Overview

Employers are responsible for sending family and medical leave contributions to the Department of Family and Medical Leave (DFML) on behalf of their covered individuals. To do this, employers must withhold PFML contributions from employees’ paychecks. Employers are only required to send an employer contribution if they have 25 or more covered individuals in their workforce.

Individual contributions are capped by the Social Security taxable maximum.

Employers must contribute at least the minimum share of the contribution described below; however, they may choose to cover a larger share of the contribution for some or all of their employees. For example:

- An employer with employees covered by multiple collective bargaining agreements can vary the amounts it withholds from employees in each of those bargaining units

- An employer can withhold varying amounts among full-time and part-time staff

Employers should consult with their legal counsel about implementing different percentages within their own organization.

Contribution rates are set annually for January 1-December 31. The new contribution rate applies to wages earned on or after January 1 of each year.

If you have a private or self-insured plan that is paying benefits to your employees that is the same or equal to PFML and are approved for an exemption, you do not have to make PFML contributions on those benefits.

Taxes on the private or self-insured plan benefits are a separate topic; we suggest consulting a tax professional.

Additional Resources

Employer contributions calculator

The charts below show the employer contribution rates while our contribution calculator helps you to estimate how this will look for you and your Massachusetts workforce.

By using this calculator, I understand that the Department of Family and Medical Leave is not bound by estimates given.

I agree. Take me to the calculator.

Disclaimer

The information and calculations displayed on this site do not necessarily reflect the actual amount of your required contribution. The calculator results are approximations and should not be considered as the final determination of your required contribution.

2025 & 2026

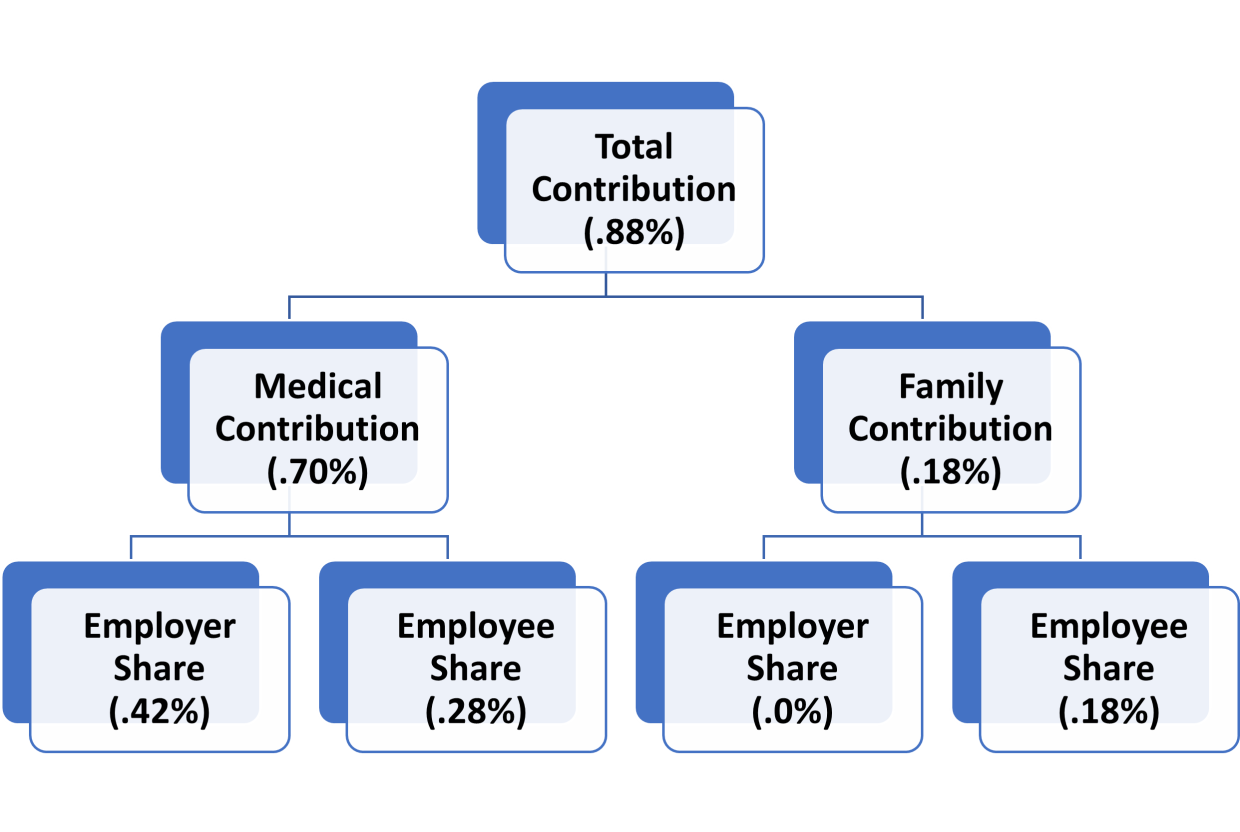

Contribution rate split for employers with 25 or more covered individuals

Employers with 25 or more covered individuals must send to DFML a contribution of 0.88% of eligible wages. This contribution can be split between covered individuals’ payroll or wage withholdings and an employer contribution.

