Office of the Governor

The Office of the Governor (GOV) was established under Section I of Chapter II of the Constitution of the Commonwealth. It consists of the Offices of the Governor and the Lieutenant Governor, both of whom are elected every four years. The Governor and Lieutenant Governor oversee a cabinet consisting of the secretaries of the following offices:

| Executive Office for Administration and Finance (A&F) | Executive Office of Labor and Workforce Development (EOLWD) |

| Executive Office of Education (EOE) | Executive Office of Public Safety and Security (EOPSS) |

| Executive Office of Energy and Environmental Affairs (EEA) | Executive Office of Technology Services and Security (EOTSS) |

| Executive Office of Health and Human Services (EOHHS) | Massachusetts Department of Transportation (MassDOT) |

| Executive Office of Housing and Livable Communities (EOHLC) | Executive Office of Veterans Services |

| Executive Office of Economic Development (EOED) |

Each secretary is appointed by the Governor and is responsible for overseeing the activities of the executive offices and agencies within the secretariat. GOV sets policy for implementation by all cabinet secretariats, agencies, offices, commissions, boards, and other entities within the state executive department to achieve GOV’s mission.

According to GOV’s internal control plan,

The Office of the Governor is committed to making Massachusetts a truly great place for all individuals to live, work, start a business, raise a family, and reach their full potential. It will work toward a growing economy with family-sustaining jobs; ensure that schools across the Commonwealth provide opportunity for every child regardless of zip code; improve the delivery of state services; and make Beacon Hill a true partner with our local governments to create safer and thriving communities across Massachusetts.

Office of the Comptroller of the Commonwealth

According to the Office of the Comptroller of the Commonwealth’s (CTR’s) website,

[CTR’s] mission is to oversee the Commonwealth’s financial systems, promoting integrity, mitigating risk, and providing accurate reporting and promoting transparency to illustrate the financial health of Massachusetts. . . . We promote accountability, integrity, and clarity in Commonwealth business, fiscal, and administrative enterprises.

CTR is an independent agency established by Section 1 of Chapter 7A of the Massachusetts General Laws. The Comptroller is the administrative and executive head of CTR and is appointed by the Governor for a term that runs concurrently with the Governor’s term.

Section 2 of Chapter 7A establishes an advisory board to the Comptroller as follows:2

There shall be an advisory board to the comptroller which shall consist of the attorney general, the treasurer, the secretary of administration and finance who shall be the chairman, the auditor, the court administrator of the trial court, and two persons who have experience in accounting, management, or public finance who shall be appointed by the governor. . . .

Said advisory board shall provide advice and counsel to the comptroller in the performance of his duties. The advisory board shall be responsible for reviewing any rules or regulations promulgated by the comptroller prior to their implementation. The advisory board shall also review prior to publication the annual financial report of the commonwealth published by the comptroller.

CTR oversees more than $123 billion in state revenues and expenditures. Its offices are located at 1 Ashburton Place in Boston.

State Employee Settlement Agreements

Initial research revealed that state agencies did not have a consistent, comprehensive, established definition of what constitutes a state employee settlement agreement. In our opinion, this creates a risk of unfair, disparate treatment, as well as a lack of transparency for settlement activity across state government. For the sake of consistency in the audit, we defined a state employee settlement as a settlement resulting from a formal claim3 (union and non-union grievances, complaint, or lawsuit) against a state agency brought by a current or former employee.

State employee settlement agreements can result from claims including, but not limited to, discipline and termination, discrimination, position classifications, employment conditions, promotion, vacation, and sick leave. Claims also include complaints settled through the Massachusetts Civil Service Commission, Massachusetts Commission Against Discrimination, Massachusetts Department of Labor Relations, Massachusetts Human Resources Division, and grievance procedures as part of collective bargaining agreements.

The Office of the Attorney General is only involved in another state agency’s settlement process if that process goes to court. For the purposes of this audit, we reviewed state employee settlement agreements that resulted in monetary and non-monetary awards.

During the audit, we requested from all agencies listed in Appendix C all policies and procedures in effect during the audit period regarding the use of state employee settlement agreements. No agency (0%) had its own internal policy on how a state employee settlement agreement is defined, when one would be considered or used, or how it would be developed.Agencies provided us union agreements that documented their grievance process with certain labor unions, if a unionized employee were to file a grievance.

