Authors: Tony Rassias - Bureau of Accounts Deputy Director

Municipal treasurers and collectors, among other local officials, periodically submit data and other information to the Bureau of Accounts (Bureau) as well as to the Division of Local Services (DLS) Municipal Databank. This article will report results seen by the Bureau from certain treasurer and collector submissions in both tabular and/or graphic form, report financial information that all local financial officials should have an interest in, and finally indicate where these and other results can be found on the DLS website.

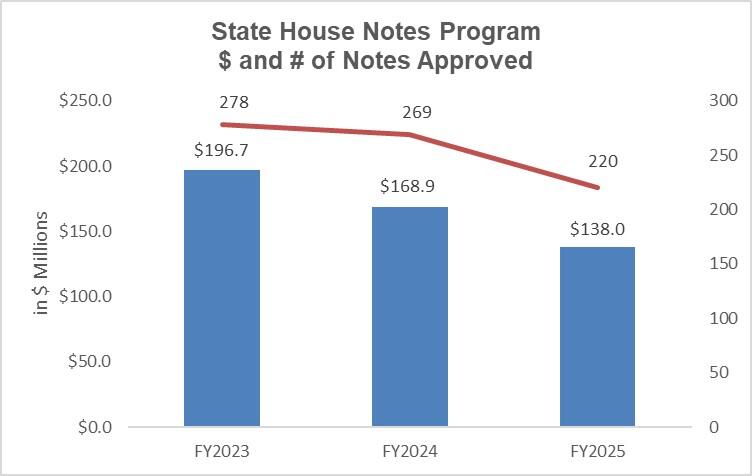

The State House Notes Program

First established in 1911, the Massachusetts State House Notes Program (Program) is a convenient, no-cost note certification procedure for the issuance of short-term debt and long-term serial and refunding notes by a governmental entity. Administered by the Bureau’s Public Finance section, the Program provides an alternative to the certification of Notes procedure by commercial banks.

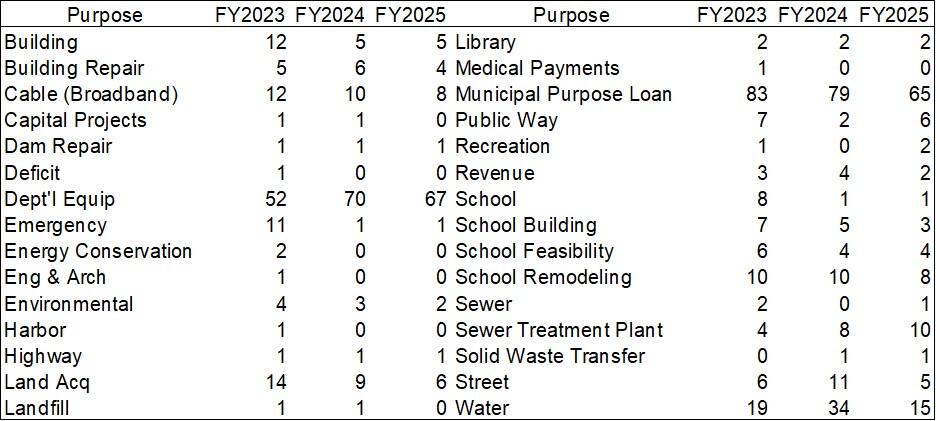

The following graph and tables show the total dollar amount and number of State House Notes certified by the Bureau in recent fiscal years.

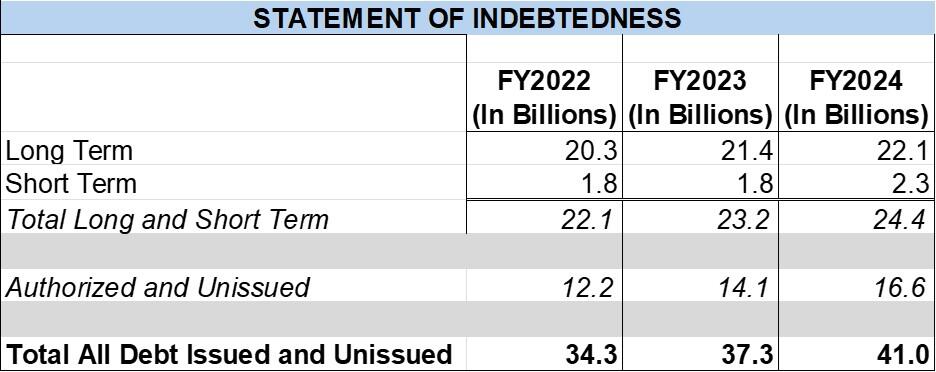

The Statement of Indebtedness (SOI)

G.L. c. 44, § 28 requires the Director of Accounts to maintain complete and accurate records of indebtedness incurred by cities, towns and districts. This statute also requires treasurers to furnish any other information requested by the Director with respect to the authorization and issuance of loans. The Bureau uses this Statement to reconcile against the accounting officer’s balance sheet and Schedule A as of June 30th.