Family leave

Up to 100% of the family leave contribution can be withheld from a covered individual's wages (0.18% of eligible wages).

Medical leave

Up to 40% of the medical leave contribution can be withheld from a covered individual's wages (0.28% of eligible wages). Employers are responsible for contributing the remaining 60% (0.42% of eligible wages).

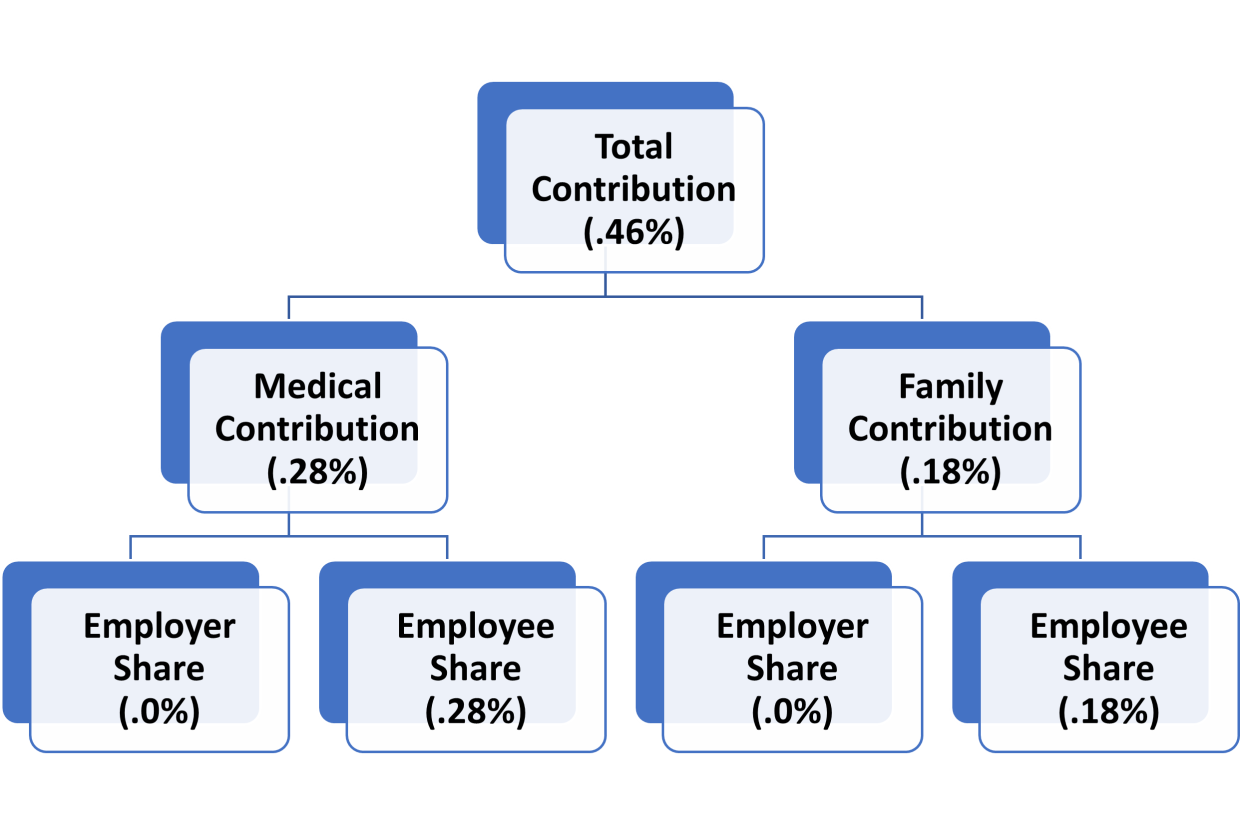

Contribution rate split for employers with fewer than 25 covered individuals

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0.46% of eligible wages. This contribution rate is less because small employers are not required to pay the employer share of the medical leave contribution.

Small employers are responsible for sending the funds withheld from covered individuals' wages but are under no obligation to contribute themselves. However, they may elect to cover some or all of the covered individuals' share.

Family leave

Up to 100% of the family leave contribution can be withheld from a covered individual's wages (0.18% of eligible wages).

Medical leave

Up to 100% of the medical leave contribution can be withheld from a covered individual's wages (0.28% of eligible wages). There is no employer share for employers with fewer than 25 covered individuals.

Contact

Phone

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Revenue - Hours of operation: Monday-Friday, 8:30 a.m. - 4:30 p.m.

| Date published: | January 23, 2019 |

|---|---|

| Last updated: | October 1, 2025 |