Author: Tony Rassias - Deputy Director of Accounts

One important way in which city and town clerks interact with the Division of Local Services (DLS) is through the submission of Proposition 2½ (Prop 2½) ballot question election results. This is an important responsibility, not just for statistical purposes, but to update and maximize the community’s annual Prop 2½ levy limit. Without this information, the community’s tax levy would likely exceed its levy limit, and the Bureau of Accounts would be unable to approve the annual tax rate(s) until the vote(s) is/are uploaded.

The process involves the Clerk’s submission of Prop 2½ ballot question wins and losses into Gateway. Detailed instructions and a helpful video are available to guide this procedure. These vote results include general override, underride, stabilization fund override, debt exclusion and capital expenditure exclusion types. Clerks identify vote purposes into one of nine categories: Culture and Recreation, Employee Benefits, Funds, General Government, General Operations, Health and Human Service, Public Safety, Public Works and Facilities, and School.

General Override

A general override is a voter-approved, permanent increase in a community's property tax levy, allowing it to raise funds beyond the automatic annual 2.5% increase and any growth from new taxable properties. This override is intended to fund recurring operational expenses like schools, public safety, and other municipal services.

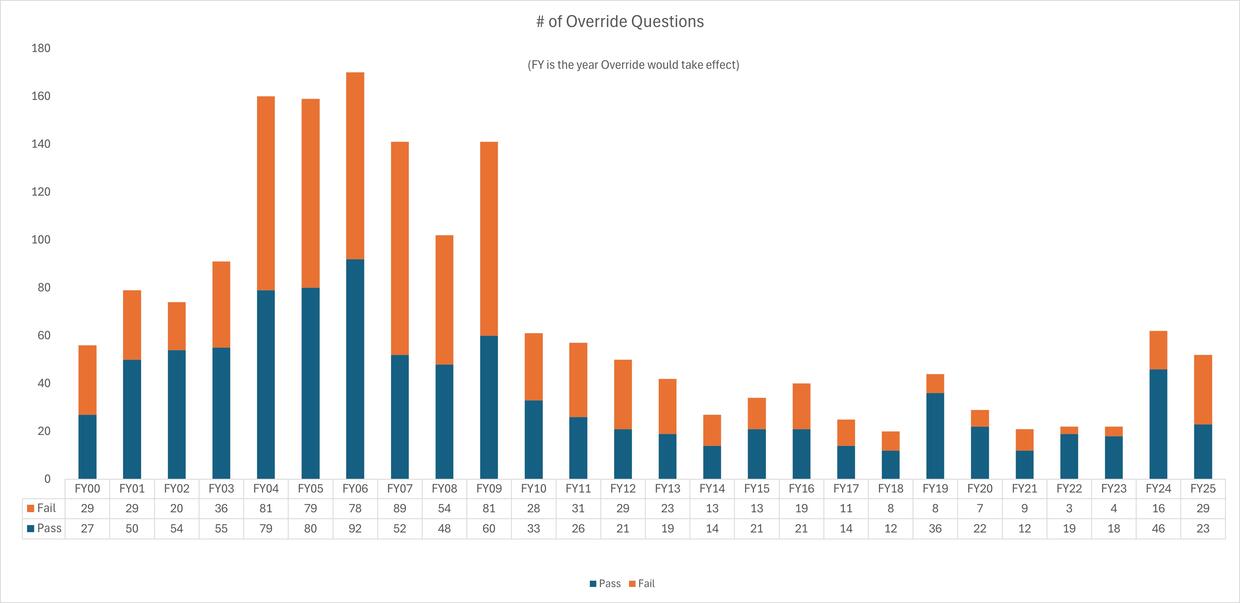

The graph below displays the number of general override questions as reported to DLS since FY2000. (Note that the fiscal year as shown reflects the fiscal year that the override would take effect.) Last spring, when most of the votes for FY2025 were held, 45 municipalities had at least one override question on the ballot, totaling 52 questions. Of those, 29 failed and 23 passed, adding $48.2M to the allowable levy limit.