Instead of providing us agency policies on the consideration, development, and use of state employee settlement agreements, state agencies cited guidance from CTR that provided detail on how CTR defines a state employee settlement agreement. Agencies informed us that they follow CTR’s policy for processing and reporting state employee settlement agreements. CTR uses this definition to identify state employee settlement agreements that are able to be paid by the Settlements and Judgments fund administered by CTR. This guidance does not serve as agency policy regarding the use or development of state employee settlement agreements. This policy relates to the payment of settlements and provides only limited instruction on what a state agency should do when claims, subpoenas, or other complaints are received.

Settlements and Judgments Fund

The Settlements and Judgments fund is a reserve appropriation within the Commonwealth’s annual budget. It was created in 1985 and is administered by CTR to fund certain court judgments, settlements, and legal fees. A state agency entering into an employee settlement may use the Settlements and Judgments fund administered by CTR.

CTR promulgated Section 5 of Title 815 of the Code of Massachusetts Regulations (CMR), which documents how state employee settlement agreements are to be paid for by state agencies. According to 815 CMR 5.01, this regulation was established for the following purpose:

(1) The purpose of [this regulation] is to clarify the procedures by which agencies may preserve the availability of funds and may obtain access to funds for the payment of judgments and settlements. Such clarification will:

(a) Aid agencies in making the payment of judgments and settlements a part of their current year operation or capital project budgeting; and

(b) [Ensure] faster payment of judgments and settlements, which will lessen the waiting time for successful claimants and litigants against the Commonwealth and its agencies and minimize the amount of any applicable interest.

(2) [This regulation] shall identify funds legally available for payment, and shall minimize the need to use deficiency payments for judgments and settlements of claims against the Commonwealth. 815 CMR 5.00 shall also prevent any use by agencies of the Commonwealth of funds not legally available for payments of such judgments and settlements.

As part of administering the Settlements and Judgments fund, CTR must submit a quarterly Settlement Judgment Transparency Report4 to the Legislature to report on the financial activity of the fund. These reports do not include department-funded settlement payments as those payments fall outside the scope of the statutory reporting requirement. (See Other Matters.)

Payment of State Employee Settlement Agreements

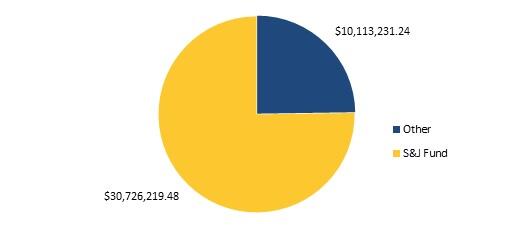

Under 815 CMR 5.06, subject state agencies are allowed to pay state employee settlements by using either (1) the agency’s current year operating budgets (salary line items) without regard to the year in which the claim(s) arose or (2) by accessing the Settlements and Judgments fund administered by CTR. As CTR processes claims on behalf of departments, all monetary settlements5 must be reviewed by CTR prior to payment regardless of whether they are paid from the Settlements and Judgments fund. During our audit, we identified more than $40.8 million paid by the Commonwealth in employee settlement agreements. See chart below for funding sources disclosed by agencies.

Source of Funding for State Employee Settlement Agreements

January 1, 2010 through December 31, 2022

Note: Other includes department funding sources chosen by the agency that funded the settlement.

Under 815 CMR 5.09, agencies are required to notify CTR within 15 days when a state employee settlement agreement involves a monetary award to be paid to the current or former employee, regardless of whether that settlement is ultimately paid from the Settlements and Judgments fund. In addition to the Settlement Agreement and General Release, agency employees must submit a completed “815 CMR 5.00 Non-Tort Settlement/Judgment Authorization Form” or “S&J Form” to CTR that details information on the claimant, employment status (current or former), department, settlement type, amount of payment, amount of attorney fees, amount of any interest due,6 and payment type (through CTR or the department). CTR checks that the “S&J Form” contains approvals from the agency’s chief fiscal officer and agency counsel. In certain circumstances, approval is required from the Office of the Attorney General and A&F for state employee settlement agreements greater than $250,000.7 If the required information has been supplied, CTR continues to review the form to determine whether there is a single claimant or multiple claimants and whether the claimant(s) name(s) will be withheld from public disclosure.

Claims with sufficient information provided by a department are entered as records into CTR’s Settlements and Judgments Access database. CTR conducts a secondary review of the state employee settlement agreement and payment information. CTR confirms the availability of sufficient funding to pay the claim through the Massachusetts Management Accounting and Reporting System (MMARS) and consults with the department if there are any issues. In addition, CTR ensures that the payments are made using the appropriate MMARS codes for correct financial reporting. It also ensures that proper tax withholdings and tax reporting are made by the department. Once the review is complete, CTR sends an approval email to the department.