The following table shows for all cities and towns the total of all long-term and short-term debt authorized and issued as well as the total of all debt authorized and unissued for FY2022 to FY2024.

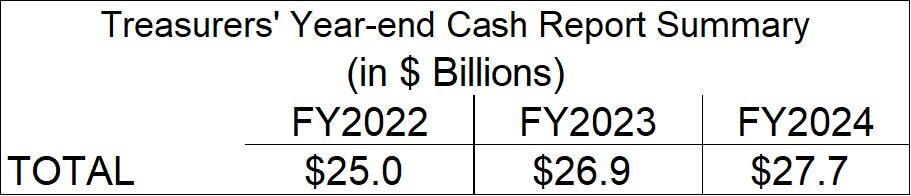

Treasurer’s Year-End Cash Report

This Cash Report demonstrates that the treasurer’s reconciled bank accounts agree with the ledger balances of the accounting officer. The Bureau uses this Report to reconcile against the accounting officer’s balance sheet as of June 30th.

The following table and graph summarize for all cities and towns the total amount of cash in the custody of the treasurer for FY2022 to FY2024 as of June 30th each year.

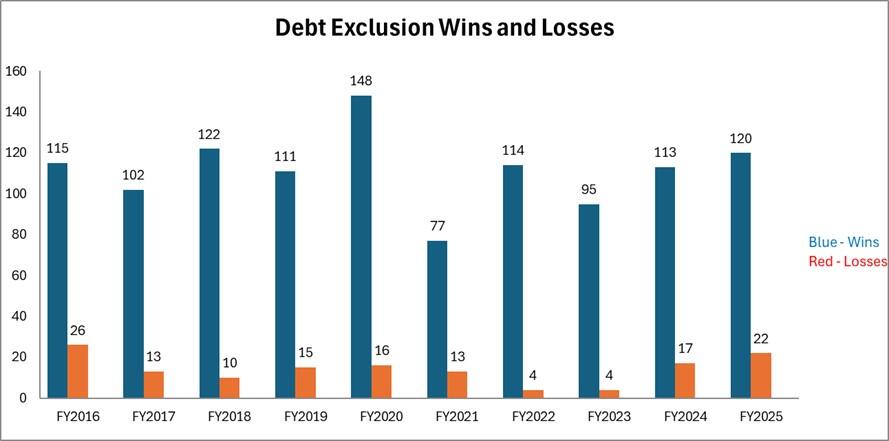

Debt Exclusion Votes

Cities and towns may opt by ballot vote to raise their Prop 2½ property tax levy limit by an amount of debt service being paid annually over time for a given project. The debt exclusion allows the levy limit to be raised above the levy ceiling of 2.5% of total assessed value.

For FY2025, 1,673 total debt exclusions were in effect. There were 285 communities that increased their FY2025 levy limit by debt exclusion, including many having five or less in effect and one having 76.

The following graph shows the number of debt exclusion votes taken by cities and towns and reported to DLS since FY2015 and their won/loss record.