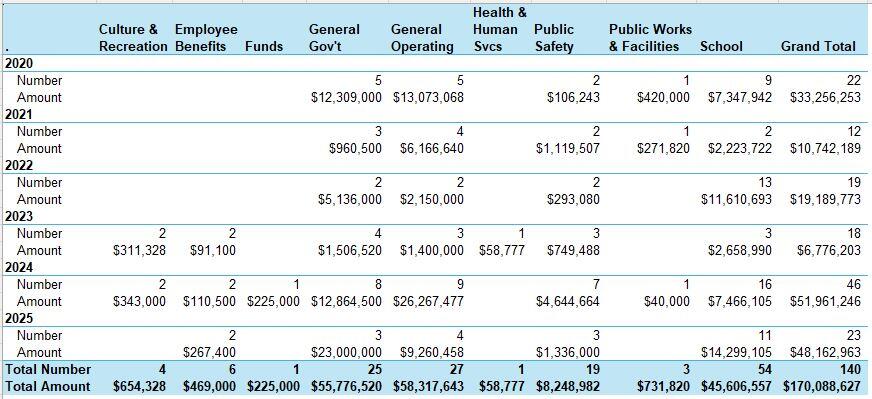

The table below breaks out the override votes that passed since FY2020 by type as reported by municipalities to DLS.

Underride

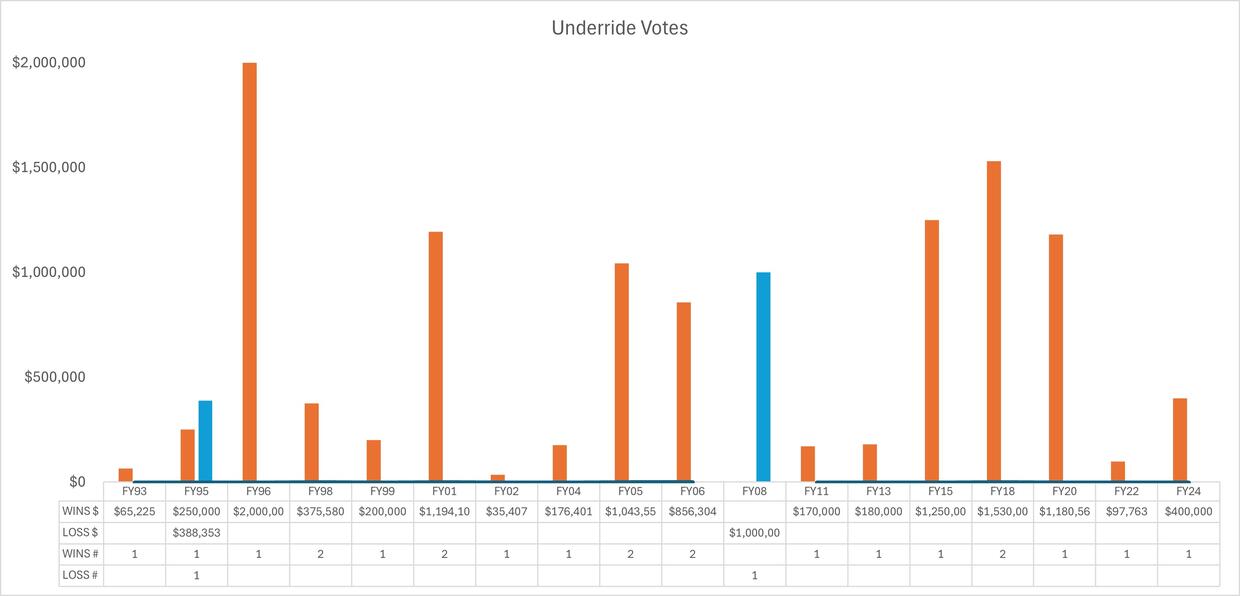

An underride is a voter-approved permanent decrease to the tax levy limit. It's the opposite of an override. As shown in the table below, since the inception of Prop 2 ½, 24 underride votes have been put before voters, and 22 of that 24 were approved, reducing the allowable levy limit by a total of $11M. The most recent underride ballot question was in FY24 when voters in Ware approved a $400K underride.

Stabilization Fund Override

The third type of Prop 2 ½ ballot question that impacts the levy on a permanent basis is a stabilization fund override, which pertains to specific annual appropriations. For example, a capital stabilization fund override would be utilized to fund annual capital projects outside the usual 2 ½ limitations. A vote to authorize such an override must be approved by a majority of voters and, if approved, the additional levy capacity must be allocated to the specific stabilization fund purpose in subsequent years by a two-thirds vote of the town's governing body (i.e., select board, city/town council). The amount that can be raised annually increases by 2.5%.

