Author: Paula King, BLA Field Advisor

Understanding New Growth and the critical role it plays in the fiscal well-being of a municipality is an important tool to unlocking a broader appreciation for the interconnectivity of local finance in Massachusetts. Before we begin, we recommend reviewing the core aspects of Proposition 2 1/2, including What is New Growth and how is it calculated? and What is the Levy Ceiling and how is it calculated?, please view the Proposition 2 1/2 video playlist. For historical context, please feel free to revisit our two-part series on New Growth published in 2017 in the February 2nd and May 4th editions of City & Town. These articles provided the framework for the following review and analysis.

New Growth is the dollar increase in the annual levy limit that reflects the additional tax revenue generated by new construction, renovations, and other increases in the property tax base during a calendar year. Proposition 2½ allows a municipality a 2½% annual increase to the levy limit restrictions imposed by MGL Ch. 59 §21C, but the levy limit also increases each year with the addition of New Growth as a standard part of the levy limit calculation. This additional increase to the levy limit is permitted based upon the valuation of new construction and other increases to the tax base that are not attributed to market value changes. It does not include value increases caused by normal market forces or by revaluations.

New Growth always increases the tax levy – a building being demolished causing it to lose value or a property that is no longer taxable does not result in a corresponding decrease. (For more information, see IGR 2023-9, Fiscal Year 2024 Guidelines for Determining the Annual Levy Limit Increase for Tax Base Growth.) For example, when a property is subject to taxation for the first time or has an increase in assessed value from the prior year due to a physical change to the existing improvement, that additional value is considered New Growth. These annual increases are allowed so long as they do not result in a levy limit above the levy ceiling of 2 ½ percent of the full and fair cash value of the community. (Chapter 59 Sections 21C(b) and (f)). (For more information, see Proposition 2½ and Tax Rate Process)

Assessors are responsible for identifying and reporting New Growth. This key part of the tax rate setting process requires the assessing office to track and record relevant growth activity on an ongoing basis. State law directs local inspectors to provide written notification to the assessor “for the construction of any building in such city or town or for any substantial alteration or addition thereto.” Assessors should coordinate with the building department and receive permitting information as a way to monitor construction progress and maximize New Growth opportunities. Inspections based on building permits enable assessors to timely measure and update property records which provides the information needed for New Growth. Because New Growth expands the levy limit, it is also a key part of the budget process.

Assessors attempt to ensure all New Growth is captured accurately and completely. One recurring challenge that comes up every year is what does and does not qualify as growth. Routine maintenance such as new siding, a new roof, new windows or changes to grade and condition does not qualify. Just because a building permit is issued, it does not automatically result in New Growth. Assessors should carefully follow the guidelines established by the Bureau of Local Assessment and contact their BLA advisor if they have any questions.

Assessors should maintain detailed information on its New Growth utilizing the LA13 New Growth template. Whether reporting growth for real or personal property, it is essential that assessors provide a brief description of what the New Growth consists of in the comment section. The personal property account is an area where municipalities can typically see large increases in growth. As a result, we encourage assessors to review all personal property accounts, including the prior year’s assessed values. It’s important for assessors to distinguish between what is a new account and what is considered New Growth. For example, an established business is identified incorrectly as a new account and the value in the account is improperly identified as growth, thereby impacting the growth total. There may be instances when the entire value of an existing personal property account would qualify as growth, but only if the business replaced all its existing personal property.

Another item for assessors to review is a personal property account that has had a significant drop in value from the prior year, but also has a large amount of growth. Again, in certain instances, this may be considered New Growth, however, if the local House of Pizza changes its ownership and name to “Joe’s Pizza Palace,” the personal property does not qualify as growth unless it is replaced with new machinery/equipment and furnishings. A new account resulting from a change in ownership alone does not qualify as New Growth.

Real and personal property New Growth in and of itself is a good indication of the investment occurring in a community. Tax base growth under Proposition 2 ½ includes any parcel of real or personal property that falls under the following conditions:

- The property is subject to taxation for the first time, such as new articles of personal property or an exempt property that is no longer tax exempt.

- The property is being taxed as a separate parcel for the first time. This is usually subdivisions or condo conversions.

- The property has increased in assessed valuation over the prior year if it is not due to a revaluation program, for example, when a new deck or an addition is added to an existing improvement.