Whether an agency makes a settlement payment using its department appropriations or the Comptroller makes the payment using the Settlements and Judgments fund, there is one main MMARS expenditure object code designated for employment-related settlements and judgments (A11). Within the Settlements and Judgments Access data provided to us, we found 22 additional MMARS codes used for logging state employee settlement agreement payments (Appendix B). The MMARS settlements and judgments code contains employment-related claims, including any claim for damages arising out of an individual’s employment by the Commonwealth, such as awards of back pay for improper termination, lump sum awards, discrimination claim awards, emotional distress awards, and attorney fees and costs. This MMARS code does not include retroactive salary adjustments, unpaid regular time, periodic collective bargaining agreement increases, or any other payment adjustments that are not the result of a claim or lawsuit filed against the department that results in a court judgment, administrative order, or state employee settlement agreement.

Confidentiality Language in State Employee Settlement Agreements

During the audit period, the executive branch agencies under audit had no documented policies in place over the use of nondisclosure agreements or confidentiality clauses related to state employee settlement agreements. However, in response to our inquiries, some agencies informed us they did not use nondisclosure agreements or confidentiality clauses in their state employee settlement agreements; however, we were prevented from verifying these claims because we were not provided any documentation to substantiate them.

Some state employee settlement agreements have been found to be inherently public records. In [Boston] Globe Newspapers Co Inc. vs. Executive Office of Energy and Environmental Affairs et al., a declaratory judgment, dated June 14, 2013, found that records of separations, severance, transition, or settlement agreements entered into by state agencies and public employees, or records of payments made from the Settlements and Judgments fund by the Comptroller, are public records subject to mandatory disclosure. Employee addresses, phone numbers, and other personal information can be redacted in certain cases. The court weighed whether public employees’ privacy rights take precedence over the public’s right to know about government expenditures. The court stated a public employee’s identity and the information contained within the agreement are wholly unrelated to an individual’s privacy interest and, therefore, are not subject to privacy exemption. Therefore, the disclosure of a state employee settlement agreement with the employee’s identity, current or former work entity, the financial terms of the agreement, and various legal provisions do not implicate a right to privacy.

According to A Guide to Massachusetts Public Records Law by the Public Records Division of the Secretary of the Commonwealth’s office:

The public interest in the financial information of a public employee outweighs the privacy interest where the financial compensation in question is drawn on an account held by a government entity and comprised of taxpayer funds. Additionally, the disclosure of the settlement amount would assist the public in monitoring government operations. Therefore, exemptions to the Public Records Law will not operate to allow for the withholding of settlement agreements as a whole. However, portions of the agreements, and related responsive records, may be redacted pursuant to . . . the Public Records Law.

While certain information could be redacted from settlement documents, the state employee settlement agreement itself is a public document subject to disclosure and public inspection.

State Employee Settlement Agreements by the Numbers

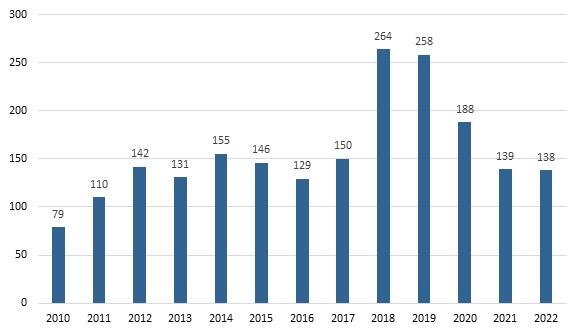

Based on state employee settlement agreement lists provided to us by the executive offices and agencies listed in Appendix C, during the period of January 1, 2010 through December 31, 2022, the audited agencies entered into 2,029 state employee settlement agreements with a total cost in excess of $40,839,452. On average, these agencies entered into 156 state employee settlement agreements per year with an average cost of $20,128 per settlement.8 The number of state employee settlement agreements peaked in 2018 to over 250 settlement agreements. Settlement activity was high by historical standards in 2019 as well. EOPSS had two class action settlements in 2014 and 2015 that were consolidated into two respective settlements. The 2014 class action included 2,750 total employees, and the 2015 class action included 2,732 total employees. See the chart below.