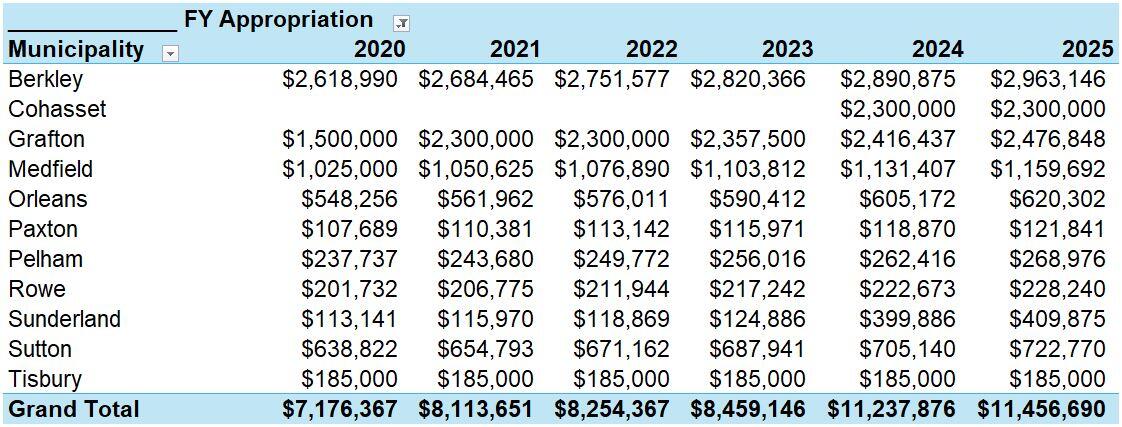

As depicted in the table below showing stabilization fund overrides raised by fiscal year since FY2020 after being approved by voters, there are only 11 municipalities that have adopted and currently utilize this type of override as reported to DLS.

Debt Exclusion

A debt exclusion is an action taken by a community through a referendum vote to raise the funds necessary to pay debt service costs for a particular project from the property tax levy but outside of the limits under Prop 2 ½. By approving a debt exclusion, a community calculates its annual levy limit, then adds the excluded debt service cost. The amount is added to the levy limit for the life of the debt only and may increase the levy above the levy ceiling.