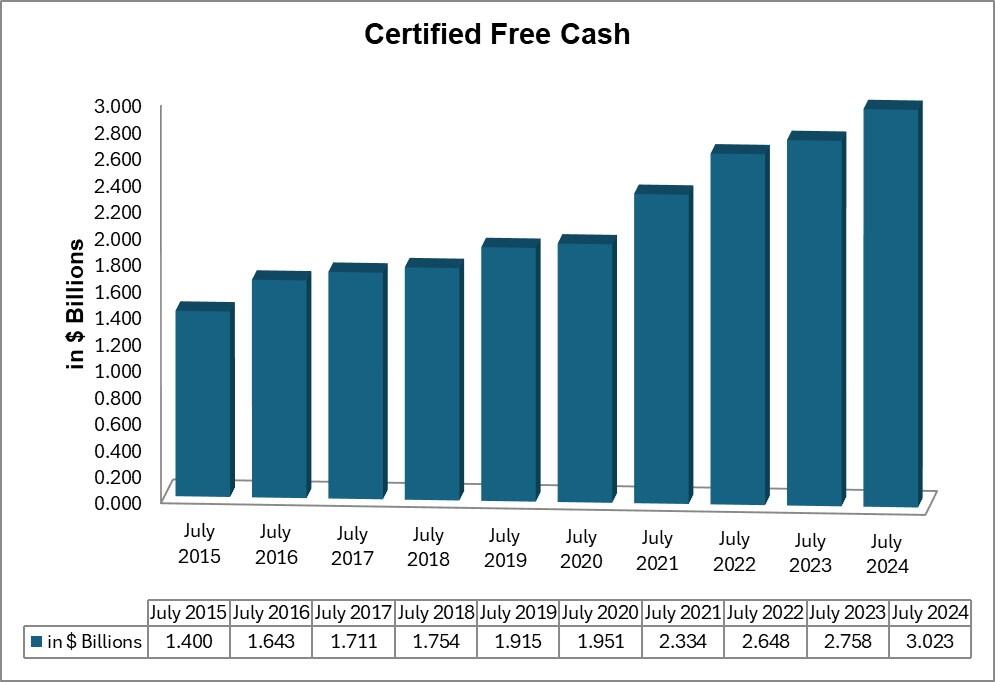

Free Cash

Treasurers and collectors participate in a team approach to address community fiscal issues, help to develop a capital improvement program and policies on risk management. They should be familiar with the term “free cash”, an entity’s General Fund surplus available for legislative body appropriation for any lawful purpose.

The Bureau must first receive and review the community’s balance sheet as of June 30th and from it certify an unobligated surplus prior to appropriation. Any appropriation from free cash cannot exceed the amount certified.

The following graph shows the total amounts certified for cities and towns since July 1, 2015.

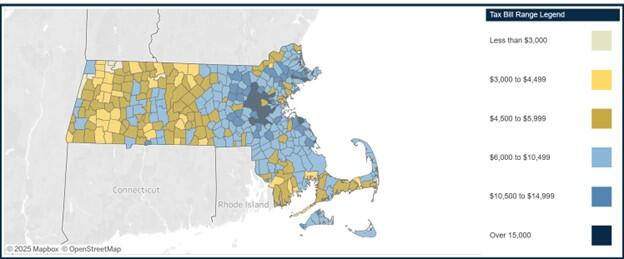

The Average Single-Family Residential Tax Bill

DLS calculates a community’s average single-family residential property tax bill by:

- dividing the total class code 101 assessed property values by the number of single-family parcels to establish an average property value for the class;

- multiplying that average property value by the community’s residential class tax rate as certified by the Bureau for that fiscal year.

The following color-coded map provides a visual representation of the FY2025 community averages around the state.

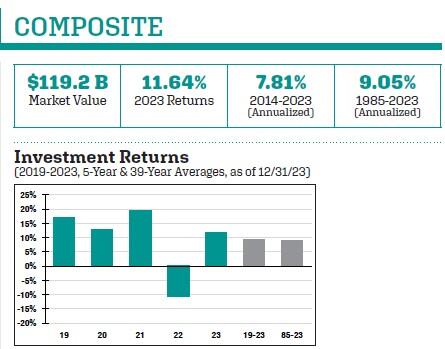

PERAC’s 2023 Annual Report

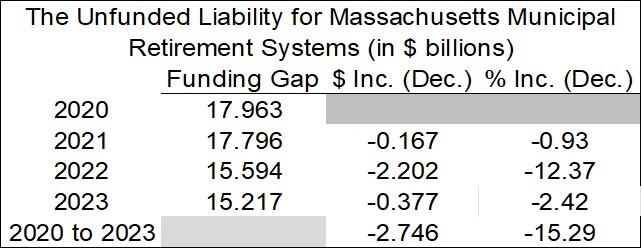

Municipal treasurers who are treasurers of the local retirement system are familiar with the Public Employee Retirement Administration Commission (PERAC) and PERAC’s annual reports. PERAC’s 2023 Annual Report, the latest Report published at the time of this writing, includes composite profile data, individual system data and unfunded pension liability for Massachusetts retirement systems within their purview.

Projecting future pension costs requires an actuarial look at future demographic and economic events such as investment returns, the number of workers, retirees, life expectancy, wage and benefit growth, inflation, and the value of invested assets. On an actuarial basis, these factors show an unfunded liability.

The following table shows unfunded liability reported in PERAC’s Annual Reports for 99 municipal systems from 2020 to 2023. This data does not include 5 state systems or the system reported for Boston Teachers.

Where can I find this information and more?

The Municipal Finance Trends Dashboard and City and Town Data Visualizations found on the DLS website are good places to begin. If you are unable to find the information you are looking for and the information is available in Gateway, the application used by local officials to transact business with DLS, contact the Data Analytics & Resources Databank team at databank@dor.state.ma.us for further assistance.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Tracy Callahan, Sean Cronin, Janie Dretler, Jessica Ferry, Christopher Ketchen, Paula King, Jen McAllister, Brianna Ortiz and Tony Rassias

| Date published: | October 16, 2025 |

|---|