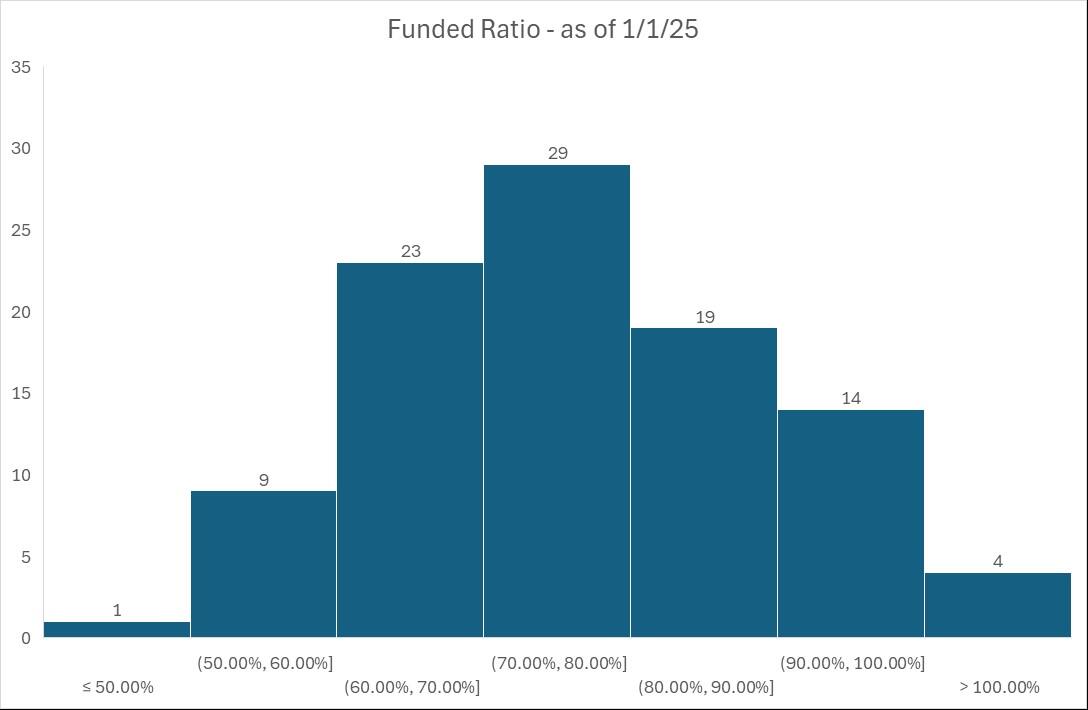

PERAC lists each system’s funded ratio, the total value of a plan’s assets weighed against its accrued liabilities as of its last valuation date. It indicates the extent to which assets cover system liabilities. A system with a greater funded ratio is considered a stronger system. The group median is 75.3%, up from last year’s 73.6%. The following presents the five highest and five lowest funded ratios and then all 99 systems by percentage category.

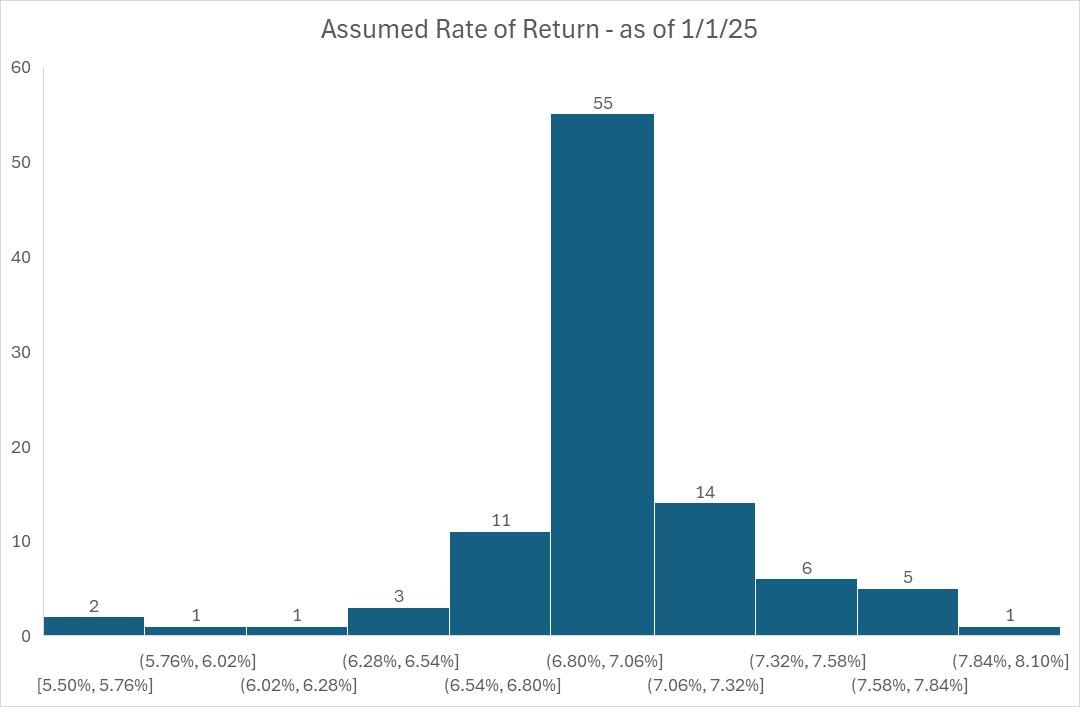

A system’s ARR is a major component in a retirement system’s projected asset growth because of the importance of investment earnings to the system. The ARR is chosen by the retirement system and should represent the long-term rate of return based upon a retirement system’s investment policy. The current list shows that no system has reported an ARR greater than Plymouth County at 7.88%, with the lowest in Leominster at 5.5%.

