- Office of the State Auditor

- Division of Local Mandates

Media Contact

Noah Futterman

Boston — A report issued today by State Auditor Suzanne M. Bump pointed out that the Commonwealth’s payments in lieu of taxes (PILOT) program for state-owned lands (SOL) is underfunded and disproportionately disadvantages smaller, rural communities in favor of larger, wealthier communities. Additionally, the report finds that state laws governing taxes paid to cities and towns by solar power generators are outdated, confusing for both municipalities and the solar operators, and may slow the adoption of solar technologies.

PILOT programs help municipal governments replace some or all revenue lost from certain state property tax exemptions, such as those associated with nonprofit organizations, recreational areas, and properties owned by the Commonwealth. This is the first report from the Office of the State Auditor in 19 years to look at PILOTs for state-owned land and the first ever to review the solar energy facility PILOT program.

“These PILOT programs were designed to help communities with significant state-owned land holdings and to promote solar development, but chronic underfunding of the former and rulings from the Appellate Tax Board on the latter have blunted their impact,” Bump said. “There are simple steps lawmakers can take to get these programs back on track: provide adequate funding, implement provisions to protect communities with declining property values, and clarify that solar tax exemptions are designed for residential and small commercial installations. At a time when municipalities are facing historic financial challenges, I encourage the Legislature to act quickly on these recommendations.”

SOL PILOT Program is Underfunded

The SOL PILOT Program provides reimbursements payments to municipalities for tax-exempt land owned by the Commonwealth. In the last twenty years, the program’s funding has not met statutory obligations to reimburse municipalities. Since fiscal year 2009, the SOL PILOT Program’s appropriation has remained flat, at close to $30 million, meanwhile property tax collections across the state have increased by approximately 57 percent during the same period. Bump’s study estimates that if the Legislature were to fully fund the SOL program, it would need to increase this allocation to at least $45,650,194.

Quote from Linda Dunlavy, Executive Director of the Franklin Regional Council of Governments:

“The State-Owned Land PILOT Program represents a pact: cities and towns will house and provide critical services for untaxed properties that benefit the public, such as universities, recreational lands, and government buildings, and in exchange, the state government will ensure they are fairly compensated. But years of underfunding of this critical program have strained this agreement and local budgets. With COVID-19 challenging local government budgets like never before, now is the time for the Commonwealth to finally fully fund this important program.”

