Overview

Chapter 55 of the Acts of 2017 established the Cannabis Control Commission (CCC) as the independent agency responsible for developing and enforcing regulations over the marijuana industry in Massachusetts. According to its website, CCC’s mission is to “safely, equitably, and effectively [implement and administer] the laws enabling access to medical and adult use marijuana in the Commonwealth.”

CCC is overseen by five commissioners, with one each appointed by the Governor, the Attorney General, and the Treasurer and Receiver General and two appointed by a majority vote of those three officials. The Treasurer and Receiver General designates the chair of CCC and the commissioners appoint an executive director to oversee the day-to-day management of the agency.

CCC is headquartered at 2 Washington Square in Worcester and received total appropriations of $15,217,877, $19,218,649, and 19,763,742 in fiscal years 2022, 2023, and 2024, respectively.

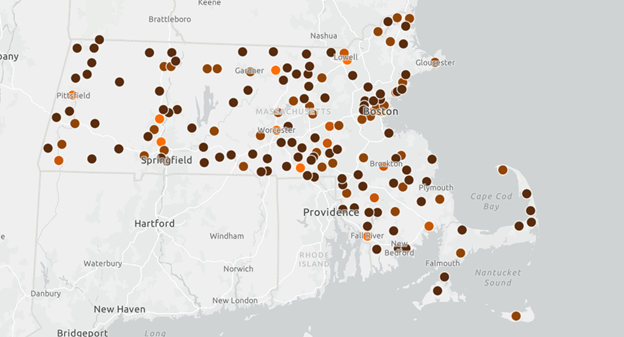

Marijuana Establishments in Massachusetts

Note: The dots on this map indicate locations of marijuana establishments and are colored by density—the darker the color of the dot, the more marijuana establishments there are in the area.

Marijuana Regulation Fund

Section 14 of Chapter 94G of the General Laws established a marijuana regulation fund (MRF) consisting of all money received by the Commonwealth for marijuana establishment licensing fees, all penalties imposed on marijuana establishments for violations of Chapter 94G of the General Laws, and all revenue generated by the excise tax on cannabis products established in Section 2 of Chapter 64N of the General Laws.

Money from the MRF is appropriated by the Massachusetts Legislature to support various state agencies, including CCC, as part of the annual budget process. According to Section 14(b) of Chapter 94G of the General Laws, these funds are used for the “implementation, administration and enforcement of [laws and regulations related to cannabis production, distribution, and possession] by the commission and by the department of agricultural resources.” Also, 15% of the MRF is transferred to the Cannabis Social Equity Trust Fund, which was established in Section 14A of Chapter 94G of the General Laws. During fiscal years 2022 through 2024, all money appropriated to CCC came from the MRF.

Licensing

Section 5 of Chapter 94G of the General Laws and Section 500 of Title 935 of the Code of Massachusetts Regulations (CMR) give CCC the authority to review applications for new licenses for prospective marijuana establishments and applications for renewals of existing licenses. This process is administered through the Massachusetts Cannabis Industry Portal (MassCIP). Applicants submit their license applications through MassCIP. The licensing process includes multiple stages, including application submission, provisional license approval, architectural review (if required), final licensing approval, and annual renewal.

Prorated Fees for Extensions

In August 2022, CCC voted to allow license extensions1 at the discretion of the executive director for up to 120 calendar days. Licensing staff members originally managed extension requests using a Microsoft Excel spreadsheet and prorated the fee for the extension based on the number of days by which the license was extended. CCC voted in May 2024 to extend the authority to grant administrative extensions to the chief of investigations and enforcement, allowing licensees to request an additional 120 to 240 calendar days on top of the original 120-day extension.2 Following this change, the licensing team notified the investigations and enforcement team of prorated fees that had not yet been collected from licensees who received extensions. The licensing team created a tracker to document licensees who had received extensions and identified 161 cases where fees were due.

By November 2024, CCC had formalized the extension request process by introducing a License Extension Application in MassCIP, requiring licensees to submit extension requests through the system before their license expiration date. Licensees must submit both their extension request and prorated fee payment through MassCIP, where CCC employees review the request within the system. Once CCC employees have reviewed and approved the request and the fee has been paid, MassCIP sends an automated notification to the licensee through MassCIP confirming the extension.

Revenue Collection

CCC collects revenue through license fees, registration fees, and regulatory fines. CCC’s finance and accounting team has distinct procedures for processing each type of revenue, as described below.

License Fees

License fees vary based on the type of license, with waivers or reductions available for eligible license categories such as microbusinesses3 or Social Equity Program participants. Payments can be made through an online portal, by check sent to CCC, or to CCC’s bank lockbox.