Forty-nine systems, compared to forty-six last year, reported an ARR of 7.0% which is the group median. From last year, Northampton and West Springfield increased their ARR to 7%, Danvers and Webster decreased theirs to 7% and Stoneham decreased its from 7% to 6.75% this year. The following presents ARR’s by percentage category.

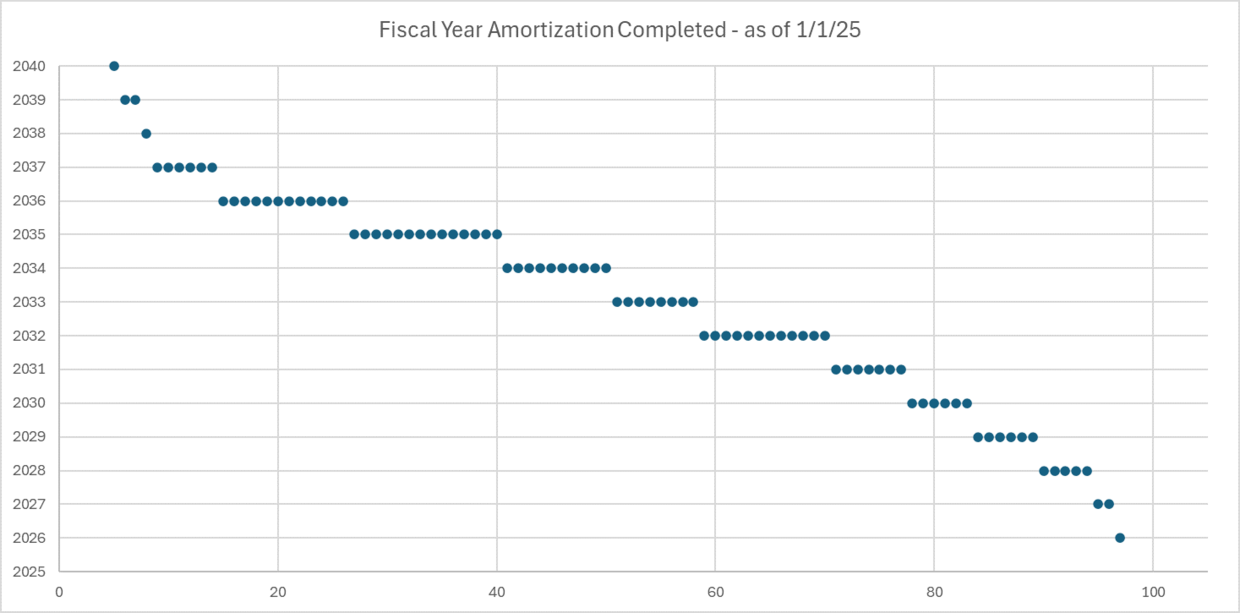

State law mandates that each system amortize its UAL by a fiscal year of its choosing, but no later than by FY2040. A system’s UAL is the difference between its projected future pension costs, demographic and economic events and the value of its invested assets. Projecting these costs and values requires an actuarial review that includes many factors. PERAC’s FY2023 Annual Report, its most current annual report, shows an unfunded liability for the 99 municipal systems of about $15.2 billion (about $43.4 billion when including all 105 systemswithin PERAC’s oversight).

The following presents in graphic form the number of systems that will reach full funding reported as of their latest valuation. As of 1/1/2025, four systems are already considered fully funded and two are expected to be fully funded in 2024. The most common date for expected full funding is 2035, two years greater than reported last year.

When comparing PERAC’s most recent list to its 1/1/2024 list, 66 of the 99 municipal systems updated their valuation. If a system’s valuation was not updated, there is no change to the information listed. The following highlights the 66 systems reporting new information, all of which updated their valuations to 1/1/2024.

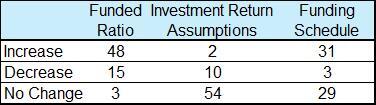

The following table shows changes from PERAC’s 1/1/2024 report in the three common fiscal metrics for 66 systems that updated their valuations to 1/1/2024.

Individually, the funded ratio increased by 6.3 percentage points in the Salem system while Leominster’s decreased by 18.1 percentage points. ARR’s increased 0.25 percentage points in the West Springfield system while 54 others showed no change. Funding schedules were shortened in the Gardner, Holyoke and Needham systems by one year each.

Retirement board information shown in PERAC’s 1/1/2025 listing only reflects system performance as of the valuation date shown. All systems are scheduled to amortize their unfunded liability before the legal deadline of 2040 and investment return assumptions continue to remain conservative.

Here are some repeated words of caution:

- An asset portfolio dependent upon the capital markets always carries a risk of value and revenue loss which then negatively affects the system’s funded ratio;

- When the UAL reaches $0, the system is said to be fully funded, after which appropriations are only required to cover the Normal Cost, costs that represent a portion of the Actuarial Present Value of pension plan benefits to be paid in a single fiscal year. However, the funding status can change: actuarial and investment losses, changes in plan provisions, and/or assumption changes can increase UAL, or even return a fully funded system to a less than fully funded status;

- In a near future local budget, systems with low funded ratios could experience their annual fixed cost assessment consuming a far greater portion of their annual operating budget.

Click this link to see PERAC’s complete list of Retirement Board Funded Ratios.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | February 20, 2025 |

|---|