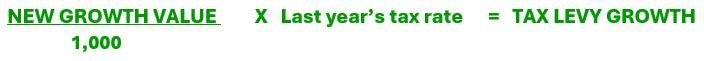

The purpose of this provision is to recognize that new development will lead to more municipal costs. For example, new development may mean more wear and tear on the roads, more children in schools, or more calls to police and fire. Instead of reallocating a fixed levy limit to an expanded tax base, the provision increases the levy limit by an amount equal to the assessed value of new growth divided by 1000 and multiplied by the prior year’s tax rate for the appropriate property class.

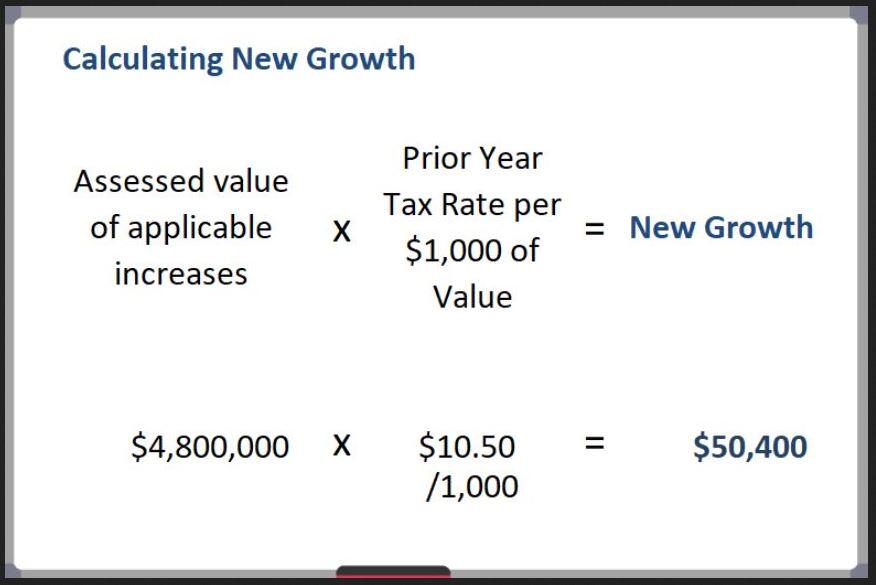

New Growth represents the amount that would have been generated if the value had been included in the previous tax year levy. It is calculated by multiplying the assessed value associated with applicable increases by the prior year’s tax rate and then added to the current year’s levy limit.

Please see below for a numeric representation of the New Growth calculation. The aggregate value of increases due to new construction and renovations for the year is $4.8 million. We multiply that by the prior year’s tax rate of ten dollars and fifty cents per $1,000 of value to arrive at a new growth value of $50,400.

Capturing new growth can be a fluid process as construction and renovation projects do not fit neatly into the fiscal year schedule, and oversights can occur. Assessors must complete additional adjustments utilizing the Omitted & Revised form in order to capture additional growth that was overlooked in the initial assessment. This additional growth is added to the prior fiscal year’s levy limit going forward.

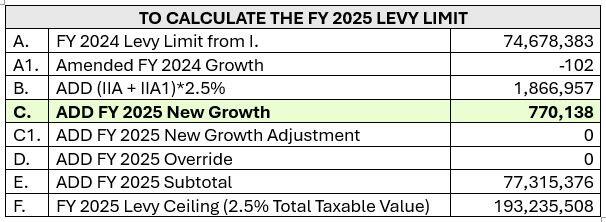

Let’s put this all together and calculate a levy limit.

We hope you find this information useful. In an upcoming edition of City & Town, we’ll build upon our understanding of New Growth to analyze data trends and geographic impacts of New Growth across the Commonwealth. If you’d like to review additional information related to New Growth, please see the DLS Municipal Trend Dashboard - New Growth Analysis webpage. If there is a topic or area of assessing you’d like to learn more about, please email us at bladata@dor.state.ma.us.

Helpful Resources

City & Town is brought to you by:

Editor: Dan Bertrand

Editorial Board: Marcia Bohinc, Linda Bradley, Sean Cronin, Emily Izzo and Tony Rassias

| Date published: | April 4, 2024 |

|---|