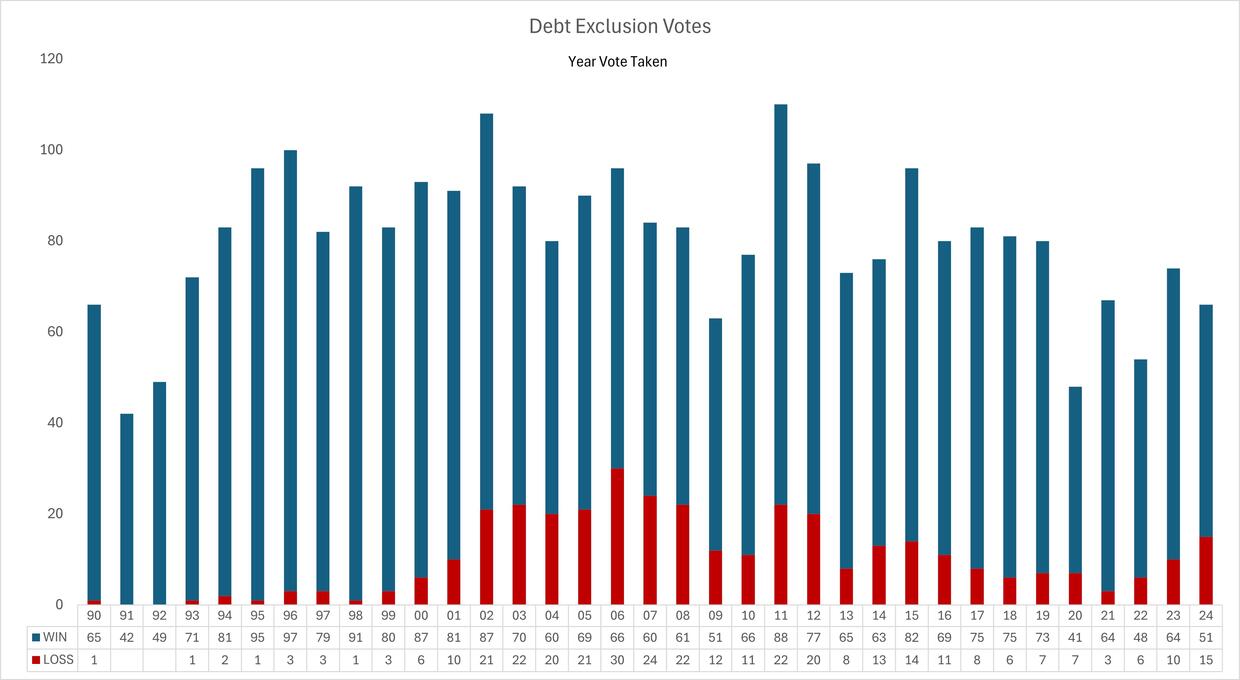

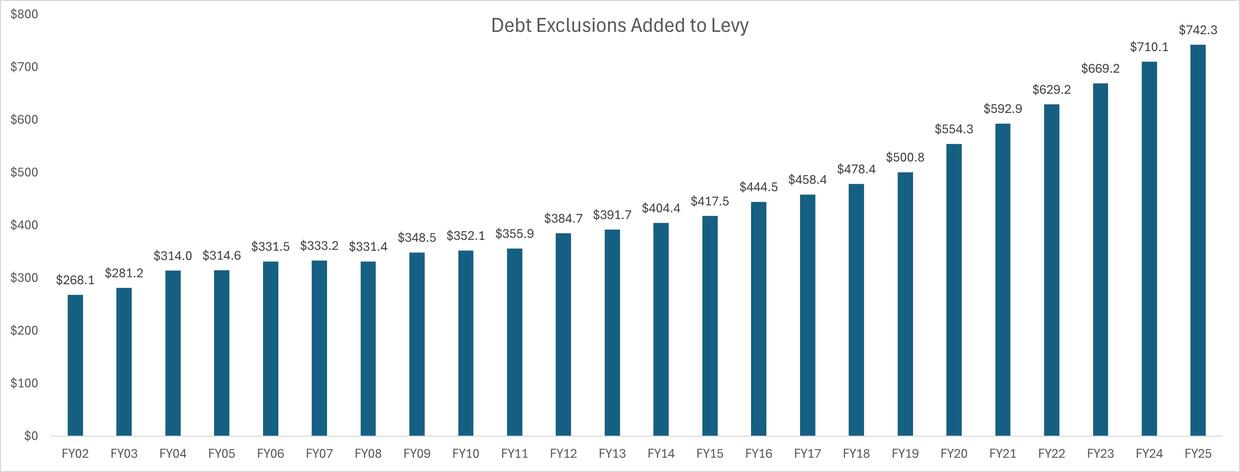

As shown in the first graph below, which uses data as reported to DLS, this is a popular type of Prop 2 ½ ballot question that enables communities to fund large capital projects with, essentially, a dedicated revenue stream. Between 1990 and 2024, there have been 464 total debt exclusion questions put before voters, with 312 (67%) approved. The second graph below shows the amount of additional property taxes raised to pay for the debt service: in FY2025, the amount was $742.3M.