Settlement Activity by Year

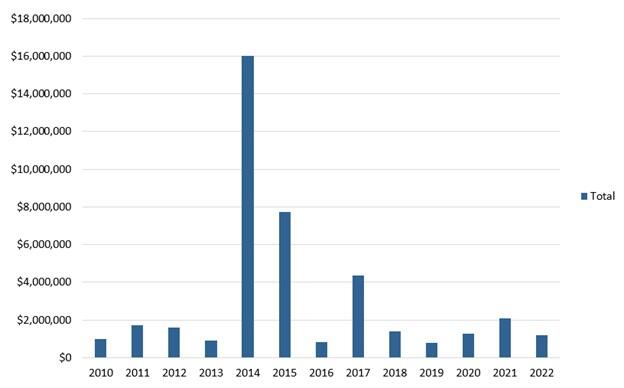

The dollar value of each state employee settlement agreement is determined by negotiations between the state agency and the employee or their representative. Agencies’ employee settlement costs peaked in 2014 at nearly $16,007,000 because of a large class action suit settled by EOPSS that exceeded $14,053,000. See the chart below.

Settlement Activity Cost by Year

| Year | Settlement Cost |

|---|---|

| 2010 | $ 970,461 |

| 2011 | 1,713,890 |

| 2012 | 1,586,816 |

| 2013 | 915,276 |

| 2014 | 16,006,909 |

| 2015 | 7,735,073 |

| 2016 | 811,231 |

| 2017 | 4,349,500 |

| 2018 | 1,408,157 |

| 2019 | 790,806 |

| 2020 | 1,255,220 |

| 2021 | 2,092,625 |

| 2022 | 1,203,485 |

| Grand Total | $ 40,839,452* |

* Discrepancy in total is due to rounding.

Between January 1, 2010 and December 31, 2022, executive offices and agencies self-reported settlement activity ranging from 1 settlement to 624 settlements.9 Over the audit period, the three offices with the highest settlement counts were EOHHS (624), EOPSS (579), and MassDOT (527). The offices with the highest settlement costs over the audit period were EOPSS ($25,499,440), EEA ($5,176,923), and EOHHS ($4,301,466). See the table below.

Number of Self-Reported Settlement Agreements and Total Cost of Settlements by Agency during the Audit Period