The finance team reviews payment information for accuracy on a daily basis and works with the licensing team as needed to ensure proper recording. CCC then posts these transactions to the state accounting system (MMARS), which subsequently transfers the collected funds to the Marijuana Regulation Fund (MRF).

Excise Taxes

Marijuana establishments must collect a 10.75% excise tax at the point of sale and submit these payments to the Department of Revenue through monthly tax returns. The Department of Revenue then transfers these funds to the MRF monthly.

Fines

CCC’s Investigations and Enforcement Department assesses fines against marijuana establishments for regulatory violations4 based on the severity and circumstances. Payments must be made by check and either sent to CCC’s designated bank’s lockbox or mailed to CCC’s Worcester office. The financial team classifies these payments using distinct revenue codes in the Massachusetts Management Accounting and Reporting System (MMARS), the state’s accounting system.

Section 13 of Chapter 94G of the General Laws gives CCC the authority to impose fines on marijuana establishments for offenses, including, but not limited to, the following violations noted during the audit:

- exceeding limits of allowed cultivation square footage;

- compromising public safety;

- applying unallowable pesticides;

- failing to maintain sanitary conditions;

- failing to report inventory discrepancies;

- failing to adhere to internal standard operating procedures; and

- failing to maintain training records.

Electronic Payment Processing

CCC uses a third-party online payment portal to process credit and debit card payments. The Office of the Comptroller of the Commonwealth (CTR) receives a daily payment file from the portal and automatically generates the accounting entries in MMARS. These entries transfer the funds to the MRF and to the appropriate revenue accounts associated with the license or application type, as identified by external cash receipt table code. CCC’s finance team reviews a monthly MMARS report summarizing all CCC payment activity.

Host Community Agreements

Section 3 of Chapter 94G of the General Laws empowers communities to impose reasonable safeguards on the operation of marijuana establishments in the form of ordinances, bylaws, and host community agreements (HCAs) between a municipality and individual marijuana establishments operating in that municipality. HCAs may include a Community Impact Fee (CIF), to be paid by the marijuana establishment, that meets the following requirements, according to Section 3(d)(2)(i) of Chapter 94G of the General Laws:

The community impact fee shall be: (A) reasonably related to the costs imposed upon the municipality by the operation of the marijuana establishment or medical marijuana treatment center . . . (B) amount to not more than 3 per cent of the gross sales of the marijuana establishment or medical marijuana treatment center; (C) not be effective after the marijuana establishment or medical marijuana treatment center’s eighth year of operation; (D) commence on the date the marijuana establishment or medical marijuana treatment center is granted a final license by the commission; and (E) not mandate a certain percentage of total or gross sales as the community impact fee.

According to 935 CMR 500.180, CCC has the authority to review, regulate, enforce, and approve HCAs to guarantee compliance with Section 3 of Chapter 94G of the General Laws. In particular, the executive director or the executive director’s delegate is required to review each HCA submitted by a license applicant and to determine whether all language in the HCA is enforceable under the law. CCC began reviewing HCAs for compliance on March 1, 2024.

HCA Review Process Effective Through February 29, 2024

Before March 1, 2024, CCC did not directly review HCAs for compliance with the law.5 Instead, license applicants were required to submit attestations confirming that their HCAs met the necessary legal standards. This process relied on self-certification by applicants without formal verification by CCC.

HCA Review Process Effective Starting March 1, 2024

Beginning March 1, 2024, CCC initiated a more rigorous review process for HCAs. The investigations and enforcement team reviews each HCA submitted by a license applicant to determine whether all language within the agreement is enforceable under the law. CCC uses a checklist to review applications, ensuring that HCAs meet the requirements outlined in 935 CMR 500.180.

CIFs

We interviewed CCC staff members regarding their review of CIFs included in submitted HCAs. While CCC started to review HCAs as of March 1, 2024, it opted to begin reviewing CIFs within HCAs at least six months later, in November 2024. Since CCC’s review of CIFs started five months after the audit period, we were unable to test CCC’s review of CIFs. CCC management told us in March 2025 that they have encountered difficulties reviewing CIF documentation because of legal issues and disputes with municipalities.

Settlements and Judgments

As an agency of the Commonwealth of Massachusetts, CCC is subject to Chapter 258 of the General Laws, the regulations on settlements and judgments outlined in 815 CMR 5.00, and CTR’s “Settlements and Judgments Policy.”

| Date published: | August 14, 2025 |

|---|