Capital Exclusion

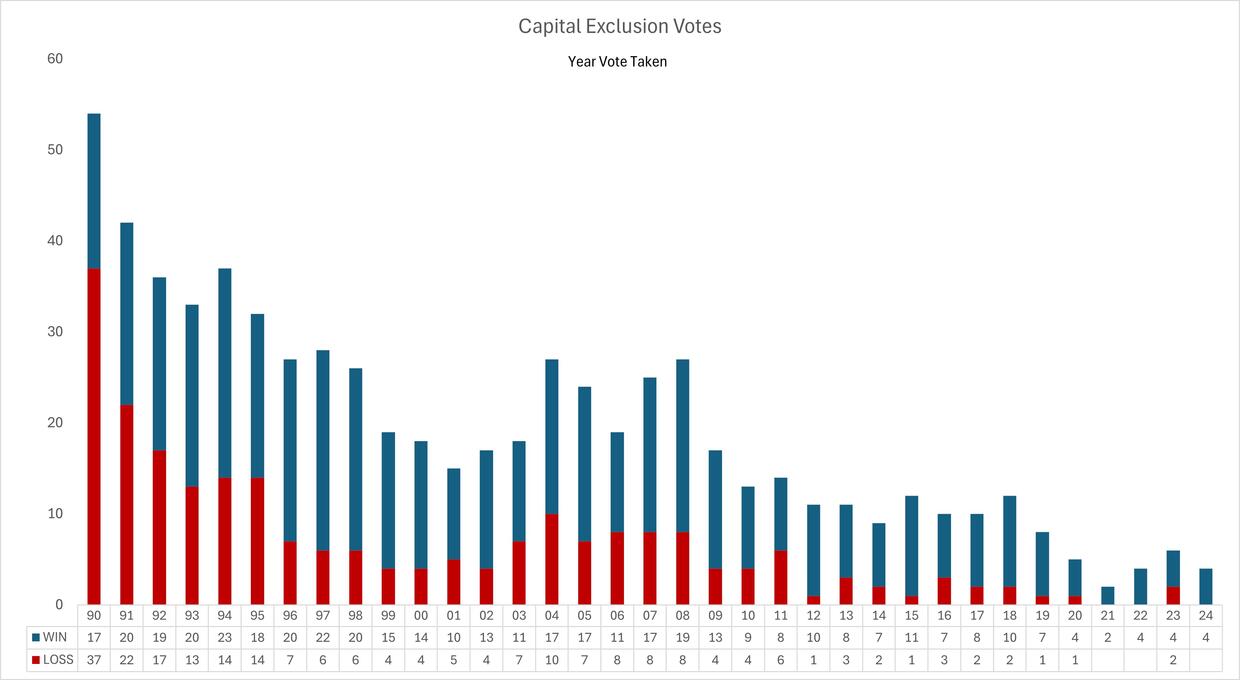

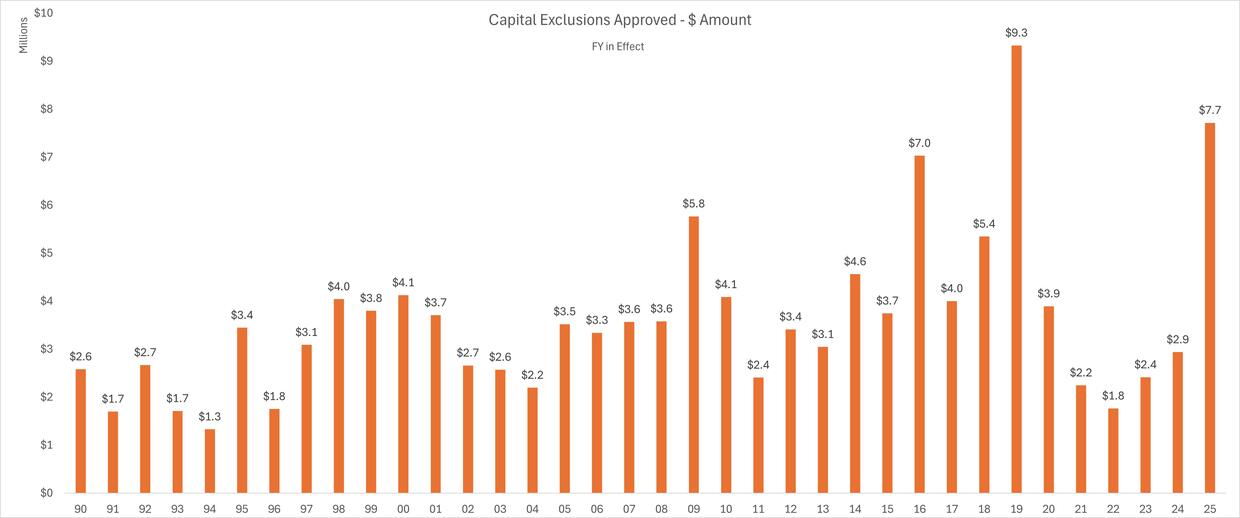

Similar to a debt exclusion, a capital exclusion is allowed under Prop 2½ to raise monies for capital projects; however, a capital exclusion is added to the levy limit only for the year in which the project is expected to be undertaken. As shown in the first graph below, which uses data as reported to DLS, this is another popular type of ballot question: between 1990 and 2024, there have been 235 total capital exclusion questions put before voters, with 122 (52%) approved. The second graph below shows the amount of additional property taxes raised to pay for the projects: in FY2025, the amount was $7.7M, one of the higher amounts in the data set.

All reported votes and historical data can be found on our site. You can estimate what dollar amount an override will cost as it relates to the tax rate. DLS also provides guidance on Prop 2½ ballot questions. The DLS Property Taxes and Proposition 2½ Training and Resources section provides videos and numerous resources related to Prop 2½.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Emily Izzo, Christopher Ketchen, Paula King, Jen McAllister and Tony Rassias

| Date published: | April 17, 2025 |

|---|