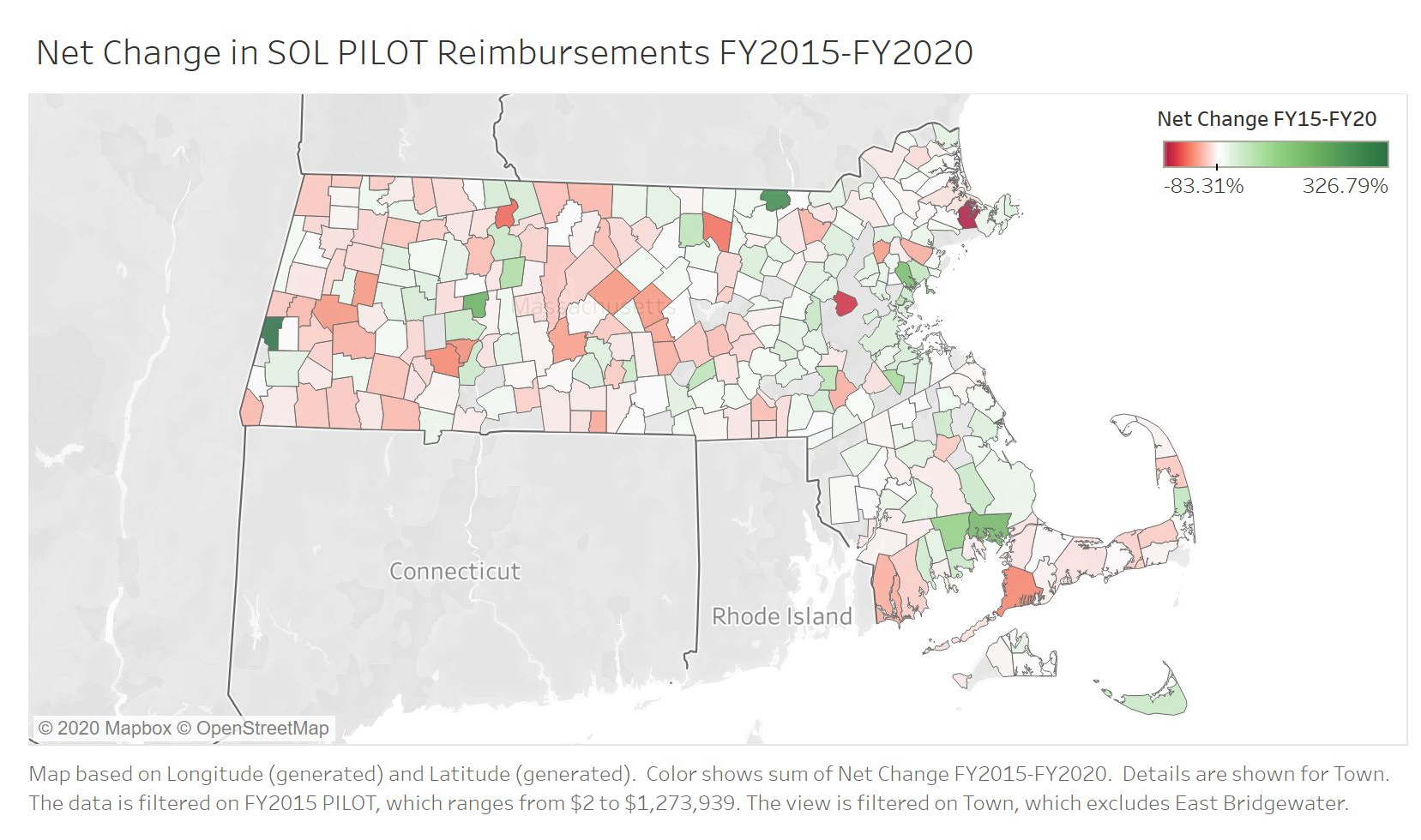

SOL PILOT Funding Formula Exacerbates the East-West Divide

Under the SOL PILOT Program’s funding formula, reimbursements are partly based on each municipality’s state-owned land value. Bump’s study notes that communities with decreasing, stagnant, or slowly increasing property values have seen reductions in their PILOT payments. As a result, communities in the eastern part of the state, where property values have consistently risen, have seen their SOL PILOT reimbursements increase, while reimbursements to communities in the western part of the state have generally decreased.

Bump urges the Legislature to add a hold harmless provision to the SOL Pilot Program to ensure communities with property values that are declining or growing at below average rates do not see their reimbursements reduced.

Quote from Sen. Adam Hinds:

“The implementation of PILOT for state-owned land has resulted in an unequal system that is detrimental to small towns. I appreciate that the Auditor is putting forth clear and concrete findings and recommendations that we can use to reform or improve the implementation of the program in our Commonwealth.”

Confusion about PILOT Agreements Stymies Solar Development

Under state law, municipalities can enter into PILOT agreements with energy generation companies, including solar energy producers. Such agreements provide predictable revenue for the communities and security to generation facilities by allowing them to anticipate future tax payments. However, decisions by the Appellate Tax Board have allowed large commercial solar facilities to avoid paying personal property taxes on their equipment by taking advantage of an exemption on solar equipment that was designed to promote residential and small commercial solar installations. These rulings have created confusion for local officials and may result in slower rates of solar development in the future. The study calls on the Legislature to clarify the solar property tax exemption and the tax status of solar facilities that may be eligible to enter into a PILOT agreement.

Senator Michael Rodrigues and Representative Jeffrey Roy have brought forward bills to address these problems by clarifying the solar tax exemption and resolving issues resulting from the ATB rulings.

Quote from Lane Partridge, the Assessor of the Town of Concord and past president of the Massachusetts Association of Assessing Officers:

“The Auditor’s report confirms the challenges local officials and municipalities have been having administering the solar property tax exemption law and the need for legislative change. These provisions were enacted many decades ago and are outdated in terms of technology or current municipal practices. We will continue to work with all stakeholders to address this issue and update the law."

The Office of the State Auditor’s Division of Local Mandates (DLM) produced the study. In addition to responding to requests from local governments about potential unfunded mandates, DLM also produces Municipal Impact Studies, such as this one, that provide deep analysis of aspects of state law that have significant fiscal impacts on municipalities.

An overview of the report’s findings and recommendations is available here.

###