| Self-Reported Settlements Disclosed During the Audit Period | Amount ($) | |

|---|---|---|

| EOPSS | 579 | $ 25,499,440 |

| EEA | 108 | $5,176,923 |

| EOHHS | 624 | $4,301,466 |

| MassDOT | 527 | $3,714,634 |

| EOE | 58 | $667,973 |

| EOLWD | 37 | $576,405 |

| A&F | 58 | $303,410 |

| EOTSS | 14 | $291,933 |

| GOV | 1 | $62,500 |

| EOED | 7 | $172,229 |

| EOHLC | 15 | $72,539 |

| CTR | 1 | $0 |

| Total | 2,029 | $ 40,839,452 |

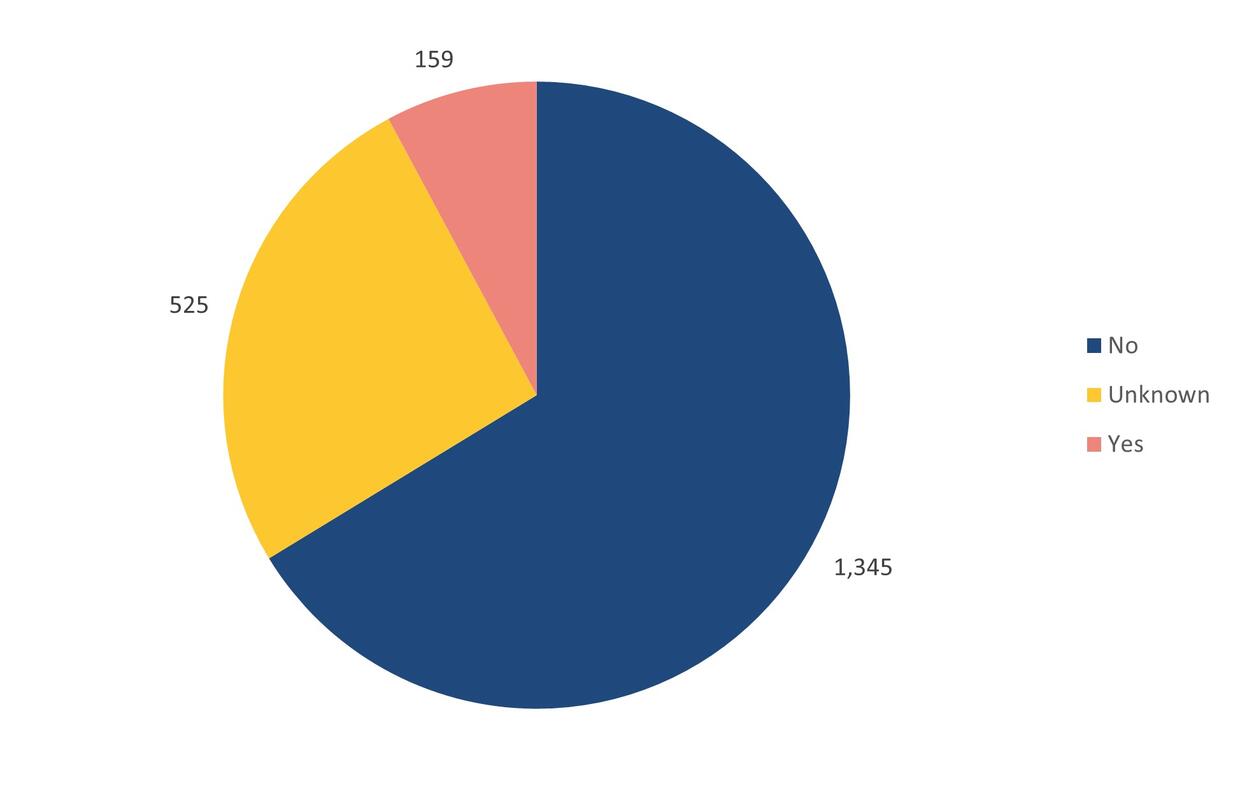

Within the list of 2,029 state employee settlement agreements provided to us, which we were not able to verify are all the settlement agreements that were executed during our audit period, state agencies claimed that only 146 of these state employee settlement agreements contained some form of confidentiality language. We identified 13 more settlements that included confidentiality language during our review of settlement agreements, bringing the total to 159. However, due to departments’ reported failure to retain appropriate documentation, we were unable to verify these claims and it is possible that some, or many, additional confidentiality clauses exist that were not reported to us. Departments claimed that they were unable to determine whether this language was present in 525 other state employee settlement agreements because they indicated that they do not have access to the executed state employee settlement agreement or left the field blank. See the chart below.

State Employee Settlement Agreements Containing Confidentiality Language During the Audit Period, as Self-Reported by State Agencies

Our analysis of the 159 state employee settlement agreements with confidentiality language revealed that EOHHS reported that it used confidentiality language in 73 state employee settlement agreements, the most during the audit period. We found an inconsistency in the usage of confidentiality language, varying by agency. For instance, 34 (or 92%) of EOLWD’s 37 state employee settlement agreements for the audit period reportedly included some form of confidentiality language. MassDOT claimed that only 5 (1%) of its 527 self-reported state employee settlement agreements contained confidentiality language. Our office was unable to verify all of these claims. See the tables below.

Use of Confidential Language in Executive Office Agencies (Self-Reported)

| Executive Office | Number of Settlements with Confidentiality Language* | Total Number of Settlements | Agency Percentage Use |

|---|---|---|---|

| A&F | 19 | 58 | 33% |

| EOE | 1 | 58 | 2% |

| EOED | 2 | 7 | 29% |

| EEA | 11 | 108 | 10% |

| EOHLC | 2 | 15 | 13% |

| EOLWD | 34 | 37 | 92% |

| EOTSS | 9 | 14 | 64% |

| GOV | 1 | 1 | 100% |

| EOHHS | 75 | 624 | 12% |

| MassDOT | 5 | 527 | 1% |

| Grand Total | 159 | 1,449 | 11%** |

* Settlement agreements, and the use of confidentiality language in those agreements, are self-reported by agencies. Each agency is reported as part of its executive office.

** Please note that this is the percentage of employee settlement agreements from the audit period with confidentiality language.

Cost of Settlements That Included Confidentiality Language (Self-Reported)

| Executive Office | Number of Settlements with Confidential Language | Cost of Settlements with Confidentiality Language |

|---|---|---|

| A&F | 19 | $153,710 |

| EOE | 1 | $- |

| EOED | 2 | $152,230 |

| EEA | 11 | $693,266 |

| EOHLC | 2 | $31,121 |

| EOLWD | 34 | $71,115 |

| EOTSS | 9 | $226,600 |

| GOV | 1 | $62,500 |

| EOHHS | 75 | $838,344 |

| MassDOT | 5 | $74,966 |

| Grand Total | 159 | $2,303,851* |

* Discrepancy in total is due to rounding.

Appendices A, D, and E present further data on the funding source and claim type by department, as well as a list of employee settlement agreements with confidentiality language reported.

| Date published: | January 28, 2025 |

|---|